|

IN BRIEF

|

Find out everything you need to know about AXA senior health insurance, designed specifically to meet the needs of retirees and the elderly. This tailor-made offer allows you to benefit from refunds adapted as well as complete coverage, including hospitalization, optics and many other treatments. With flexible formulas of up to 30% off for seniors, AXA is committed to supporting your health while preserving your budget. Prepare to live your retirement peacefully thanks to a mutual that understands your expectations and offers you effective solutions.

AXA senior mutual health insurance is specially designed to support retirees and the elderly with their health needs. With a varied range of suitable formulas, it offers complete coverage that meets many criteria. In this article, we will explore the benefits and the disadvantages of this mutual to help you make the best choice for your health.

Benefits

Comprehensive coverage suitable for seniors

AXA senior mutual health insurance offers guarantees specially designed for the elderly. Reimbursements include not only medical consultations, but also dental, hospital and optical care. In fact, you can benefit from support for fee overruns, allowing access to quality care without financial worries.

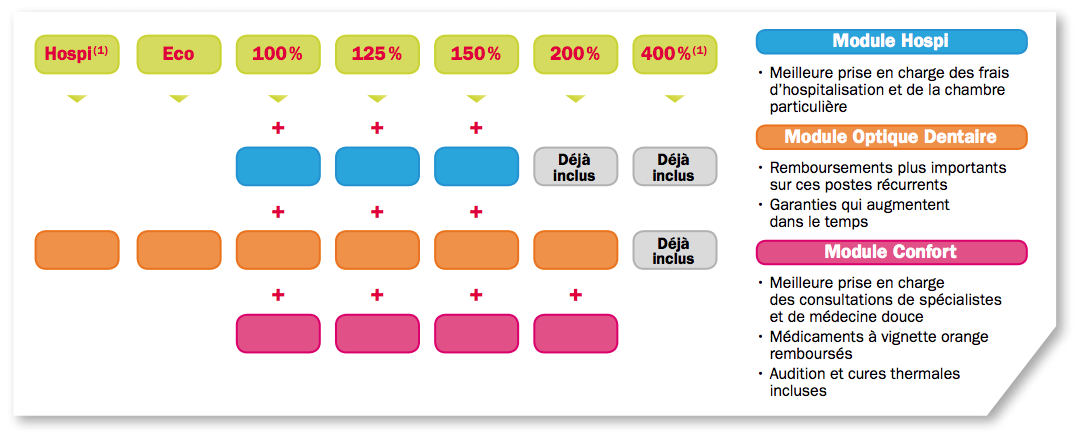

Customizable options

AXA offers several packages that adapt to your specific needs and your budget. Whether you are in consultation very often or need orthopedic equipment, you will find an option that meets your expectations. Furthermore, the reinforcements in hospitalization and optical care are available for even more comprehensive coverage.

Attractive discounts

Taking advantage of an advantageous rate is essential to controlling your health budget. With AXA, seniors can benefit from discount of up to 30% from the age of 60. In addition, the current offer shows a permanent reduction of 10%, making mutual insurance even more accessible.

Axa mutual price: everything you need to know about prices and guarantees

IN BRIEF Pricing criteria : Profile, level of guarantees, management fees. Free quote online from €9.04/month. 7 formulas And 3 optional packs at Axa. Refunds included for routine care, hospital, dental And optics. Free download of guarantee tables. Formulas My…

Disadvantages

Potentially high prices depending on the guarantees chosen

Although AXA mutuals offer comprehensive coverage, some policyholders may find the high prices depending on the options chosen. It is important to carefully analyze your health needs so as not to subscribe to unnecessary guarantees which would increase the cost of contributions.

Complexity of offers

With several formulas available, the multitude of options can sometimes make comparison and choice complex. It is therefore essential to look carefully at each guarantee and take the time to assess the different health needs.

Age limits

It is also important to note that there are age limits for some options. Although most plans are accessible from the age of 60, contract conditions may vary depending on the age and pre-existing health of the insured, which can lead to exclusions or refusals of coverage in certain cases.

To find out more about AXA senior mutual health insurance, do not hesitate to request a online quote or explore the specific offers, in order to find the health solution that suits you best.

Are you preparing to choose health insurance adapted to your needs as a senior? AXA mutual health insurance offers you a range of solutions that specifically meet the expectations of retirees. In this article, we will explore the different options available, the advantages of reimbursements, and the criteria to consider to make the best choice.

1st euro insurance: a complete guide to understanding its advantages

IN BRIEF Support health costs from first euro spent Reimbursement to 100% real amounts Advantageous rates for better management of your health budget Exemption fromadvance fee in case of hospitalization Immediate coverage for expatriates and international travelers A single contact…

AXA mutual health insurance plans for seniors

AXA offers seven formulas separate health insurance dedicated to seniors. Each formula is designed to fit your specific health needs and your budget. Whether you need enhanced coverage for hospitalization, optical or dental care, there is a choice that will meet your expectations.

