|

IN BRIEF

|

Private health insurance in Morocco is a subject of capital importance for everyone, whether workers, expatriates or families. In a context where social security does not always cover all health needs, it is crucial to understand how this additional coverage works. By opting for private health insurance, policyholders can access optimal quality of care, benefit from better guarantees and rapid support. Let’s discover together the essential elements of this insurance, its advantages as well as the different options available to guarantee health security adapted to each situation.

Private health insurancein Morocco is a crucial subject for those looking for health coverage adapted to their needs. While the social security system offers basic protection to part of the population, private health insurance complements and improves this coverage. This article offers you an overview of the advantages and disadvantages of this type of insurance to help you make an informed decision. Advantages

Extensive protection

One of the main

advantages of private health insurance lies in the extent of the coverage it offers. Unlike AMO (Compulsory Health Insurance), which can reimburse only part of medical costs, private policies offer more complete coverage. Insured persons can benefit from reimbursements which often reach up to 100% of costs incurred in the private sector, thus guaranteeing access to quality care. Rapid access to care

With private health insurance, waiting times for consultations and surgical procedures are generally reduced. This is a major advantage for those looking to avoid the long waits often encountered in the public sector. Policyholders can thus consult specialists promptly and ensure their health in a timely manner.

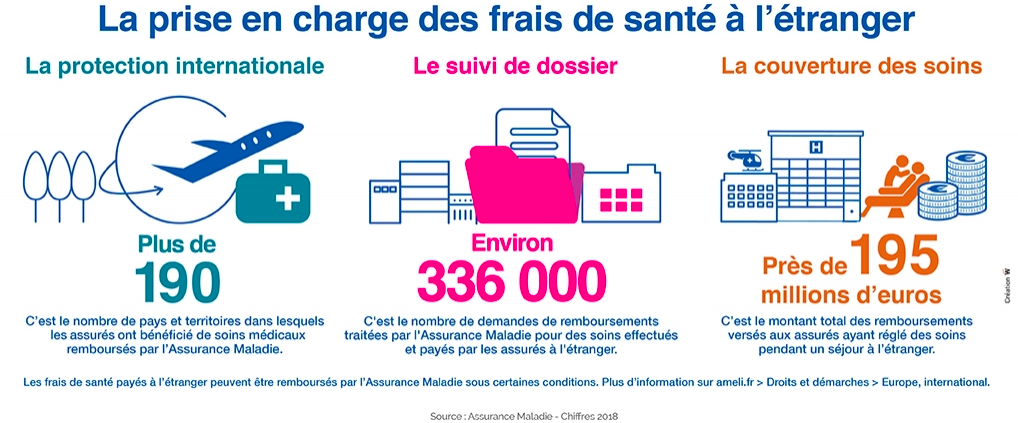

International support

For expats or those who travel frequently, it is essential to subscribe to a

international health insurance . Many companies offer tailored policies that cover medical treatment abroad. This provides peace of mind when traveling, knowing that you will be taken care of, no matter your location.Learn more here.Disadvantages

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

High cost

One of the main

disadvantages of private health insurance is the cost. Premiums can vary considerably depending on the guarantees offered, and they can represent a significant budget for some people. This can make access to this type of coverage difficult for certain segments of the population, particularly those who do not have a high income. Complexity of contracts

Private health insurance contracts can often be complex and contain restrictions that are not always clear to the insured. It is essential to read the terms and conditions carefully, as some costs may not be covered. This requires a certain amount of diligence when subscribing to avoid unpleasant surprises later.

Coverage Limits

It is crucial to note that some policies may have limits on the amounts reimbursed or on specific benefits. For example, exclusions may be applied to certain pre-existing conditions or specialized treatments. Before choosing a policy, it is therefore recommended to find out about the details of the coverage.

Find out more here.Private health insurance in Morocco is a crucial subject for anyone wishing to benefit from adapted and effective medical coverage. Easy to access and diversified, it represents a response to the shortcomings of AMO (Compulsory Health Insurance). In this article, we will explore the different facets of private health insurance, its benefits, how it works, as well as the associated costs.

