|

IN BRIEF

|

is a crucial issue for preserving their well-being and strengthening your attractiveness as an employer. AXA Santé Entreprise positions itself as a partner of choice, offering solutions adapted to each structure. This comprehensive guide will help you explore the various options for complementary health insurance , the essential guarantees and the advantages of high-performance coverage, while facilitating your decision-making for choosing a contract that meets the specific needs of your team. Together, let’s take the first step towards enhanced health protection for all your employees. https://www.youtube.com/watch?v=kdGCfUEFwu8For managers concerned about the well-being of their employees, choosing the right complementary health insurance is essential. AXA Santé Entreprise positions itself as a key player, offering solutions adapted to the size and specific needs of each company. This article explores in detail the

and disadvantages of AXA for optimal health coverage. Advantages Complete and adapted protection

AXA offers flexible health insurance plans, allowing companies to choose the best coverage for their employees. Whether it is for hospitalization costs, orthodontics or other specific care, AXA ensures that each employee can benefit from solid coverage.

Wide choice of formulas

The different coverage options offered by AXA allow companies to configure their contract according to their specific needs. This includes à la carte solutions that can be adapted to specific situations and the requirements of each employee.

Assistance and additional services

In addition to health coverage, AXA offers high value-added services, such as personalized advice or support in managing health procedures. This makes life easier for employers and improves employee satisfaction.

Disadvantages

Potentially high costs

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Although AXA offers suitable coverage, the cost of premiums can be higher than other insurers. Managers must be aware of the expenses to be incurred and evaluate whether this protection fits well with their overall budget.

Complexity of options

The diversity of formulas and guarantees can also lead to some confusion. Managers must spend time analyzing the different options to choose the most advantageous protection, which can be a challenge in already busy business environments.

Legal obligations

Since January 1, 2016, companies have been required to offer supplementary health insurance to their employees. Although AXA offers flexible solutions, it is essential to be in compliance with the legislation, which can lead to additional constraints for managers.

For a more detailed overview of the available options and for a free simulation, you can visit the AXA website

. For expatriate employees, other solutions can also be explored, such as those offered by

AgoraExpator viamutual insurance comparators . In a world where the health of your employeesis essential, opting for complementary company health insurance is essential. AXA Santé Entreprise offers solutions adapted to the needs of your structure, while guaranteeing optimal protection for employees. This guide reveals the different options available and helps you make the best choice to ensure the well-being of your team.

Why choose AXA for your company’s complementary health insurance? AXA stands out for its reputation

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

and his experience. A world leader in insurance, it offers

personalized solutions for businesses of all sizes. Thanks to their tailored offers, AXA guarantees complete coverage of health costs, including hospitalization, consultations and other delicate care. Customer testimonials also highlight their satisfaction with the services provided, proving that choosing AXA means choosing trust . The different guarantees of AXA complementary health insurance AXA complementary health insurance offers a range ofguarantees

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

ensuring the well-being of your employees. Among these, we find options for orthodontics, dental care, as well as consultations with general practitioners and specialists. Each company can personalize its coverage according to its specific needs thanks to à la carte packages. In addition, support is provided to better understand the

guarantee tables and the refunds available. Compliance with current legislation Since January 1, 2016, it has become mandatory to insure your employees

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

with company health insurance. AXA supports you in this process by offering you contracts that comply with legislation, while guaranteeing that the quality of services is maintained. This regulatory obligation not only ensures employee health coverage, but also contributes to their

motivation and their commitment within your organization. The advantages of group health coverage Opting for group health insurance has many advantages: prices that are often more advantageous than an individual subscription, better protection for your employees, and strong added value for the image of your company. By integrating effective health coverage, you show your employees your commitment to their well-being

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

, thereby strengthening their trust and long-term loyalty.

AXA’s role in healthcare management AXA is responsible for managinghealth benefits

, thus allowing your employees to concentrate on the essential: their work. The customer area offered by AXA facilitates access to information relating to their coverage, as well as the submission of reimbursement requests. This personalized follow-up ensures

peace of mind to everyone, while reducing the administrative burden for your business.How to get a personalized quote with AXA? To benefit from AXA’s offers, it is possible to make a free online quote

. This helps you evaluate coverage options that fit your business needs. In just a few clicks, you can compare guarantees and identify the plan that best meets your expectations. This accessible and rapid process promotes informed decision-making.

