Discover the essential health insurance for foreigners in Switzerland! What options are available to you to benefit from optimal medical coverage during your expatriation in this exceptional country? Follow the guide to understand the issues and find the best health insurance that will meet your needs.

Basic healthcare coverage for foreign residents

For foreign residents, understanding basic health care coverage is essential to ensure that common health needs are effectively addressed. This article examines the different facets of this coverage, taking into account national specificities and the varied expectations of expatriates.

International health insurance and foreign residents

International health insurance plays a crucial role for expats by providing comprehensive medical coverage. These provide access to basic and emergency care without having to worry about administrative barriers. They generally include consultations with the general practitioner, routine medical examinations, as well as emergency care. For those who travel frequently, it is essential to choose insurance that offers maximum flexibility and administrative simplicity.

Specificities of Switzerland for foreign residents

In Switzerland, health insurance is compulsory for all residents, including foreigners. The Swiss healthcare system is renowned for its efficiency and quality, making it a popular choice for expats. Foreign residents must register for health insurance within three months of arriving in the country. Basic coverage includes medical consultations, emergency hospital care and certain prescribed medications. With solid base coverage, it’s also possible to purchase add-on plans for additional services, such as dental and vision.

Registration requirements and conditions

Emergency Care Options and Limitations

Choosing the right coverage for your needs

Choosing the right insurance coverage is essential for foreign residents. It is important to compare offers and take into account specific needs depending on the country of residence. In Switzerland, for example, there are several insurers that offer varied plans, allowing you to select the one that best meets expectations in terms of medical services, costs and flexibility.

Understanding the different aspects of basic healthcare coverage for foreign residents is essential to smoothly navigate your host country’s healthcare system.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage for foreigners in France essential Request from form S1 for registration to the social security Foreign students : compulsory registration for health insurance European Health Insurance Card (CEAM) for holidays in France Different rights depending on…

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

Role of health funds and choice of insurer

Understanding the Role of Health Funds in Switzerland

Health insurers in Switzerland play a fundamental role in the country’s healthcare system. They are responsible for providing basic coverage to all residents, including foreigners. This coverage is mandatory and must be taken out within three months of settling in Switzerland. The Swiss health system is characterized by a great diversity of insurers, which can make the choice complex for newcomers.

Health insurers cover a wide range of essential medical services. This includes doctor visits, hospital care, prescribed medications and various therapeutic treatments. It is crucial to fully understand the benefits covered by basic insurance to ensure that all medical necessities are taken care of.

For foreigners, it is also important to note that certain health insurance companies offer additional services, particularly adapted to the needs of expatriates. These services can include care around the world, medical repatriations and care in private clinics.

Criteria for Choosing an Insurer for Foreigners

Choosing a health insurer in Switzerland can be a real headache. It is essential to compare the different offers on the market based on several criteria specific to the needs of foreigners. Here are some key criteria to consider.

1. Cost of Premiums: Premiums can vary considerably between different insurers. It is important to find a balance between the cost and the quality of the services offered. Comparing prices is therefore a crucial step.

2. Franchise: The deductible is the amount the insured must pay out of pocket before the insurance begins to cover the costs. Choosing a deductible suited to your financial situation can influence the amount of your monthly premium.

3. Additional Services: For a foreigner, additional benefits can be particularly attractive. Make sure the insurer offers offers tailored to your specific needs, particularly in terms of international coverage and emergency care.

4. Network of Service Providers: Each health fund has a network of health providers (doctors, hospitals, pharmacies). Check that the providers you use or plan to use are supported by the chosen fund.

Administrative Procedures and Flexibility

The simplicity and flexibility of administrative procedures are also important criteria for foreigners. Some insurers offer simplified procedures for purchasing and managing health insurance, which can save you time and hassle.

1. Online portals and mobile applications: Many insurers offer online portals and mobile applications to make it easier to manage policies, track reimbursements and make appointments with doctors.

2. Multilingual Customer Service: Choosing an insurer with multilingual customer service can be a considerable asset in overcoming language barriers and understanding the terms of your insurance contract.

3. Flexibility of Contracts: The ability to modify coverage, add beneficiaries or change plans can provide greater adaptability to your changing needs as a foreigner in Switzerland.

