|

IN BRIEF

|

L’health insurance in Belgium represents an essential part of the country’s health system, guaranteeing access to care and financial protection for its citizens. With reimbursements varying between 60% and 75% of medical and dental costs, it is crucial to understand the conventional rates, as well as the different mutual societies which help reduce the cost of care. Indeed, although insurance coverage is generally solid, a portion of the costs remains the responsibility of patients. Learning about the specifics of this system and the various options available will help you navigate the complex healthcare landscape in Belgium with confidence.

There health is an essential element of our well-being, and in Belgium, the system ofhealth insurance plays a crucial role in this regard. Understanding the rates and related coverage is essential to benefit from optimal protection. This article provides an overview of benefits and disadvantages associated with health insurance in Belgium, as well as key information for navigating this system.

Benefits

One of the main benefits of health insurance in Belgium is its solid and well-structured framework. Thanks to the system of social security, Belgians benefit from substantial reimbursement of their medical costs. In general, around 60 to 75% of healthcare-related expenses are covered by mutual funds, which can alleviate financial pressure during medical consultations or treatments.

In addition, the mutual, which operate as health insurance organizations, offer varied coverage adapted to the needs of policyholders. Thanks to additional plans, policyholders can expand their coverage and benefit from higher reimbursements for various treatments, such as dental care or specialist consultations. This strengthens the safety of individuals in the face of unforeseen medical emergencies.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages. First of all, despite reimbursements, patients remain responsible for around 20 to 25% of healthcare costs. This means that in the event of significant expenses, Belgians may find themselves having to pay a significant amount out of their own pocket.

Then, the system can sometimes appear complex, particularly for expatriates who may not be familiar with the specificities of the mutual Belgians. Late repayments can also be a source of frustration. In addition, the quality of the services offered may vary from one mutual insurance company to another, which requires that you be well informed when selecting health coverage.

It is therefore essential to weigh the pros and cons to choose the health insurance that best suits your needs. To learn more about this topic, you can consult expat resources available online, such as those offered by Expatica or even mutual societies like Partenamut.

The system ofhealth insurance in Belgium is complex but essential to benefit from adequate health coverage. It is based on a network of mutual, which ensure reimbursement of a large part of medical costs. To better understand this system, it is important to learn about the prices consultations and care, as well as the level of blanket offered by the various mutual insurance companies on Belgian territory.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Health rates in Belgium

In Belgium, congruent treatment prices are set for most medical services. For example, the price of a consultation with a general practitioner is €22.22, of which approximately 75% are reimbursed by the Social security. Thus, patients must expect to bear part of the costs, which is a common reality in the Belgian healthcare system.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Reimbursements by mutual insurance companies

THE mutual societies in Belgium play a crucial role in healthcare reimbursement. They undertake to take care of 60% And 75% medical and dental costs of their affiliates. However, it is essential to note that even with this coverage, there is still a liability for 20 to 25% can weigh on the finances of policyholders.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Health coverage and compulsory healthcare

There mutual in Belgium covers a majority of necessary health care, including medical consultations and dental services. This coverage, although free, can be supplemented by additional insurance to cover the costs remaining the responsibility of the insured. This is a recommended option, especially for people with more significant medical needs.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Access to social security

There Belgian social security is funded by contributions levied on workers’ income. Even expatriates can benefit from certain allowances and health coverage under certain conditions. It is therefore essential for each resident, whatever their situation, to find out about their rights. For more details, you can check out resources such as Partenamut.

Supplementary insurance and international coverage

For those who wish to travel or live abroad, there are options tointernational health insurance which can supplement Belgian social security coverage. These insurance policies, like those offered by AXA, can be crucial to ensuring appropriate care in the event of a medical emergency abroad.

Interested users can also explore the different types ofadditional insurance available. These products are often adapted to the specific needs of policyholders, offering a much wider choice in terms of covering health costs. To learn more, feel free to explore resources like International Health.

In Belgium, the health system is extremely structure and powerful, offering a wide range of blankets health care. Health insurance, governed by Social security, works mainly through mutual societies, which reimburse a large part of medical costs. It is crucial to understand how it works to better anticipate health expenses and choose the mutual insurance best suited to your needs.

How does mutuality work in Belgium?

There mutuality in Belgium functions as a social security fund which reimburses part of medical and dental costs. In general, the mutual societies cover between 60% and 75% costs. This means that the policyholders remain responsible for approximately 20 to 25% of fees linked to health care, which encourages you to choose your health insurance carefully. To deepen your knowledge, you can consult the complete guide on the operation of mutual societies on the website Partenamut.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Prices for medical consultations in Belgium

Know the conventional rates is essential to anticipate your healthcare costs. For example, the price of a consultation with a general practitioner is set at €22.22, of which 75% are reimbursed by the Social security. This means that you will only have to pay approximately €5.56 from your pocket. This pricing structure applies to many medical services, but it is crucial to check your practitioner’s rates as they can vary.