For more information, do not hesitate to consult AXA’s practical guides or other online resources that will help you understand the health coverage to adopt for your business. You can also explore the options available on specialized health sites, such as those discussing cheap mutual insurance or international health insurance. discover our complete guide to axa health coverage. Learn about the options, benefits and tips for choosing the best health insurance suited to your needs. protect your health with confidence with axa.The health needs of employees are essential to foster a fulfilling and productive work environment. AXA offers solutions for

complementary health companies

Essential guarantees for your employees To ensure the well-being of your employees, it is crucial to offer them guarantees that cover their daily needs. With the complementary health insurance AXA

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

, you have access to plans that cover a variety of care, ranging from medical consultations to hospitalization costs. Discover the different

health guarantees offered, including routine care, orthodontic costs and more, to guarantee your employees comprehensive coverage.The benefits of compulsory complementary health insurance Since January 2016, each company has the obligation to offer a mutual health insurance

to its employees. AXA stands out by offering personalized solutions that adapt to the structure of your company while respecting legal requirements. The goal is to guarantee adequate coverage for your employees while simplifying the membership process. You will find all the necessary information on the terms and conditions by consulting the AXA website.

Protection adapted to your company Each company is unique, which is why AXA allows you to choose tailor-made health coverage. Depending on the specific needs of your employees and your budget, you can opt for an à la carte contract that covers a wide range of health services. In addition, AXA is committed to helping you choose the best plan thanks to its personalized advice and its rich customer feedback.

Evaluate costs and reimbursements

Investing in quality supplementary health insurance represents a significant cost. However, it is essential to evaluate the reimbursements offered by AXA in order to minimize the remaining cost for your employees. By carefully examining the guarantee tables

provided by AXA, you will be able to understand the financial issues and make an informed decision on the best protection to offer.

Easily access your customer area To simplify the management of your employees’ health insurance , AXA provides a customer area accessible online. This allows employees to consult their rights, submit their reimbursement requests, and take advantage of various practical features. This transparency and ease of access reinforce job satisfaction and the feeling of health security within your company. Additional resources to help you choose well

To deepen your knowledge on the subject, do not hesitate to consult practical guides and mutual insurance comparators. Sites such as

AGF Mutuelle or Medi Insurance

offer detailed articles to help you choose your

health coverage . These resources can be very useful in finalizing your decision and ensuring the best choice for your employees. Comparison of business health coverage options with AXA Criteria Details Type of contractCollective contract compulsory since January 1, 2016.

Basic warranty

| Coverage of hospitalization costs and routine care. | Additional options |

| Orthodontics, advanced dental and optical care. | Flexibility |

| Customizable contracts according to the needs of the company. | Pricing |

| From €7.39 per month, adaptable depending on the number of employees. | Additional services |

| Support in health prevention and medical advice. | Refunds |

| Fast and simplified reimbursement. | Online access |

| Contract management and reimbursement via a secure customer area. | discover our complete guide to axa health coverage. get clear information on the different plans, the guarantees offered and advice on choosing the best option for your health and that of your family. |

| View this post on Instagram | Testimonials on AXA Santé Entreprise: Complete guide to optimal health coverage |

| “As the manager of an SME, I was faced with a crucial choice for my employees. I opted for the | complementary health insurance AXA |

solid guarantees

which cover routine care and hospitalizations. The feedback from my team is very positive, which creates a calm and productive working environment. » “What really convinced me to choose AXA was the flexibility of contracts

. We have been able to personalize our coverage based on the size of our business and the specific needs of our employees. This made everyone feel valued and supported in their health. » “In matters of refund

