|

IN BRIEF

|

In a world where healthcare costs can quickly become overwhelming, it is essential to choose a mutual insurance company that will provide you with blanket which you need. The AXA mutual formula stands out for its ability to complete reimbursements of Social Security and to adapt its offers to your specific expectations. In this article, we will guide you through the different guarantees, options and practical advice to get the most out of your AXA mutual insurance. Get ready to demystify the technical terms and discover how this health coverage can truly reduce your daily health budget.

There AXA mutual insurance stands out for its flexibility and numerous coverage options. With several formulas and modules adapted to the needs of policyholders, it aims to offer complete health protection. This article explores the benefits And disadvantages of this mutual to help you make an informed choice regarding your health coverage.

Benefits

A personalized cover

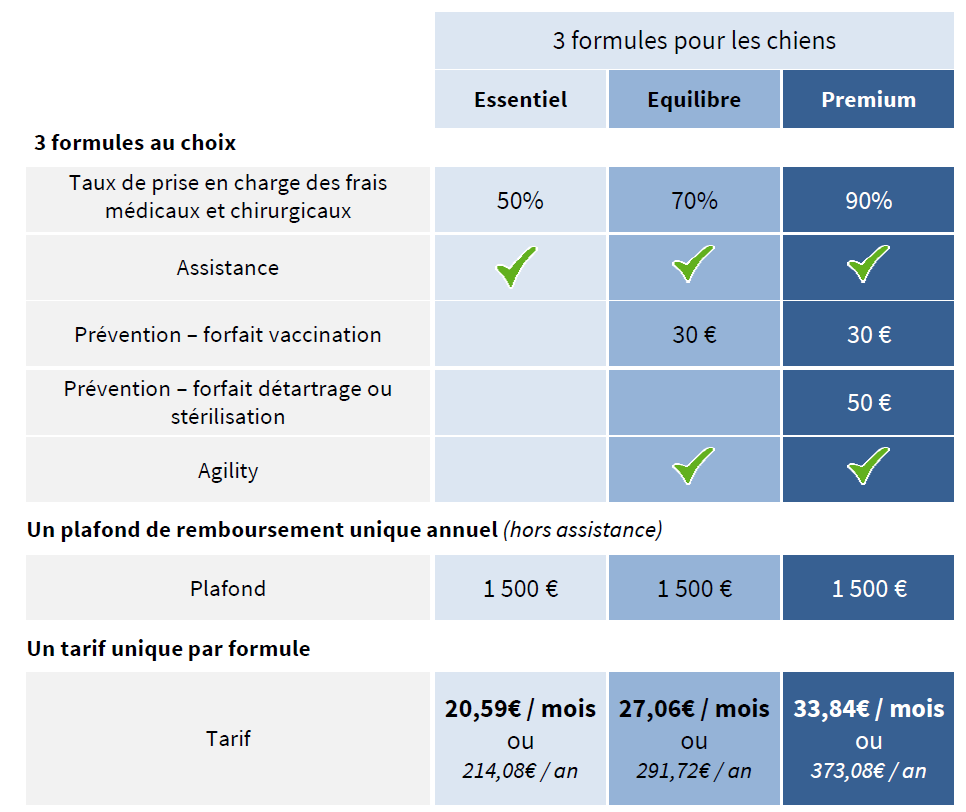

AXA mutual insurance offers up to eight formulas different, allowing policyholders to choose the one that best suits their specific needs. In addition, with three optional modules, you have the opportunity to build a tailor-made contract, integrating guarantees adapted to your personal situation.

Simplified reimbursements

Thanks to the reform My Health, AXA facilitates refunds providing concrete examples for each situation. The reimbursement basis of €25 and coverage by the Social Security of 70% (i.e. €16.50 after deduction of the fixed contribution) guarantees transparency in costs and ensures efficient reimbursement.

Convenient digital features

AXA developed the application My AXA, which allows policyholders to easily manage their reimbursement requests online. This modern tool simplifies administrative procedures and offers real-time monitoring of your reimbursements.