The basics of health insurance in Morocco

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The system of

social security in Morocco is intended to provide coverage to employees in the public and private sector. However, despite this effort, a significant proportion of the population does not have access to social protection adequate. While AMO covers part of medical costs, health services, particularly in the private sector, can be expensive and sometimes inaccessible. This is where private health insurance comes into play. Why choose private health insurance?

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Private health insurance offers several significant advantages over AMO. First of all, it guarantees better access to quality care, which is particularly important for expatriates and self-employed people. Depending on the contracts, it can cover up to

100% costs related to hospitalization, depending on the healthcare providers chosen. In addition, the responsiveness of private insurers allows reimbursements to be processed much faster. The different types of coverage offered

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Private health insurance contracts vary depending on the needs of the insured. The plans can include specific guarantees such as coverage for medical consultations, analyses, dental care and even surgical interventions. Insurance companies also offer options to cover costs related to alternative and conservative medicine.

Costs of private health insurance

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

THE

cost of private health insurance in Morocco may fluctuate depending on the coverage chosen, the age of the insured and their state of health. On average, monthly premiums can vary from a few hundred to several thousand dirhams. To find out more about prices and terms, it is advisable to find out about the offers available here .Comparison between AMO and private insurance

It is essential to understand the difference between AMO and

private insurance . The AMO, although it offers basic coverage, only covers part of the medical costs. On the other hand, private insurance allows you to have more complete and more personalized support. This includes selection of specialist doctors, private facilities, and no excessive waits for care.International health insurance for expatriates

For expats living in Morocco, international health insurance is often recommended. Indeed, this guarantees protection adapted to the challenges that foreigners may encounter in the local health system. Services offered include reimbursement for medical and surgical expenses, preventive care, and coverage for medical evacuations. For more information, see this link

here .Steps to take out private health insurance

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Signing up for private health insurance is a relatively simple process. You must first assess your health needs. Then, it is advisable to compare the different offers by consulting various insurers. Ultimately, selecting a policy that matches your personal requirements is crucial to ensuring adequate protection. You can explore more available options

here .By choosing private health insurance in Morocco, policyholders can benefit from more comprehensive coverage that is better suited to their needs, especially in a context where access to quality care may be limited. Don’t hesitate to explore the different options and make informed choices to ensure the safety of you and your family.

discover private health insurance in Morocco: access to quality care, coverage adapted to your needs, and peace of mind for you and your family. learn about the best options available and protect your health today.

security social and mutual insurance companies, it is crucial to understand the options available to you. In this article, you will find useful information, practical advice and tips for navigating the world of private health insurance in Morocco. What is private health insurance?

Private health insurance is coverage that covers

medical expenses And surgical not covered by social security. By subscribing to private health insurance, you often benefit from better reimbursement for care, particularly in the event of hospitalization or expensive treatments, especially in private establishments where prices can be high. Types of coverage available

In Morocco, private health insurance options vary. It is possible to choose between various formulas offering

coverage levels adapted to individual needs. Some insurances cover up to 90% of costs. hospitalization costs , while others focus on reimbursement for specific care. It is therefore recommended to compare the different offers to select the one that best suits your situation.Why choose private health insurance?

Most expatriates and Moroccans opt for private health insurance to benefit from better access to

health care . Indeed, although the regime ofAMO(Compulsory Health Insurance) offers basic coverage, it does not always guarantee complete and rapid care. By choosing private insurance, you ensure better care and reduced waiting times in the private sector. Costs and prices of private health insurance

Private health insurance prices can vary considerably depending on the coverage chosen and the insurer. It is essential to

understand prices to avoid surprises during reimbursements. Insurance companies often offer personalized quotes , which allows you to choose the formula that best suits your budget and your needs.Tips for choosing your private health insurance

To make an informed decision, here are some practical tips:

Compare offers

- : Use online comparators to evaluate the different options available on the market. Read the general conditions

- : Take the time to fully understand the terms and exclusions of your insurance contract. Consult customer reviews

- : The experiences of other policyholders can help you better assess the quality of services offered by insurers. Check the network of health establishments

- : Make sure your insurer works with reputable hospitals and clinics that are accessible when needed. Expatriates and health insurance in Morocco

