|

IN BRIEF

|

Health insurance in France is a crucial subject for every citizen, both for those who reside in the country and for those who live abroad. With a multitude of options available and sometimes complex regulations, it is essential to have a complete guide to navigate this universe. Whether you are an expatriate, a student, or simply looking for information to better understand your rights and obligations, this exploration will allow you to demystify the ins and outs ofhealth insurance. Let’s learn together to make informed choices to guarantee your well-being and that of your loved ones.

When we approach the subject ofhealth insurance in France, it is essential to know its different facets. This comprehensive guide will allow you to discover everything you need to know about how health insurance works, its advantages and disadvantages, as well as the options available to make informed choices regarding health coverage.

Benefits

The first major asset of thehealth insurance in France is the Social Security system, which provides basic coverage for almost all residents. This means that, whatever your situation, you benefit from access to quality health care, without exorbitant cost. Thanks to this system, medical consultations, hospitalizations and even certain medications are partially reimbursed.

Another advantage is the diversity of options available. In addition to Social Security, there are numerous mutual And private health insurance to cover the remainder. This allows policyholders to personalize their coverage according to their specific needs, whether dental, optical or alternative medicine.

The compulsory AXA mutual insurance certificate: what you need to know

IN BRIEF Mandatory mutual insurance certificate : essential document to prove membership in your company’s complementary health insurance. Importance : Necessary for reimbursement of care and benefit of third-party payer. Legal obligation : Every company employee must have this document.…

Disadvantages

Despite these many advantages, there are also disadvantages to consider. First of all, the cost of complementary health insurance can represent a significant financial burden, particularly for families or individuals with modest incomes. It is therefore essential to compare the different offers to avoid ending up with unsuitable or too expensive coverage.

In addition, understanding different insurance contracts can be complex. With a multitude of choices, it is not always easy to navigate and find the option that perfectly suits your needs. The lack of transparency on certain aspects of contracts can also lead to misunderstandings, particularly on reimbursement deadlines or guarantee ceilings.

In short, familiarize yourself with the particularities of thehealth insurance in France in order to make an informed choice that meets your expectations and needs. Whether you are a resident, expatriate or traveler, being well informed is the first step towards optimal health coverage.

In a constantly changing world, it is essential to understand thehealth insurance In France. This comprehensive guide will allow you to navigate through the different options available, to discover the rights and obligations of policyholders, as well as the specificities linked to the health for expatriates and non-residents. Whether you are in France or abroad, this article will provide you with all the information you need to make informed choices regarding your health coverage.

Salary supplement: how AXA mutual insurance can help you

IN BRIEF Salary supplement : crucial during sick leave. AXA mutual : multiple options to compensate for your loss of income. Daily allowances : amount paid by your mutual in the event of illness. Simple steps to follow to benefit…

The basics of health insurance in France

In France, health insurance is mainly managed by the Social security. It covers the health costs of policyholders by reimbursing part of the expenses linked to medical consultations, medications and hospitalizations. However, it is often recommended to subscribe to a mutual to complete these reimbursements and benefit from more extensive coverage.

Travel and mutual insurance: how to choose the best health coverage for your vacation

IN BRIEF Understand the importance of mutual travel insurance. Evaluate the medical expenses abroad. Compare the guarantees and the options available. Choose according to your destination. Take into account the duration of your stay. Consider the risks related to your…

Types of health insurance

Compulsory health insurance

Mandatory health insurance guarantees all residents basic reimbursement for health care. It is based on a system of contributions and is accessible to everyone, including the self-employed and the unemployed.

Supplementary health insurance

To cover the remaining costs after reimbursement from Social Security, there is complementary health insurance, commonly called mutual. They allow you to benefit from additional support for more expensive care.

Taking out private insurance: what you need to know

IN BRIEF Subscription private insurance: key steps Importance of evaluating your personal situation Understand the guarantees proposed Terms membership and eligibility criteria Compare the price and offers from different insurers Right to retraction 14 days for certain contracts Tips for…

Health insurance for expats

THE expatriates and non-residents must find out about the specifics of health insurance abroad. If you live abroad, it is crucial to take out international health insurance that will protect you against unexpected medical expenses. Options such as international private health insurance can be a good idea to ensure you have suitable coverage.

