Find out how to choose the best international health insurance for expats and ensure comprehensive medical coverage. What criteria should you take into account for optimal protection during your trips abroad? Follow our advice to make the right choice and travel with peace of mind.

Criteria to consider when choosing international health insurance

Coverage and geographic reach

One of the first criteria to take into account is the geographic coverage of your international health insurance. Make sure your insurance covers all the countries where you plan to travel or reside. Some contracts may limit treatment to certain countries or continents, which can be problematic if your travel is frequent and varied.

Types of care covered

It is imperative to check the types of care covered by the insurance. Good international health insurance should include:

* Routine and preventative care

* Urgent Care

* Hospitalization

* Dental and optical care

* Specialized consultations

Some insurers also offer additional options, such as coverage of maternity costs or coverage for alternative medicines.

Coverage levels

Insurance policies vary in terms of the coverage offered. It is often possible to choose between several levels, ranging from basic coverage to more comprehensive and expensive coverage. Consider your specific needs and those of your family to determine which level is best for you.

Network of health professionals

Access to an extensive network of healthcare professionals is essential. Check if the insurer has partnerships with hospitals, clinics and doctors in areas where you frequently travel. This will allow you to benefit from quality care without incurring any costs.

Costs and deductibles

Costs vary considerably from insurer to insurer. Compare monthly or annual premiums as well as applicable deductibles. Take into consideration possible hidden costs, such as exclusions and reimbursement limits, to avoid unpleasant surprises. For advice on reducing your insurance budgets, consult certain specialized articles.

Flexibility and additional options

Flexibility is a crucial aspect of any international health insurance. Some policies allow you to adjust coverage based on your changing needs, such as adding or removing benefits. Additionally, additional options may include prescription drug coverage or medical evacuation support.

Simplicity of administrative procedures

Administrative formalities can quickly become complicated, especially if you are frequently on the move. Choose insurers that offer online services and mobile applications to manage your claims and documents. The simple, seamless processes allow you to focus on what really matters: your health and well-being.

Quality of customer service

Finally, good customer service is an essential element. Check online reviews and find out about the quality of support provided by the insurer. 24/7, multilingual support can be a real asset, especially in the event of an emergency abroad.

By taking these different criteria into account, you will be able to choose international health insurance that perfectly meets your needs and offers you peace of mind when traveling.

