|

IN BRIEF

|

L’international health insurance is a crucial consideration for anyone considering living or traveling abroad. Understand the price and the options available is essential to ensure adequate coverage for life’s unexpected events. Prices can vary considerably, averaging between €400 and €1000 per year, depending on numerous criteria such as country of residence and the specifics of accessible health care. By choosing a suitable policy, which offers the possibility of personalizing the guarantees, particularly for care dental, optical And preventive, it is possible to obtain coverage that truly meets your needs while protecting your well-being abroad.

When considering moving or traveling abroad, it is essential to understand the intricacies of international health insurance. These insurance policies offer you a wide range of coverage that adapts to your specific needs, while taking into account the diversity of prices from one country to another. In this article, we’ll explore average prices, available options, and the pros and cons associated with this type of insurance.

Benefits

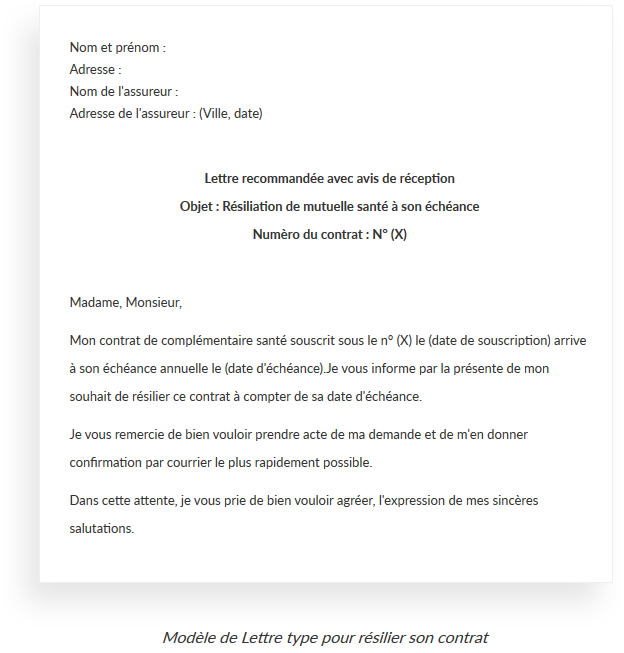

The main advantage of a international health insurance lies in the flexibility it offers. Indeed, you can choose options adapted to your personal situation, such as dental, optical or preventive care. This allows you to customize your contract to meet your specific needs. In addition, some companies, such as AXA, offer competitive prices, starting from €10.99, while guaranteeing complete coverage for your medical expenses, assistance and repatriation.

Another major advantage is the protection that these insurances provide. Whether you suffer an accident or fall ill, you can benefit from appropriate medical support, even outside your country of residence. This means you can travel with peace of mind, knowing your health is protected.

Salary supplement: how AXA mutual insurance can help you

IN BRIEF Salary supplement : crucial during sick leave. AXA mutual : multiple options to compensate for your loss of income. Daily allowances : amount paid by your mutual in the event of illness. Simple steps to follow to benefit…

Disadvantages

Despite the many advantages, international health insurance also have some disadvantages. First of all, prices can vary significantly depending on the country of residence. For example, the cost of health care can be high in the United States or Japan, which directly impacts the price of your insurance contract.

Additionally, customizing options can sometimes be confusing. The many options available can make it difficult to choose the contract best suited to your needs. It is therefore important to carefully evaluate the options and compare several offers before subscribing. We recommend that you consult comparators such as Santexpat to clarify your choice.

Finally, some policies may have exclusions or restrictions that are not immediately apparent at the time of purchase. It is essential to read the general conditions of your contract carefully to avoid any unpleasant surprises in the event of a claim.

When expatriating or on an extended trip, subscribe to a international health insurance is crucial to guaranteeing your safety and well-being. This article walks you through the different prices, available options, and things to consider when choosing the coverage that’s best for you.

Travel and mutual insurance: how to choose the best health coverage for your vacation

IN BRIEF Understand the importance of mutual travel insurance. Evaluate the medical expenses abroad. Compare the guarantees and the options available. Choose according to your destination. Take into account the duration of your stay. Consider the risks related to your…

Prices of international health insurance

The price of a international health insurance can vary considerably depending on many factors. On average, adequate coverage is between €400 and €1000 per year, giving an approximate monthly range of €33 to €83. Various elements influence these prices, including the country of residence and the cost of healthcare in that region.

