|

IN BRIEF

|

THE Allianz Group stands out in the field of mutual health insurance by offering a wide range of products and services adapted to all needs. Whether you are an individual looking for a complementary health personalized or an employer wishing to protect your employees through a collective contract, Allianz offers innovative and accessible solutions. With options of refund optimized and guarantees that cover essential areas such as optical, dental and audiology, Allianz is committed to making health more affordable and improving your quality of life. Here’s everything you need to know about its offers and services.

The Allianz Group’s mutual health insurance is an interesting option for those looking for complementary health adapted to their needs. Thanks to a range of diversified offers, Allianz is committed to providing tailor-made solutions, both for individuals and businesses. This article highlights the benefits and the disadvantages services offered by Allianz to help you make the best choice for your health coverage.

Benefits

Pricing and accessibility

One of Allianz’s great strengths lies in its ability to offer competitive rates in just one minute via their online tool. This price transparency allows policyholders to quickly evaluate the best options without going through long and complicated processes.

100% Health Guarantee

When it comes to reimbursements, Allianz offers an efficient system where you can benefit from 0€ remaining charge for optical, dental or audiology services thanks to their guarantee 100% Health. This constitutes a major advantage for those who wish to reduce their healthcare costs.

Company mutual insurance

For employers, the establishment of a company mutual insurance is a legal obligation. Allianz offers collective contracts that protect not only employees, but also their families. Such coverage makes it possible to considerably reduce the out-of-pocket cost for health costs, thus strengthening satisfaction and well-being at work.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Limited customization

Despite the multiple options offered, some customers may consider that the personalization contracts is somewhat limited. This can be a problem for those looking for very specific coverage or atypical guarantees that fall outside the usual framework.

Complex information

The diversity of choices can also make access to information complex for the general public. The multitude of guarantees and levels may require significant adaptation time to fully understand all of the services offered. This may disconcert some policyholders, especially those who are unfamiliar with insurance terminology.

Variable reimbursements

THE refunds by Allianz can vary considerably depending on the type of care and level of coverage chosen. It is therefore essential to carefully assess your needs before selecting your contract, in order to avoid unpleasant surprises when covering your healthcare costs.

The Allianz Group, recognized for its expertise in complementary health, offers a diverse range of contracts to meet individual and collective health reimbursement needs. In this article, we’ll explore the different offerings, the benefits they offer, and how they can help reduce your out-of-pocket daily healthcare costs.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The different mutual health insurance formulas

Allianz offers several options adapted to the varied needs of its customers. Whether you are an individual, a liberal professional or an employee, you can choose a complementary health that fits your situation and your budget. Allianz offers plans such as Comfort and Premium, which allow you to benefit from optimized reimbursement in many areas, particularly in optical, dental And audiology.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The advantages of choosing Allianz for your health

Opting for Allianz mutual insurance means benefiting from the guarantee 100% Health. Thanks to this offer, policyholders can benefit from 0€ remaining charge for essential optical, dental and audiology care. This represents a real opportunity for those who wish to control their healthcare costs while accessing the necessary care.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Corporate health insurance: a beneficial obligation

Under collective contracts, employers have an obligation to provide additional health coverage to their employees. This framework not only protects employees, but also improves their quality of life at work. By choosing the Allianz collective contract, companies actively participate in reducing the out-of-pocket costs for their employees, allowing them to concentrate on their work with complete peace of mind.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

How does complementary health insurance work?

Mutual insurance works in addition to social security. Health expenses are first reimbursed by compulsory health insurance, then the remaining expenses are covered by supplementary health insurance. It works seamlessly, ensuring optimal access to care without incurring excessive costs.

