|

IN BRIEF

|

Escaping abroad is an enriching adventure, whether for vacation, of the studies, A work or a retirement. However, before you pack your bags, it is essential to find out about thehealth insurance. Know your rights and procedures to undertake can save you a lot of hassle in the event of a health problem outside France. Whether you are a expatriate worker or simply a tourist, social protection abroad deserves special attention to guarantee your peace of mind during your stay.

When you plan to go abroad, whether for vacation, studies, or work, it is essential to fully understand the implications of your health insurance. Pick-up arrangements, administrative obligations and procedures to follow may vary considerably depending on your destination. This article presents the different aspects of thehealth insurance internationally, including benefits and the disadvantages to consider before your departure.

Benefits

Medical coverage

One of the main advantages of subscribing to a health insurance for the foreigner is the medical care coverage. This ensures you have access to necessary medical treatment during your stay, which can prove crucial in the event of an accident or illness. In addition, for countries in the European Economic Area (EEA), the European health insurance card allows you to be supported under the same conditions as a local resident.

Administrative facilities

By informing you of your rights and procedures related to assistance social abroad, you would reduce the risk of unpleasant surprises. On platforms like Ameli, you will find precise and up-to-date information on the forms to complete and the steps to follow to benefit from your rights.

Coverage of scheduled care

If you have to extend your stay for necessary care, certain insurances allow reimbursement of costs. scheduled care. Before your trip, it is possible to ensure that specific treatments will be covered. More information on this subject is available on the websiteAmeli.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Potentially high costs

One of the major disadvantages ofhealth insurance abroad is the cost. Insurance premiums can be quite high, especially for extended guarantees. It is essential to compare offers, not just in terms of costs, but also in terms of coverage. Don’t forget to find out about the price of private health insurance for your destination.

Coverage Exclusions

It is crucial to read the terms and conditions of your insurance policy carefully, as some exclusions may apply. Pre-existing care, for example, may not be covered. In addition, if you go to a country that does not have social security agreements with France, you will have to pay medical expenses on site and wait for reimbursement upon your return.

Complex administrative procedures

The administrative procedures linked to thehealth insurance can sometimes be complex and require a certain investment of time. You may have to return your Vitale card and notify your health insurance fund in France before your departure, which can cause problems if this is not properly managed. For further clarification, see this link: Health insurance abroad.

Preparing for a trip abroad involves many aspects, and among the most crucial ishealth insurance. Whether you are traveling for vacation, to study, or for professional reasons, it is essential to understand your rights and the steps necessary to be properly covered. This guide will help you navigate the world of international health insurance, by covering the steps to take before your departure and by informing you about the social protections available to you.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Steps to take before your departure

Before leaving French territory, it is crucial to apply for the European Health Insurance Card (EHIC). This document allows you to benefit from health coverage when you travel within the European Union, the European Economic Area, Switzerland and the United Kingdom. To do this, go to your Ameli account and access the “My steps” section to make this request in a few clicks.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Understanding your rights abroad

The rights tohealth insurance for a French person living abroad vary depending on the country of residence. Find out about the arrangements for medical care in the country of destination. Indeed, each State has its own rules and bilateral conventions which determine which health benefits can be reimbursed.

Reimbursement of care abroad

If you need medical care abroad, you will need to go back to your Ameli account, in the “Request reimbursement for care abroad” section. Note that for care covered by the CEAM, reimbursement will be simpler, while for other situations, the costs will have to be paid in advance and will be reimbursed later.

Prepare your health before departure

If you are sick or need specific care, it is strongly recommended to contact your insurer before leaving. This will allow you to check your coverage, as well as that of the organizer of your stay if applicable. Anticipating these steps will save you inconvenience once you are there.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Working abroad and health insurance

Finally, if you are going abroad for professional reasons as anexpatriate, it is essential to notify your health insurance fund in France of your departure. This includes returning your Vitale card and updating your status. In addition, depending on the host country, you may be subject to specific health insurance conditions.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Explore other insurance options

There are alsoprivate health insurance solutions that can greatly facilitate your health coverage abroad. Whether for occasional trips or for extended stays, it is often recommended to find out about the different options available. To learn more, consult the various resources and guides on the subject, such as the importance of private health insurance in Tunisia or everything you need to know about health insurance for expatriates.