Dental care coverage

Dental care also benefits from protection by mutual societies, but it is important to note that reimbursement may be limited compared to other types of care. Generally, a specific reimbursement percentage is established, sometimes lower than that for medical consultations. For more details and to ensure better reimbursement, it is recommended to contact your mutual or consult specialized resources such as hospitalization insurance.

Understand the differences between basic and supplementary insurance

In Belgium, there is a compulsory insurance which covers essential needs, but it is often necessary to opt for a additional insurance to benefit from more comprehensive protection. This supplement can cover services not covered by basic insurance, such as certain alternative medicines, medical equipment or specific care. Remember to carefully analyze your personal needs and those of your family before choosing a suitable formula.

What to do when traveling or vacationing in Belgium?

When you go on vacation, it is important to ensure your health coverage. In fact, the Belgian social security is active on the national territory and mutual societies reimburse medical expenses incurred in the country. However, there may be variations depending on your situation, so do not hesitate to consult informative sites such as that of CLEISS to check your rights.

In summary

Become familiar with how thehealth insurance in Belgium not only allows you to better manage your health expenses, but also to choose the mutual which suits you best. Coverages vary, so it’s wise to take the time to explore all options for optimal health. For more in-depth information on global health insurance, feel free to check out this link: Understanding Global Health Insurance.

| Type of care | Reimbursement rate |

| General consultation | 75% |

| Specialist consultation | 75% |

| Hospital care | 60% to 100% |

| Medicines reimbursed | 60% to 100% |

| Dental care | 60% to 75% |

| Laboratory analyzes | 75% |

| Emergency evacuation | 100% |

| Medical repatriation | 100% |

| Preventative care | 100% |

| Unreimbursed expenses | 20% to 40% |

Testimonials on Health Insurance in Belgium: understanding prices and coverage

Belgium benefits from a system of social security robust, and the mutuality plays a central role in covering healthcare costs. As an insured, it is essential to understand how this works. For me, when I needed a consultation with my GP, I was relieved to learn that the conventional rate was set at €22.22. Thanks to social security, I was reimbursed up to 75%, which significantly reduced my expenses.

My experience has also shown me that Belgian mutual societies reimburse between 60% and 75% of medical expenses, including dental care. The remaining 20 to 25% may seem restrictive, but it reflects how the system encourages citizens to engage in their health while benefiting from essential coverage. It’s particularly reassuring to know that the majority of my medical expenses are covered.

As an expat, I was a little lost at first when it came to health coverage. However, I quickly realized that Belgian healthcare insurance is second to none. Even if she is optional, it greatly strengthens the coverage offered by compulsory health insurance. I chose supplemental insurance to ensure maximum protection and it has been an excellent choice, especially in the event of a medical emergency.

THE mutual insurance benefits are really beneficial. For example, I needed an ultrasound, and the peace of mind that reimbursement from my health insurance gave me was invaluable. Understanding what mutual insurance is for in Belgium gives me a feeling of security, and I feel really supported by the country’s health system.

Another positive aspect is that the Belgian social security is funded by public funds and contributions based on our income. This means that the system is united and is aimed at everyone. As a citizen, I am proud to contribute to a system that provides access to care for all, and this motivates me to take care of my health.

Introduction to Health Insurance in Belgium

Understand the health insurance in Belgium is essential for any resident, and particularly for expatriates. The system of Belgian social security is well established, offering coverage that varies depending on care and reimbursement. This article aims to break down the pricing structure and protections offered by the mutuality in Belgium, to guide you in choosing the best health coverage.

