|

IN BRIEF

|

S3125 form for care received abroad.When you are planning a trip abroad, it is essential to worry about your health coverage . Medical care can be expensive outside your borders, and being well informed about the documents required to benefit from mutual coverageis essential. Whether for a holiday, studies or expatriation, knowing how your health insurance works abroad will allow you to travel with peace of mind. By understanding the steps to follow and the forms

https://www.youtube.com/watch?v=-Ja7l-YMgPA When you go abroad, it is essential to understand the documents required to benefit from optimal health coverage. Whether you are on vacation or expatriate, it is crucial to know what type of mutual document

you will be required. This article guides you on the advantages and disadvantages of your mutual in an international context.

Advantages Possessing a mutual document for abroad has many advantages. First, it ensures that you are financially covered for unexpected health expenses. Some mutuals cover care, and it is therefore less likely that you will incur high costs in the event of an accident or illness. In addition, your European health insurance card

(CEAM) will facilitate access to public health services, especially within the European Union. Another advantage is the possibility of being reimbursed quickly. By having the right documents at hand, such as the form S3125

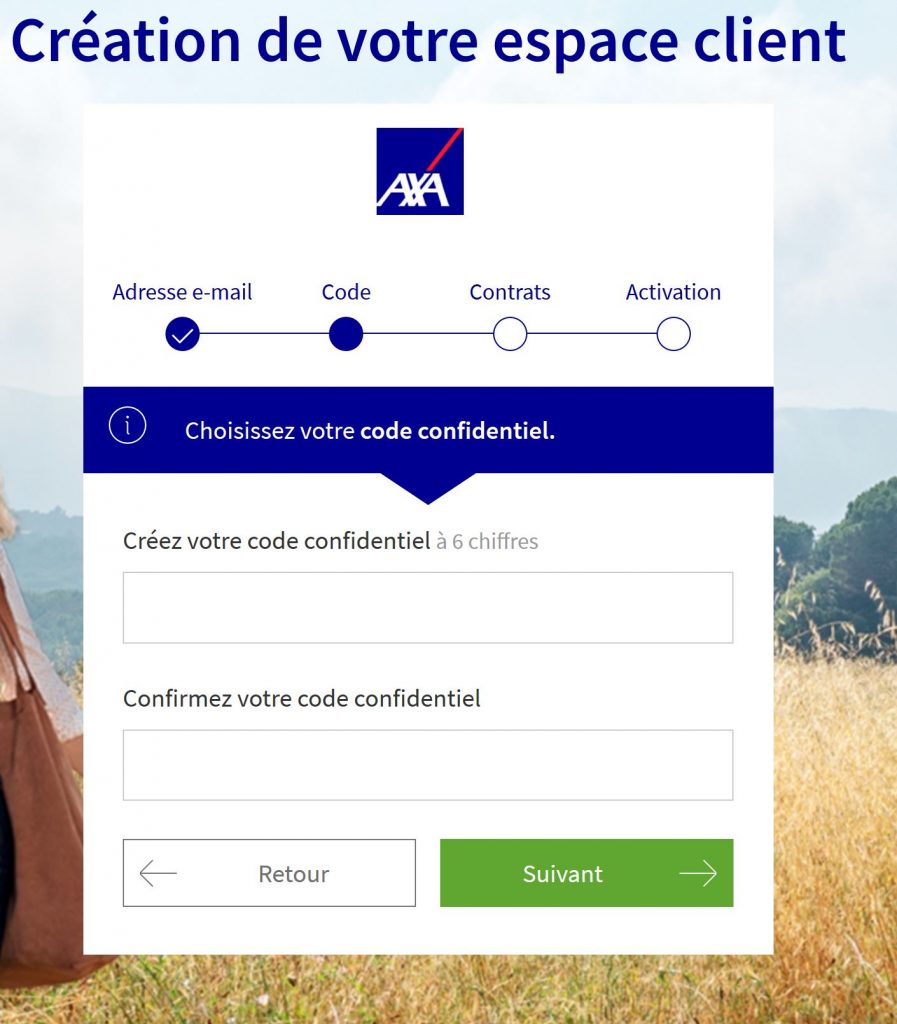

Is AXA a good insurance for you?