Taking out private insurance: what you need to know

IN BRIEF Subscription private insurance: key steps Importance of evaluating your personal situation Understand the guarantees proposed Terms membership and eligibility criteria Compare the price and offers from different insurers Right to retraction 14 days for certain contracts Tips for…

How to choose the best international health insurance

To select the best international health insurance, it is essential to personalize your contract. This will allow you to choose specific options such as dental, optical or preventative care. However, it is also necessary to consider potential downsides, such as the fact that some options may increase the total cost of the contract.

Mutual hospitalization insurance: why choose AXA?

IN BRIEF Importance of a hospitalization guarantee in your complementary health. Reimbursements of up to 400% for hospital costs. Support for pre and post-operative costs at 150%. Options for home hospitalization And medical transport at 150%. Formulas flexible adapted to…

Factors influencing the cost of your coverage

Insurers evaluate prices taking into account the geographical area where you reside. The higher the cost of healthcare in that country, the more expensive the insurance premium will be. For example, a consultation with a general practitioner can cost around €40 in Japan and up to €80 in the United States, which says a lot about the importance of choosing the right coverage for your destination.

Axa mutual insurance: everything you need to know before subscribing

IN BRIEF Needs assessment : Analyze your current treatments and your healthcare expenses. Diversified offers : AXA offers 7 customizable formulas to adapt to each profile. Selection criteria : Consider the guarantees, services, And options available. Exclusive benefits : Discover…

The different options available

L’international health insurance offers a wide range of options. Some of the most common types of coverage include medical expenses, medical repatriation assistance, and even trip cancellation or baggage protection. It is therefore essential to understand these options before signing a contract to ensure that you are adequately protected according to your specific needs.

Mutual and travel insurance: what you need to know before you leave

IN BRIEF Essential preparation before a trip: don’t neglect insurance. Difference between travel insurance And mutual. Importance of guarantees to leave peacefully. Consider the destination to choose the right coverage. Check the options And services available. Understand the risks related…

1st euro health insurance

Another option to consider is1st euro health insurance, which allows you to start receiving coverage from the first euro spent on medical care. This can be particularly advantageous for expats who want immediate protection, and who do not want to manage high deductibles. You can learn more about these benefits here.

Axa: complete guide to choosing the right insurance

IN BRIEF Understanding Axa offers Analysis of guarantees proposed Comparison of prices available Customer reviews on AXA and its services Criteria for choosing blanket adequate Guide to subscribing online easily Information on claims and declarations In a world where protecting…

Compare insurers

To find the best coverage, it is advisable to compare different health insurance companies. Comparison platforms can help you evaluate the offers on the market, and you will be able to consult all the necessary information to make an informed choice. For a list of the best international insurance companies, you can refer to this page.

Axa mutual health insurance: everything you need to know to choose the right one

IN BRIEF AXA offers personalized health insurance. Analyzing your health care behavior is crucial. There are 7 AXA mutual insurance plans adapted to different needs. The benefits include quality customer service and competitive rates. Consider the guarantees and options for…

The benefits of international health insurance

Subscribing to international health insurance has many advantages. In addition to ensuring coverage adapted to the specific needs of expatriates and travelers, it offers the peace of mind of knowing that you are protected against the unforeseen events of life abroad. Since each situation is unique, it is essential to analyze your personal and financial needs before finalizing your choice.

Useful resources

For more information on the different types of coverage, do not hesitate to visit sites like AXA Voyage or UFE, which offer valuable details on international health insurance.

When thinking about covering yourself abroad, it is essential to understand the price and the options available for a international health insurance. This type of insurance offers varied protections depending on needs and country of residence, ranging from assistance in the event of illness to options for specific care. This article will provide you with practical advice for navigating the complex world of international health coverage, helping you make an informed choice.