Quality service for everyone

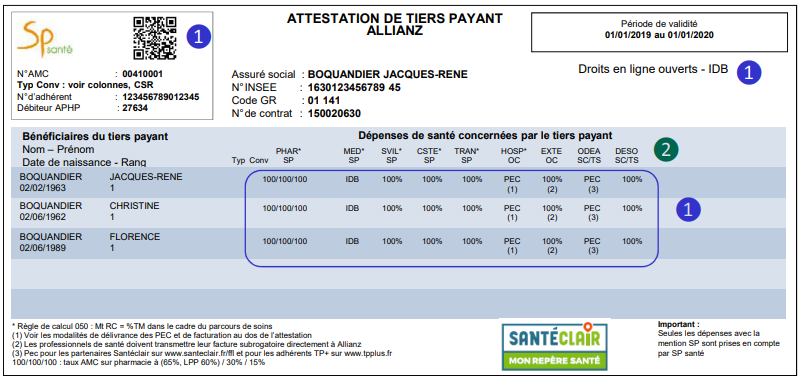

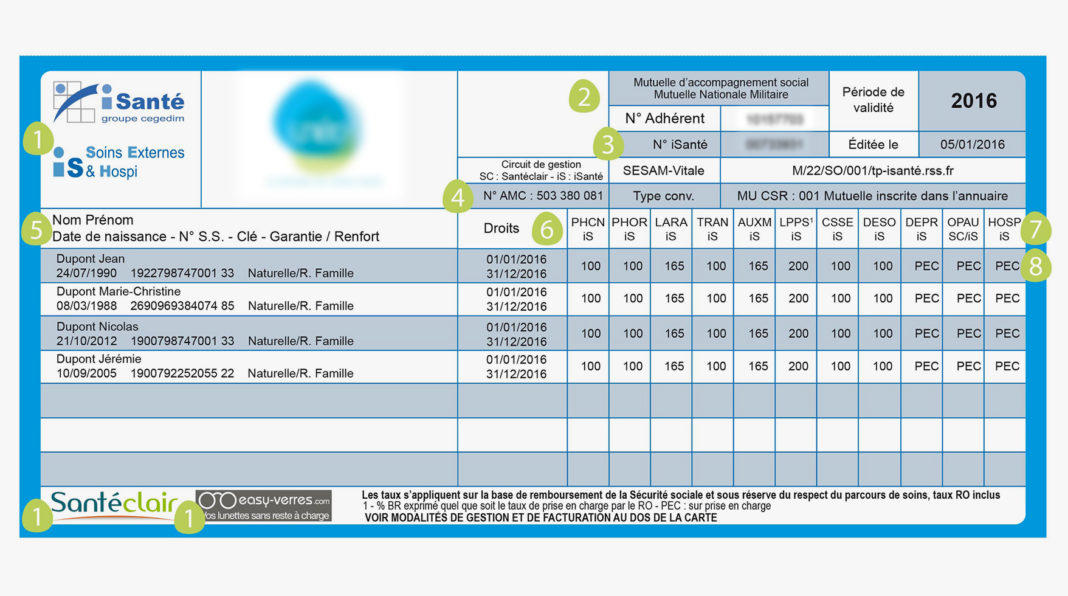

By choosing Allianz, you have access to a quality healthcare network via Santéclair, allowing you to benefit from preferential rates with healthcare professionals. This facilitates access to necessary care while reducing the cost of reimbursements.

Practical information and contacts

For all questions relating to the offers and services offered by Allianz, you can consult their official website, where online support is available. For a quick quote, information on reimbursements or to subscribe to complementary health insurance, do not hesitate to go to the page dedicated to complementary health.

The Allianz Group offers a varied range of solutions in terms of complementary health and of mutual health insurance, designed to meet individual and collective needs. Whether you are an individual or an employer, discovering the benefits of this mutual insurance can transform your health experience and significantly reduce your medical costs. In this article, we guide you through the different options available, as well as their associated prices and services.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

The advantages of Allianz mutual insurance

Choose the mutual Allianzmeans opting for guarantees adapted to your situation. Thanks to the offer 100% Health, you can benefit from optical, dental or audiology care without any out-of-pocket costs. This means that you benefit from comprehensive coverage for expenses that can sometimes weigh heavily on the family budget.

Mandatory company health insurance

For businesses, setting up a collective mutual health insurance is a legal obligation. By choosing a contract with Allianz, you protect your employees, as well as their families, while reducing the out-of-pocket costs linked to health costs. This contributes to employee loyalty and improved well-being.

How does complementary health insurance work?

There complementary health of Alianz works in complementarity with compulsory health insurance. It reimburses part of the costs not covered by social security, thus reducing the cost of care. The collective contract also obliges the employer to participate in the financing of the mutual, thus promoting better access to care for all employees.

