|

IN BRIEF

|

In a world where health takes center stage, it is crucial to understand the tools at our disposal to protect ourselves. L’AXA mutual certificate is an essential document that guarantees your rights and facilities in the medical field. Whether you are looking for information on the third party payer, the reimbursement process, or the management of your health coverage, this comprehensive guide will provide you with valuable clarification. Prepare to discover the specificities of this certificate and get the most out of your health insurance contract with AXA.

In this article we will explore theAxa mutual certificate, an essential document which guarantees each insured person to be reimbursed for their health costs. Whether you are a new user or simply looking to better understand this document, we will provide you with an overview of its advantages and disadvantages in order to better guide you in your efforts.

Benefits

One of the main advantages of the Axa mutual certificate is its ease of access. If necessary, policyholders can easily print Or receive by email their third-party payer certificate from their Customer Area. This greatly facilitates the management of administrative procedures related to medical care.

In addition, this certificate offers financial security. Indeed, thanks to third-party payment, the patient will not have to advance the amount of medical costs, because the insurer takes care of the payment directly with the healthcare professional. This means less worry at the time of the medical consultation, allowing you to concentrate on the essentials, your health.

Finally, the certificate allows you to better manage your health reimbursements. AXA offers tools and an intuitive online platform that makes it easier to track your reimbursements. You can consult your rights and optimize your health budget with complete peace of mind.

AXA hospitalization insurance: understand the prices and guarantees

IN BRIEF Understanding of hospitalization guarantees in 3 essential questions. Coverage of hospitalization costs: 80% or 100% reimbursed based on care. Support for accommodation costs in approved establishments. Options hospital package And flat-rate participation for surgical procedures. Reimbursement of the…

Disadvantages

Another constraint concerns reimbursement deadlines. Although the certificate facilitates the procedure, the time to receive a reimbursement can sometimes be delayed, which can create inconvenience for certain policyholders who expect rapid intervention.

Finally, it is important to note that the extent of coverage may vary depending on the different plans offered by AXA. To do this, you must read your contract carefully and understand the options subscribed to to avoid any surprises when validating your care.

In short, although the Axa mutual certification has disadvantages, its advantages play a crucial role in covering health expenses and the daily management of health needs. For more information and assistance, you can consult AXA’s services and your options available via your Customer Area.

Another constraint concerns reimbursement deadlines. Although the certificate facilitates the procedure, the time to receive a reimbursement can sometimes be delayed, which can create inconvenience for certain policyholders who expect rapid intervention.

Finally, it is important to note that the extent of coverage may vary depending on the different plans offered by AXA. To do this, you must read your contract carefully and understand the options subscribed to to avoid any surprises when validating your care.

In short, although the Axa mutual certification has disadvantages, its advantages play a crucial role in covering health expenses and the daily management of health needs. For more information and assistance, you can consult AXA’s services and your options available via your Customer Area.

In this guide, we will explore in detail the Axa mutual certification and its issues. What is this essential document, how to obtain it and what are its different functions? Whether you are already insured or are considering subscribing to mutual insurance, this guide will provide you with all the information you need to control your health coverage.

Mutual travel abroad: why is it essential?

IN BRIEF Financial protection against unforeseen events such as accidents or theft of luggage. Support for medical care according to the legislation of the visited country. Refund expenses incurred in the event of a medical emergency. Obligation to present a…

What is mutual attestation?

The mutual certificate is a document which certifies that you are covered by mutual insurance, in this case, that offered by Axa. It is often requested by various organizations, particularly during hospitalizations or when you consult a healthcare professional. It certifies your affiliation and the validity of your complementary health insurance contract.

Axa health company: complete guide to optimal health coverage

IN BRIEF Complementary health insurance dedicated to employees to optimize their coverage. Solutions adapted to the size of thecompany. Complete coverage for hospitalization costsand current expenses. A la carte contracts to customize options according to your needs. Compliance with the…

How to obtain your Axa mutual certificate?

To obtain your Axa mutual insurance certificate, there are several possibilities. First of all, if you are already a customer, you can download it directly from your Customer Area on the Axa website. It can also be sent by email upon request. Remember to keep it carefully, as it may be necessary during your medical consultations.

Axa mutual number: how to find it easily

IN BRIEF AXA Mutual : Easily contact customer service. Telephone number for support: 0970 808 088, available Monday to Saturday. Emergencies (Troubleshooting and towing): 01 55 92 26 92, 24 hours a day. To report a disaster (Hail): 09 70…

Third-party payment: a major advantage

One of the major functionalities of the Axa mutual certification is its role in the system of third party payer. Thanks to this option, you will not have to advance the amount of health costs. Your certificate allows your healthcare professional to be directly reimbursed by the mutual insurance company. This makes it much easier to manage your healthcare expenses and reduces stress when paying.