Premium Issues and Increases

Finally, it is crucial to stay informed about current issues such as health insurance premium increases, which can greatly affect your budget. Health insurance premiums for cross-border workers, for example, sometimes experience significant increases, which is not without consequences on personal finances. It is advisable to monitor current events and reassess coverage regularly to ensure it remains adequate and financially viable.

In summary, understanding the role of health insurers and wisely selecting an insurer adapted to your specific needs is essential to benefit from optimal medical coverage in Switzerland. For more information on choosing your insurance, check out expert advice on Choosing your health insurance can be a good starting point for making an informed decision.

By following these steps, you will be better prepared to navigate the Swiss healthcare system and select coverage that will give you peace of mind while meeting your medical and financial needs.

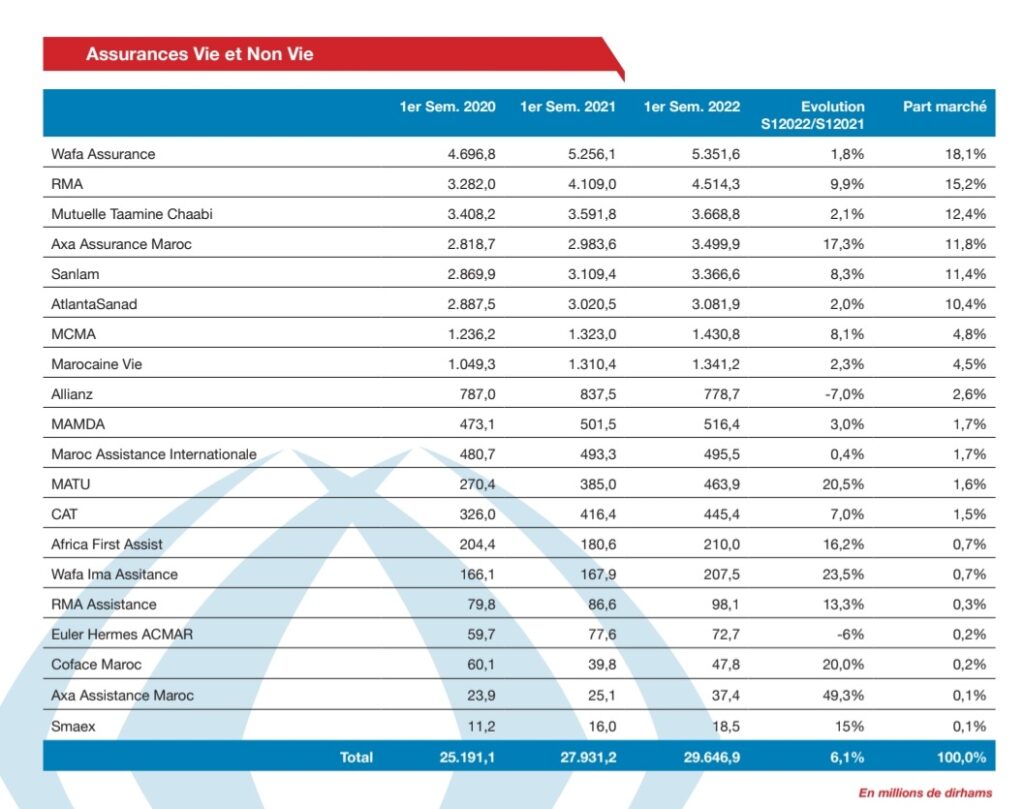

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Get the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to social protection scheme local. THE mutual do not cover treatment abroad…

Supplementary insurance: an essential for expatriates?

Compulsory basic insurance in Switzerland

Basic insurance in Switzerland, also called LaMal, is compulsory for all residents, including foreigners. It covers essential health care such as doctor visits, hospitalization and certain medications. This insurance guarantees minimal protection, but it may not be enough to cover all of your specific medical needs. As a foreigner, it is crucial to take out this insurance within three months of your arrival in Switzerland.

Choose additional insurance

To benefit from additional services not covered by basic insurance, it is often recommended to take out additional insurance. Supplementary insurance can include services such as dental care, consultations with specialists not covered by LaMal, and wellness services such as alternative medicine. This flexibility allows you to customize your coverage to meet your specific needs.

