|

IN BRIEF

|

When you are considering moving abroad, it is essential to think about your health insurance. Appropriate health coverage can make all the difference in the event of a hard hit. Before leaving France, it is essential to understand the steps to follow and the options available to you. Whether you are an expatriate worker or simply looking for new adventures, know the specificities of your expatriate health insurance will allow you to leave with peace of mind. Take the time to explore the different options to ensure your safety and that of your loved ones abroad.

When you are considering leaving your country to live abroad, the question ofhealth insurance becomes essential. Subscribe to a expatriate health insurance adapted is essential to guarantee your well-being and medical safety. Whether you are leaving for a short or long term, understand the benefits and the disadvantages of these insurances will allow you to make an informed choice.

Benefits

One of the main benefits of expatriate health insurance is the full coverage that she offers. Unlike French social security, which does not always guarantee adequate protection across borders, good health insurance will allow you to benefit from reimbursement of medical expenses in your new country of residence, as well as access to quality care. .

Additionally, some insurances also include support services, such as remote medicine or the organization of medical repatriations, thus offering peace of mind during your expatriation. You also have the option to choose between various levels of coverage, which allows you to adapt the contract to your needs and your budget.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage for foreigners in France essential Request from form S1 for registration to the social security Foreign students : compulsory registration for health insurance European Health Insurance Card (CEAM) for holidays in France Different rights depending on…

Disadvantages

Despite these many advantages, it is important to take into account certain disadvantages. Taking out expatriate health insurance can be expensive, especially if you choose extended coverage. In addition, it is essential to carefully read the contract clauses, as some policies may have significant exclusions or reimbursement limits.

Another point to consider is the complexity of administrative procedures which may be required to obtain reimbursement from various organizations. You will potentially have to juggle between your social insurance fund in France and your insurer abroad, which can become tedious. It is therefore advisable to find out about the procedures before leaving to avoid any unpleasant surprises.

In summary, prepare your moving abroad implies in-depth reflection on expatriate health insurance. This preparation will not only help you protect your health, but also help you enjoy your experience abroad with peace of mind.

Going abroad is a big leap into the unknown and requires careful preparation, particularly with regard to your health insurance. Before embarking on this adventure, it is essential to understand the importance of appropriate health coverage to protect your well-being and that of your family. Find out here everything you need to know to choose your expat health insurance before packing your bags.

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

Why take out expat health insurance?

Living abroad can lead to unforeseen health problems. Health systems vary from country to country, and you could find yourself without adequate access to care if you don’t have the right coverage. Take out expat health insurance allows you to benefit from complete protection and peace of mind against medical risks.