Prepare well before your departure and make sure you have taken all these elements into account to leave with peace of mind!

Preparing for a trip abroad is an exciting adventure, but it is essential not to neglect the appearance of your health insurance. Whether for vacation, studies or expatriation, knowing your rights and the steps to take can save you from possible unforeseen events. In this article, we’ll explore the key steps you can take to ensure you have secure coverage during your stay abroad.

Check your health insurance rights

Before you leave, it is crucial to find out about your rights regarding social protection in your destination country. Health insurance terms can vary considerably depending on the country, especially if you are an employee, student or retiree. Also find out about bilateral agreements that may influence your rights regarding healthcare reimbursement abroad.

Apply for the European Health Insurance Card

To facilitate your care within the European Economic Area (EEA) and Switzerland, it is recommended to request the European health insurance card (CEAM). You can carry out this process directly online via your account on the website.Ameli. This card will allow you to access medical care under the same conditions as residents of the country visited.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Anticipate scheduled care

If you have planned medical treatment abroad, be sure to establish beforehand that this treatment cannot be carried out in France or in another EU/EEA/Switzerland country. This will avoid possible unreimbursed costs. Make a request for support to your health insurance fund to guarantee coverage of medical expenses.

Treatment not covered by the EHIC

For treatment provided in a country not covered by the EHIC, it is important to be informed that you will have to pay the medical expenses in advance. You can then request a refund upon your return to France via your Ameli account. Fill in the “Request a refund for treatment abroad” section to facilitate this procedure.

Find out about private insurance

In some cases, private health insurance may offer more extensive coverage, particularly in countries that do not participate in a social security agreement with France. Compare the available plans and find out about the offers before you leave. For example, in Morocco, there are specific insurances that can be advantageous for expatriates. For more information, consult this link.

Inform your health insurance fund

Finally, do not forget to inform your health insurance fund of your departure. Depending on your situation, you may be required to return your Carte Vitale and fill out certain specific forms. Also remember to check whether your situation allows you to access health services in the country you are going to, by consulting the Ameli website for tailored advice.

Taking the time to be well informed and to carry out these essential procedures before your departure will allow you to travel with peace of mind. Make sure you are fully covered and ready to make the most of your adventures abroad!

Health insurance for abroad: essential advice

| Axis of comparison | Details |

| European Health Insurance Card | Essential for stays in the EU, it guarantees coverage of medical care. |

| Request a refund | Access your Ameli account to submit your request for reimbursement after treatment abroad. |

| Social protection abroad | Find out about your rights and in particular about health coverage depending on your status (worker, student, etc.). |

| Private health insurance | May be essential to cover costs not covered by social security. |

| Inform the CPAM | Inform your Primary Health Insurance Fund of your departure abroad. |

| Scheduled care | Check if the treatment can be carried out within the required time frame before leaving. |

| Costs of care outside the CE zone | Anticipate the costs to be paid and the subsequent steps for reimbursement. |

| Medicines abroad | Check if you need a prescription for medications during your stay. |

| CPAM cancellation | Consider deregistering your CPAM if you emigrate permanently. |

Testimonials on Health Insurance for Foreigners: What You Need to Know Before You Leave

Marie, 32 years old, traveling to Barcelona: “When I decided to go on vacation to Barcelona, I hadn’t really thought about the issue of health insurance. Fortunately, a friend advised me to contact my health insurance fund and ask my European health insurance card. It really put my mind at ease, knowing that I could have coverage if I had a medical need. Every time I travel, I am reminded of the importance of these steps.”

Thomas, 27 years old, expatriate in Australia: “Before leaving, I took the time to find out about my rights as an expatriate worker. I had to notify my CPAM of my departure and to know what type of social protection was offered to me. This helped me avoid problems with reimbursement for treatment abroad. Check the support arrangements of your insurance, because each country has its specificities.”

