|

IN BRIEF

|

Selecting a health insurance adapted to your needs is essential, especially for expatriates or anyone looking for effective coverage abroad. The 1st euro mutual insurance stands out for its ability to reimburse health costs from the first euro spent, thus offering a real advantage in avoiding excessively high remaining costs. In this quest, it is crucial to understand the specificities of this option, its comparative advantages compared to other formulas such as “complementary insurance to the CFE”, and above all, how to choose the coverage that suits you best. Let’s discover together the keys to making the right choice in terms of health insurance!https://www.youtube.com/watch?v=Jr6sv5peBK4

health insurance adapted to your needs is essential, especially when you are an expatriate or not affiliated with the Caisse des Français de l’Étranger (CFE) . Themutuelle 1er euro is an option that deserves to be studied. It offers a reimbursement of medical expenses from the first euro spent, thus offering many advantages, but also some disadvantages. This article details these points to help you make an informed choice. Advantages

The

mutuelle 1er euro presents several advantages which make it attractive for many policyholders. First of all, it guarantees immediate reimbursement, as soon as health expenses are incurred. Unlike other plans, it is not necessary to wait for reimbursement of the CFE . This guarantee constitutes a major advantage for those who want rapid and efficient coverage of their medical costs.Additionally, the absence of out-of-pocket costs is another significant advantage. With a

1st euro mutual insurance , you are reimbursed 100% of the costs incurred, eliminating the anxiety associated with unexpected costs. Reimbursement times are also reduced, allowing you to quickly benefit from money for your care. For more information on health insurance options for expats, you can check out resources such asInternational Health .Disadvantages

Axa supplementary health insurance: everything you need to know

IN BRIEF Free online quote for tailor-made health insurance from €9.04 per month. Reimbursement to €0 out-of-pocket costs for eligible medical equipment. Tips for choose wisely your complementary health insurance according to your budget. Clear understanding of guarantees offered by…

Despite its many advantages, the

1st euro mutual insurance also poses certain limits. First of all, there may be higher contributions compared to other traditional health insurance. This can become a deterrent, especially for those on a tight budget. It is therefore important to compare the different offers available to check whether the quality-price ratio suits you. Furthermore, some

1st euro mutual insurance may have warranty exclusions, meaning certain health benefits may not be covered. It is essential to read the insurance terms and conditions carefully to familiarize yourself with which services are covered and which are not. To help navigate these choices, you can consult online comparison sites that highlight the different options, such as AXA mutual insurance prices .In short, the

1st euro mutual insurance represents an attractive solution for many policyholders thanks to its immediate care and full reimbursement. However, it is crucial to examine the prices and check the guarantees in order to make an informed choice adapted to your personal situation. Feel free to explore different online resources for an in-depth comparison and advice on the best approaches. Are you considering subscribing to a

1st euro mutual insurance ? This type of health insurance has become a popular option for those looking for quick and complete reimbursement of their healthcare costs. In this article, we will explore in detail what 1st euro mutual insurance is, its advantages compared to other insurances, and how to choose the one that suits you best. What is a 1st euro mutual?

How to contact axa for your complementary health insurance

IN BRIEF Phone number: Call 36 41, available 24/7. 24/7 Support: Contact AXA on 01 55 92 26 92 in case of emergency. Contact form: Complete the form on the AXA website for any request. Contact by email: Use the…

A

1st euro mutual insurance stands out for its ability to intervene from the first euro spent. This means that you are reimbursed in full and immediately, without needing to go through a primary fund like the CFE. This operation offers simplicity and transparency particularly appreciated by policyholders, especially during unforeseen health expenses. The advantages of mutual insurance at the 1st euro

Axa Global: Understanding the Challenges of Insurance on an International Scale

IN BRIEF AXA EssentiALL : inclusive insurance for vulnerable customers. Green investment target of €26 billion by 2023. International health insurance with adaptable monthly premiums. Internationalization : expansion in Asia, after Europe and the United States. World leader in corporate…

Choosing a 1st euro mutual has several advantages:

Fast refunds:

- By opting for this type of insurance, you benefit from reduced reimbursement times. Reduction of the remainder payable:

- Being reimbursed from the first euro, your out-of-pocket costs will be minimal, which is essential for your health budget. Global Accessibility:

- Many 1st euro mutual funds are designed to be valid worldwide, which is ideal for expats. How to choose your 1st euro mutual insurance?