, AXA is exemplary! The deadlines are short and the transparency of the guarantee tables has allowed us to quickly anticipate the costs for our employees. I feel confident knowing that my colleagues are well protected. » “Since the implementation of compulsory mutual insurance via AXA, the climate within our society has changed. Our employees discuss their health and the benefits of this coverage more often. This shows to what extent aeffective health protection

can strengthen team cohesion and employee engagement. » In an ever-changing world, the health of your employees must be a priority for any business. Therecomplementary health

offered by AXA presents itself as a high-performance solution suitable for all business sizes. This article guides you through the different coverage options and the benefits of such protection. Why choose AXA for the health of your employees? AXA offers a

health coverage comprehensive and flexible that meets the varied needs of employees. Since 2016, it has been compulsory for companies to guarantee mutual health insurance to their employees, and AXA stands out with its personalized offers. Choosing AXA means opting for simplified management of healthcare expenses and enhanced protection for your employees. A variety of suitable guarantees

AXA offers a wide range of

guarantees which allow companies to personalize their offers according to the needs of their staff. Whether for hospitalization costs, routine care or specific care such as orthodontics, the options are numerous. This allows you to offer your employees optimal coverage so that they can live peacefully. Considerable financial benefits

Adopting AXA health insurance also means reducing the financial burden on your employees. Thanks to competitive prices and an efficient reimbursement structure, AXA is committed to making health more affordable. By choosing a

complementary health company , you contribute to the peace of mind of your employees, which often translates into increased productivity. How does health coverage work at AXA?

AXA health coverage works in addition to basic health insurance benefits. It thus makes it possible to improve the coverage of medical costs. To benefit from this coverage, simply choose a plan adapted to your business, taking into account criteria such as the size of the team and its health needs.

