|

IN BRIEF

|

In a world where health has become a major concern, choosing a mutual adapted to its needs is essential. With AXA France, you have access to complete and personalized complementary health insurance. Find out how AXA offers tailor-made solutions to help you manage your health budget, but also to ensure optimal reimbursement for expenses often not covered by health insurance. Let’s dive into AXA’s offers and services to understand how this mutual can enrich your daily life.

AXA France offers a variety of services mutual health insurance which adapt to the needs of each person. Whether you are an individual, an employee or a company, AXA has solutions designed to offer you efficient and personalized health coverage. This article explores the benefits and the disadvantages AXA offers, helping you make an informed decision.

Benefits

Extensive and complete coverage

There complementary health AXA includes the device 100% Health, allowing access to optical and dental care without any out-of-pocket costs. This is a major advantage for those who wish to benefit from optimized reimbursements on these often high expense items.

Flexibility of offers

AXA offers a wide choice of customizable plans, with options adapted to every budget and every need. Policyholders can select specific modules, depending on the medical care and practitioners they choose, ensuring perfectly tailored coverage.

Convenient online services

To effectively manage your health budget, AXA offers convenient online services, such as a customer area to track your reimbursements and easy access to guarantee tables. This makes managing your contracts much simpler and more accessible.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Possible high costs

Although AXA’s offerings are varied, some users find that the contributions can be relatively high compared to other mutual insurance companies. It is therefore essential to compare the formulas carefully before subscribing.

Understanding Warranties

In order to fully benefit from AXA’s services, it may be necessary to fully understand the details of the guarantees and refunds offered. This can be a little complex for policyholders who are not familiar with insurance.

Administrative process

Managing administrative procedures, such as contract renewal, can sometimes seem difficult. AXA recommends taking these steps 2 to 4 months before the due date, which requires some anticipation.

When you are looking for complementary health insurance for you or your business, AXA stands out for its varied offers and quality services. Thanks to a tailor-made approach, it is possible to find coverage adapted to your specific needs, whether you are an individual or a professional. Discover the different plans, online services, and AXA advantages in this article.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The different health supplement formulas

AXA offers several formulas complementary health that fit your needs and your budget. Among these, you will find options for all segments of the population: individuals, businesses, and seniors. This includes in particular reinforced guarantees for routine, hospital, dental and optical care, so that you can benefit from optimal reimbursement.

Tailor-made guarantees

With AXA, you have the possibility to personalize your health insurance according to your situation. Whether for dental, optical or hospital care, each formula can be adjusted. In addition, AXA also sets up additional options to meet the specificities of each insured.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

100% Health with AXA

One of the major innovations of theAXA health insurance is the integration of 100% Health. This initiative allows you to benefit from full reimbursements for equipment in optics (such as lenses and frames) or in dentalcare. This way, you will be able to access quality care without having to pay additional costs.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

AXA online services

To make it easier to manage your healthcare budget, AXA provides you with very practical online services. You can request a free quote, access your reimbursements, or choose the healthcare professionals that suit you best. These digital tools are designed to make your customer experience simpler and smoother.

Professional support

In terms of support, AXA is committed to providing you with expert advice to help you understand your health coverage and get the most out of your guarantees. You can consult various online resources to learn more about reimbursed care, and much more.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Corporate health insurance

AXA is not limited to individuals; their corporate health insurance solutions are also very popular. Providing effective protection to your employees is essential for their well-being and satisfaction. With offerings tailored to the size of your business, you can choose coverage that attracts and retains talent.

Ease of renewal and management

Another advantage ofAXA is the ease with which you can renew your contract complementary health. Simply submit your renewal request to the Health Insurance fund 2 to 4 months before the expiry date to avoid any interruption in your coverage. This allows you to stay focused on your health and that of your loved ones without hassle.

Access information easily

To explore in depth the AXA offers and services, you can visit their official website. Whether you are looking for complementary health, information for seniors, or even evaluations of their mutual insurance, AXA gives you access to all the information you need to make informed decisions.

When it comes to protecting your health and that of your loved ones, AXA France offers a multitude of solutions adapted to your needs. With offers of complementary health accessible and various online services, AXA is committed to offering you comprehensive coverage and personalized support. Discover the different options, the advantages of their formulas and how to optimize your health reimbursements.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

AXA’s complementary health offers

AXA provides you with formulas for complementary health tailor-made, called “My Health”. These offers adapt to your profile and your budget, whether for routine, hospital, dental or optical care. You can choose from 7 plans, as well as 3 optional packs to benefit from enhanced guarantees in the areas that interest you most.