Mutual hospitalization insurance: why choose AXA?

IN BRIEF Importance of a hospitalization guarantee in your complementary health. Reimbursements of up to 400% for hospital costs. Support for pre and post-operative costs at 150%. Options for home hospitalization And medical transport at 150%. Formulas flexible adapted to…

Choosing suitable health insurance

To choose your health insurance carefully, take several criteria into consideration, including price, the guarantees offered and the reputation of the companies. It is recommended to compare the different options available on the market. To help you, here is a complete guide to international health insurance, as well as a detailed tutorial on international private health insurance.

Axa mutual insurance: everything you need to know before subscribing

IN BRIEF Needs assessment : Analyze your current treatments and your healthcare expenses. Diversified offers : AXA offers 7 customizable formulas to adapt to each profile. Selection criteria : Consider the guarantees, services, And options available. Exclusive benefits : Discover…

Information on AXA Health insurance

Among the many players in the market, AXA stands out for its offers adapted to everyone’s needs. To fully understand the options and make the best choice, consult this presentation of AXA health insurance.

Mutual and travel insurance: what you need to know before you leave

IN BRIEF Essential preparation before a trip: don’t neglect insurance. Difference between travel insurance And mutual. Importance of guarantees to leave peacefully. Consider the destination to choose the right coverage. Check the options And services available. Understand the risks related…

Understanding health insurance in France: a complete guide

Navigating the complex world ofhealth insurance in France can seem intimidating, especially for new arrivals or those considering decisions about their coverage. This comprehensive guide aims to shed light on the different facets of health insurance, offering practical advice and tips to help you understand your options and make informed choices.

Axa: complete guide to choosing the right insurance

IN BRIEF Understanding Axa offers Analysis of guarantees proposed Comparison of prices available Customer reviews on AXA and its services Criteria for choosing blanket adequate Guide to subscribing online easily Information on claims and declarations In a world where protecting…

The basics of health insurance in France

In France, thehealth insurance is an advanced system that guarantees every resident access to medical care. The system is mainly composed of Social security and of mutual which supplement reimbursements of health costs. Understanding how these two elements interact is essential to getting optimal coverage.

The roles of Social Security and mutual insurance companies

There Social security covers part of the medical costs, but does not always cover the entirety of the expenses. For this reason, subscribe to a mutual or supplemental health insurance is often recommended. This makes it possible to reduce the out-of-pocket cost and obtain higher reimbursement for certain treatments, such as consultations or hospitalization.

Choosing the right mutual

The choice of a mutual depends on various criteria, including your health needs, your budget and the guarantees offered. Take the time to compare offers and identify those that include options tailored to your personal situation. Details of waiting periods, assistance services, or home consultations are elements to consider carefully.

Comparison of different mutual insurance companies

There are many mutual on the market, each with its own specificities. To help you make the best choice, consult insurance comparators online. This will allow you to evaluate the prices, reimbursement levels and additional options that each mutual offers.

Understanding international health insurance options

For those who spend part of their time abroad or who are considering moving abroad, it is imperative to know the international health insurance options. These insurances are designed to cover treatment abroad and can be a valuable addition to your French coverage.

Financial aspect of international insurance

The prices of international health insurance can vary considerably, depending on the coverage chosen. Some plans only include emergency care, while others provide comprehensive coverage for all types of care. Before making a decision, assess your healthcare needs and compare available offerings. For more information on this topic you can consult this practical guide.

Understand the world ofhealth insurance in France requires time and attention, but with the right information and a methodical approach, it is possible to make informed choices that will guarantee your health and well-being. Don’t neglect the importance of informing yourself well and comparing the options available to you.

