|

IN BRIEF

|

Supplementary health insurance is an essential issue to guarantee your well-being and that of your family. With

AXA

, you have the opportunity to explore solutions adapted to your specific needs thanks to a

mutual health quote

simplified and accessible. In this article, we reveal the key elements for navigating the world of

complementary health

, the benefits of AXA coverage, as well as advice on choosing the best option for your health. Ready to take the first step towards optimal health protection?

Axa mutual health quote: everything you need to know

When considering choosing a complementary health, the quote proposed by AXA stands out for several advantages. This article will enlighten you on the benefits and the disadvantages of subscribing to AXA health insurance, so that you can make an informed decision.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Benefits

AXA mutual health insurance offers a multitude of profits which make it an attractive option for many policyholders. Firstly, AXA offers a wide range of guarantees which can be customized to your specific needs. Whether you need dental, vision, or medical coverage, you’ll likely find a plan that meets your requirements.

In addition, thanks to its network of agents, AXA ensures responsive customer service and quality. You will have the opportunity to speak directly with an advisor who will be able to guide you in choosing your mutual health quote and explain all the options available to you. Access to online quote also simplifies the comparison process.

AXA also benefits from the program 100% healthy, which allows you to benefit from full reimbursement for essential care, particularly in the areas of visual, dental and hearing health. This can represent a considerable saving for policyholders.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Disadvantages

Despite its many advantages, AXA mutual health insurance also presents disadvantages to consider. One of the main criticisms that can be made against AXA is the price of his contributions, which can be considered high compared to other mutual on the market. Be sure to carefully analyze the value for money based on the guarantees offered.

Another point not to be overlooked is the complexity of options available. The diversity of choices can make it difficult to select the most appropriate plan for you and your family. In addition, some policyholders reported difficulties to fully understand the guarantee charts, particularly with regard to reimbursements expressed as percentages.

Finally, although AXA is recognized for its services, some people may feel a lack of transparency in communication on management fees, which can influence the final cost of your health coverage.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Axa mutual health quote: everything you need to know

In this article, we offer you a complete overview of AXA mutual health quote. You will discover how to obtain quotes adapted to your needs, the different options available, as well as useful advice for making the best choice in terms of complementary health insurance. Whether you are an individual, an employee in a company or a member of an association, understanding the specificities of AXA mutual insurance is essential to properly protect your health and that of your loved ones.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Get a quote online

To begin with, it is important to know that you can easily request a mutual health quote online on the AXA website. This allows you to save time and receive a personalized offer based on your needs. All you need to do is complete a questionnaire which will take into account your situation, your health habits and the desired guarantees. Do not hesitate to consult the AXA website for more information: AXA online quote.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Comparison of guarantees

When you get a quote, it is essential to compare the different guarantees proposed. AXA provides several levels of coverage adapted to various needs. Take into consideration dental, optical, and hospital care as well as alternative medicine. Read the guarantee tables carefully to understand your reimbursements and do not let yourself be misled by often unclear percentages. For further clarification, see the guide on best AXA mutual insurance companies.

Aid and subsidies

There are several devices and aids that can reduce the cost of your complementary health insurance. The reform 100% healthy allows patients to access care without out-of-pocket costs for certain essential equipment. Find out about your eligibility and the steps to follow to benefit from these benefits. More details are available on full reimbursement of care: 100% health with AXA.

How to cancel your AXA mutual insurance

If you wish to change mutual insurance or if your needs change, know the procedure for termination of your contract is crucial. AXA facilitates this process. For more information on the steps to follow, see this link: AXA Mutual Termination.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Contact AXA customer service

Finally, if you have any questions or would like clarification regarding your mutual health quote, do not hesitate to contact AXA customer service. They are available to answer all your questions and guide you in your choice of health coverage. Check the contact information and opening hours on their official website.

Axa mutual health quote: everything you need to know

Are you looking to subscribe to a complementary health which perfectly meets your needs? AXA mutual health insurance offers a wide range of options adapted to each profile. In this article, find out everything you need to know about getting a quote, the guarantees offered, as well as tips for choosing the best health coverage for you and your family.