The integration of 100% Health

One of AXA’s major assets is the integration of 100% Health in its offers. This allows you to benefit, without any outage, from numerous equipment in optical And dental, thus facilitating access to quality care. Thanks to this initiative, you can take care of your health and daily life without additional financial worries.

AXA online services to manage your health

To support you on a daily basis, AXA offers a range of online services. These tools are designed to help you manage your health budget and make informed choices regarding health professionals suited to your needs. You can, for example, consult health advice, make treatment requests, or even download important documents directly from your customer area.

Advantageous reimbursements and extensive coverage

AXA’s complementary health insurance guarantees you reimbursement for expense items that are generally not covered by Health Insurance, such as certain alternative medicines or optical expenses. Reimbursements are optimized from the first year of subscription, allowing you to benefit from a best reimbursement for your dental and vision care without additional contribution.

Solutions specially designed for businesses

AXA does not forget businesses and offers solutions complementary collective health. Providing effective health protection to your employees is essential for their well-being. AXA solutions adapt to the size of your company and help retain and motivate your teams. Learn more about these offers here: Supplementary collective health.

Understand the difference between mutual and complementary health insurance

It is essential to understand the difference between mutual insurance and complementary health insurance to make the right choice. Indeed, mutual insurance operates on the principle of solidarity and reimbursements based on actual costs incurred. On the AXA website, you will find clear and precise explanations to better understand these concepts: Difference between mutual and complementary health.

To find out more about the benefits of AXA mutual health insurance, consult this link: Benefits for your employees. You can also easily find the AXA mutual number here: Find the AXA number.

Finally, if you want to compare offers, go to LesFurets.com. This will make it easier for you to find the health coverage that best suits you.

Comparison of offers and services from AXA France mutual insurance company

| Offer/Service | Description |

| Complementary Health | Benefit from health coverage adapted to your needs and your budget. |

| 100% Health | Access to optical and dental equipment at no extra cost. |

| Formulas Available | 7 coverage options with the ability to add optional packs. |

| Advantageous Reimbursements | Better reimbursed from the first year, without additional contributions. |

| Online Services | Tools to manage your health budget and choose health professionals. |