1st euro insurance: a complete guide to understanding its advantages

IN BRIEF Support health costs from first euro spent Reimbursement to 100% real amounts Advantageous rates for better management of your health budget Exemption fromadvance fee in case of hospitalization Immediate coverage for expatriates and international travelers A single contact…

Disadvantages

Potentially high costs

Depending on the formula chosen and the options added, the AXA mutual insurance can represent a significant monthly cost. It is therefore crucial to define a budget before subscribing, to ensure that it fits within your financial capabilities.

Difficulty understanding guarantees

Despite the clarity regarding reimbursements, the diversity of guarantees and optional modules can sometimes cause some confusion for policyholders. It is therefore important to find out carefully and ask for explanations if necessary when subscribing.

Sustainability of choices

Once committed to a formula, policyholders may find themselves faced with the difficulty of to change their contract without penalty. This can be a problem if health needs change over time, making it imperative to anticipate future needs during initial underwriting.

There Axa mutual insurance company presents itself as an essential solution for those looking for health coverage adapted to their needs. In this article, we will explore the different plans offered by Axa, explain how reimbursements work, and help you choose the coverage that meets your expectations. Whether you are looking for information on guarantees, fee overruns, or additional charges, you will find clear and motivating answers here.

Axa mutual health: how to contact customer service by telephone

IN BRIEF Phone number: Call 3641 (free service, cost depends on operator). Hours: Available 24/7 and 6/7. For health insurance: Contact 09 70 80 81 82 from Monday to Friday, from 9am to 6pm. Assistance: Emergency number 01 55 92…

Why choose Axa mutual insurance?

Axa mutual insurance stands out for its ability to adapt to the reality of each individual thanks to its eight formulas and three optional modules. These offers allow you to create a tailor-made contract, taking into account your budget and your specific needs. A thoughtful choice ensures that you have health coverage that meets your daily requirements.

Essential guarantees

A good mutual insurance company, like that offered by Axa, must cover the costs remaining your responsibility after the intervention of the Social security. In terms of health, it is essential to understand the guarantees offered to you: routine, hospital, dental and optical care. This will allow you to anticipate and effectively manage your healthcare expenses.

Axa mutual business: everything you need to know

IN BRIEF Obligation to subscribe to a contract of complementary health for the employees Six options available: First, Eco, Medium, Comfort, Well-being And Optimal Tax deduction possible thanks to the Madelin Law Administrative management made easier: monitoring of contributions and…

Understanding Refunds

It can sometimes seem complex to decipher the health reimbursement system. For example, the Basis of reimbursement of Social Security for a consultation is €25, of which 70% is covered, or €16.50 after deduction. Depending on your Axa plan, the fee overruns can be covered in whole or in part, thus guaranteeing you optimal reimbursement.

100% Health and its benefits

As part of the reform My Health, Axa offers the device 100% Health, which aims to eliminate remaining costs for certain treatments. By providing concrete examples of reimbursements adapted to various situations, this system makes access to care easier and more affordable for everyone.

Everything you need to know about AXA senior mutual health insurance

IN BRIEF Supplementary retirement health insurance AXA for coverage adapted to seniors. Reimbursement of vaccines and care not covered by Social Security. Seven formulas available according to your needs and budget. Savings: up to 30% off for seniors aged 60…

Choosing the right health supplement

To choose the complementary health that suits you, the first step is to define the budget that you can devote to your health security. From there, you can explore the different Axa plans and select the one that will give you the best balance between coverage and cost. Working with an Axa advisor can also offer you clarity on the options available.

Supplementary health supplement

For those who wish to go even further, the additional health supplement acts as a back-up to your first mutual fund. This makes it possible to achieve optimal coverage for certain particularly high health costs. Depending on your specific needs and situation, it may be a good idea to consider this option for complete peace of mind.

Mutual insurance for foreigners: complete guide to choosing the right one

IN BRIEF Expatriate health insurance : Importance of suitable coverage Premium Options : Advantages of care such as single room Choose the best insurance : Need for in-depth comparison Comparison of reimbursements : Analysis of specific care Anticipate health risks…

How to get reimbursed?