Axa mutual health: how to contact customer service by telephone

IN BRIEF Phone number: Call 3641 (free service, cost depends on operator). Hours: Available 24/7 and 6/7. For health insurance: Contact 09 70 80 81 82 from Monday to Friday, from 9am to 6pm. Assistance: Emergency number 01 55 92…

Reimbursements for care and vaccines

One of the great advantages of AXA complementary health insurance is its ability to supplement reimbursements for care that is often partially covered by the Social security. This also includes the vaccines which are not on the reimbursement list, thus guaranteeing you more complete health protection.

Axa mutual business: everything you need to know

IN BRIEF Obligation to subscribe to a contract of complementary health for the employees Six options available: First, Eco, Medium, Comfort, Well-being And Optimal Tax deduction possible thanks to the Madelin Law Administrative management made easier: monitoring of contributions and…

Discounts for seniors

If you have more than 60 years old, you will be able to benefit from significant reductions, which can go up to 30%. This offer includes immediate coverage with no waiting period, which is ideal for people looking to optimize their health protection quickly.

Mutual insurance for foreigners: complete guide to choosing the right one

IN BRIEF Expatriate health insurance : Importance of suitable coverage Premium Options : Advantages of care such as single room Choose the best insurance : Need for in-depth comparison Comparison of reimbursements : Analysis of specific care Anticipate health risks…

Choosing your complementary health insurance in retirement

Before subscribing, it is essential to study in detail the guarantees offered by AXA. Think about your state of health, the frequency of your consultations and your requirements, particularly if you consult doctors practicing fee overruns. This will help you choose the plan that will offer you the best value for money.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage : Foreigners in France must be covered by a health insurance. Form S1 : Necessary to benefit from insurance coverage in certain cases. Age requirements : Under 28 years old for certain specific formulas. European Health…

Conclusion of the advantages of AXA senior mutual health insurance

AXA senior health insurance is specially designed to meet your health needs while offering you enhanced guarantees. It also guarantees long-term savings thanks to tailored discounts. Take the time to study the available options and request a personalized quote to find the health coverage that suits you best.

As you approach retirement, choosing a suitable health insurance becomes essential. AXA senior health insurance offers tailor-made guarantees, designed to meet the specific needs of seniors. In this article, discover the different coverage options, the advantages of this mutual insurance, and advice for choosing the formula best suited to your situation. The plans offered by AXA for seniors

Complete health check: what price in Belgium?

IN BRIEF Cost of one complete health check-up : approximately €369.49 with VAT included. Reimbursements possible byhealth insurance for various examinations. Health check as photography of the state of health at a given time. Free availability for patients of 45…

AXA offers you several

complementary health insurance plans specially designed for seniors. In 2024, you can choose from seven plans that fit your needs and your budget . Whether for routine care, consultations with specialists, or even forhospitalization and optical reinforcements , AXA has designed a variety of options to cover all of your expectations.Significant financial advantages

Medical care for foreigners: what you need to know

IN BRIEF Health insurance for the foreigners on vacation or extended stays. Conditions to benefit from the medical protection In France. Required supporting documents: medical certificate, RIB, and administrative documents. Support for scheduled care in the EU and outside the…

When you choose AXA mutual health insurance, you benefit from advantageous offers. Seniors can take advantage of an immediate

30% reduction from 60 years old on their rate. In addition, regular discounts are available, such as a 10% reduction on mutual health insurance for new policyholders. These benefits make it possible to significantly reduce health care costs during retirement. Essential coverage for routine care

There

complementary health insurance AXA covers various health-related costs, particularly those not reimbursed by Social Security. Hospitalization costs, hearing aids , dental care as well as optical expenses are covered, which allows you to benefit from quality care without worrying about costs. This is a fundamental aspect to consider when you select your mutual insurance company.How to choose the right formula?

Before subscribing to mutual health insurance, first assess your

specific needs . Think about the frequency of your visits to the doctor, anyspecialized consultations , as well as fee overruns that may occur. By carefully examining the guarantees of each plan, you will be able to choose the coverage best suited to your personal requirements.Get a personalized quote

To find out the rate and coverage options that best suit your situation, do not hesitate to

request a quote . AXA makes this process easier by allowing you to carry out an online simulation to evaluate the different formulas offered. This step is essential to make an informed choice and benefit from the best possible health coverage.To find out more about the

AXA senior health insurance , consult the resources available on the AXA website and discover the many membership possibilities:complementary health insurance for retirees . You can also consult comparators to find the best mutual insurance according to your needs on sites such asGoodassur .AXA Senior mutual health insurance: Comparison of options

Criteria

| Information | Formulas available |

| Seven formulas adapted to the needs and health budget of seniors. | Discounts |

| Offer of up to | 30% permanent reduction for people over 60 years old .Specific reimbursements |

| Coverage of excess fees for hospitalization, dental care, optics. | Immediate coverage |

| Immediate access with no waiting time when subscribing. | Reinforcements available |

| Enhanced options for optical and dental care. | Customer service |

| Dedicated support for senior policyholders. | Online quote |

| Simulation and quick quote directly on the AXA website. | discover axa senior health insurance, specially designed to meet the needs of seniors. benefit from comprehensive coverage, personalized support and tailored services to guarantee your well-being and peace of mind on a daily basis. |