IN BRIEF AXA : Evaluation of the services offered to policyholders Options blanket adapted to individual needs Analysis of price and guarantees Assistance and international services Comparison with others insurance companies Feedback fromusers and customer satisfaction Things to consider before…

for care received abroad, you will be able to submit your reimbursement request efficiently. This also allows you to have peace of mind, knowing that you have planned health protection for your stay.

Disadvantages Despite these advantages, the use of a mutual document

for abroad presents disadvantages. First of all, administrative formalities can quickly become complex. Filling out the correct form, collecting all medical bills, and familiarizing yourself with your health insurance’s reimbursement conditions can take a lot of time and effort. Another potential downside is limited coverage. Some mutual insurance companies do not cover all types of care or may have exclusions depending on the country. It is therefore essential to find out about the specifics of your coverage before leaving. Indeed, a prolonged stay in a country that does not have an agreement with your mutual insurance company can cause financial inconvenience. This is why it is recommended to consult resources like this

for clearer vision. When traveling abroad, it is essential to know which documents related to your mutual

Non-resident health insurance: everything you need to know

IN BRIEF Health insurance for non-residents: a necessity to cover medical costs abroad. Social protection depends on residence and procedures administrative tasks to be carried out. Different coverage levels available according to the needs of expatriates. Importance ofaffiliation to benefit…

you must carry to be covered in the event of medical care. In this article, we will guide you through the various essential elements and the steps to follow to ensure optimal protection during your stay abroad.

The European Health Insurance Card (EHIC) There European Health Insurance Card

The best international mutual insurance: complete guide to choosing wisely

IN BRIEF Define your project : Identify your travel or expatriation objectives. Evaluate your needs : Consider your specific health requirements. Compare options : Use a insurance comparator for international mutual societies. Check warranties : Ensure that the contract covers…

(EHIC) is often the main document to have if you are going to a European Union country or Switzerland. It allows you to access public healthcare in these countries as if you were a local resident. To obtain it, remember to make a request to your health insurance company, ideally several weeks before your departure. Children and all family members must also apply.

Form S3125 for care received abroad While the EHIC may cover certain treatments, other types of expenses may not be covered. In this case, you will need to complete theform S3125 , which is intended to declare thecare received abroad

Chapka mutual insurance: everything you need to know

IN BRIEF Chapka Assurances : expert in travel insurance since 2002. Unlimited medical coverage in the event of an accident or illness. Complete assistance for stays abroad up to 90 days. Adapted guarantees for tourists ,expatriates and PVT Medical teleconsultation…

. This form will allow you to request reimbursement of your medical expenses. Remember to keep all medical bills and documents to support your claim.

Additional documents depending on your mutual insurance Requirements may vary depending on the mutual

Update on AXA mutual insurance: is it really effective?

IN BRIEF Full support contracts with AXA, even for the cheapest options. Analysis of 168 reviews of Internet users on AXA mutual health insurance. Watch out for some traps when selecting a supplement: percentages, packages, ceilings. Customer reviews shared on…

that you choose. Check your contract carefully to make sure you have all the necessary documents. Some mutual insurance companies may require specific or additional documents for the payment of care abroad. Also find out about possible steps to take once you return to France, in order to maximize your reimbursement.

Reimbursement of care abroad: steps to follow

Axa mutual business guarantee: everything you need to know

IN BRIEF Pension guarantees for the protection of employees against financial risks. Offer of complementary health adapted to the needs of businesses. Tables of guarantees and reimbursement of health costs. Information on the portability complementary health insurance in the event…

To be reimbursed for your care abroad, start by gathering all your documents: invoices, medical prescriptions, and of course, the required forms. After completing form S3125, you will need to send it to your mutual insurance company, attaching all supporting documents. Pay attention to reimbursement times, which may vary from one mutual fund to another.