Submitting a reimbursement request with Axa health insurance is a simple and efficient process. You can send your requests via the application My AXA or by any other means indicated in your contract. By familiarizing yourself with the reimbursement process, you will save time and minimize the stress of administrative procedures.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage : Foreigners in France must be covered by a health insurance. Form S1 : Necessary to benefit from insurance coverage in certain cases. Age requirements : Under 28 years old for certain specific formulas. European Health…

Special offers for families

Axa also offers specific benefits such as birth bonus. This initiative demonstrates the importance that Axa places on families and their health. Being well covered throughout this crucial phase of life is a priority for many parents who can thus navigate more peacefully.

Complete health check: what price in Belgium?

IN BRIEF Cost of one complete health check-up : approximately €369.49 with VAT included. Reimbursements possible byhealth insurance for various examinations. Health check as photography of the state of health at a given time. Free availability for patients of 45…

Where can I find more information?

To deepen your knowledge of Axa mutual insurance company and the many options it offers, do not hesitate to consult online resources. You can turn to their official website for more details on the additional health guarantees or explore the information available on specialized sites. Additionally, for an international perspective on mutual insurance, consult this dedicated resource. Don’t let questions or hesitations slow down your journey towards optimal health coverage!

AXA mutual insurance is an ideal option for anyone wishing to benefit from comprehensive health coverage adapted to their needs. With several plans and options available, understanding the guarantees offered by AXA is essential to maximize your reimbursements and optimize your healthcare expenses. This article will guide you through the main features of AXA mutual, highlighting key elements you need to know.

Medical care for foreigners: what you need to know

IN BRIEF Health insurance for the foreigners on vacation or extended stays. Conditions to benefit from the medical protection In France. Required supporting documents: medical certificate, RIB, and administrative documents. Support for scheduled care in the EU and outside the…