How to contact AXA customer service for your health insurance

IN BRIEF Phone number for customer service: 09 70 80 81 82 Accessible from Monday to Friday, of 9 a.m. to 6 p.m. For specific requests, use the email address: service.relationsclienteleweb@axa.fr Support available 24 hours a day And 7 days…

What to do if you lose the mutual certificate?

It may happen that you lose your Axa mutual certificate. Don’t worry, the process is simple. You can reprint it or receive it by email in a few clicks from your Customer Area. This will allow you to easily continue to benefit from your rights without interruption.

Understanding 1st euro insurance: a complete guide for policyholders

IN BRIEF Definition : What is thehealth insurance from 1st euro ? Target : Intended for French expatriates. Benefits : Support from first euro. Pricing : Prices advantageous and flexible. Blanket : Exemption from advance payment costs. Comparison : Differences…

Health coverage: understanding the guarantees

Understanding the different guarantees offered by your Axa mutual insurance contract is crucial to getting the most out of it. Your certificate contains key information about the refunds that you can expect for different healthcare costs, such as consultations, medications and hospitalization. Familiarize yourself with these details to better manage your health budget.

Travel insurance without age limit: what you need to know

IN BRIEF Travel insurance for the elderly people without age limit. Options from 23€ with extended guarantees. Reimbursement ceiling of up to 500,000€. Check if coverage starts from first euro. Insurance cancelation often available. Duration of stay generally limited to…

Frequently Asked Questions

For additional details, do not hesitate to consult the FAQ section from the Axa website. There you will find answers to common questions regarding the certificate, health coverage and the procedures to take.

Travel insurance without age limit: what you need to know

IN BRIEF Many insurers impose a age limit for travel insurance. Some insurers, such as Groupama, offer contracts with no age limit. THE essential guarantees include coverage for emergency medical expenses. Pay attention to age restrictions, which may vary depending…

Find out more about the third-party payment certificate

To deepen your knowledge of the certificate third-party payer and how it works, see our dedicated article here. This will allow you to better understand the benefits offered by Axa and make the most of your health coverage.

The AXA mutual certificate is an essential document that proves your health coverage. Not only does it facilitate reimbursements, but it is also essential to benefit from third-party payment at healthcare professionals. In this comprehensive guide, we will explore the key aspects of this document, its usefulness, as well as ways to obtain and manage it easily.

What is an AXA mutual certificate?

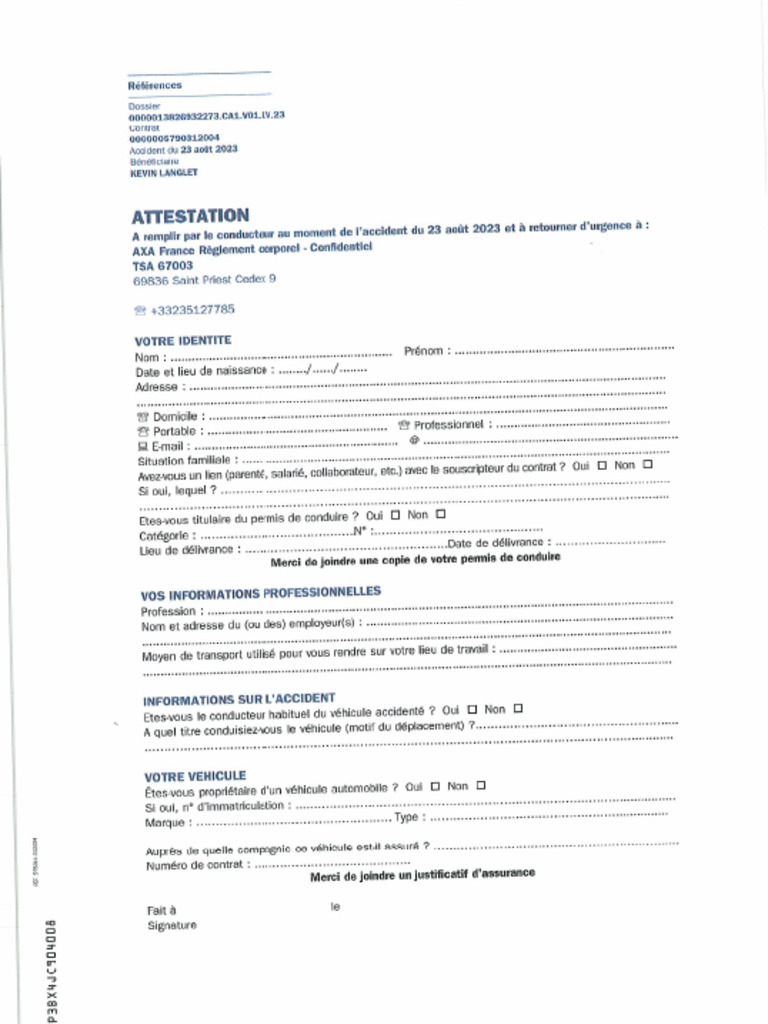

The AXA mutual certificate is a document issued by your insurer, certifying that you are covered by supplementary health insurance at the time of your reimbursement request. It serves as proof for both you and healthcare professionals. This certificate is generally necessary to benefit from third-party payment, which allows you not to advance the costs of consultations.