Choosing the right mutual insurance for traveling abroad

While it is important to check your mutual insurance cover for abroad, it is also crucial to choose the one that best suits your needs. Several options are available on the market, including specialized mutual insurance for travelers. Do in-depth research and compare the different offers to choose the one that will offer you the best health protection during your stay abroad. For more information and practical advice, be sure to consult online resources such as Service-Public.fr or blogs specializing in mutual health insurance. These sites will allow you to deepen your understanding of the documents necessary for your health coverage

discover our guide to mutual insurance for foreigners, which helps you choose the health coverage suited to your needs during your stay abroad. protect yourself effectively and travel with peace of mind! When you go abroad, whether for a vacation or an extended stay, it is essential to ensure that you are well covered in terms of health. This includes understanding the documents necessary for your mutual

Axa mutual company: how to contact customer service?

IN BRIEF Contact AXA business easily by phone at 01 55 92 21 94. For emergency problems, dial the breakdown number at 01 55 92 26 92. Email address for customer information service: service.informationclient@axa.fr. Communicate by mail to AXA France…

abroad. Here is a guide to help you navigate these crucial aspects of your health protection.

Understanding the European Health Insurance Card (EHIC) Before your departure, it is strongly recommended to request your European health insurance card

Axa car assistance abroad: everything you need to know to travel with peace of mind

IN BRIEF Car insurance to travel peacefully abroad Check its guarantees before departure Importance of green card for the cover Steps to follow in the event of breakdown Assistance 24/7 in case of immobilization Protection personalized for the vehicle Tips…

(CEAM) from your health insurance organization. This card will allow you to benefit from public healthcare in European Union countries, as well as in certain other partner countries. To obtain it, go to your Ameli account and follow the steps indicated.

Forms to fill out For reimbursement of care you may receive abroad, several forms are required. The form Cerfa n°12267 must be completed and sent for your refund request to be processed. In addition, it is important to complete the form S3125

for treatment received abroad, accompanied by all relevant medical documents and invoices.

Contact your mutual Before leaving, take the time to contact your mutual

to check your coverage abroad. Some mutual insurance companies offer specific options for stays abroad, such as adapted travel insurance. It is crucial to clarify these points to avoid surprises in the event of a medical need.

Reimbursement deadlines Reimbursement times may vary depending on insurance companies. Make sure you understand these deadlines and what is required to submit a refund request. Also check if your mutual

offers a remote transmission option, which can simplify the reimbursement process.

Documentation to provide

When preparing your file for a reimbursement request, remember to gather all the necessary documents. This includes the medical prescription, treatment invoices, as well as completed forms. Good preparation in advance will help you facilitate the processing of your request.

International health insurance Finally, depending on the length of your stay and your destination, it may be wise to subscribe to ainternational health insurance

. These provide extensive coverage, often more comprehensive than traditional mutual insurance, and can be adapted to your specific travel needs. Compare the available options to choose the one that suits you best.

| Essential documents for mutual insurance abroad | Document |

| Description | European Health Insurance Card (EHIC) |

| Allows access to public healthcare in EU countries. | Form S3125 |

| To be completed for care received abroad, with invoices. | Cerfa form n°12267 |

| Used for reimbursement of health expenses abroad. | Medical prescriptions |

| Important for obtaining medicines abroad. | Proof of stay |

| Proof of your presence abroad, useful for reimbursements. | Certificate from the insurer |