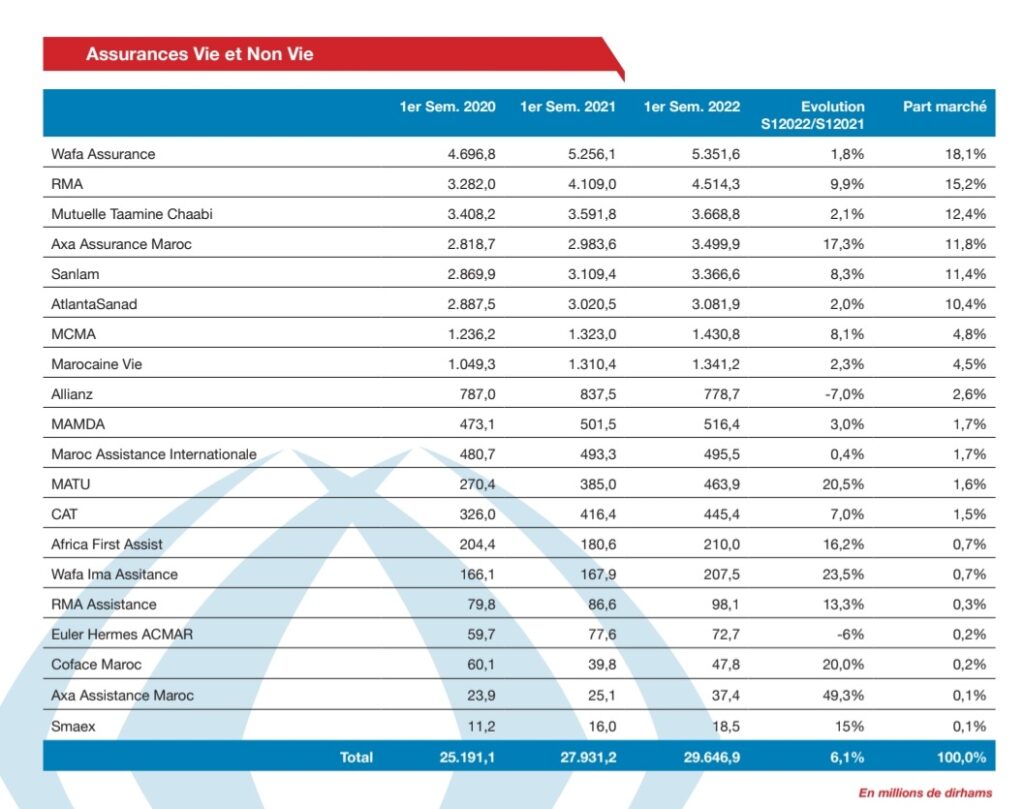

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

Steps to take before your departure

Before you expatriate, it is imperative to inform your Health insurance fund in France of your departure and, if necessary, that of your minor children. You must also send your Vitale card and complete the form declaration of transfer of residence to avoid any further complications.

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Get the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to social protection scheme local. THE mutual do not cover treatment abroad…

Compare expat health insurance options

There are several types of expat health insurance, such as comprehensive coverage or basic coverage. Before you decide, take the time to compare the offers and ask yourself the right questions about your specific needs. Sites like International Health Mutual can provide you with valuable information.

The cost of private health insurance: what you need to know

IN BRIEF The cost of a private health insurance varies depending on age and length of coverage. Average price of mutual insurance: approximately 90 €/month for women and 105 €/month for men. THE monthly contributions generally oscillate between 30 and…

Understanding the different types of coverage

Expatriate health insurance contracts are generally divided into two categories: those which are in partnership with the Fund for French people abroad (CFE) and those called first euro. It is crucial to check whether your insurance offers an agreement with the CFE to simplify reimbursement procedures. You can find more details about these options on resources like Health Mobility.

Health insurance in Belgium: understanding prices and coverage

IN BRIEF Social security system in Belgium: a protective framework THE mutual reimburse between 60% and 75% of medical costs Conventional price for a general consultation: €22.22 with 75% refunded 20 to 25% of health costs remain the responsibility of…

Factors influencing the cost of your expat health insurance

The cost of your expat health insurance may vary depending on different factors, such as your age, health and the region you are traveling to. Find out about the average prices by region and the different options to find the contract best suited to your needs and your budget. Find information about this at International Health Mutual.

Occupational medicine in Clichy: a complete guide for employers and employees

IN BRIEF Presentation of the occupational medicine has Clichy Role of occupational health services in prevention Legal obligations of employers And employees Hours and contact details Center for occupational medicine Importance of medical visit and health monitoring Assistance in the…

Tips for choosing the best expat health insurance

Before finalizing your contract, consider reading reviews and testimonials from other expats. Also carefully check the guarantees offered and the exclusions of your insurance policy. These are things that can have a significant impact on your protection should the need arise. For more tips, visit Transatlantic Bank.

Easy mutual: everything you need to know about health insurance

IN BRIEF Supplementary health : definition and objectives Importance of mutual health insurance for refunds Criteria for choosing best mutual adapted Coverage of health costs: dental, optical, etc. Comparison of offers and prices Conditions of termination and options available Mutual…

Administrative obligations at the end of your stay

When your adventure abroad comes to an end, it is important to update your information with the social security In France. You will have to declare your return, which will allow you to regain your rights to health coverage in France. Visit the website of Ameli for the precise steps to follow.

Before embarking on a new adventure abroad, it is crucial to understand your expatriate health insurance. This guide offers practical advice to help you choose the right coverage and prepare yourself effectively for living abroad. Protecting yourself from unforeseen medical emergencies and providing the best possible care is essential, and the right decisions made in advance can make all the difference.

Declare your departure

The first important step before any expatriation is to declare your departure to your French health insurance fund. This also includes declaring the departures of your minor children. This official procedure is necessary to update your situation in the social security system, and to avoid any future complications regarding your rights.