Sandrine, 45 years old, retired in Spain: “When I moved to Spain to retire, I was worried about what it meant for my health coverage. By contacting my fund, I discovered that my rights largely depended on the agreements between France and Spain. My European card was very useful to me, but I also needed additional insurance for treatments that were not covered. Good advice: don’t leave anything to chance and find out well before you leave.”

Julien, 30 years old, student in Germany: “Studying abroad is an incredible adventure, but I knew the health aspect was crucial. I did my research and found out that I had to complete a health declaration. social security website to qualify for health insurance. When checking my coverage, I learned that I should also consider a health supplement for specific care. It gave me invaluable serenity during my stay.”

Clara, 38 years old, frequent traveler: “I love traveling, but every time I cross a border, I make sure my insurance is up to date. The first thing I do before every departure is check my EHIC card and to ensure that my procedures are in order. In the event of illness abroad, this guarantees me a rapid reimbursement. It’s always stressful being away from home, but knowing that I’m covered is a huge reassurance.”

Health insurance for abroad: introduction

Going abroad, whether for vacation, work or for a longer period of time, requires particular attention to your health insurance. Indeed, it is essential to know your rights regarding support medical care abroad. This article guides you through the necessary steps to guarantee your peace of mind during your stay abroad.

Prepare before you leave

Before leaving French territory, make sure to start your process proactively. One of the first actions to take is to request your European Health Insurance Card (EHIC). This card, to be requested via your Ameli account in the “My procedures” section, will allow you to access medical care in the European Economic Area and Switzerland.

Find out about your rights

It is crucial to understand your health insurance rights depending on the country you are traveling to. Reimbursement terms and coverage vary considerably from country to country. Find out about local laws regarding medical care to ensure you are adequately protected during your stay.

Make sure you have health coverage

If you leave as expatriate worker, check the specific conditions of your employment contract. Some employers offer international health coverage, but it’s imperative to read the fine print to find out the level of protection it offers.

Check scheduled care

If you are planning specific medical care abroad, you will need to prove that this care is not available in France or in another EU/EEA/Switzerland country. Don’t forget to keep all the necessary proof and documents to facilitate your reimbursement procedures upon your return.

Reimbursement of care abroad

To benefit from a reimbursement of medical expenses incurred abroad, go to your Ameli account in the “Request reimbursement for treatment abroad” section. This will allow you to assert your rights and be reimbursed for the costs incurred, as long as your need for care is covered by your insurance.

Anticipate the unexpected

Before leaving, take the time to contact your insurer to clarify the reimbursement terms and possible deductibles. In the event of a health problem abroad, you will know the steps to follow to avoid uncovered costs. Also consider getting a travel health insurance if your usual coverage is insufficient.