AXA supplementary health insurance: everything you need to know

IN BRIEF Free online quote for personalized health insurance Offers from €9.04/month Refunds for routine care, hospitalization, dental, optical and hearing expenses Easy understanding of health coverage Charts of guarantees And refunds available for download Opinion on the quality of…

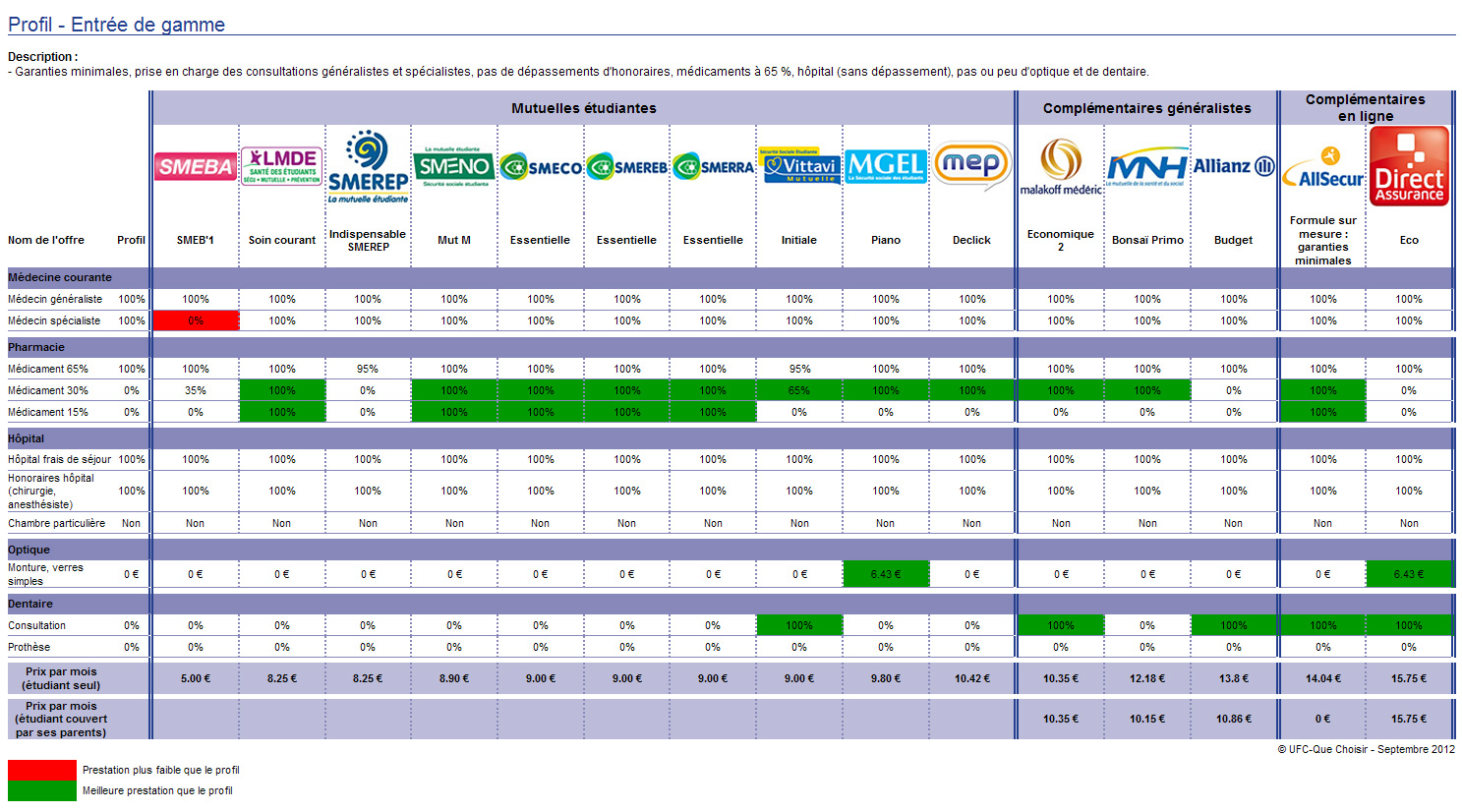

The choice of your 1st euro mutual insurance must be made taking into account several criteria:

Comparison of guarantees:

- Check the guarantees covered by the mutual insurance company, in particular routine care, hospitalization, and dentistry. Prices:

- Contributions vary from one insurer to another. It is therefore essential to compare prices to find the most advantageous option for you. Additional services:

- Find out about the services offered such as assistance, teleconsultation, or even support for specific treatments. 1st euro mutual or CFE complementary health insurance?

Axa mutual insurance: understanding the advantages of mutual health insurance

IN BRIEF Supplementary health customizable from €9.04/month. Choice of level health guarantees adapted to your needs. Effective reimbursements for health expenses. Intervention in addition to Social security. Analysis of the criteria influencing the price of your mutual insurance. Benefits of…

If you are an expatriate, you are probably wondering whether it is better to opt for a

1st euro mutual insurance or a complementary health CFE . The main difference is in the support. While the CFE reimburses only after declaration, the 1st euro mutual intervenes from the start, without requiring complex administrative procedures.To learn more about the differences between these two types of insurance, check out this article:

International insurance at 1st euro or complementary health CFE .Consult an online comparator

Axa mutual contract: everything you need to know

IN BRIEF Supplementary health AXA: adapted protection from €7.39/month Reimbursements on health expenses not covered by theHealth insurance Choice of modules to personalize your CONTRACT Options third party payer with many health professionals Care support dental And optical, including refractive…

To make your choice easier, do not hesitate to use a

