|

IN BRIEF

|

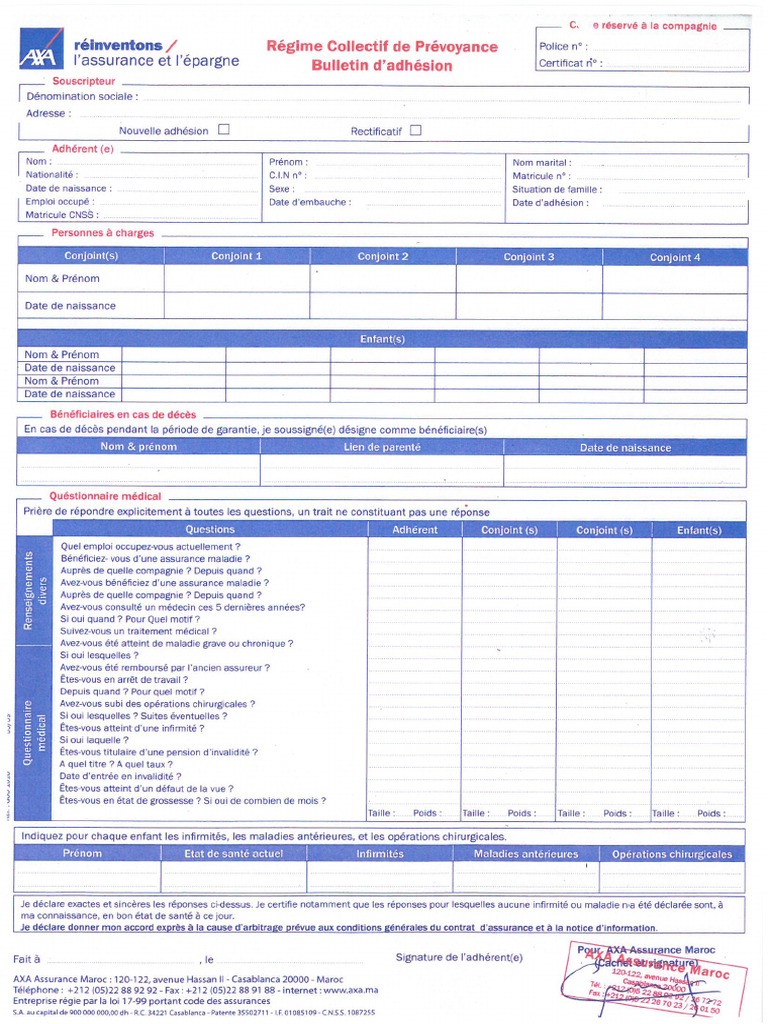

In a context where health-related challenges are increasingly important, the importance ofprivate health insurance in France cannot be underestimated. Faced with a growing demand for care and to gaps in public coverage, complementary health insurance plays an essential role in guaranteeing quality access to a variety of medical services. By offering solutions adapted to each individual’s needs, private health insurance not only reduces costs health expenses, but also to encourage a fast support and efficient. In terms of prevention and modernization of the health system, these insurers have a key responsibility that can transform the healthcare experience of the French.

In France, private health insurance occupies a prominent place in the healthcare system. Faced with growing medical needs and the limits of coverage offered by public health insurance, it represents an essential solution for many citizens. This article explores the benefits and the disadvantages associated with private health insurance in France, in order to better understand its role in health protection.

Benefits

Improved access to care

One of the main benefits of private health insurance is the improvement of access to care. Policyholders have the flexibility to choose their practitioners and access reputable healthcare facilities, often without prolonged waits. This can be particularly valuable for surgical procedures or specialized care.

Reimbursement of medical expenses

Another considerable benefit is the financial coverage of expenses. Private health insurance contracts offer levels of refund higher than those of compulsory health insurance. This includes covering consultations, expensive medications and even dental and optical care, which are often poorly covered by the public system.

Personalized support

The contracts offered by insurers allow personalized support according to the specific needs of each person. Policyholders can adapt their health coverage according to their preferences, which promotes a more proactive and adapted approach to health.