Administrative procedures to subscribe

Taking out health insurance in Switzerland may seem complex, but the procedures are generally well organized. You will need to provide documents such as your passport, residence permit and proof of residence. Many companies offer online services to facilitate administrative procedures. The simplicity and flexibility of the procedures can considerably simplify the lives of expatriates.

Fees and deductibles

Health insurance costs in Switzerland can vary depending on several factors, including your age, health and the level of coverage chosen. In addition to monthly premiums, there are deductibles, which are amounts you must pay before insurance begins to reimburse medical expenses. There are several deductible options, allowing you to adapt your expenses according to your budget.

Benefits for expatriates

Health and supplementary insurance in Switzerland offer comprehensive coverage which can be particularly advantageous for expatriates. In addition to high-quality healthcare, this insurance gives you peace of mind while traveling abroad. If you are self-employed or travel frequently for business reasons, this coverage may include emergency care while traveling.

Some key points for choosing your insurance

– Analyse of needs: Assess your medical needs and those of your family.

– Comparison of offers: Compare different offers to find the best coverage at the best price.

– Flexible contracts: Look for contracts that offer customization options.

– Customer service: Opt for a company with good customer service, ideally multilingual.

[vos protections sociales]For more information on international social protection, you can consult resources such as those offered by (https://www.capital.fr/votre-carriere/expatriation-verifie-votre-protection-sociale-1284885) and (https://www.malakoffhumanis.com/particuliers/international/pack-expat-cfe-particulier/).[services pour expatriés]

By following these tips, you will be better prepared to navigate the health insurance system in Switzerland and choose the coverage that best meets your specific needs.

The cost of private health insurance: what you need to know

IN BRIEF The cost of a private health insurance varies depending on age and length of coverage. Average price of mutual insurance: approximately 90 €/month for women and 105 €/month for men. THE monthly contributions generally oscillate between 30 and…

Health insurance in Belgium: understanding prices and coverage

IN BRIEF Social security system in Belgium: a protective framework THE mutual reimburse between 60% and 75% of medical costs Conventional price for a general consultation: €22.22 with 75% refunded 20 to 25% of health costs remain the responsibility of…

Registration procedures and deadlines for new arrivals

Health insurance regulations in Switzerland for foreigners

In Switzerland, the health system requires everyone residing in the country, including foreigners, to take out basic health insurance. Expatriates must take out insurance within three months of their registration in the municipal register. This obligation concerns both self-employed workers and employees.

Registration Procedures

To register for health insurance in Switzerland, expatriates must follow several steps:

1. Registration in the municipal register : This step is fundamental and must be completed within 14 days of arrival in Switzerland.

2. Choice of health insurance : Comparing different insurance companies is essential to find the best coverage suited to your needs.

3. Subscription to basic insurance : Once the insurance has been chosen, complete the necessary forms and provide the required documents (passport, residence permit, proof of address, etc.).

Registration deadlines and penalties

Swiss law imposes a strict deadline of three months to take out health insurance. If this deadline is not respected, the cantonal authorities will automatically assign insurance to the person concerned, often at the highest rate. In addition, financial penalties may be applied for each month of delay.

Exceptions and additional coverages

Expatriates can also take out additional insurance to cover specific care not included in basic insurance, such as dental or optical care.

Registration with the doctor and access to care

After taking out insurance, it is advisable to register with a general practitioner in Switzerland. The system generally allows you to freely choose your practitioners, but certain insurance plans may restrict this choice.

Conclusion of administrative procedures

Although the administrative procedures for taking out health insurance in Switzerland may seem complex, following the steps and meeting the deadlines will allow you to access the Swiss healthcare system with peace of mind. The key is to be well informed and choose insurance adapted to your personal and professional needs.

Occupational medicine in Clichy: a complete guide for employers and employees

IN BRIEF Presentation of the occupational medicine has Clichy Role of occupational health services in prevention Legal obligations of employers And employees Hours and contact details Center for occupational medicine Importance of medical visit and health monitoring Assistance in the…

Easy mutual: everything you need to know about health insurance

IN BRIEF Supplementary health : definition and objectives Importance of mutual health insurance for refunds Criteria for choosing best mutual adapted Coverage of health costs: dental, optical, etc. Comparison of offers and prices Conditions of termination and options available Mutual…

Costs and premiums: what you need to know to prepare well

Understanding the principles of health insurance in Switzerland

Navigating the Swiss healthcare system can be complex for foreigners. Health insurance in Switzerland is compulsory for all residents, including expats. It is therefore crucial to understand the different types of insurance available, the cost of contributions and the associated premiums.