online comparator . These tools will allow you to quickly view the different offers and make an informed choice based on your needs and your budget. You will often find advice to help you in your approach.If you would like to explore concrete examples of 1st euro mutual insurance companies, consult this link:

First euro individual expat pack at Malakoff Humanis .find out how to choose the best 1st euro mutual insurance that meets your needs. compare offers, benefit from suitable coverage and optimize your healthcare expenses with practical advice and detailed information.

1st euro mutual insurance is essential to guarantee optimal health coverage, especially if you are an expatriate or travel regularly. This type of insurance offers you the possibility of being reimbursed from the first euro spent, without going through a social security fund. In this article, we offer you practical advice to make the right choice and better understand the issues of this health coverage. What is a 1st euro mutual?

Understanding 1st euro health insurance: advantages and operation

IN BRIEF Health insurance at 1st euro : immediate coverage of health expenses. Operation: reimbursements at actual amount from first euro spent. Independence: offered by a private insurer, without CFE. Protection: medical consultations, hospitalizations, various care. Simplified management to deal…

There

1st euro mutual insurance stands out for its ability to reimburse health costs from the first euro incurred. Unlike a traditional mutual insurance company, it is not necessary to go through a social security organization such as the CFE. This means that you can obtain rapid and simplified reimbursement for your healthcare expenses, whether for medical consultations, surgeries or medications. The advantages of a 1st euro mutual fund

Axa mutual health insurance prices: what do you need to know?

IN BRIEF The price of the AXA mutual insurance varies depending on the profile of the insured. Criteria influencing the price : age, place of residence, And level of guarantees. Insurance packages from €9.04 per month. Reimbursements based on Basis…

Opt for one

mutual health insurance to the 1st euro has several notable advantages. First of all, it makes it possible to considerably reduce the remains responsible for the insured, which is particularly useful in the event of a medical emergency. In addition, reimbursement times are often shorter, allowing you to quickly access care without worrying about administrative formalities. How to choose the right 1st euro mutual fund?