Understanding 1st euro insurance: a complete guide for policyholders

IN BRIEF Definition : What is thehealth insurance from 1st euro ? Target : Intended for French expatriates. Benefits : Support from first euro. Pricing : Prices advantageous and flexible. Blanket : Exemption from advance payment costs. Comparison : Differences…

Disadvantages

Cost of premiums

However, one of the main disadvantages of private health insurance is the cost of premiums. For many households, the expense of private health insurance can be a real financial burden. These costs vary considerably depending on the guarantees chosen, and it is important to evaluate the budget before subscribing.

Complexity of contracts

Another disadvantage is the complexity insurance contracts. Terms and conditions can often be difficult to understand, which can lead to misunderstandings about reimbursement levels or possible exclusions. It is crucial to carefully read and understand the different offers before making a choice.

Coverage Limits

Finally, although they offer good protection, private insurance can also have disadvantages. coverage limits, particularly with regard to certain specific treatments or care. Thus, even with health insurance, there may be costs payable by the insured, making the experience less advantageous in certain situations.

In France, private health insurance plays a crucial role in protecting the health of citizens. It complements the public system, offering additional coverage which allows access to quality care, while guaranteeing faster care. This article explores the benefits and impact of private health insurance on the daily lives of policyholders.

Travel insurance without age limit: what you need to know

IN BRIEF Travel insurance for the elderly people without age limit. Options from 23€ with extended guarantees. Reimbursement ceiling of up to 500,000€. Check if coverage starts from first euro. Insurance cancelation often available. Duration of stay generally limited to…

An essential complement to the public health system

Private health insurance has become essential for many French people, particularly because of inadequacies in public coverage. Social Security reimbursements, while fundamental, may prove insufficient in the face of increasing health costs. Complementary organizations, such as mutual and the insurers, thus contribute to co-financing medical expenses, facilitating access to care, particularly for long term care.

Travel insurance without age limit: what you need to know

IN BRIEF Many insurers impose a age limit for travel insurance. Some insurers, such as Groupama, offer contracts with no age limit. THE essential guarantees include coverage for emergency medical expenses. Pay attention to age restrictions, which may vary depending…

Rapid access to care and better quality of service

One of the main advantages of private health insurance is the speed of access to care. Privately insured people often benefit from reduced waiting times for specialist consultations and surgical procedures. This responsiveness has a significant positive impact on the quality of life of patients and their rehabilitation, allowing them to regain their autonomy more quickly.

Everything you need to know about medical insurance in France

IN BRIEF Health Insurance : structure and operation in France Universal health protection : rights for all, even without activity Refund : rate varying from 15% to 100% depending on the treatment Supplementary health : essential to cover the remaining…

International coverage for expatriates

For people living or traveling abroad, private health insurance offers a major advantage: international coverage. Some insurance policies provide for reimbursement to the first euro, which means that policyholders can benefit from immediate coverage of their medical costs, even abroad. This guarantee is particularly appreciated by expatriates who wish to be protected in all circumstances.

Mutual hospitalization only: what axa offers

IN BRIEF Blanket hospitalization costs including the hospital package at €20/day. Reimbursement of 80% to 100% costs related to surgical procedures and drug treatments. Support of the fee overruns during interventions. Options private room in hospital, with reimbursement of up…

The preventive role of private insurers

Private insurers are not limited to covering curative care. They also play a key role in the disease prevention. Through health education programs, regular check-ups and awareness initiatives, they help encourage healthy behaviors among policyholders. This approach aims not only to improve the health of individuals, but also to reduce long-term costs for the overall health system.

First euro insurance: a complete guide to fully understand

of insurance with the first euro is the immediate coverage of medical costs. Unlike other insurances where you have to advance the costs and wait for reimbursement, here, you are reimbursed directly by the insurer, which considerably simplifies the management…

Conclusion on choosing private health insurance

Choose one private health insurance adapted to its needs is essential to guarantee complete and effective protection. It is recommended to compare the different options available and find out about the services offered by each organization. In France, this choice is an important step towards better health care.

In a modern health system, private health insurance plays a determining role in guaranteeing access to quality care. In France, the role of complementary organizations has become essential, especially in the face of increasing medical costs and the growing expectations of policyholders. This article highlights the profits and the importance of private health insurance for each individual.