For expatriates living in Morocco, it is often advisable to subscribe to a

international health insurance . This allows you to benefit from extensive coverage, both in Morocco and abroad. Several specialized insurance companies offer plans adapted to the needs of expatriates, including coverage for specific care and medical emergencies.Additional Resources

To deepen your knowledge about health insurance in Morocco and estimate your needs, online resources can be useful. Sites such as

Expat Financial ,The Insurance Comparator , or evenInternational Health Mutual offer advice and help in choosing your insurance. Comparison of different types of health insurance in Morocco

Type of insurance

| Features | Compulsory Health Insurance (AMO) |

| Basic coverage for public and private employees with reimbursement ranging from 70% to 90%. | Private Health Insurance |

| Completes AMO guarantees, reimburses uncovered costs. Ideal for rapid access to private care. | Mutual Health |

| Works as a supplement to the AMO, helps reduce the remaining cost of medical care. | Expatriate Health Insurance |

| Covers the specific needs of expatriates, often with international cover, tailored to care abroad. | CNSS diet |

| Management of reimbursements for employees in the private sector, covering part of medical costs. | Costs |

| Prices vary depending on the contracts, it is essential to compare the offers to choose the best option. | discover the advantages of private health insurance in Morocco. protect your health and that of your family thanks to suitable guarantees, rapid reimbursement and access to a large network of healthcare professionals. |

Marie, an expatriate for a year, shares her experience:

“I chose to take out private health insurance upon my arrival in Morocco. I quickly realized that private sector healthcare, while effective, can be expensive. My insurance allows me to have peace of mind during medical visits and at the hospital, because it covers up to 90% of my costs. » Ahmed, employee in a Moroccan company, testifies:

“My family and I are covered by the AMO plan, but I decided to take out private health insurance as a supplement. This decision was beneficial because it guarantees me rapid reimbursements and access to high-quality care. » Sofia, who has just finished her studies in Morocco, explains:

“As a student, I became well informed about health insurance options. I chose private health insurance because it gives me greater flexibility in choosing my doctors and healthcare facilities. I feel more reassured, especially in an emergency. » Youssef, entrepreneur, agrees:

“At first, I doubted the importance of private health insurance. However, a small incident made me realize that the basic coverage of AMO was not always enough. Thanks to my insurance, I was fully covered, which saved me from a large unexpected expense.” Fatima, a mother of two, highlights the advantages:

“Having private health insurance saved my life during my children’s medical visits. The public system is sometimes saturated, while my insurance allows me to quickly access specialized pediatric care.” Finally, Samira, a young professional, concludes:

“I really encourage everyone living in Morocco, expats or locals, to find out about the different private health insurance options. It is really worth investing in your health and that of your family.” Private health insurance in Morocco is an essential option to guarantee optimal health coverage, in addition to existing social protection schemes. It offers various advantages, especially for those looking for fast care and a higher quality of care. In this article, we decipher how private health insurance works, its disadvantages, its advantages, and how to choose the best coverage for your needs.

What is private health insurance?

Private health insurance is a contract that allows you to cover your medical expenses, whether consultations, hospitalizations or medications. Unlike

Compulsory Health Insurance (AMO), which only covers part of the costs, private insurance can offer a higher reimbursement, often between80%and 100% of the cost of care provided in the private sector. This guarantees you quick and better supervised access to healthcare facilities. The advantages of private health insurance 1. Access to quality care

With private health insurance, you benefit from access to

private hospitals

with modern facilities and qualified staff. Waiting times for a consultation or intervention are generally reduced, which is crucial in an emergency. 2. Choice of service providers You have the freedom to choose your doctor, your specialist or your establishment. This flexibility is one of the great advantages of private health insurance, which allows you to select the care that suits you best.

3. Support for specific care

Many private insurances include

coverage options

areas, such as preventive medicine, dental care, and sometimes even wellness care. This diversity allows you to benefit from support adapted to your needs. The disadvantages of private health insurance 1. High cost

The main disadvantage of private health insurance in Morocco is its cost. Premiums can vary widely, making this less accessible for some people. It is crucial to carefully evaluate your budget before making a choice.