Understanding the guarantees of AXA mutual insurance

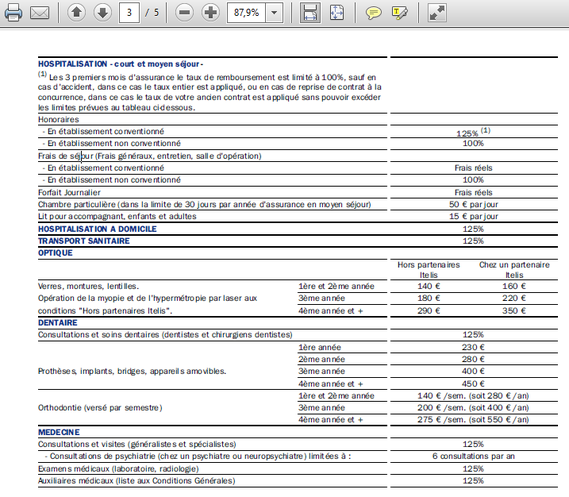

Before requesting a estimate, it is essential to understand the different guarantees offered by AXA. Each contract may include varying levels of reimbursement for health costs, such as consultations, dental care, hospitalization costs or optical expenses. Take the time to compare these warranties to determine which ones best suit your specific needs.

Get a personalized quote

AXA makes it easier to obtain a mutual health quote online. Go to their website and fill out a simple form that will allow you to receive precise information on the offers available to you. Do not hesitate to consult your AXA advisor to adjust your quote according to your tastes and your budget. Comparison tools can also help you visualize the differences between different options.

Evaluate the price of your complementary health insurance

The cost of a complementary health may vary depending on several criteria, such as your age, your family situation and the level of coverage desired. By visiting the page dedicated to price calculation on the AXA website, you will be able to better understand the elements that influence the price of your mutual insurance. Also take into account management fees which can impact the final price.

Pitfalls to avoid when choosing your health insurance

When choosing your health coverage, be sure to avoid certain pitfalls. Avoid being seduced by reimbursement percentages without understanding what they refer to. Also make sure that the guarantees chosen are in line with your potential health expenses. It is crucial to carefully read the general conditions of each contract.

Why choose AXA?

AXA is recognized for its solidity and the diversity of its offerings. By opting for their services, you not only benefit from a comprehensive health coverage, but also personalized support throughout your process. Whether you are an active worker, a senior or the head of a family, AXA offers solutions adapted to each profile.

Additional information

For more details on specific offers or to contact customer service, see the following links: Understanding AXA mutual health insurance And Contact AXA mutual health insurance.

Axa mutual health quote: everything you need to know

| Criteria | Description |

|---|---|

| Types of guarantees | Basic, intermediate and superior options depending on your needs. |

| Online quote | Ease of obtaining a quick quote thanks to a simplified form. |

| Refunds | Refunds of up to 100% depending on the levels chosen. |

| Health assistance | Access to a 24/7 health assistance service for your emergencies. |

| Competitive rates | Offers adapted to your budget, with decreasing prices for families. |

| Senior Options | Specific plans for seniors, including adapted care. |

| Equipment coverage | Reimbursement for optical, dental and hearing devices. |

| Customer interface | Personal online space to manage your services at any time. |

| Personalized advice | Support from an advisor to adjust your guarantees. |

Testimonials about Axa Devis Mutuelle Santé

Marine, 34 years old: I decided to subscribe to the complementary health insurance AXA after comparing several quotes. What really appealed to me was the possibility of adjusting my guarantee levels according to my needs. Thanks to the support of my advisor, I was able to choose coverage adapted to my family situation, which gives me great peace of mind.

François, 50 years old: As a senior, choose a mutual health insurance is an important decision. With AXA, I was impressed by the clarity of the quotes offered. They explain every detail, which allowed me to make an informed choice. The specific offers for seniors are an undeniable plus, combining blanket and competitive prices.

Sophie, 28 years old: I am a young professional and I needed health coverage as soon as I entered working life. AXA’s online quote was quick and easy to obtain. I appreciated the transparency of the information and the possibilities for customization. Now I feel safe, knowing that my health is well protected.

Paul, 45 years old: As a member of an association, I was keen to choose a mutual collective for our team. AXA was able to meet our expectations by offering a quote adapted to the specificities of our group. The establishment of the compulsory company mutual insurance has been smooth, and my colleagues are delighted with the guarantees offered.

Isabelle, 60 years old: With the reform of 100% healthy, I had concerns about access to quality care. AXA reassured me by explaining the entire reimbursement process. Their quote allowed me to clearly visualize what I could expect in terms of reimbursements, which is essential for my peace of mind.

Axa mutual health quote: everything you need to know

When you are looking for a complementary health that meets your needs, the AXA mutual health quote presents itself as a suitable solution, combining complete protection and customizable options. This article will guide you through the different steps to obtain a quote, the guarantees offered as well as practical advice to make the best choice according to your situation.

How to get a quote from AXA mutual health insurance?

Get a AXA mutual health insurance quote is a simple and accessible process. First, you need to visit the AXA website, where you will find a quote request form. Complete the requested information regarding your personal situation, health needs and coverage preferences. This step is crucial, because it directly influences the recommendations proposed by AXA.