Return of your Vitale card

Before leaving France, you must return your Vitale card and the European Health Insurance Card. This will facilitate your transition to new health coverage and avoid any confusion in your social security history. Do not neglect this step, because it is crucial to avoid administrative complications during and after your expatriation.

Choosing suitable expatriate health insurance

It is strongly recommended to take out expatriate health insurance before your departure. These insurance policies are specially designed to meet the needs of people living abroad, providing comprehensive coverage for medical care. Compare the different contracts available, paying particular attention to guarantees offered, to ensure that you are well protected.

Check the agreements with the CFE

When you choose your private health insurance, make sure that it has agreements with the CFE (Caisse des Français de l’Étranger). This will make it easier for you to reimburse your medical expenses and ensure that you receive the best care when needed. This coverage is essential to avoid large health expenses abroad.

Plan your health budget

The price of your expatriate health insurance will depend on several factors, including your age and your state of health. It is therefore essential to evaluate your budget health before leaving. Don’t hesitate to compare average prices by region to find the right coverage and at a rate that suits you. Also remember to reassess your situation from time to time, as changes may influence your insurance premium.

Questions to ask yourself before choosing

Before subscribing to health insurance, ask yourself the right questions questions regarding your specific needs. Will you need coverage for dental, optical or medical evacuations? Understand your priorities to make the best possible choice. To help you with this process, check out resources such as these tips.

Cover your children

If you go with children, it is important to check that their health coverage is also adequate. Consider including coverage for pediatric care and possible accidents, as health needs may differ from country to country. Make sure the whole family is well covered to experience your expatriation peacefully.

Comparison of types of health insurance for expatriates

| Criteria | Details |

| Type of contract | Expatriate contract or traditional mutual insurance |

| Geographic coverage | Global or limited to certain countries |

| Waiting period | Period during which care is not reimbursed |

| Reimbursement of expenses | 1st euro or percentage of costs incurred |

| Coverage options | Hospitalization, routine care, dental, optical |

| Assistance abroad | Medical emergency support services |

| Price | Varies by age, country and health status |

| Contract duration | Flexible: annual, temporary |

| Claims management | Ease of declaration and reimbursement |

Testimonials on Expat Health Insurance: What you need to know before you leave

Before I left for abroad, I was worried about my health coverage. I had heard so many stories about the complications of getting health insurance abroad. Finally, I decided to subscribe to a expatriate health insurance. I don’t regret my decision! Not only did I benefit from a full coverage for my medical care, but I also had peace of mind knowing that I could access quality care without exorbitant costs.

When I made the decision to leave France to settle abroad, I knew I had to be proactive about my health. My friends asked me to check if my private health insurance had an agreement with the Caisse des Français à l’Étranger (CFE). It was essential! Thanks to this precaution, I was able to make reimbursement requests quickly without any hassle. I really recommend finding out about the agreements between your insurance and the CFE before leaving.

I spent several weeks comparing the different health insurance options. I was surprised to discover how much the prices varied! It is essential to consider your age and health when selecting your insurance. Ultimately, I chose coverage that allowed me to access medical care without having to worry about hidden fees. This made all the difference during my expatriation period.

One thing I learned is that you absolutely must declare your departure to the Health insurance fund In France. This may seem like a simple formality, but it is crucial to avoid any write-offs or complications with your health coverage. After completing the necessary documents, I received helpful advice on what to do in the event of a medical emergency abroad. This information reassured me before my departure.

Finally, I cannot stress enough the importance of taking the time to find out about health insurance before leaving. Expatriates should ensure that they have a adapted health cover to their specific needs, including checking health-related guarantees and cost infiltration. This will allow you to enjoy your experience abroad without stress!

Before embarking on the adventure of living abroad, it is essential to find out about theexpatriate health insurance. This coverage is essential to guarantee your well-being during your stay abroad. This article guides you through the important steps and details to take into account to ensure your health and safety.

Declaration of departure

When you make the decision to live abroad, the first step is to declare your departure to your health insurance fund in France. This formality is crucial, because it involves the cancellation of your Vitale card and removes you from the French social security list. Also remember to include your minor children in this declaration if you are traveling with them.