Comparison of Types of Health Insurance in France

| Type of Insurance | Description |

| Basic Health Insurance | Covers essential medical expenses, such as consultations and hospitalizations. |

| Supplementary Insurance | Coverage for fee overruns and unreimbursed costs. |

| International Health Insurance | Protection during stays abroad, ideal for expatriates and travelers. |

| Student Health Insurance | Designed for students, it offers conditions adapted to young people. |

| Provident Insurance | Completes health coverage with guarantees in the event of incapacity or disability. |

| Health Insurance | Mandatory for everyone, it ensures a minimum of health coverage. |

Testimonials: Understanding health insurance in France

When I went to study abroad, I quickly realized the importance of having a health insurance adapted. Thanks to a comprehensive guide to health insurance in France, I was able to choose the coverage that suited my needs while being abroad. It was a relief to know that no matter where I was, I could access the care I needed without financial stress.

As an expat in France, I found the process of understanding the different options ofhealth insurance a little intimidating at first. However, this comprehensive guide has been my ally. He helped me decipher the nuances between various insurance policies and understand the criteria to consider when choosing the best coverage. I now feel much more secure in my choice.

A friend of mine, who recently moved to France, recommended that I consult a guide on health insurance. Thanks to his advice, I realized that all international health insurance options are not worth each other. The guide allowed me to compare the different plans available, and I am now convinced that I have made an informed choice for my health protection abroad, while remaining in touch with my French roots.

Another testimony particularly struck me: a young woman who had to face an unexpected health problem during a trip. She explained that her understanding ofhealth insurance allowed him to manage medical care quickly. With adequate coverage, she was able to obtain the necessary treatments without worrying about exorbitant costs. It is a true testimony to the importance of being well informed about your health insurance options.

Finally, I cannot emphasize enough the need for a comprehensive guide to understanding thehealth insurance In France. The feedback from those who have gone through these processes inspires me and reinforces my conviction that taking the time to properly inform future travelers and expatriates is essential. Knowing your rights and options can make all the difference between a stressful trip and a peaceful experience.

Health insurance in France is a subject of capital importance for all residents, whether French or foreign. This comprehensive guide aims to enlighten you on the different options available, the coverage plans, as well as the criteria to take into account to make an informed choice. Whether you are a newcomer, an expat or simply looking for reliable information, this guide will help you navigate the complex world of health insurance.

The Fundamentals of Health Insurance in France

In France, the health coverage is mainly based on two players: Social Security and supplementary insurance. Social Security guarantees basic coverage, while mutual or private health insurance supplements this protection through additional reimbursements.

Social Security

It covers part of the health expenses. Reimbursements vary depending on the care received. It is important to familiarize yourself with the reimbursement rates to know what portion of the costs will be covered. Contracted health professionals apply rates determined by Social Security, which optimizes reimbursements.

Supplementary Insurance

Supplementary health insurance, often referred to as mutual, is essential to supplement Social Security reimbursements. It covers the remaining costs and varies widely in terms of guarantees and prices. It is crucial to compare offers to choose a mutual adapted to your health needs. Different Types of Contracts

There are several types of health insurance contracts in France, each with its own characteristics. These contracts can be classified according to their level of coverage, their rates and the additional services offered.

Basic Contracts

These contracts offer minimum coverage, often corresponding to the reimbursements provided by Social Security. They are generally less expensive but may be insufficient for certain health expenses, such as dental care or glasses.

Reinforced Contracts

These contracts include additional guarantees, in particular for routine care, hospitalization or alternative medicines. They are recommended for people with specific needs or a state of health requiring frequent monitoring.

Criteria for Choosing Your Health Insurance

When choosing health insurance, several criteria must be taken into account to make the right choice.

The Guarantees Offered

Analyze the guarantees included in the contracts. This includes reimbursement rates for routine care, hospitalizations, dental, optical, as well as possible reimbursement for alternative medicines. A good contract should meet your specific needs.

The Budget

Evaluate your

budget and choose insurance that fits it. Don’t just be guided by price, but also consider the level of coverage. Sometimes a slightly higher rate can be more advantageous in the event of a serious medical need. Customer Reviews

Read customer reviews on different health insurance plans. Feedback can give you an indication of the quality of service, speed of reimbursements and overall level of satisfaction.

Understanding health insurance in France is a crucial step in ensuring protection tailored to your needs. By finding out about the different plans, types of contracts and selection criteria, you will give yourself every chance of making a good choice and ensuring your health with peace of mind.