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

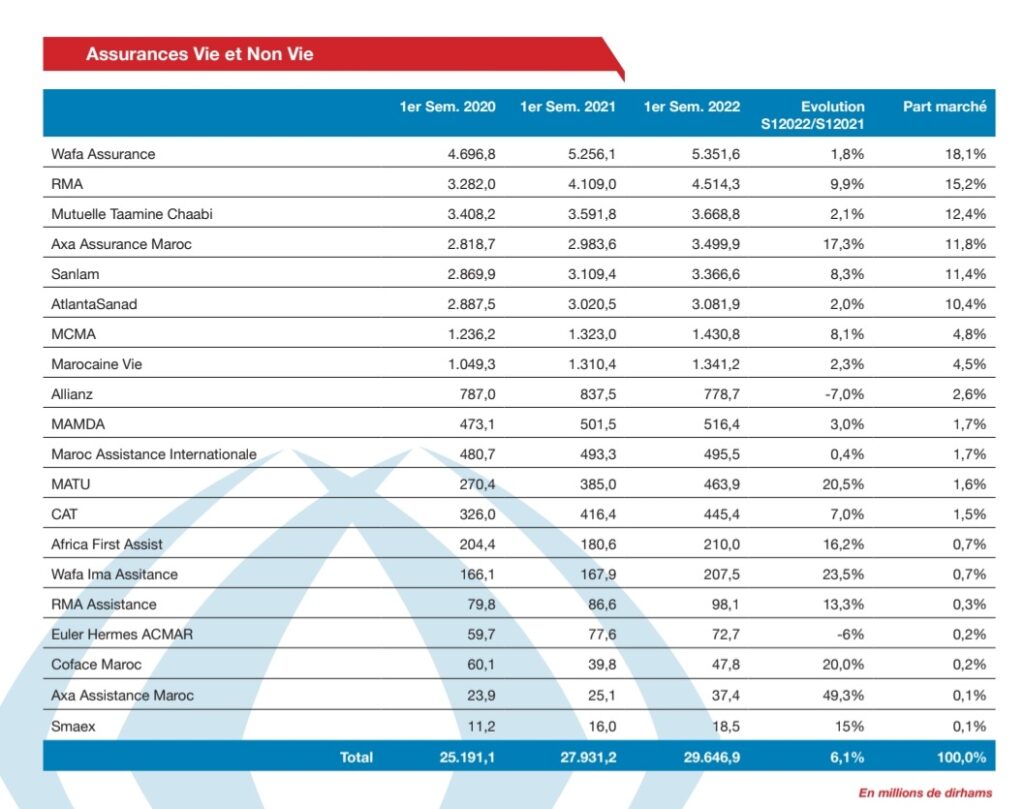

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

Comparison of the main health insurance companies for expats

Understanding the Health Insurance Needs of Expatriates

When moving abroad, the issue of health insurance must be a top priority. Healthcare systems vary greatly from country to country, and it is crucial to choose insurance that fully meets your specific needs. Self-employed workers, entrepreneurs or employees must benefit from coverage adapted to their international travel and activities.

Comparison of Health Insurance Companies

Several large health insurance companies stand out on the international market. Let’s analyze the main ones to help make an informed choice.

Allianz Care

Allianz Care offers comprehensive coverage with a large network of care providers. Among its advantages, we find:

- 24/7 medical assistance

- Optional coverage options for dental and vision

- Access to online doctors

This company is particularly appreciated for its flexibility and its modular options, ideal for expatriates requiring adaptable coverage.

AXA Global Healthcare

AXA offers international health insurance plans designed to suit individual needs. The main benefits include:

- Global network of clinics and hospitals

- Emergency care and medical evacuation coverage

- Mobile app for easy claims management

AXA stands out for its easy access to care, particularly during frequent business trips.

Cigna Global Health

Cigna Global Health is a popular option for expats thanks to its wide variety of included medical services. Its strong points are:

- Comprehensive coverage of routine and preventative care

- Wellness and health management programs

- Multilingual customer service

Cigna emphasizes proactive health management, making it an attractive choice for those looking for a holistic approach.

Selection criteria

To make an informed choice among these companies, it is essential to consider several criteria:

- Cost of the premium: Check monthly and annual premiums to assess whether they fit into your budget.

- Reputation : Read reviews and testimonials from other expats to understand their experience with the company.

- Medical network: Make sure your destination has a network of approved healthcare providers.

- Additional services: Evaluate additional services such as mental support, teleconsultations or wellness programs.

Specific Options for Certain Regions

Needs may vary depending on the regions and countries of expatriation. For example, the requirements for coverage in the United States differ widely from those in Vietnam. For specific information on insurance in Mexico, we recommend consulting this resource which provides a detailed explanation of local particularities. For expats in the United States, checking your social protection is crucial.

By taking the time to compare the options available and consider your specific needs, it is possible to find international health insurance that offers you the security and peace of mind necessary to fully enjoy your expatriation.

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Get the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to social protection scheme local. THE mutual do not cover treatment abroad…

The cost of private health insurance: what you need to know

IN BRIEF The cost of a private health insurance varies depending on age and length of coverage. Average price of mutual insurance: approximately 90 €/month for women and 105 €/month for men. THE monthly contributions generally oscillate between 30 and…

Medical coverage and services included in insurance offers

When considering international health insurance, it is crucial to understand the different medical coverage options and the services included. Adequate coverage is essential to travel peacefully and benefit from quality care.

The different types of medical coverage

International health insurance offers a variety of medical coverages tailored to the needs of expats and travelers. Among the main coverages we find:

– Emergency care : Coverage of medical costs in the event of accidents or sudden illness.

– Medical consultations : Reimbursement of visits to the general practitioner or specialist.

– Hospitalization : Coverage of hospital stay costs, including surgical procedures.

– Dental and optical care : Some policies also include partial or full dental and eyeglass coverage.