Why is it important?

First of all, the mutual certificate allows you to have access to care without having to pay any money immediately. In addition, it simplifies the reimbursement process by proving your affiliation with AXA. In the event of an inspection, it also validates your situation with health organizations, making your rights clear and accessible. How to obtain your AXA mutual certificate?

To obtain your certificate, nothing could be simpler! Log in to your

AXA Customer Area . You can download the certificate directly in a few clicks. In the event of loss, it is also possible to receive your document by email by following the same steps on the insurance website. For more details, visit the page dedicated tothird-party payment .Managing your certificate

It is important to keep your certificate up to date. Remember to renew it or check its validity 2 to 4 months before the expiry of your health insurance contract. For any renewal request, do not hesitate to contact your

Health Insurance Fund . This will help you avoid any inconvenience when using your health services.Tips for optimizing its use

To maximize the use of your certificate, keep a digital copy in your personal documents. This will allow you to have it at hand during your medical appointments. Additionally, familiarize yourself with the mode of

refund offered by AXA to avoid unpleasant surprises. For a detailed overview of these options, you can consult the reimbursement advice on the AXA website here .Frequently asked questions

Frequently asked questions will help you clarify any doubts. Whether on the differences between complementary health insurance and mutual insurance, or on reimbursement processes, do not hesitate to ask your questions. AXA is available to provide clarification and ensure you are well informed.

Key elements

| Concise details | What is a mutual attestation? |

| This is a document attesting to your membership in a | mutual health insurance .How to get it? |

| Available in your | AXA Customer Area or by email. Usefulness of the certificate |

| Clarifies your rights and facilitates | third party payer .Digital materialization |

| Easy printing or downloading from your online account. | Validity period |

| Valid as long as you remain a member of your mutual insurance contract. | Renewal |

| Request to be made 2 to 4 months before the end of your health coverage. | Access in case of loss |

| Fast recovery via your | Customer Area .Types of coverage |

| Covers various medical expenses depending on the contract chosen. | Services included |

| Refunds, | foresight , and support.discover our complete guide to the AXA certificate: steps, advice and essential information to obtain your certificate with ease. |

I recently made the choice to subscribe to a

AXA mutual insurance and, to my surprise, the whole process was simplified thanks to the complete guide on mutual attestation. At first I had no idea what it entailed, but this guide enlightened me on each step to follow. The first thing that struck me was the practical aspect of the certificate

third party payment . Thanks to the clear and concise explanations, I understood that I could take advantage of this functionality to avoid paying health costs. It has really changed the way I approach my doctor visits and medical consultations.Another part of the guide that was very useful to me was the section on recovering my certificate if I lost it. I learned that all I had to do was connect to my

AXA Customer Area to reprint my certificate instantly. It reassured me to know that I did not have to navigate complex procedures. In addition, the guide addresses various aspects of

health coverage . The explanations on how medical expense reimbursements work helped me better manage my health budget. I now knew how much I could expect to be reimbursed and under what conditions, which allowed me to anticipate my expenses.Finally, I easily found the answers to all my questions thanks to the FAQ section. The differences between

complementary health and mutual were clearly explained, which allowed me to choose the best option according to my needs. Overall, I highly recommend diving into this

complete guide to AXA mutual certification . It is a real tool for anyone who wishes to better understand their rights and benefit from effective medical protection.Introduction to AXA mutual certification

The AXA mutual certificate is an essential document which certifies your health coverage with this renowned mutual insurance company. It can prove essential in various situations, such as finding a healthcare professional, hospitalizations or even processing your reimbursements. In this comprehensive guide, we will discuss the different aspects of the AXA mutual certificate, its application, its use, as well as practical advice to optimize its management.

What is the AXA mutual certificate?

The mutual certificate is an official document which proves that you are indeed affiliated with AXA for your complementary health insurance. This document details your rights and guarantees regarding reimbursement of medical expenses. It is crucial to understand its usefulness, because it facilitates communication between you and health professionals, as well as the reimbursement of your health expenses by your mutual insurance company.