Everything you need to know about the AXA health contract: guarantees and options available

IN BRIEF Various formulas: 7 coverage options tailored to your needs. Basic warranty: Support for routine care, hospitalizations, dental And visuals. Reinforced options: 3 optional modules to improve your coverage. Refunds: Variety of examples of refunds thanks to the reform…

Invaluable financial support

There coverage of health expenses can quickly become a cause for concern. Private insurance provides valuable support by contributing to the reimbursement of medical costs not covered by compulsory health insurance. By choosing good health insurance, you ensure that your medical care, whether for consultations, surgical procedures or specific treatments.

Health insurance abroad: complete guide for expatriates

IN BRIEF Expatriates: Understand the challenges of health insurance abroad. Refund : Methods of compensation by the local insurance organization. Rights: Find out about your rights depending on the country of residence. Blanket : Choose the best international health insurance.…

Flexibility and choice

One of the main advantages of private health insurance is the flexibility that she offers. Insured persons can freely choose their healthcare professional and the type of care they need. This avoids the long waits often associated with the public system and provides rapid access to necessary diagnosis and treatment. To find out more about health supplements, consult this link.

Prevention and well-being

Private insurance also plays a key role in prevention diseases. In fact, many mutual funds and insurance companies offer prevention programs and tools to encourage policyholders to adopt healthy behaviors. For example, they can offer refunds for control visits or awareness-raising actions on health themes. This constitutes a real asset for the well-being of policyholders.

Guarantees adapted to each need

Each person has specific health needs. Private health insurance allows you to choose personalized guarantees depending on his situation. Whether you are a young worker, a large family or a retiree, it is essential to find coverage that meets your needs and your budget. To discover the best options, you can consult this complete guide.

International protection

For those who travel often or live abroad, a private health insurance can provide invaluable protection. Some policies allow reimbursement on the first euro even abroad, thus ensuring complete medical coverage regardless of your place of residence. This is especially important for expats and frequent travelers. To understand this type of coverage, see this site.

| Axis of comparison | Details |

| Care Coverage | Private insurance supplements compulsory health insurance reimbursements, allowing better coverage of medical costs. |

| Access to Care | Policyholders benefit from priority access to care, reducing waiting times for treatment. |

| Prevention | Insurers play an active role in health promotion with prevention and screening programs. |

| Flexibility | Private insurance contracts can be tailored to the specific needs of each policyholder, providing tailored protection. |

| Financial Protection | In the event of serious illness or prolonged care, private health insurance provides essential financial security. |

| Fast Refund | Reimbursements to the first euro guarantee rapid coverage of costs incurred, even internationally. |

| Choice of Professionals | Policyholders have the freedom to consult the healthcare professional of their choice, which promotes better care. |

Testimonials on the importance of private health insurance in France

In a context where the needs for health care are increasing, many people express their satisfaction with the services offered by private health insurance. For example, Martin, a young father, shares his experience: “Since I took out mutual insurance, I feel much more peaceful. The medical costs for my children are largely covered, which allows me to take them to the doctor without hesitation.”

Also, Sarah, an active professional, testifies: “I travel frequently for my work and to have a private health insurance gives me peace of mind. In the event of illness or accident abroad, I know that I am well protected, which allows me to concentrate on my work without fear.”

For his part, Jacques, a senior, underlines the importance of private insurance in the context of long term care : “As I age, medical visits and treatments become more frequent. Thanks to my complementary health insurance, I can benefit from appropriate support and rapid access to the specialized care that I need.”

Finally, Louise, a young mother, confides: “When I had to face unexpected expenses related to my baby’s health, my mutual insurance covered a large part of the costs. It was a real relief and “allowed me to focus on my family without financial stress.”

These testimonies illustrate to what extent theprivate health insurance plays an essential role in the daily life of the French. It not only offers financial protection, but also easier access to care, thus strengthening an already changing health system.

Private health insurance plays a crucial role in France, allowing citizens to benefit from additional coverage that complements the protection offered by compulsory health insurance. Faced with increasing health costs and increased demand for care, private insurance is essential to guarantee effective medical care adapted to individual needs. This article explores the different aspects of private health insurance and its impact on the French health system.