When we approach the subject of

health insurance in France, it is essential to know the different options available to you. As a resident or expat, it is essential to ensure that you benefit from coverage adapted to your personal needs, especially given the frequent developments in the healthcare field. Whether you choose the general plan or aprivate health insurance , it is crucial to understand the guarantees and the terms linked to them.One of the fundamental aspects to take into account is the difference between the

compulsory health insuranceand additional options. While the first is put in place to guarantee minimal access to care, the second makes it possible to improve this coverage by reimbursing part of the uncovered expenses. This is particularly useful for dental, optical and hospital care. Furthermore, for the

French abroad or non-residents, the international health insurancebecomes an essential subject. You should carefully evaluate the options available and compare the different insurance contracts to ensure that your coverage is optimal in the event of travel or stay abroad. The differences in prices and services can be significant, hence the importance of a comparative in-depth. Finally, choose a company like

AXA or other recognized players on the market can make a real difference. By taking the time to carefully analyze your needs and the solutions available to you, you will be able to make an informed choice that is beneficial for your health and well-being. Staying informed is the key to successfully navigating the complex world of health insurance. FAQs about health insurance in France

What is health insurance in France?

Health insurance in France is a coverage system that allows citizens and residents to access medical care while benefiting from partial or total reimbursement of their health costs. Who can benefit from health insurance in France?

All residents in France, including salaried workers, self-employed workers, students and retirees, can benefit from health insurance, under certain conditions. How does health insurance work in France?

The system is based on a partnership between the State and insurance companies. Contributions are deducted from income and care is reimbursed according to different scales established by Social Security. What types of care are covered by health insurance?

Health insurance covers a wide range of care, including medical consultations, hospitalizations, dental and optical care, as well as prescribed medications. What is complementary health insurance?

Supplementary health insurance is an optional insurance which supplements the reimbursement of Social Security, in order to cover remaining expenses, such as excess fees or certain unreimbursed care. How to choose your complementary health insurance?

It is important to assess your health needs, compare the different offers and take into account the guarantees offered to choose the best complementary health insurance adapted to your situation. What are the waiting periods for health insurance?

Waiting periods vary depending on insurance companies and contracts. It is essential to do your research to understand whether there are waiting periods before benefiting from certain guarantees. What is the difference between health insurance and private health insurance?

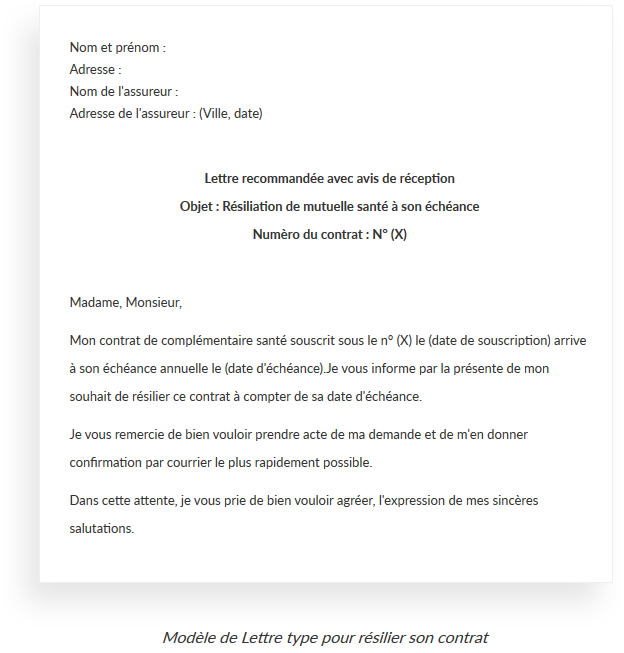

Health insurance, managed by the State, only covers part of medical costs, while private health insurance offers additional coverage, allowing more complete reimbursement of care. Is it possible to change insurer?

Yes, it is entirely possible to change insurer. However, this requires understanding the conditions for terminating your current contract and comparing the new health insurance offers available. How does third-party payment work?

Third-party payment allows policyholders not to have to advance health costs. During the consultation, the healthcare professional will be paid directly by the insurer, which facilitates access to care.