Obtaining the AXA mutual insurance certificate

The request to obtain your AXA mutual certificate can be done simply from your

Customer Area . In case of loss, it is also possible to reprint it or request it by e-mail. Make sure to keep your Customer Area up to date, as it will allow you to easily manage all your documents related to your mutual insurance company.Steps to collect your certificate

To ensure easy access to your certificate, here are the steps to follow:

Log in to your

- AXA Customer Area .Go to the section dedicated to documents.

- Download or print your mutual insurance certificate.

- Understanding the different types of certificates

AXA offers several types of certificates, including the certificate of

third party payer . This type of certificate allows you not to advance health costs during your consultations. Thanks to this facility, you can consult health professionals without having to worry about immediate payment, because the mutual covers the costs from the practitioner.Use of the third party payment certificate

When you go to a healthcare professional using third-party payment, all you need to do is present your certificate. In this way, AXA mutual insurance pays the reimbursement of costs directly. This can represent a real saving of time and money, especially in the event of frequent care.

Why is mutual attestation important?

Understanding the importance of your AXA mutual insurance certificate is fundamental. Not only does it constitute proof of your affiliation, but it also plays a key role in the management of your

health reimbursements . By presenting it during your medical consultations, you ensure optimal coverage, and you avoid significant advances in costs.Anticipation of procedures

Before proceeding with major treatment or hospitalization, make sure that your certificate is up to date. If you have any questions, do not hesitate to contact AXA to clarify your rights and guarantees. Finally, keep your certificate on hand before any consultation, in order to simplify the management of your reimbursements.

Frequently asked questions

Many questions may arise regarding the AXA mutual certificate. Here are some points often discussed:

What information is contained in the certificate?

- How do I keep my personal data up to date with AXA?

- What to do in the event of a change of situation (marriage, moving)?

- Do not hesitate to consult the

frequently asked questions or contact customer service for answers tailored to your situation. discover our complete guide to the AXA certificate. get all the information you need to understand and obtain your certificate quickly and easily.

third party payer . This mechanism allows you not to advance health costs since yourmutual directly handles settlements with healthcare professionals. It is therefore essential to fully understand the issues related to this certificate to make the most of your coverage. If necessary, please note that it is possible to easily obtain your certificate via your

AXA Customer Area . You can print it at any time or even receive it bye-mail , which gives you significant flexibility. This service allows you to monitor your health reimbursements and manage your administrative procedures in a simplified manner, thus avoiding unnecessary stress.For those who wish to renew their supplementary health insurance contract, it is advisable to make a request to your Health Insurance fund between 2 to 4 months before the expiry date. This anticipation will allow you to avoid interruptions in your health coverage and benefit from the best options offered by AXA.

Finally, it is essential to note that the

AXA mutual insurance offers different guarantees adapted to your needs. Whether it concerns reimbursement of health costs or specific services linked to your contract, AXA provides you with all the information necessary for you to navigate the world of health insurance with peace of mind. Knowing all these modalities is the key to optimizing your health budget and taking care of yourself with complete peace of mind. Frequently Asked Questions about the AXA Mutual Certificate

What is the AXA mutual insurance certificate?

The AXA mutual health insurance certificate is an official document which proves that you are covered by mutual health insurance. It is often requested to benefit from reimbursement of health costs or to access health services.

How do I obtain my AXA mutual certificate?

You can obtain your mutual certificate by going to your

AXA Customer Area . If you have lost your certificate, it is also possible to reprint it or receive it directly by e-mail from this space.What is the third-party payment certificate?

The third-party payment certificate allows your healthcare professional not to ask you to pay your consultation or treatment costs in advance. With this certificate, AXA directly covers the costs, thus avoiding you having to advance large sums.

How to request a refund with AXA?

To request a refund, you must first consult your

Customer Area . Then, you can submit your request by downloading the necessary documents, such as treatment sheets or quotes.When should I renew my AXA mutual insurance?

It is advisable to apply for renewal of your supplementary health insurance contract between 2 to 4 months before your contract expires. This will allow you to compare offers and ensure continuity of your coverage.

What services are included in my insurance contract?

Your AXA pension contract offers various services, such as declaring sick leave, downloading your Madelin signature, and consulting your contract at any time via your Customer Area.

Does AXA offer solutions for expatriates?

Yes, AXA offers mutual insurance plans specially designed for expatriates in France, taking into account the specific needs related to their situation. These options aim to guarantee optimal health coverage even abroad.

What are the reimbursement times for health costs by AXA?

In general, reimbursement times at AXA are fast, but they can vary depending on the documents provided and the type of costs. It is advisable to follow your reimbursements via your

Customer Area to stay informed of progress. Why is it important to have a mutual insurance certificate?

The mutual insurance certificate is crucial because it serves as proof to justify your health coverage to healthcare professionals and reimbursement organizations. Without it, you may encounter difficulties in obtaining care or rapid reimbursements.