Personalized health insurance

With Allianz, you have the possibility to create a personalized health insurance. Choose from different ranges and levels of coverage that meet your needs and budget. This flexibility is essential to ensure that each policyholder finds a plan that suits them.

Pricing and customer satisfaction

There mutual Allianz is recognized for its transparency in matters of prices and for the satisfaction of its customers. Reviews of their offers show good value for money and quality services, including generalized third-party payment which facilitates procedures during medical consultations. To explore the different options and prices, you can consult Allianz’s online resources.

For practical advice on setting up company mutual insurance, you can consult the page here.

How to contact Allianz?

For any questions relating to the offers and services of the mutual Allianz, do not hesitate to contact them directly. For more information, you will find useful telephone contact details here.

Compare Allianz Group mutual insurance offers

| Offer | Description |

| Supplementary health | Protection against health costs not covered by Social Security, rapid reimbursement time. |

| Corporate health insurance | Obligation for employers, collective coverage for their employees and families. |

| Generalized third-party payment | Simplifies payment for care, avoiding advance costs for policyholders. |

| 100% Health Guarantee | Reimbursements without charges in optics, dental and audiology. |

| Senior offer | Comfort and Premium range, adapted to the specific needs of retirees. |

| Santéclair care network | Access to quality care at negotiated rates, guaranteeing savings. |

| Personalized health insurance | Coverage options that meet the needs and budget of each insured. |

| Fast refunds | Simplified process for obtaining reimbursements, with online tracking. |

| Customer feedback | Generally positive opinions on the service and guarantees offered. |

| Ease of contact | Customer support available to answer all contract questions. |

Testimonials about Allianz Mutuelle Group: What you need to know about its offers and services

With Allianz Group, I discovered that it is crucial to benefit from a complementary health efficient which adapts to my needs. Within minutes I received a clear quote, which gave me a better understanding of the options available. THE price proposed is competitive and reassured me about my ability to cover my health costs.

What appealed to me most about Allianz, this is the guarantee 100% Health. This means I no longer have to worry about my remains responsible in optics, dentistry or audiology. Knowing that I can access quality care at no additional cost gives me invaluable peace of mind.

For businesses, Allianz Group offers a compulsory company health insurance. As an employer, I have been able to set up group coverage which reduces the remainder payable by my employees for their health costs. This is a major asset for attracting and retaining talent while taking care of their well-being.

When I chose my complementary health, I was pleasantly surprised by the flexibility of the offers. With Allianz Health, I had the opportunity to select the range that best suited my budget while allowing me to choose the level of coverage suited to my personal situation.

The opinions of my colleagues on the mutual Allianz are generally positive. They particularly appreciate the widespread third-party payment which simplifies the reimbursement process and the Santéclair care network, guaranteeing access to quality care at negotiated rates. It’s added peace of mind for the whole family.

Reimbursements made by Allianz are fast and transparent. Thanks to their help desk, I can manage my claims easily and track my healthcare expenses without hassle. This allowed me to better plan my finances without any surprises.

For those considering subscribing to a mutual health insurance for seniors, Allianz offers, such as their Comfort and Premium ranges, offer several levels of cover. This makes it possible to adapt solutions to each stage of life, while guaranteeing attractive reimbursements in areas such as eye health or dental care.

The Allianz Group positions itself as a major player in the mutual health sector, offering a wide range of offers adapted to the needs of each policyholder. Whether you are an individual looking for a complementary health or a company wishing to protect its employees, Allianz offers tailor-made solutions with competitive prices and extensive guarantees. In this article, we will explore in detail the different options available, the benefits and services associated with Allianz mutual insurance.

Offers from Allianz mutual insurance

Customizable health supplement

Allianz offers complementary health offers tailor-made, adapted to each profile and each budget. You have the freedom to choose from several levels of coverage, whether for routine care, hospitalization, or dental and optical. Thanks to this flexibility, each policyholder can find the solution that perfectly suits their needs.

Compulsory company health insurance

For employers, Allianz offers collective health insurance contracts, mandatory since the implementation of the ANI law. By subscribing to this type of contract, companies can protect not only their employees, but also their families. In addition, health costs are reduced thanks to additional reimbursement, thus reducing the remains responsible.