To make the right choice regarding

1st euro mutual insurance , it is essential to assess your specific health needs. Take into account the types of care you may require and check the guarantees offered by each insurer. Do not hesitate to compare theprices and the levels of coverage offered by several insurance companies. Criteria to take into account

When making your selection, pay particular attention to the following criteria:

price contributions, services additional benefits in terms of insurance and retirement, as well as the reputation of the insurer. Also make sure that the mutual covers your health costs abroad if you are an expatriate. Some companies, such as AXA, offer solutions adapted to French people living outside France. Where to find reliable information?

To keep you well informed about the

1st euro mutual insurance , several online resources are useful. Consult insurance comparators to clearly visualize the options available. You can also go to specialized sites to get advice and feedback from other users. For example, you can discover detailed advice on choosing a good expat health insurancehere or find out about the rates of AXA mutual insurance here .Finally, for a thorough understanding of the subject and to take into account all the available options, it may be beneficial to read expert articles on the comparison between CFE health insurance and that of the 1st euro, as proposed

here .The advantages of the 1st euro mutual

Criteria

| Details | Reimbursement from the 1st euro |

| Immediate support without excess. | Without CFE affiliation |

| No need to be attached to the CFE to benefit from it. | Reimbursement deadlines |

| Fast process, usually within a few days. | Competitive rates |

| Contributions accessible from 47 euros per month. | Pension options |

| Coverage for health and retirement risks. | Access to a healthcare network |

| Possibility of choosing partner health professionals. | International network |

| Coverage of care outside France. | find out how to choose the 1st euro mutual that meets your needs. compare offers, benefit from optimal reimbursement and ensure the health of your family with complete peace of mind. |

The choice of a

mutual health insurance at 1st euro can sometimes seem confusing, especially when it comes to expatriation. Several policyholders share their experience in order to enlighten those who find themselves in this situation. Anne, an expatriate in Australia, says: “When I left France, I didn’t know what type of insurance to choose.

international insurance at 1st euroallowed me to benefit from immediate coverage. Every euro spent was reimbursed without any preconditions. This considerably alleviated my financial worries and let me enjoy my new life peacefully.” Jean, who arrived in Canada, explains why he opted for

complementary health CFE : “I had initially thought about a 1st euro mutual fund, but I realized that the CFE could offer significant advantages, particularly for specific care. However, I recognize that the guaranteed from the 1st euro are very interesting, especially for those who want a quick refund.” Sophie, based in Portugal, takes stock of her subscription: “Subscribe to a

mutual insurance at 1st euro was the best decision. The system works perfectly and I have never had to pay up front. Additionally, I appreciate the fact that this coverage allows me to freely choose my healthcare providers.” For those wondering about the cost, Lucas shares: “After comparing several offers, I found a

1st euro health insurance at a very affordable price. THE reduced repayment times and the absence of any remaining charges also convinced me. It’s clear that for an expatriate, this is an option that should not be overlooked.” Finally, Claire testifies to the advantages linked to the absence of a link with the CFE: “It really relieved me not to have to adhere to a system that I did not fully understand. With my

expatriate mutual insurance at 1st euro , I only pay the contribution due to my insurer, which simplifies things enormously.”Introduction to Mutuelle 1er Euro

The mutual

1st euro is a health coverage option that is attracting more and more people, especially those looking to optimize their health expenses. This type of insurance allows reimbursement of health costs from the first euro spent, without having to go through a primary fund such as the CFE. In this article, we will explore the essential aspects to consider when choosing the 1st euro mutual that will best meet your needs. Understand how 1st euro mutual insurance works

The mutual

1st euro stands out for its simple and straightforward operation. Unlike other forms of insurance where a minimum amount must be reached before reimbursement, this mutual covers medical costs from the first expense. This allows immediate reimbursement without preconditions. The advantages of 1st euro mutual insurance

Choose one

1st euro mutual insurance has several advantages. Firstly, it offers 100% reimbursement of costs incurred, which considerably reduces the remainder payable by the insured. In addition, it guarantees reduced reimbursement times, thus allowing smoother financial management in the event of medical expenses. The guarantees offered

When considering a 1st euro mutual, it is crucial to examine the guarantees it offers. Many mutual insurance companies include various benefits such as reimbursement of medical consultations, hospitalization costs, alternative medicine, and even dental and optical care. Make sure you choose coverage that meets your specific needs.