Once your form has been submitted, an AXA advisor will contact you to discuss the details and guide you towards the most suitable options. You will also have the possibility to adjust your request in order to optimize the guarantees that interest you the most.

The guarantees offered by AXA

There AXA mutual health insurance stands out for its various guarantees, making it possible to cover essential health costs. These include covering hospitalization costs, medical consultations, dental care and optical equipment.

AXA also provides you with specific options for complementary care, such as osteopathy, physiotherapy, and alternative medicine. These guarantees are adjustable according to the desired level of coverage and your budget, thus allowing you to adapt to the diversity of needs.

The advantages of an AXA complementary health insurance

Choose the complementary health insurance AXA offers you several advantages. First of all, you will benefit from rapid and efficient management of your health expenses, thus optimizing your coverage. In addition, AXA offers a network of partners with preferential rates, which can also reduce your healthcare costs.

In addition, AXA integrates additional services such as teleconsultation, simplified access to healthcare professionals, and advice on managing your health. These services aim to offer you quality health monitoring, in order to guarantee your daily well-being.

Avoid pitfalls when subscribing

When looking for complementary health insurance, it is essential to avoid certain pitfalls. Start by asking questions about the amount of reimbursements presented in percentages. Make sure you understand what these percentages mean to avoid unpleasant surprises.

It is also essential to carefully read the general conditions of the proposed contract. Take into account the waiting periods, the exclusions of guarantees and the reimbursement ceilings. In this way, you will have a clear vision of your coverage and will be able to choose with confidence.

AXA health insurance rates

AXA health insurance rates vary according to several criteria. These include your age, your state of health, the level of guarantees chosen, as well as other factors such as your specific health needs. This allows AXA to offer you a fair and adapted rate. To effectively compare prices, it is advisable to request several quotes online. This will help you to have a clear idea of the different offers available and to choose the one that offers the best value for money according to your situation.

get your AXA health insurance quote in a few clicks and benefit from health coverage adapted to your needs. compare our offers and find the best solution for you and your family.

When it comes to choosing a

health insurance , AXA stands out with a varied offer adapted to the specific needs of each person. Thanks to anonline health insurance quote , it is now easier than ever to compare the available options and adjust the coverage according to your personal situation. The first step to benefit from AXA’s services is to understand the different levels of guarantees. Indeed, AXA offers flexible formulas that allow you to personalize your health coverage according to your

health expenses and your expectations. Whether you are an active person, a senior or have special needs, you will necessarily find an option that suits you. Another essential aspect to consider is the

rate of your health insurance. AXA adopts a policy of transparency by allowing you to obtain a detailed quote, taking into account your profile and your specific needs. This helps you to avoid financial surprises and to commit yourself safely to your choice. It is also crucial to take into account the

additional guarantees offered by AXA, such as full reimbursement for certain treatments thanks to the 100% health reform. This allows policyholders to benefit from quality care with no remaining costs, and is a real asset in favor of your health.Finally, do not hesitate to seek the help of an AXA advisor. They are there to support you throughout your process, both for the subscription and for the adjustment of your guarantees. With AXA, you put all the chances on your side to choose the

mutual health insurance that will meet all your needs. Axa health insurance quote: everything you need to know Q: What is an AXA health insurance quote?

A: An AXA health insurance quote is a personalized document that indicates the rates and guarantees offered by AXA for supplementary health insurance, based on your profile and your specific needs.

A: You can get a quote for your AXA health insurance online on the AXA website or by contacting an AXA advisor. It is also possible to request a quote in an agency.

Q: What criteria influence the amount of the AXA health insurance quote?A: The amount of the quote depends on several criteria such as your age, your state of health, the desired level of guarantees and the insurance management fees.

Q: Is it possible to customize your AXA health insurance quote?A: Yes, you have the possibility to personalize your quote by choosing the options and levels of guarantees that best suit your health needs.

Q: What does AXA health insurance generally cover?A: AXA mutual health insurance generally covers medical expenses, consultations, dental care, hospitalization costs and other specific care depending on the level of guarantees chosen.

Q: What are the deadlines for receiving a quote from AXA mutual health insurance?A: The turnaround times for receiving an AXA health insurance quote are generally quick, often within 24 to 48 hours of your request, but this may vary depending on the information provided.

Q: Do I have to pay a fee to request a health insurance quote?A: No, requesting a quote for AXA health insurance is completely free and without obligation on your part.

Q: Can I cancel my AXA health insurance after signing a contract?A: Yes, it is possible to cancel your AXA health insurance, under certain conditions. Apart from the first month, you will have to respect a notice period and check the terms of your contract.