Inform social security of your departure

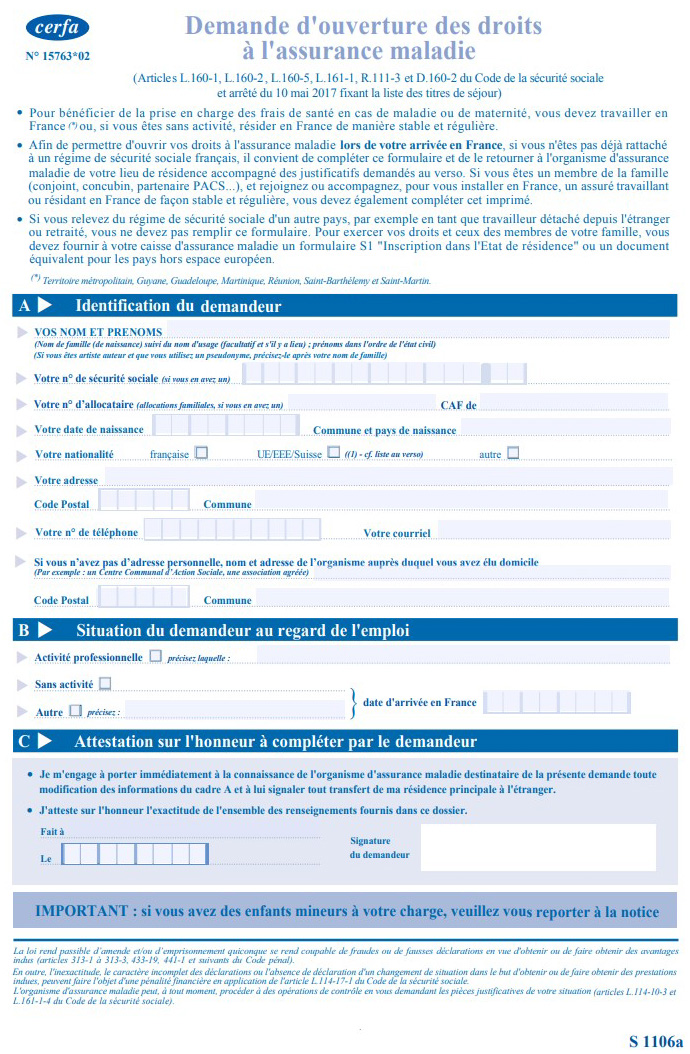

Before leaving France, it is essential to inform your primary health insurance fund (CPAM) of your expatriation project. Fill it out declaration form for departure abroad in order to formalize your situation. This will help update your file and ensure that your rights are respected during your stay abroad.

Get practical advice

Finally, do not hesitate to consult official sites or discuss them with other expatriates to obtain practical advice on the health system of the country where you are going. Preparing for your health while abroad can make all the difference in ensuring a pleasant and stress-free stay.

When you plan to go abroad, whether for vacation, of the studies, of work or even for your pensions, it is essential to find out about your health insurance. Social protection can vary from one country to another, and it is essential to be well informed to avoid inconvenience during your stay.

Before you leave, be sure to ask for your European health insurance card (CEAM). This can be done easily from your account Ameli. This card will allow you to benefit from medical care coverage in many countries of the European Union and the European Economic Area. However, it is important to check whether the destination country has bilateral conventions with France, as this may affect your rights regarding reimbursement of care.

In the event of a medical package, it is also advisable to obtain detailed information from your trip organizer and your insurer. Indeed, to guarantee optimal coverage, you may be required to take out additional insurance which covers costs not covered by French social security.

Remember that if you are expatriate worker, certain steps are added to your checklist, in particular informing your health insurance fund in France and returning your social security documents. So, being well prepared will allow you to travel with peace of mind, whatever the reason for your departure.

FAQ: Health insurance for abroad

How do I apply for the European Health Insurance Card before my departure? Before leaving, you can request your European health insurance card by logging into your Ameli account and accessing the “My procedures” section. This will ensure you have adequate protection during your vacation abroad.

What are my social protection rights if I go abroad? Regardless of your situation (holidays, studies, work or retirement), it is crucial to know the necessary arrangements to benefit from support during your stay abroad.

How does health insurance work for a French person living abroad? Your right to health insurance depends on the country of residence, in particular if it is part of the European Economic Area or a bilateral agreement with France.

What should I do to obtain reimbursement for my care abroad? To request a reimbursement, go to your Ameli account, in the “My procedures” section and select “Request reimbursement for care abroad”.

What are the deadlines for receiving care scheduled abroad? It is your responsibility to prove that the necessary care cannot be provided in France or in another EU/EEA/Switzerland/United Kingdom country before being able to claim coverage.

What should I do if I fall ill abroad? Before leaving, contact your insurer and the organizer of your stay to check your coverage and the steps to follow in the event of an accident or illness.

Is it necessary to inform my CPAM of my departure abroad? Yes, if you are leaving for the EU/EEA/Switzerland or a country with a bilateral agreement, it is essential to inform your CPAM affiliation to avoid any surprises in your care.

What medical expenses are covered if I am abroad? For care provided in a country that the European Health Insurance Card does not cover, you will have to pay the costs on site and then request a refund upon your return to France.

How do I get my CPAM deregistered if I am an expatriate worker abroad? Before your departure, it is necessary to return your Vitale card and take steps with your health insurance fund in France.

What document do I need to fill out to go abroad? You will need to complete form 12267*06 to declare your departure abroad to your social security fund.