Criteria for choosing a 1st euro mutual insurance company

To choose your

mutual health insurance at 1st euro , several criteria must be taken into account. Here are the main elements to evaluate:The mutual rate

Price is often a deciding factor. Compare the

prices of the different mutual insurance companies and make sure you understand what is included in each offer. Be careful of insurance companies offering services at very low prices, as they may neglect certain essential guarantees. Opinions of policyholders

Consulting feedback from other policyholders can provide you with a clear picture of the quality of customer service and reimbursements. Insurance comparison sites or forums can help you gather valuable opinions.

Reimbursement deadlines

Another criterion not to be underestimated is the repayment period. Find out how quickly the mutual reimburses its policyholders. A mutual fund that takes time to repay can cause financial difficulties in the event of unexpected expenses.

By choosing your

1st euro mutual insurance , you ensure appropriate health protection and financial support if necessary. Take the time to evaluate your options, taking into account the criteria mentioned, to make an informed choice that will meet your expectations and those of your family. Remember that your health and your budget deserve your full attention to ensure adequate coverage.discover how to choose the 1st euro mutual insurance that meets your health needs and your budget. compare offers, analyze guarantees and benefit from optimized reimbursement for your medical expenses.

mutual insurance at 1st euro stands out for its unique operation which guarantees full reimbursement of health costs from the first euro spent. This type of insurance is particularly suitable for people wishing to avoid complex administrative procedures linked to reimbursements, because it does not require the intervention of a primary fund. This makes it an ideal solution for expatriates, self-employed workers, or anyone wanting simple and effective health coverage. When looking for a

1st euro mutual insurance , it is crucial to assess your specific needs. Consider the frequency of your medical expenses, the nature of the medical care you may require, and the network of healthcare professionals available to you. A good mutual insurance company must not only cover current costs, but also offer guarantees adapted to your personal situation, such as pension options or specific coverage for particular care.THE

varied prices 1st euro mutuals should also be considered. Contributions may differ from one company to another, so it is useful to carry out a comparison offers available on the market. Remember that price should not be the only determining factor. The quality of customer service, reimbursement times, and warranty exclusions must also be taken into account in your choice. Finally, take the time to read the reviews of other policyholders and consult online comparison sites to gain an overview of the different options available to you. By following these tips, you will be able to make an informed choice for your

mutual health insurance to the 1st euro, and thus protect your health optimally. FAQ about Mutuelle 1er Euro

What is a 1st euro mutual?

There 1st euro mutual insurance is health insurance that reimburses health costs from the first euro spent, without needing to go through a primary fund like the CFE. What are the advantages of a 1st euro mutual insurance company?

The main advantages include a immediate refund health costs, reduced remaining cost , and generally shorter repayment periods.How does a 1st euro mutual fund work?

This mutual covers the medical expenses from the first euro committed, thus allowing optimal coverage without advance costs. Who is the 1st euro mutual insurance for?

It is mainly aimed at expatriates or to people without affiliation with the CFE, looking for complete coverage for their health care. What types of costs are covered by a 1st euro mutual fund?

This mutual insurance generally covers medical expenses , consultations, hospitalization, and sometimes evendrugs and preventive care. Do you have to be affiliated to the CFE to benefit from 1st euro mutual insurance?

No, the 1st euro mutual insurance operates independently of CFE affiliation, allowing policyholders to only pay the contribution due to their insurer. What criteria should you take into account when choosing your 1st euro mutual insurance company?

It is important to consider the guarantees offered , THEcontribution rate , and therepayment period , as well as the opinions of policyholders.