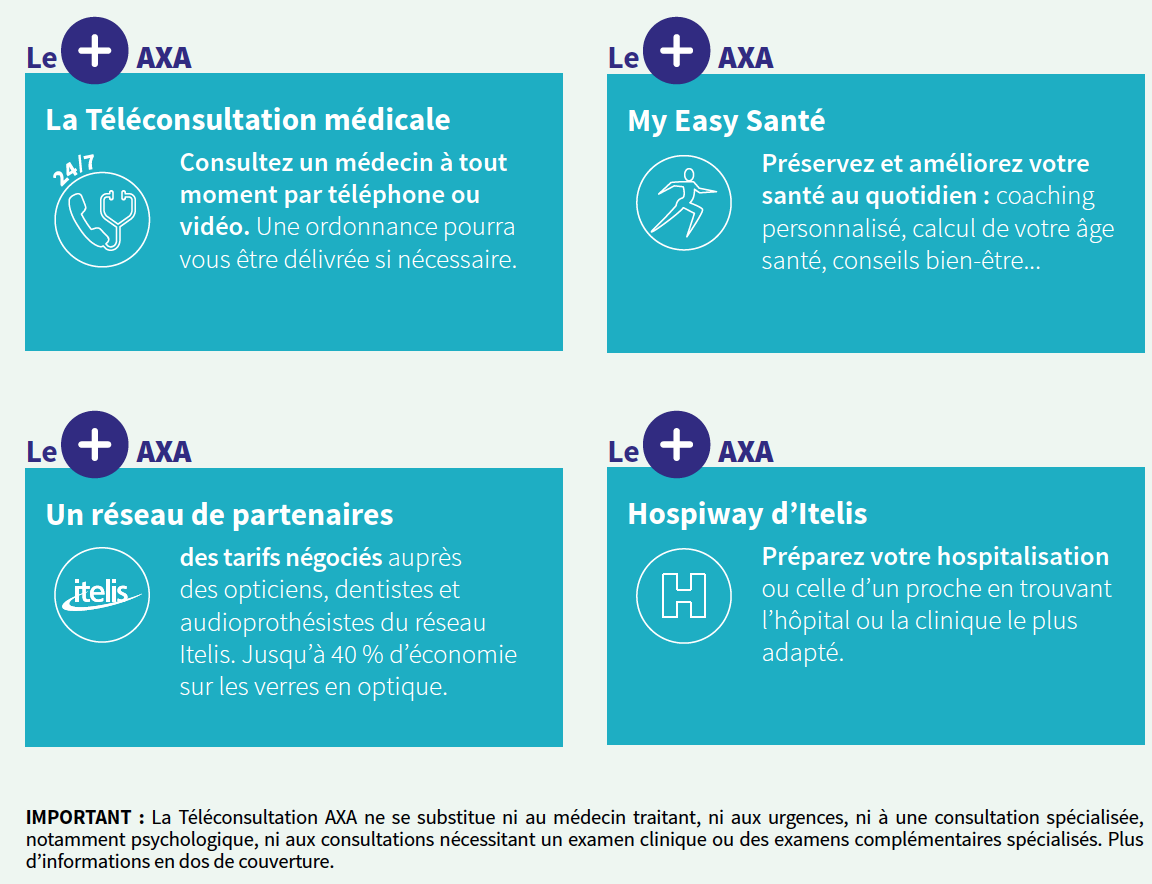

High added value services In addition to basic coverage, AXA offersadditional services

that add real value to its offerings. A dedicated customer area allows employees to easily manage their reimbursements and access useful information about their health. Personalized support is also available to answer any questions regarding their guarantees.

How to choose the right formula?

To choose the plan that best suits your business, it is essential to assess the needs of your employees. Take stock of common health expenses in your team and determine which options would bring the most benefit. AXA offers the possibility of creating tailor-made contracts to meet the specific challenges of your business.

Professional advice AXA does not just offer products, it also supports you in your choice. Specialist advisors are available to guide you through the different options and help you select the most appropriate coverage for your company. By opting for AXA, you ensure you benefit from expert insurance advice, while guaranteeing the health of your employees. discover our complete guide to axa health coverage, which will help you understand the different health insurance options, the guarantees offered, and how to choose the plan that best suits your needs. take charge of your health with axa!

In today’s professional world, employee health is more than ever a priority for companies. Guarantee a

health coverage

optimal performance is essential for the well-being of employees, and this is where

AXA corporate health

complementary health , AXA allows managers to insure their team with the protection they deserve. With the health contract offered by AXA, companies benefit from unique flexibility. Every business, regardless of its size, can choose specific guarantees that meet the needs of its staff. Whether for hospitalization costs, dental care or even routine medical prescriptions, AXA is committed to reducing the financial burden on employees, thus providing invaluable peace of mind. THEpractical guide AXA also allows managers to better understand the options available. Thanks to personalized advice, they can choose the most appropriate coverage. THEcustomer testimonials

show positive feedback on the quality and efficiency of the services offered. This demonstrates AXA’s commitment to meeting the expectations of its policyholders, by demonstrating flexibility and responsiveness in a constantly evolving professional environment.

Finally, since the introduction of the ANI law, employee health coverage has become a legal obligation. Thanks to AXA, comply with this obligation while offering your teams complete and appropriate protection. By choosing AXA health enterprise, you are choosing a high-performance protection , which will contribute to retaining your employees and improving their quality of life at work. FAQs about AXA corporate health coverage What is the objective of the complementary health insurance offered by AXA for companies?

The objective is to offer a high-performance protectionadapted to the size of your company, thus guaranteeing optimal health coverage for your employees.

What guarantees are included in AXA’s complementary health insurance?

AXA offers

full guarantees which include reimbursement of hospitalization costs, medical consultations, routine care and other medical services. Is it compulsory to insure your employees with complementary health insurance?

Yes, since

January 1, 2016 , the subscription of a mandatory health insurance for employees is a legal requirement for all companies. What advantages does AXA offer for group health contracts?

AXA provides

offers tailored to the needs of companies and their employees, as well aspersonalized advice

to choose the best health coverage.

How can I get a quote for AXA’s corporate health insurance? A free online quote is available, allowing you to customize the à la carte health insurance for your company. What reimbursement options does AXA offer?

AXA offers

clear benefit tables and varied options for reimbursements, in order to meet the expectations of policyholders. What high value-added health services does AXA provide?

AXA offers various

high value-added services such as medical assistance, prevention programs, and dedicated support for its policyholders. How does AXA help employees understand health coverage?

AXA provides a

practical guide to improve the articulation between basic health insurance and supplementary health insurance, thus facilitating the understanding of the available options.