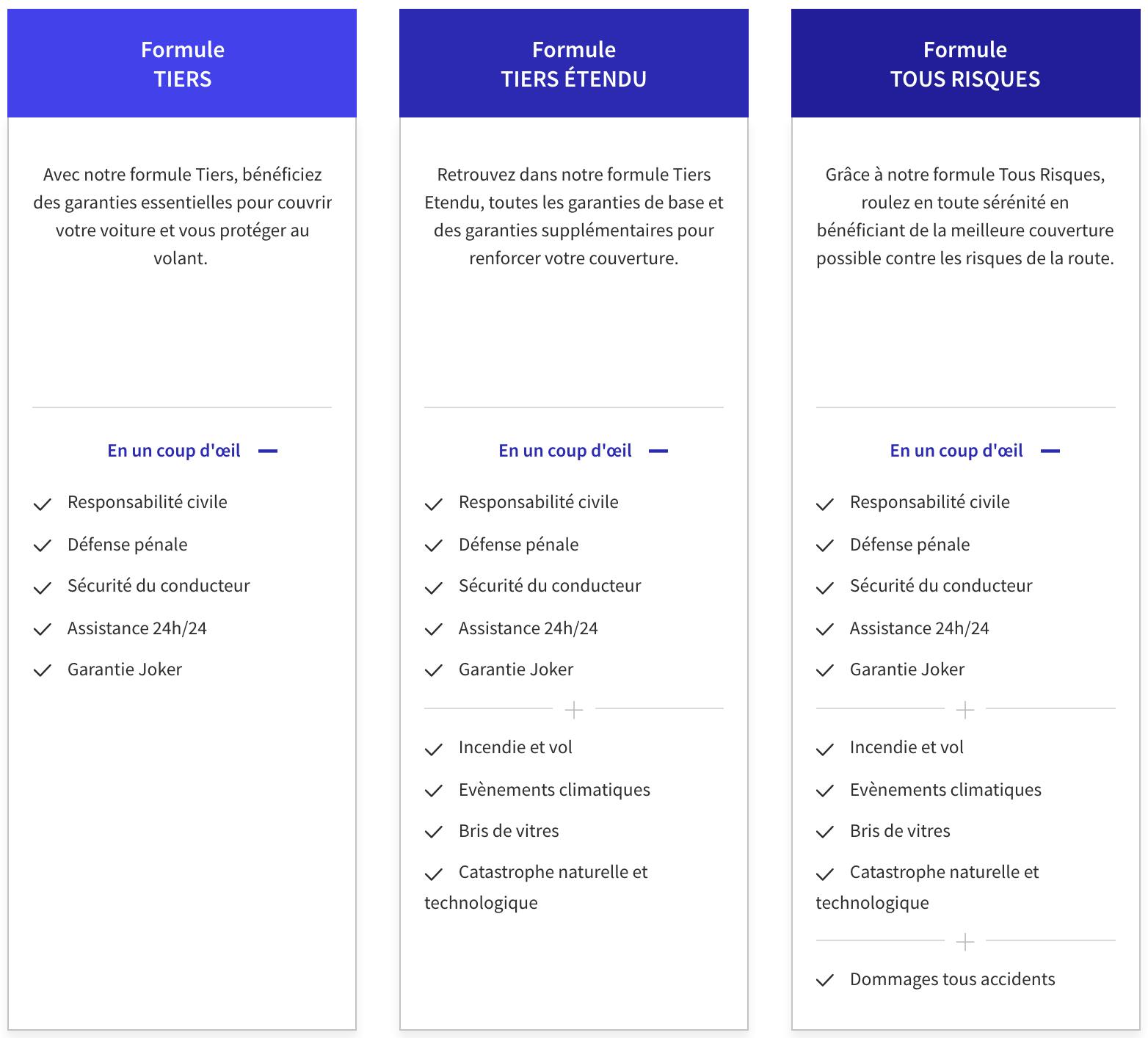

AXA mutual guarantees

AXA mutual offers a variety of guarantees which aim to cover the health costs remaining your responsibility after intervention by Social Security. Whether for routine, hospital, dental or optical care, you will find a formula that meets your specific needs.

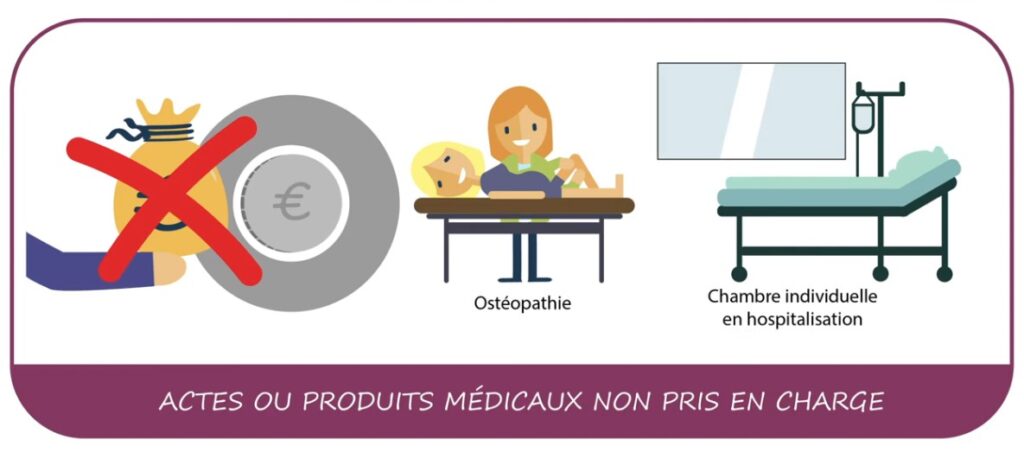

Coverage of excess fees

A crucial element to take into account is the support of fee overruns. Depending on the plan chosen, AXA may fully or partially cover these additional costs, which can make a big difference in your health budget. It is important to consult the details of the guarantees provided in your contract to fully understand how these excesses are managed.

Examples of reimbursements under 100% Health

With the reform My Health, AXA has integrated solutions for refund adapted to different situations. You can find concrete examples of reimbursements on the AXA website, allowing you to anticipate your expenses and better plan your visits to healthcare professionals.

Choose your health insurance carefully

The first step to taking full advantage of your complementary health is to carefully determine your budget. Evaluate how much you are willing to invest on a recurring basis for your healthcare expenses. This will help you choose the AXA plan that best suits your financial situation while meeting your health needs.