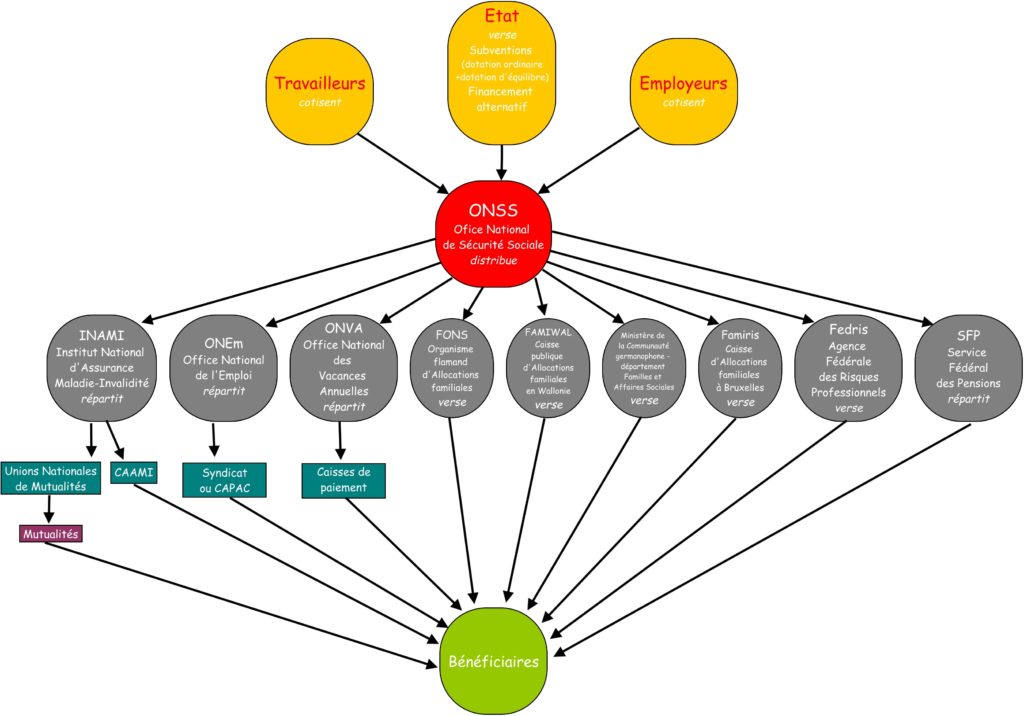

The Social Security System in Belgium

There securitysocial rity in Belgium is fueled by contributions and state subsidies. It plays a crucial role in covering medical costs. Each resident, whether employed or self-employed, contributes to this system through deductions from their remuneration. These contributions guarantee a basic medical coverage, which facilitates access to health care.

Social Security Reimbursements

During a consultation with a general practitioner, for example, the conventional rate is €22.22. Of this amount, 75% is reimbursed by the social security, which considerably reduces the cost for the patient. However, it is important to note that 20 to 25% of health costs may remain the responsibility of the insured, hence the importance of choosing the right choice. mutual.

Coverage and Options of Mutual Insurance Companies

Mutual societies, equivalent to health insurance funds in other countries, work to reimburse the medical costs of policyholders. In general, they cover 60% to 75% of medical and dental costs. This coverage comes in several levels, and it is essential to familiarize yourself with the options available to you.

Choosing the right mutual

There are a multitude of mutual insurance companies in Belgium, and each has its own specificities. THE basic services are generally the same, but additional services may vary. For specific care, such as dental, optics or alternative medicine, some mutual insurance companies will offer higher reimbursements, and others will not. It is therefore crucial to assess your medical needs and analyze the different formulas available.

Additional Insurance

In addition to the basic coverage offered by mutual insurance companies, it is sometimes wise to explore additional insurance. They reinforce protection against remaining costs borne by the insured, thus guaranteeing greater peace of mind. These insurances can cover care abroad, prolonged hospitalizations, or specific treatments not covered by Belgian social security.

Understanding Costs

It is essential to understand the associated costs to health insurance in Belgium. Monthly premiums can vary considerably from one mutual fund to another and depend on the options chosen. Before committing, take the time to compare prices and quality of services, while taking into account your personal needs.

In summary, the systemhealth insurance in Belgium is a well-established and accessible structure, but it is essential to understand its mechanisms. Whether you’re a long-term resident or an expat, the coverage choices you make can have a significant impact on your health and finances. Take the time to inform yourself and make the choice that suits you best.

There social security in Belgium plays a crucial role in the healthcare system, providing significant reimbursements on many medical costs. Thanks to the mutual societies, policyholders can benefit from coverage that varies between 60% and 75% costs related to their care. For example, for a consultation with a general practitioner, whose conventional rate is set at €22.22, you can recover up to 75% costs via social security. This demonstrates the importance of finding out about these systems in order to maximize reimbursements.

It is important to note that, despite this support, part of the health costs remains the responsibility of patients, generally of the order of 20 to 25%. This means that it is essential for each citizen or resident to fully understand their mutual insurance and explore additional options that may exist to further reduce their out-of-pocket costs.

There health care coverage in Belgium can also include additional benefits such as emergency evacuation and repatriation, which is particularly relevant for expatriates. Thus, building health insurance in Belgium turns out to be an exercise in discernment. It is crucial to compare the different offers and ensure that the chosen mutual insurance perfectly meets your health needs.

In short, the health insurance system in Belgium is rich and diversified, offering a solid framework for reimbursement of care. A good understanding of prices and coverage can provide you with better medical protection and allow you to meet your health expenses with complete peace of mind.

FAQ about Health Insurance in Belgium

What are the prices for medical consultations in Belgium? The conventional price of a consultation with a general practitioner is set at €22.22, of which 75% will be reimbursed by Social Security.

What percentage of medical costs is reimbursed by Belgian mutual insurance companies? In Belgium, mutual societies reimburse between 60% And 75% medical and dental expenses incurred by the insured.

What is compulsory health coverage in Belgium? Mandatory health coverage, provided by mutual insurance, covers the majority of health care costs, but 20 to 25% costs remain the responsibility of the patients.

How does social security work in Belgium? Belgian Social Security is financed by state subsidies and contributions deducted from workers’ income by the ONSS.

What is a mutual fund used for in Belgium? The mutual covers services within the framework of compulsory health care insurance, at no additional cost to the insured.

What does health insurance cover for expats in Belgium? Expat health insurance can offer basic coverage varying from 15% to 100% depending on the type of care and the country, often requiring additional insurance.

What are the rights of foreigners regarding health insurance in Belgium? Foreigners may be entitled to certain allowances and health insurance coverage, under certain conditions.