Return of documents

It is important to return your Vitale card as well as your European social security card to the Health Insurance Fund. This will avoid any confusion regarding your health coverage upon your return to France.

Choosing the right health coverage

Before leaving French soil, it is strongly recommended to take out expatriate health insurance. This cover is essential to protect you in the event of illness or accident abroad. Insurance contracts for expatriates are specially designed for those who reside more than 6 months per year outside France, thus offering you protection adapted to your situation.

Warranty and coverage options

When choosing your health insurance, it is essential to carefully study the guarantees offered. Analyze the level of coverage: medical expenses, hospitalization, repatriation, and medications. Contracts vary greatly depending on your personal needs and the destination country. Take the time to compare offers to find the one that suits you best.

Allocate costs and budget

Before finalizing your choice of insurance, it is also essential to examine the associated costs. Prices may vary depending on your age, health and the options you choose. A good strategy is to compare not only the average prices by region, but also to understand the differences between full coverage And basic coverage.

Negotiate with insurers

Do not hesitate to negotiate the price of your expatriate health insurance. Some insurers may be open to adjustments, especially if you can demonstrate that you are a good candidate for an price reduction due to your state of health or medical history. Take advantage of this opportunity to get the best deal possible.

Stay in touch with Social Security

As an expatriate, you must also be vigilant regarding your connection with the Social security. When you live outside France, you can stay in contact with the Caisse des Français de l’enseignement (CFE) to find out about your rights and procedures. This can be particularly useful when returning to France or in case of specific needs.

Declaration forms

Remember to fill out the transfer of residence declaration form in the month following your move abroad. This step, although often neglected, is crucial to keep your file up to date and prevent future problems related to your health coverage.

Before taking the plunge and living abroad, it is crucial to prepare yourself well, especially with regard to your health insurance. As an expatriate, you will no longer necessarily benefit from health insurance coverage. Social security French. It is therefore essential to declare your departure to your Health insurance fund to avoid complications in the future.

When you stay abroad, it is strongly recommended to take out a expat health insurance. This will allow you to benefit from coverage adapted to your situation and the specificities of the host country. An expatriate health insurance contract guarantees quality medical care, even in the event of an emergency.

Before committing, ask yourself the right questions in order to choose the contract that suits you best. Check them guarantees offered, waiting periods, and ensure that cooperation exists between your insurer and the CNAM. This can make it easier to reimburse your medical expenses.

Also remember to compare offers, as prices can vary considerably from one insurer to another. Items such as your age, your state of health, and the country of residence can influence the price of your coverage. So, structuring your research can save you money while maintaining your health security.

The establishment of a expatriate mutual insurance gives you the assurance of being well covered, whatever the circumstances. Take the time to study all the options available before finalizing your choice, to leave with peace of mind.

FAQs about Expatriate Health Insurance

Q: Why should I take out health insurance before going abroad?

A: It is strongly recommended to subscribe to a expatriate health insurance before your departure in order to benefit from coverage adapted to your situation abroad.

Q: What should I do with my Vitale card before leaving?

A: Before your departure, you must return your Vitale card and come and have yourself removed from the list of insured persons at your health insurance fund in France.

Q: What is CFE and should I be concerned about it?

A: The Fund for French People Abroad (CFE) offers health coverage for expatriates, and it is essential to check if your private insurance has an agreement with the CFE to facilitate reimbursements.

Q: What criteria should I take into account when choosing my health insurance?

A: Before subscribing, it is important to check the guarantees offered and to ask the right questions regarding your need for complete or basic coverage.

Q: What documents do I need to complete when moving abroad?

A: Within one month after your move, you must complete the transfer of residence declaration form to your health insurance fund.

Q: What should I do if I plan to stay abroad for less than six months?

A: If your stay is planned for less than six months per year, specific options may be adapted to your situation, so check with your health insurance.

Q: How does the reimbursement of health costs abroad work?

A: For reimbursement, you must send your requests to your insurer, ensuring that it has an agreement with the CFE if applicable.

Q: What are the average costs of expatriate health insurance?

A: The price of expatriate health insurance may vary depending on several criteria, including your age, health and country of destination. Comparing offers is essential to finding coverage at the best price.