View this post on Instagram

Testimonials on the Mutual Document for Foreigners: what you need to know When I decided to go on vacation abroad, I was a little confused about my health coverage. I quickly realized that it was essential to apply for my European health insurance card

before leaving. Thanks to this card, I was able to benefit from medical care in Spain without having to worry about the costs up front. It is an essential document for anyone wishing to travel with complete peace of mind. When I moved to Australia, I also realized the importance of completing thenecessary forms . I had to provide the form S3125

for my medical care in order to be reimbursed by French social security. Although it seemed a bit complicated at first, I was pleasantly surprised by how efficient the system was once everything was in order. My cousin, who studied in Italy, faced unexpected medical expenses. Fortunately, she had anticipated by finding out about the documents to provide to his mutual insurance company. Thanks to your European Health Insurance Card andCerfa form n°12267

, it was able to be reimbursed quickly. This motivated me to prepare my own documents to avoid such stressful situations. A friend experienced a more complex altercation: he fell ill while traveling in India. It was vital for him to know the health coverage options available before his departure. On the other hand, he had not taken the time to find out about the steps to get reimbursed. After having had such an experience, he is clearly convinced that being prepared in terms of mutual insurance abroad

is crucial. When I traveled for business, I opted for a international health insurance specific. Although this incurred additional costs, I understood that this coverage was necessary for me, especially since I planned to stay abroad for a long time. It is essential to carefully assess your needs and choose amutual insurance adapted to your travels

. When you go abroad, it is crucial to ensure that you are properly coveredmedical . THE documents necessary to benefit from reimbursements of your mutual not only facilitate access to care, but also give you peace of mind in the event of an incident. This article guides you through the formalities and documents

important to prepare before your departure.

The European Health Insurance Card (EHIC) Before traveling, it is essential to request yourEuropean Health Insurance Card (EHIC). This card allows you to receive medical care in countries of the European Union, the European Economic Area and Switzerland, if necessary. To obtain it, connect to your personal space on the website Health Insurance or send a request to yourinsurance organization

. The EHIC does not replace amutual , but it can cover part of the medical costs incurred. Indeed, some countries do not practice full reimbursement and it is therefore important to supplement this coverage with mutual health insurance

adapted.

Documents required for support When you receive treatment abroad, it is imperative to keep all documents relating to your healthcare expenses. Here are the main documents to provide to be reimbursed by yourmutual

.

Medical bills Keep all invoices

medical services that have been provided. These invoices must be detailed and mention the nature of the care provided, the amount invoiced, as well as information relating to the healthcare professional.

Form S3125 To obtain reimbursement for your care, it is often necessary to complete theform S3125 . This document, called “Care received abroad”, must be filled in precisely. Don’t forget to attach the invoices

and other supporting documents requested.

Choice of mutual insurance for abroad The choice of your mutual is fundamental when planning a stay abroad. Some mutual insurance companies offer specific guarantees for care abroad, while others may have exclusions. Find out about the different options available, by checking the services proposed and thereimbursement limits

.

Anticipate in case of medical need In case of medical need, make sure you have all your documents within reach. Show your EHIC and explain your situation tohealthcare provider

. This will facilitate the process of accessing the necessary care. Avoid the unexpected by taking the time to check the coverage of your mutual and bringing together all the documents

discover our mutual insurance solutions for expatriates and travelers abroad. protect your health and that of your family with coverage tailored to your needs, wherever you are in the world. When making the decision to travel or live abroad, it is crucial to ensure that you have the correct documents to benefit from aadequate health coverage

. Beyond the security offered by your health insurance, the edition and presentation of specific documents are essential to guarantee optimal coverage of your health expenses. The first essential document to have in your possession is theEuropean Health Insurance Card (EHIC)

. This card will allow you to easily access the necessary medical care in European Union countries. Before your departure, it is therefore strongly recommended to apply for the EHIC via your ameli account or by contacting your health insurance organization. Remember that each member of your family, including children, must have their own card. In addition to the EHIC, there are otherdocuments to prepare

, in particular form S3125, which is necessary to declare care received abroad. This form will allow you to request reimbursement for your health expenses. Also remember to keep all invoices and medical documents provided by healthcare professionals, as they will be essential to justify your reimbursement request. Finally, find out about the coverage offered by your mutual