Types of health insurance in Switzerland

There are two main types of health insurance in Switzerland: basic insurance and supplementary insurance. Basic insurance covers essential medical care, while supplementary insurance offers additional benefits.

1. Basic insurance:

2. Additional insurance:

Factors influencing costs and premiums

Health insurance premiums in Switzerland are determined by several factors:

- Age: The older you are, the higher the premiums.

- Region of residence: Premiums vary depending on the canton and city where you reside.

- Franchise : This is the annual amount you must pay out of pocket before the insurance begins to reimburse. Higher deductibles result in lower premiums and vice versa.

- The insurance model: HMO, Telmed, or family doctor models may offer cheaper premiums than the standard model, but they impose restrictions on the choice of care providers.

- Health status : Although basic insurance cannot select policyholders on the basis of their state of health, supplementary insurance can do so.

Strategies to optimize your health insurance

To choose your health insurance wisely in Switzerland, it is recommended to:

- Compare offers: Use online comparators to find the insurance that best suits your needs and budget.

- Evaluate your needs: Think about what services you really need and choose supplementary insurance accordingly.

- Optimize your franchise: If you’re in good health and don’t anticipate a lot of medical care, opt for a higher deductible to lower your premiums.

- Analyze healthcare networks: Review the medical providers offered by different insurance models to make sure they meet your expectations.

Facilitate administrative procedures

The simplicity and flexibility of administrative procedures are essential. Choosing health insurance with clear and simple processes for managing reimbursements and claims can greatly improve your experience.

Navigating the Swiss healthcare system can be complex for foreigners. Health insurance in Switzerland is compulsory for all residents, including expats. It is therefore crucial to understand the different types of insurance available, the cost of contributions and the associated premiums.

Assistance for foreigners: practical guide to navigating the Swiss system

Obtain a residence permit in Switzerland

Navigating the foreigner assistance system in Switzerland starts with obtaining your residence permit. This card is compulsory for all foreigners residing in Switzerland for a period of more than three months. Switzerland offers several types of residence permits, including the B permit (long-term stay) and the L permit (short stay). It is crucial to submit your request to the cantonal migration office in your canton of residence within 14 days of your arrival.

Medical coverage in Switzerland

As a foreigner residing in Switzerland, adequate medical coverage is essential. Swiss law requires all people residing in Switzerland to take out basic health insurance. Several insurance companies offer basic and add-on plans to suit various requirements. This helps ensure that you have access to quality medical care in case of urgent need during your business or personal travel. You can explore the options available to choose health insurance that is flexible and easy to manage.

Understanding the rights and duties of expatriates

Moving to Switzerland as a foreigner implies understanding and respecting a series of rights and duties. In addition to reporting and health insurance requirements, expats should also inform themselves about local taxes, Swiss tax obligations and social security standards. It is crucial to stay informed of legislative changes and reforms, such as updates on hiring supports.

Access to housing in Switzerland

For many foreigners, finding accommodation in Switzerland can be a real challenge. Housing rules vary from one canton to another, and it is often essential to use the services of a local real estate agency to facilitate the search and formalities. In addition, it is essential to understand your rights as a tenant, particularly regarding the terms of termination of the lease and your obligations regarding maintenance and repairs.

Education and schooling of children

If you are moving to Switzerland with your family, schooling for your children is another priority to consider. Switzerland offers a quality education system, with public and private schooling options. Each canton operates its own school system; It is therefore vital to find out about registration procedures, educational programs and language learning opportunities offered in your host region.

Integration and support for foreigners

Finally, integration programs in Switzerland play a crucial role in assisting new arrivals. Many local organizations and associations offer language courses, legal advice and community activities to help foreigners adapt to their new environment. Actively participating in these programs can facilitate your integration, improve your language skills and allow you to build strong social relationships in your new community.

Navigating the Swiss system can seem complex, but with good preparation and a clear understanding of the procedures, it is possible to settle in with complete peace of mind. Be sure to find out about new initiatives and resources available to help you with this transition. For more details on accessible and affordable housing, see recommended best practices.

Expatriates in Switzerland can also take example from innovative initiatives internationally to optimize their integration experience.