How complementary health insurance works

There complementary health of Allianz works in addition to Health Insurance. It makes it possible to cover health expenses not reimbursed by the latter, whether they are consultations, medical care or interventions. Depending on the contract chosen, the refunds can be partial or total. With the option 100% Health, you can benefit from optical, dental and audiology care without any charges.

Advantages of Allianz contracts

Generalized third-party payment

One of the great advantages of Allianz contracts is the widespread third-party payment. This means that you will not have to pay up front for your medical consultations. This process significantly simplifies the management of your healthcare expenses.

Santéclair care network

As an Allianz policyholder, you can access the healthcare network Santéclair. This network guarantees you quality care at negotiated rates, thus making your consultations and treatments more accessible while preserving your purchasing power.

Allianz senior mutual insurance

For seniors, Allianz offers specific offers adapted to growing health needs. Their plans, such as ranges Comfort And Premium, offer different levels of coverage, taking into account the risks linked to age and pathologies. These contracts allow you to benefit from adapted support and optimized reimbursements.

Quotes and prices

Get a estimate for Allianz mutual insurance is simple and quick, often in less than a minute. The prices offered are competitive and adjusted according to the guarantees selected. It is therefore essential to study the different options to choose the one that best meets your expectations.

Customer reviews and satisfaction

Customer feedback on Allianz mutual insurance is generally positive. Policyholders appreciate the quality of service, the clarity of contracts and the responsiveness of teams when requesting reimbursement. So, opting for Allianz means choosing a reliable partner for your health.

Find out everything about the offers and services of the Allianz Mutuel Group

The Allianz Group is distinguished by a varied range of complementary health solutions, which meet the diverse needs of its policyholders. Whether you are looking for a individual mutual health insurance or a collective coverage for your employees, Allianz offers you customizable offers, adapted to your budget and your expectations. This allows you to benefit from a complete protection face unforeseen health expenses.

One of Allianz’s major assets is its 100% Health Guarantee, which ensures a 0€ remaining charge for optical, dental or audiology care. This allows you to use your care without worrying about additional costs, an invaluable peace of mind, especially in a period where the cost of health care continues to increase.

For businesses, Allianz offers a compulsory company mutual insurance which provides collective health coverage for your employees. Not only does this protect your employees and their families, it also helps reduce their remains responsible for health costs. Such an initiative demonstrates your commitment to caring for the health and well-being of your team, thereby strengthening company culture and work motivation.

Finally, by opting for a contract with Allianz, you benefit from quality services associated with a broader healthcare network, such as Santéclair network. This guarantees easy access to trusted healthcare professionals, while optimizing your reimbursements. With Allianz, you can be assured of receiving quality support, allowing you to make informed decisions regarding your health.

FAQ on Allianz Group offers and services

What is complementary health insurance? Supplementary health insurance is an insurance contract that covers all or part of health expenses not reimbursed by health insurance. It reduces the remainder payable by policyholders.

How does mutual health insurance work? A mutual health insurance reimburses health expenses according to the guarantees subscribed. This may involve reimbursements for optical, dental or audiology care, thus allowing better access to care.

What are the advantages of company mutual insurance? Company mutual insurance offers group health coverage for employees, helping to reduce their out-of-pocket costs. It is mandatory for companies and helps protect employees and their families.

How to choose personalized health insurance? To choose personalized health insurance with Allianz, it is recommended to evaluate your needs and your budget. Allianz offers different ranges and levels of cover.

What healthcare costs are reimbursed by Allianz? Allianz partially or fully reimburses health costs according to the terms of the contract. This includes expenses related to vision, dentistry, and other medical care.

Are there any special offers for seniors at Allianz? Yes, Allianz offers senior mutual options which include two ranges of cover: Comfort and Premium, allowing reimbursement levels to be adapted to the needs of older people.

How to get a quote for Allianz mutual insurance? The quote for Allianz mutual insurance can be requested directly online or by contacting their customer service. This will allow you to know the prices and guarantees available.

What reviews do customers leave on Allianz mutual insurance? Customer reviews of Allianz mutual insurance are generally positive, highlighting the quality of reimbursements and the availability of services. It is advisable to consult multiple review sources for a complete evaluation.

What are the terms and conditions for terminating a contract with Allianz? Termination of a contract with Allianz can be done by giving specific notice, generally stipulated in the contract. It is recommended to contact customer service for specific steps to follow.