“As a retiree, I wanted to make sure I had solid health coverage. I chose the

AXA mutual health insurance and I don’t regret it! Their options are adapted to the needs of seniors and allowed me to benefit from attractive reimbursements for my medical visits and my medications. It’s a relief to know that I’m well protected. » “When I started to compare the different

mutual , I was impressed by the clarity of AXA’s offers. With seven plans available, I found the one that perfectly suited my budget and needs. In addition, the reduction of30% of the 60 years old is a real bonus! » “I was looking for a

complementary health which takes care of dental and optical care, and AXA offered me interesting reinforcements in these areas. I feel reassured knowing that I can receive reimbursements for my glasses and dental care, which can quickly become expensive. » “When speaking with an AXA advisor, I was pleasantly surprised by their personalized advice. They took the time to explain all the guarantees available to me, and helped me choose the best option. I felt confident to finalize my registration. »

“The ease of obtaining an online quote for

AXA mutual health insurance is another point that I really appreciate. I was able to run a simulation and see exactly what I could expect in terms of reimbursements. This really simplified my decision making. » “In the event of hospitalization, I wanted to be sure that I was well covered. AXA’s guarantees regarding hospitalization and coverage of excess fees really reassured me. I know I can count on them in difficult times without having to worry about costs. »

In this article, we will explore the different facets of senior health insurance offered by AXA. We will discuss tailor-made offers that meet the specific needs of retirees, financial benefits, as well as important guarantees. Thanks to detailed information, you will be able to make an informed choice for your complementary health insurance in retirement.

Formulas adapted to your needs

There

AXA mutual health insurance stands out for its seven flexible formulas, specially designed for seniors. Each of these formulas takes into account the desired level of coverage as well as your budget. Whether you need hospitalization, optical or dental support, AXA has a solution for you. Customizable guarantees

It is essential to choose a mutual that takes your health habits into account. For example, if you regularly see specialist doctors or need hearing aids, some options may offer you

better support . By personalizing your benefits, you will be able to maximize your health care reimbursements, which is of great importance in retirement.The financial advantages of AXA mutual insurance

AXA offers attractive discounts for seniors. From the age of 60, a

30% discount immediate is applied to the mutual rate. In addition, certain contracts can guarantee you stable prices without untimely increases, which is a considerable asset for planning your long-term health budget. Transparent, no-obligation quotes

To help you choose the formula that suits you best, AXA offers online simulations. You can get a

free quote which will allow you to compare the different options without constraints. This gives you an excellent opportunity to analyze the covers in detail and select the one that best meets your expectations. Immediate coverage with no waiting time

By opting for AXA senior mutual insurance, you benefit from

immediate coverage . This means that you will not have to wait months before taking advantage of your guarantees. This type of care is ideal for people who need regular care or do not have the luxury of waiting to receive treatment.Options for dental and optical care

Dental and vision health are often a priority for seniors. AXA allows you to add enhanced options for dental and optical care. This means that if you need devices such as glasses or dentures, your costs can be well covered, making it easier for you to access quality care.

Choose your retirement health insurance carefully

When you are close to retirement, it becomes crucial to evaluate your health situation and habits. It is recommended to review the

guarantees offered depending on the frequency of consultations and care you plan to receive. Take the time to also consult the reviews of other policyholders to form an opinion on the quality of AXA’s customer service. Investing in specific health insurance for seniors is an important decision to guarantee your well-being in retirement. With AXA, you benefit from tailored coverage, attractive financial benefits, and unparalleled accessibility.

discover axa senior mutual health insurance, specially designed to provide cover adapted to the needs of seniors. benefit from personalized services, optimized reimbursement and quality support to preserve your health and well-being.

mutual health insurance adapted is essential for seniors, and AXA mutual health insurance stands out as a preferred option. Offering several specific packages, AXA has been able to meet the varied and growing needs of retirees. With dedicated guarantees, the mutual guarantees optimal reimbursement for medical care, while offering advantages in areas such as optical, THEdental or even the hospitalization.With flexible coverage options, it’s crucial to choose the plan that best suits your health and medical needs. As a future retiree, your choice will influence not only the quality of available care, but also the long-term cost of your health coverage. AXA allows everyone to simulate their needs online, thus facilitating comparisons and informed choices.

For seniors, AXA also offers attractive discounts of up to

30% for those over 60. This immediate reduction represents a real opportunity to reduce the health budget while benefiting from comprehensive coverage. In addition, AXA undertakes not to increase its rates, thus providing peace of mind to policyholders. In short, AXA senior mutual health insurance positions itself not only as financial support but also as a trusted partner for the well-being of retirees. Its flexibility, its attractive discounts and its reinforced guarantees make it an option of choice for those who aspire to live their retirement peacefully, with complete health security. Opting for AXA mutual insurance means guaranteeing health coverage adapted to your expectations and your daily needs.

FAQ about AXA senior health insurance