How to get reimbursed by Axa mutual insurance

To maximize your reimbursements, it is imperative to understand the process of refund request. Generally, you can make your requests easily via the application My AXA, which gives you a user-friendly interface to submit your invoices and track your reimbursements. This will also allow you to keep tabs on your medical and financial history.

The specifics of AXA formulas

AXA offers different formulas adapted to various needs. Whether you are looking for basic coverage or enhanced protection with additional options, it is possible to create a tailor-made contract. Explore the different warranty options to find the coverage that suits you best.

Useful resources to learn more

To deepen your knowledge about AXA mutual insurance, do not hesitate to explore the resources available online. Links like this link, Or this one, will offer you detailed information on reimbursements and specific guarantees.

| Criteria | Details |

| Formulas available | 8 formulas adapted to different needs |

| Cost coverage | Reimbursement of remaining costs after intervention by Social Security |

| Fee overruns | Partial or total coverage depending on the option chosen |

| 100% Health Reimbursements | Examples of reimbursements adapted to each situation |

| Generosity of guarantees | Reinforced guarantees for routine, hospital, dental and optical care |

| Supplementary health supplement | Possibility of adding a supplement for increased coverage |

| Access to reimbursements | Simple reimbursement via the My AXA app |

| Birth bonus | A bonus is offered upon the arrival of a new child |

| Health budget | Define a health budget based on your income |

When I started to become interested in AXA mutual insurance, I was lost in the multitude of choices. Thanks to the guarantee tables and reimbursements offered by AXA, I was finally able to visualize what would be covered. It is essential to know what your mutual insurance covers after the passage of the Social security, because it directly influences your financial contribution.

One aspect that has helped me a lot is the support for fee overruns. This was a crucial point for me, as I wanted to avoid surprises. By consulting the different AXA plans, I understood that some of them cover costs beyond the conventional rates, which reassured me and allowed me to better plan my health expenses. .

The reform My Health was also a turning point. With all the reimbursement examples tailored to each situation, I was able to see concretely what this meant for my coverage. For example, the reimbursement of treatment whose base was €25 and which is covered at 70% by Social Security enlightened me on the remaining costs that I could expect.

It was by defining my health budget that I was able to choose the coverage that suited me. The flexibility of AXA’s offering, with its 8 formulas And 3 optional modules, really makes it easier to personalize my contract. This allowed me to select exactly what I needed without finding myself paying for unnecessary options.

I also discovered what a additional health supplement. Like an additional safety net, this insurance seemed to me to be a good option to strengthen my initial coverage, especially for expensive care.

Finally, the process of refund request with the app My AXA is a real plus. The ease of use of the application allowed me to follow my reimbursements in real time, thus making my health management much more fluid and peaceful.

AXA mutual insurance company has established itself as a key player in the field of complementary health, offering varied formulas to meet everyone’s specific needs. In order to fully understand the advantages and operation of this mutual, it is essential to explore the different guarantees, reimbursements as well as the selection criteria. This article aims to enlighten you on the fundamental aspects of AXA mutual insurance, while deciphering its options and its advantages for your health.

The different health coverage formulas

AXA offers a wide range of mutual insurance formulas adapted to each profile. In total, there are 7 basic formulas and 3 optional packs. Each formula is versatile and can be personalized with additional modules to cover the following areas: hospital, dental and optical. This is a valuable opportunity for policyholders looking for a health plan that perfectly fits their personal and financial situation.

Included guarantees

AXA mutual insurance guarantees provide complete protection on a daily basis. They cover the majority of expenses related to your routine care, as well as any excess fees that you may encounter. Thus, depending on the formula chosen, these excesses can be covered in whole or in part, considerably reducing the costs to be paid by you after intervention by Social Security.

Reimbursements: what you need to know

When it comes to reimbursements, it is important to familiarize yourself with the Reimbursement Base (BR), which for many treatments amounts to €25. Social Security covers 70% of this amount, or approximately €16.50 after taking into account the flat-rate contribution. The AXA mutual insurance company supplements this reimbursement depending on the formula chosen, thus avoiding you having to pay too much in advance.