Prices for international health insurance

THE price of international health insurance can vary considerably. In general, it is between €400 and €1000 per year, or approximately €33 to €84 per month. These prices depend on several factors, including the geographical area, THE coverage options chosen, and the age of the insured. For example, the cost of healthcare can be very high in some countries like the United States compared to other regions, thus influencing the price of insurance.

Customizing health insurance options

One of the greatest strengths of a international health insurance is the possibility of personalize your coverage. Depending on your needs, you can choose specific options such as treatments dental, care optics or preventive care. This flexibility allows you to get cover that suits your lifestyle and where you live, ensuring you are well protected.

Evaluation of prices according to location

It is crucial to note that insurers take into account the cost of health care in your country of residence when evaluating rates. For example, a visit to a general practitioner can cost up to €80 in the United States, while it can be as little as €40 in Japan. Understanding these differences will help you anticipate the budget needed for adequate health coverage in your host country.

Access to health insurance abroad

International health insurance is designed to provide similar protection to that of French social security, even when you live abroad. This means that you can benefit from a reimbursement for medical variables abroad. It is therefore essential to find out what conditions are covered and how to submit a claim from your expatriate country. Choosing the right international health insuranceChoosing the best

international health insurance

can seem daunting. There are many options on the market, and it is important to do your research to make an informed choice. Using mutual insurance comparators such as Santéxpat, allows you to quickly view the different offers available and compare prices and coverages. Don’t hesitate to consult sources such as Mes Allocs or Les Furetsto obtain valuable information on quotes and options. International health insurance: understanding prices and options Criteria Details Average annual price

Between

| €400 | and |

| €1000 | , based on the level of coverage. Personalization Specific options such as dentalcare, |

| optical | care, and preventivecare. Geographic areaRates adjusted according to the cost of carein the country of residence. |

| Coverage of medical expenses | Covers consultations, hospitalization and specialized care. |

| Assistance and repatriation | Generally includes assistance in case of emergency and repatriation. Payment terms |

| Monthly or annual payment options depending on insurers. | Benefits Protection similar tosocial security |

| French abroad. | Disadvantages |

| Potentially high costs and | limited options in certain regions. View this post on Instagram |

| Testimonials on International Health Insurance: understanding prices and options | When considering living abroad, it is essential to find out about the international health insurance . Many expatriates wonder about the prices to benefit from adequate coverage. In general, the cost can vary between |

per year, or approximately

€33 to €83 per month , depending on the level of coverage and the options chosen.For Mariana, an expatriate in Asia, choosing health insurance was a real headache. “I compared several quotes. I finally opted for coverage with care dental and optical included. Even though it increased the cost slightly, it gave me peace of mind,” she shares. Indeed, the customization of optionsis a crucial aspect in choosing international health insurance.

David, who lives in the United States, emphasizes the importance of good coverage: “A simple appointment with a doctor can cost up to €80 here. This is why I took out insurance that covers medical expenses and the

assistance . I didn’t want to take the risk of having to pay for everything out of my own pocket.” This clearly illustrates that prices vary depending on the country of residence and can influence the choice of insurance. In addition, most insurers allow you to choose the geographic area. Jacques, based in Africa, explains: “I selected coverage that extends to several countries, which was crucial for my frequent travels. It costs me a little more, but this peace of mind is priceless.” Thus, the geographical area purchased plays a major role in the insurance price.Émilie, a student in Europe, chose an international mutual insurance company: “For me, the cost is important, but I also looked for coverage that would protect me abroad while maintaining theservices

of French social security. With the health insurance I chose, I feel protected during my studies.” This highlights the fact that even students can benefit from adapted health insurance to their situation.

Ultimately, understanding how international health insurance is essential. Each individual must consider their specific needs and available options to choose the most suitable coverage. Whether you are an expatriate, traveler or student, a good international health insurance is decisive for your security and well-being abroad.

International health insurance is essential for expatriates and travelers wishing to benefit from adequate protection during their stays abroad. In this article, we will explore the prices of these insurances, the options available and how to choose the best coverage for your needs. Indeed, choosing international health insurance is a process that deserves attention to guarantee your peace of mind wherever you are.