Essential coverage for everyone

In France, compulsory health insurance covers part of health costs, but it does not always cover all expenses. This is where insurance comes in private health, which allows you to obtain an additional reimbursement. Mutual insurance companies and private insurers play a fundamental role in limiting the remainder payable by policyholders. The diversification of offers results in increased flexibility, allowing each individual to choose coverage adapted to their specific needs.

Support in the face of increasing care needs

The French population is aging and the need for long-term care is increasing. Private health insurance positions itself as real support in the face of inadequacies in public coverage. By anticipating demographic changes, insurers can contribute to the improvement of health services, thus guaranteeing appropriate care for home care, stays in establishments, or even specific treatments. This ensures a better standard of living for policyholders and improves their quality of care.

Prevention and awareness: a key role to play

Private insurers also have the opportunity to play a proactive role in prevention and awareness. By offering preventive health programs, free health check-ups or reimbursement incentives for preventive actions, they encourage policyholders to adopt behaviors favorable to their health. This proactive approach helps reduce the incidence of disease and, therefore, the cost of long-term care.

Access to quality care

Opting for private health insurance provides easier access to quality care. Insured people often benefit from a better waiting time for medical consultations and interventions. This is particularly important in areas where response time can be critical, such as surgeries or specialized care. This support promotes a more peaceful and efficient health journey for patients.

International coverage

For those who travel or live abroad, private health insurance offers options for international reimbursement. This guarantees access to medical care outside French borders. Whether for a vacation or an expatriation, this international coverage allows you to have peace of mind in the face of possible health unforeseen events. By choosing suitable health insurance, each insured person can travel with complete peace of mind.

An evolving health system

The health insurance landscape is constantly evolving. As user expectations change and medical technologies advance, the role ofprivate insurance becomes more and more central. By working in concert with the public health system, private insurers can contribute to the optimization of the entire sector, guaranteeing better care for all French people.

In a context where the demand for health care continues to increase, theprivate health insurance plays an emblematic role in the healthcare landscape in France. Faced with the challenges of public coverage, this form of insurance presents itself as an essential complement, allowing policyholders to access a support faster and more complete.

Complementary organizations, such as mutual and insurers, provide crucial financial support to cover health costs that are not reimbursed by basic health insurance. Furthermore, they promote better management of health expenses, by encouraging policyholders to choose appropriate care and adopt preventive behaviors, which is fundamental for the sustainability of our health system.

In addition, private health insurance offers increased flexibility in terms of refund and choice of practitioners. By allowing reimbursement from the first euro, this insurance guarantees policyholders adequate medical coverage, even internationally. This is particularly beneficial for young people and expats looking to protect themselves in the event of a medical need, wherever they are.

Finally, private health insurance has the power to transform our health system by promoting innovation and modernization of the services offered. Insurers are on the front line to promote policies of prevention, thus contributing to a future where health remains a priority accessible to all. Investing in private health insurance therefore means choosing to take care of yourself effectively while strengthening our collective health system.

FAQ on the importance of private health insurance in France

What is private health insurance? Private health insurance is coverage that allows policyholders to benefit from reimbursement of health costs not covered by social security. It offers additional guarantees for various treatments.

Why should you consider private health insurance in France? There request for care is steadily increasing and private health insurance can help cover health costs that are not fully reimbursed by public health insurance, particularly for long-term care.

What are the advantages of private health insurance? Private health insurance offers reimbursement to the first euro, international coverage, as well as reduced waiting times for certain specialized care.

How does private insurance complement social security? Private health insurance co-finances health expenses and thus helps respond to inadequacies in public coverage, by offering more flexible options adapted to individual needs.

What is the role of complementary health insurance in the French health system? Supplementary health insurance, such as mutual funds and insurers, have a crucial role to play in providing financial support to reduce the out-of-pocket costs of policyholders, thus promoting more equitable access to health care.

Is private health insurance accessible to everyone? Yes, there are private health insurance contracts adapted to different budgets, allowing everyone to find coverage that meets their needs and financial means.

How to choose the right private health insurance? To choose the right private health insurance, it is important to compare the guarantees offered, the reimbursement levels and the prices of the different companies. Wise advice is to carefully assess your own health needs.