Examples of reimbursements with 100% Health

With the Ma Santéreform, AXA is adapting its reimbursement approach. The 100% Health system allows policyholders to benefit from care with no remaining costs in certain areas. This includes dental, optical and hearing care. By choosing the appropriate formula, you ensure that you are covered ideally for your needs.

How to choose the right supplementary health insurance?

Choose the right supplementary health insurance is essential and must start with an analysis of your budget. It is crucial to define how much you can invest each month in your health without jeopardizing your financial situation. By taking into account your income and expenses, you can determine which plan would offer you the best value for money.

The health supplement option

Among the options to consider, there is also the possibility of opting for a additional health supplement. This type of contract reinforces the coverage of a first mutual insurance company, ideal for those who wish to go beyond standard reimbursements. This allows you to have broader coverage and secure your health even more efficiently.

Access your reimbursements easily

AXA also facilitates your reimbursement procedures via the application My AXA. Using this application, you can submit your reimbursement request in just a few clicks, track its status, and access your reimbursement history. This accessibility greatly simplifies the management of your health and saves you valuable time.

There AXA mutual insurance is positioned as an ingenious solution to meet everyone’s health needs. Thanks to its diversity of options and optional modules, it allows you to personalize your coverage according to your expectations and budgetary constraints. It is essential to define beforehand the amount that you can invest in your health, because this choice will directly influence the guarantees that will be offered to you.

One of the greatness of AXA mutual insurance lies in its understanding of fee overruns. Depending on the plan chosen, AXA can partially or fully cover these costs, thus guaranteeing greater peace of mind during your medical consultations. In addition, the initiative of 100% Health allows you to have a clear view of the reimbursements to which you are entitled, making it easier to manage your healthcare expenses.

THE guarantees offered by AXA mutual insurance cover a wide range of everyday situations, whether consultations with general practitioners or specialists, dental or optical care or even hospitalization. With 8 formulas adapted to different situations, it’s easier than ever to opt for the one that best meets your specific needs.

Finally, understanding how the complementary health and associated notions, such as that of supercomplementary, is essential. This will allow you to take full advantage of your contract and optimize your reimbursements. In short, AXA mutual insurance is designed to offer you health support tailor-made, allowing you to benefit from better monitoring and reinforced protection. Take the time to explore all the options available to you to make the wisest choice for your health.

FAQ about the AXA mutual plan

What is AXA mutual insurance? AXA mutual insurance is health insurance designed to supplement Social Security reimbursements, by covering part of the health costs that remain your responsibility.

What types of plans are available at AXA? AXA offers several plans tailored to your needs, with 7 main options and 3 optional packs to strengthen your coverage.

How do reimbursements work with AXA mutual insurance? Reimbursements are based on the Reimbursement Base set by Social Security, and may vary depending on your plan. In general, part of the costs is reimbursed depending on the guarantees taken out.

What is the concept of 100% Health? 100% Health is a reform which guarantees full reimbursement of certain care, with no out-of-pocket costs, which allows access to quality care at no additional cost.

What are fee overruns and how are they covered? Fee overruns are the amounts billed by healthcare professionals beyond the agreed rate. Depending on the option chosen, AXA can fully or partially reimburse these costs.

How do I choose my complementary health insurance from AXA? To choose your complementary health insurance, start by defining your health budget, and think about the essential guarantees according to your medical needs.

What is a health supplement? Supplementary health insurance is insurance that complements your basic mutual insurance, thus offering additional guarantees to better cover your health costs.

How to request a refund with AXA? You can easily request a reimbursement via the My AXA application or by using the online services offered by your mutual insurance company.

Review of AXA mutual insurance: what do customers say? Customer reviews of AXA mutual insurance are generally positive, highlighting the diversity of plans, the quality of reimbursements and responsive customer service.

Does AXA mutual insurance offer birth bonuses? Yes, AXA offers birth bonuses in certain packages, thus encouraging newborns and helping families to cover the costs associated with the arrival of a child.