Prices of international health insurance The cost of international health insurance varies considerably depending on several criteria. On average, prices range between €400 and €1000 per year , which represents a range of €33 to €83 per month

. However, it is important to note that these prices may fluctuate depending on the geographic area of residence. For example, an expat living in a country with an expensive healthcare system, such as the United States or Japan, might pay a higher rate than someone residing in a region where care is less expensive.

Evaluation of prices according to geographical area When it comes to determining theprice of your health insurance, insurers take into account the cost of medical care in the country where you reside. This assessment aims to provide you with adequate coverage for the country’s healthcare costs. For example, a consultation with a GP can cost around€40 in Japan

while it can reach

€80 in the United States . A health insurance comparator can help you choose the best option according to your situation. Personalization of insurance contracts One of the great advantages of international health insurance is the possibility of personalize your coverage. You can choose from different options, such as treatmentsdental

,

optics And preventive . This flexibility allows you to adapt your contract according to your specific needs and your budget. However, it is essential to analyze the possibledisadvantages of certain options, as this may influence the total cost of your coverage. Reimbursement limits Before signing a contract, check thereimbursement limits proposed. Each insurer has its own limits when it comes to covering medical expenses, which can have a significant impact on your expenses if necessary. It is therefore crucial to ensure that these ceilings correspond to your expectations and the reality of medical costs in your country of residence. The different offers on the market

The international health insurance market offers a multitude of options, ranging from basic travel insurance to coverage

complete . For example, some companies offer contracts from €10.99 per month

, including services such as repatriation, medical assistance, as well as care for

hospital costs . To make the best choice, it is wise to compare several quotes and analyze the different coverages.International health insurance is an essential tool to benefit from the necessary security when traveling abroad. By understanding the priceand the optionsavailable to you, you will be able to make an informed decision that will best meet your needs and your personal situation.

When considering moving abroad or traveling abroad, it is essential to consider the subject of international health insurance . Prices can vary significantly depending on various factors, including geographic area, age of the insured and options chosen. On average, the annual cost of good international health coverage ranges between €400 and €1000 , with monthly premiums starting from

€10.99in some companies.Clarity on these pricesis crucial, because it directly influences the decision of expatriates and travelers. To choose a international health insurance adequate, it is essential to understand the different

options available. Many insurance companies offer contract customization, allowing policyholders to select coverage such as dental care, optical care or preventive care. This means that each individual can tailor their insurance to their specific needs. Another important aspect to consider is the cost of health care in the country of residence. For example, consultation fees vary just as much from one country to another: a consultation with a general practitioner in Japan can cost around €40, while in the United States it can reach €80. Therefore, understanding the healthcare system of the host country can influence the choice of health insurance. Finally, it is worth considering whether international health insurance covers other aspects such as repatriation, trip cancellation or lost luggage. By taking all these elements into account, it becomes possible to make an informed choice for health coverage

that provides essential peace of mind when expatriating or traveling. Choosing the right health insurance is a key step in ensuring optimal protection abroad. FAQ on International Health Insurance How much does international health insurance cost on average? On average, the cost of good international health coverage is between €400 and €1000 per year, which represents a monthly range of €33 to €83.What options can I customize in an international health insurance? These insurances offer the possibility of selecting specific options such as dental care, optical care or preventive care, thus allowing to create a tailor-made coverage.How do insurers evaluate the rates of an international health insurance?

Insurers establish their rates by taking into account the country of residence of the insured as well as the cost of health care in this country. What types of expenses are covered by an international health insurance?An international health insurance generally covers medical consultations, hospitalization costs and specialized care, with conditions similar to those of the French social security. What is the main objective of an international health insurance? The main objective is to provide members with protection comparable to that of French social security, even when residing abroad.

What criteria influence the cost of an international health insurance contract?

The cost depends on several criteria, including the geographical area chosen, because the cost of medical care varies considerably from one country to another. How to choose the best international health insurance?

To choose the best insurance, it is necessary to compare the different offers, examine the available options and take into account the specific needs related to your expatriation or your travels. Are there differences between travel insurance and international health insurance?

Yes, travel insurance generally covers medical emergencies for a short period of time, while international health insurance offers more extensive coverage, including regular care and repatriation. What are the best international health insurance companies?

There are several recognized insurance companies, but the choice often depends on personal needs, the geographical area and the desired options.