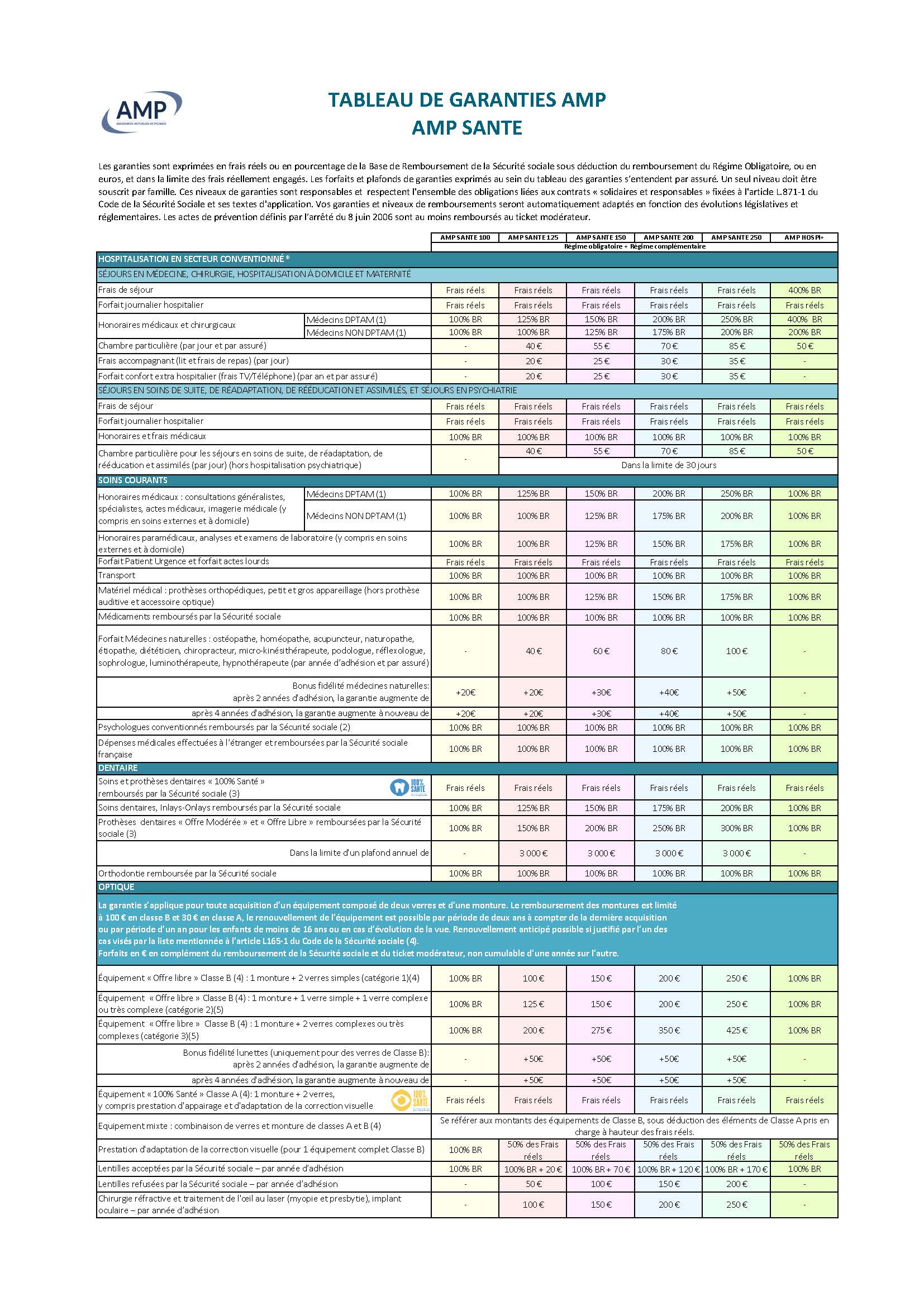

| Guarantee Tables | Easily view and download the appropriate warranty tables. |

| Solutions for Businesses | Effective protections for employees, adapted to the size of the company. |

Testimonials on the offers and services of the AXA France mutual insurance company

At AXA France, the importance given to the health of policyholders is essential. Thanks to their complementary health, many beneficiaries testify of their enriching experiences. “Thanks to AXA complementary health insurance, I was able to access optical equipment quality without worrying about costs thanks to 100% Health. It’s a real relief! » shares Claire, aged 34.

The online services available also make it easier to manage healthcare expenses. “I really appreciate the opportunity to manage my health budget directly from the application. I can easily choose healthcare professionals who meet my needs without stress,” says Thomas, a young employee.

The flexibility of AXA formulas is often highlighted. “I opted for the ‘Ma Santé’ plan which fits my budget while covering dental and optical care,” explains Sophie, a mother of two children. “I really feel safe with my mutual insurance! »

With a wide choice of guarantees, AXA stands out. “The 7 different formulas allowed me to personalize my contract according to my specific needs. It’s reassuring to know that you are well covered for all aspects of routine and hospital care,” says Julien, a healthcare professional.

Fast repayment is another appreciated aspect. “After my first visit to the dentist under AXA mutual insurance, I was surprised by the speed of reimbursement. This allowed me to focus on my health rather than on expenses,” adds Léa, a student.

Thus, AXA France offers solutions for health protection adapted to everyone. Whatever your situation, there is a formula that will meet your expectations. “I encourage all my friends to learn about the options AXA offers. They provide quality service and accessibility is a real plus,” concludes Marc, a satisfied young retiree.

AXA supplementary health insurance: An essential overview

AXA France offers a range of tailor-made solutions through its complementary health. By integrating the device of 100% Health, AXA allows its policyholders to benefit from advantageous reimbursements for various equipment, particularly optical and dental. This article will detail the offers, associated services and advantages of opting for AXA Mutuelle, in order to facilitate your choice in terms of health protection.

Offers tailored to every need

With AXA, you have access to several formulas complementary health, designed to fit a wide variety of needs and budgets. The solutions range from basic coverage to more comprehensive packages, which include enhanced guarantees for routine, hospital, dental and optical care. Thanks to this diversity, each policyholder can find the option that suits them best.

The flexibility of the formulas

THE AXA formulas are modular, allowing policyholders to personalize their level of coverage. For example, if you have specific needs, like frequent dental care or glasses, you can choose options that increase your reimbursements in these areas without having to pay for unnecessary services.