2. Complexity of contracts

In the context of private health insurance, contracts can be complex. It is recommended to read the general conditions carefully before signing. Some contracts may include exclusions or limits which may be surprising when requesting reimbursement.

How to choose your private health insurance?

1. Assess your personal needs

Before purchasing insurance, it is essential to determine your medical needs. If there are pre-existing illnesses in your family or if you have frequent care needs, opting for broader coverage may be wise.

2. Compare offers

It is advisable to compare the different offers available on the market. Pay attention to reimbursement ceilings, waiting periods and exclusions. This will help you find the insurance that best suits your profile.

3. Ask for advice

Do not hesitate to seek advice from experts or insurance brokers. They will be able to guide you towards the most advantageous options, depending on your needs and your financial situation.

In short, private health insurance is a strategic choice to benefit from more comprehensive coverage and rapid access to care in Morocco. To make the right choice, it is essential to be properly informed and compare the available offers.

discover the best private health insurance options in Morocco. protect your health and that of your loved ones with coverage adapted to your needs. compare offers to find the one that suits you best and benefit from rapid and efficient care.

In Morocco, private health insurance is an essential tool to guarantee complete protection against increasing health costs. If the

plan covers part of your medical needs, using private insurance allows you to obtain significant additional coverage. This is particularly true in the private sector where healthcare costs can quickly add up. Insured persons must take several criteria into account when choosing their health insurance

. Indeed, the offers vary not only in terms of price, but also in terms of guarantees. It is crucial to properly assess the level of reimbursement provided for consultations, surgical procedures, as well as hospitalization. To do this, it may be wise to compare different companies and Formulas, in particular to understand the rates chargedand the levels of coverage. Additionally, the healthcare system for expats also has some peculiarities that are worth looking into. Due to cultural nuances and different standards of care, a international health insurance

becomes, in certain cases, an essential requirement. It ensures expatriates immediate access to dignified care adapted to their needs. It is also important not to neglect the role of mutual health insurance

in Morocco. The latter offer significant advantages, particularly in the context of risk management and the pooling of costs. By opting for mutual insurance, policyholders benefit from better coverage of health expenses, thus making care more accessible. Therefore, finding out about the different private health insurance options in Morocco is essential to benefit from effective social security. This not only allows you to benefit from a good level of support, but also to live peacefully in all circumstances. So evaluate your needs and choose the solution that suits you best in order to protect your health and that of your loved ones. FAQs on private health insurance in Morocco

What is private health insurance?

Private health insurance is coverage that reimburses an insured person’s medical and surgical expenses, thus providing broader access to quality care.

Who can subscribe to private health insurance in Morocco? Any person, whether expatriate or Moroccan resident, can take out private health insurance to benefit from additional coverage compared to AMO.

What are the advantages of private health insurance? Private health insurance offers higher reimbursement and access to a network of private health professionals, ensuring better quality of care.

What coverage is offered by AMO? The AMO provides partial coverage for medical care, ranging from 70% to 90% of the reference rate, but does not guarantee complete coverage or access to care in the private sector.

Why is it advisable to subscribe to mutual health insurance in addition to the AMO? The mutual health insurance fills the gaps in the AMO by offering additional reimbursement, which reduces the out-of-pocket cost for medical care.

What is the cost of private health insurance in Morocco? The cost of private health insurance varies depending on several factors such as age, the level of coverage desired and the options chosen, but is generally higher than AMO.

Is international health insurance recommended for expats? Yes, international health insurance is highly recommended for expats in Morocco, as it offers more extensive coverage meeting the specific needs of foreigners.

How to choose the right private health insurance? To choose the right health insurance, it is advisable to compare offers, evaluate the level of coverage, reimbursements and the assistance services included.

Is it possible to receive reimbursement for treatment carried out abroad? It depends on the insurance policy chosen, but some private insurance companies offer reimbursements for treatment abroad, so it is important to check the terms and conditions.

Can I change insurer during the contract? Yes, it is possible to change insurer, but this often requires following certain procedures and checking the conditions for terminating the current contract.