The advantages of 100% Health

The device of 100% Health is an essential initiative integrated by AXA into its offers. This system guarantees full reimbursement for essential equipment and care, thus limiting out-of-pocket costs. Thanks to this, you can get products such as eyeglass lenses and frames or quality dental care for free, thereby reducing the financial burden of health expenses.

Online tools and services

AXA provides a series of online services to simplify the management of your health budget. These tools allow you to easily choose healthcare professionals adapted to your needs. Furthermore, you can obtain a free online quote, giving you clear visibility on costs and guarantees before making a decision.

Access to your online account

By subscribing to a AXA mutual insurance, you also have access to a personalized customer area. This allows you to view your reimbursements, track your contributions, and manage your personal information securely. This digital service gives you great flexibility and better control over your healthcare expenses.

Protection of employees and businesses

For businesses, AXA offers solutions complementary health adapted to the needs of their employees. By offering effective health coverage, companies can not only attract talent, but also guarantee the well-being of their employees. AXA plans for businesses are designed to adjust to the size and specific requirements of each structure.

Advantageous repayments from the first year

Employees covered by complementary health insurance AXA can benefit from advantageous reimbursements from the first year, without additional costs for routine care such as those related to teeth and vision. This attractiveness makes AXA a serious alternative for employers concerned about the health of their staff.

Understanding mutual and complementary health insurance

Finally, it is crucial to distinguish the mutual of the complementary health. While a mutual fund is based on a principle of solidarity between its members, complementary health insurance complements Health Insurance reimbursements. With AXA, you benefit from beneficial protection which effectively complements Health Insurance reimbursement, thus guaranteeing coverage adapted to your needs.

AXA France positions itself as a major player in the field of complementary health, offering tailor-made solutions adapted to each need. Whether it is equipment in optical or in dental, the integration of the device 100% Health allows members to benefit from full reimbursement on essential expenses, thus guaranteeing easier access to care.

The flexibility of AXA’s offers is a real asset. With his seven formulas And three optional packs, everyone can personalize their coverage according to their personal situation, whether for routine, hospital care or optical or dental reimbursements. This personalized approach reflects AXA’s commitment to meeting the varied expectations of its policyholders.

In addition, AXA offers online services which simplify the management of your health budget. Thanks to adapted tools, you can easily choose the healthcare professionals who meet your needs, thus ensuring optimal care. Tracking your reimbursements becomes easy, allowing you to keep control of your expenses.

Designed to ensure complete protection within the professional world, the complementary health insurance for businesses is also a priority for AXA. Offering coverage adapted to the size of your company is an effective way to guarantee the well-being of your employees while strengthening the attractiveness of your company.

By closely exploring AXA France’s offerings, it becomes clear that every aspect of your health is taken into account. From prevention to treatment, everything is done to give you peace of mind. Whether you are an individual or a professional, AXA meets your health expectations with innovative and effective solutions.

FAQ on Offers and Services from Mutuelle Axa France

What types of complementary health insurance does Axa offer? Axa France offers a tailor-made supplementary health which adapts to the needs and budget of each individual. Its formulas include reimbursements for expenditure items not covered by Health Insurance.

What is 100% Health at Axa? 100% Health is integrated into the offers of the supplementary health Axa. This allows policyholders to benefit from reimbursed optical and dental equipment without any out-of-pocket costs.

Does Axa offer online services? Yes, Axa provides you with online services to manage your health budget. This includes the ability to choose healthcare professionals tailored to your needs.

Can employees benefit from Axa supplementary health insurance? Yes, Axa offers solutions for complementary health insurance for businesses, allowing you to offer your employees effective protection.

What items are reimbursed by Axa mutual insurance? Axa mutual insurance ensures reimbursement of various items of health expenditure, in particular those which are not covered by Health Insurance such as certain dental and optical care.

How can I get a quote for Axa complementary health insurance? A free online quote is available on the Axa website, allowing you to compare the different plans and choose the one that suits you best.

What guarantees are included in Axa mutual insurance plans? Axa offers several optional formulas and packs with reinforced guarantees in routine, hospital, dental and optical care.

Where can I find the warranty tables for Axa formulas? THE guarantee tables Axa health supplement formulas are available for free download from their site.

What are the advantages of choosing Axa for my health insurance? Axa offers advantageous reimbursements and coverage from the first year of subscription for specific care such as dental and optical care.