Services included in international health insurance offers

In addition to basic medical coverage, international health insurance offerings often include a range of additional services to make managing health abroad easier. For example :

– Repatriation assistance : If necessary, the contract can include repatriation to the country of origin or to a suitable hospital.

– 24/7 multilingual support : To immediately answer all administrative and medical questions.

– Telephone consultations with health professionals : Access to medical staff for remote advice and consultations.

Flexibility of reimbursements and simplified administrative procedures

One of the major concerns of expatriates is the simplicity and flexibility of administrative procedures. Modern international health insurance offers often include:

– Online reimbursement files : Ability to submit reimbursement requests quickly and easily via the internet.

– Direct payments to health establishments : In certain cases, the insurer pays the hospital establishments directly, thus avoiding the policyholder having to advance costs.

– Flexibility in choosing healthcare providers : Freedom to choose your doctors and hospitals, both in the country of origin and in the country of residence.

Guaranteed global coverage

For expatriates, the possibility of benefiting from medical coverage worldwide is a major advantage. Whether for business trips or vacations, international health insurance often offers:

– Global coverage : Insurance valid in all countries, with specific options for risky regions.

– Agreements with local health networks : To guarantee access to quality care everywhere in the world.

Find out more details about the different options and benefits by visiting here.

In summary, choosing the right international health insurance allows you to travel peacefully and live abroad without worry. The explanations provided above highlight the importance of comprehensive coverage and convenient services offered by these insurance policies.

Health insurance in Belgium: understanding prices and coverage

IN BRIEF Social security system in Belgium: a protective framework THE mutual reimburse between 60% and 75% of medical costs Conventional price for a general consultation: €22.22 with 75% refunded 20 to 25% of health costs remain the responsibility of…

Occupational medicine in Clichy: a complete guide for employers and employees

IN BRIEF Presentation of the occupational medicine has Clichy Role of occupational health services in prevention Legal obligations of employers And employees Hours and contact details Center for occupational medicine Importance of medical visit and health monitoring Assistance in the…

Budget and prices: how to choose insurance based on your finances

Evaluate your specific needs

When considering international health insurance based on your budget, the first step is to assess your specific needs. As an expat, you need to consider several aspects such as the frequency of your travels, destinations and the types of medical care you may need. A thorough analysis of your needs will determine the level of coverage needed without spending unnecessarily.

Compare available offers

Consider the cost price

Evaluate the flexibility of administrative procedures

The simplicity and flexibility of administrative procedures are essential aspects when choosing international health insurance. Make sure the insurer offers online services to easily manage your documents and claims. Responsive customer service available in several languages is also an asset to facilitate your procedures.

Take travel insurance into account

Read user reviews

Finally, reading user reviews can provide you with valuable information about the reliability and quality of insurers’ services. Check forums and review sites to learn about other expats’ experiences with different insurance plans. Testimonials can direct you to the best options for customer service and claims handling.

By following these tips, you will be better prepared to choose international health insurance that fits your budget and needs.

Easy mutual: everything you need to know about health insurance

IN BRIEF Supplementary health : definition and objectives Importance of mutual health insurance for refunds Criteria for choosing best mutual adapted Coverage of health costs: dental, optical, etc. Comparison of offers and prices Conditions of termination and options available Mutual…

How to contact Axa for your mutual insurance

IN BRIEF Contact by email : Write to data protection officer has service.informationclient@axa.fr. Contact for mutuals : Contact service.affairesgeneralesdesmutuellesaxa@axa.fr. Telephone support : Call him 01 55 92 21 94 for business leaders. Business : join the 09 70 80 81…

Specific international health insurance for expatriate families and seniors

The specific needs of expatriate families

Moving abroad with family presents unique challenges, especially when it comes to health coverage. It is essential to choose suitable international health insurance that provides comprehensive coverage for each member of the family. Essentials to check include coverage of routine care for children, like immunizations and pediatric visits. In addition, the ability to access specialists and dental and eye care is essential.

International health insurance for families should also include flexible options for emergency care in each country of residence as well as when traveling. This ensures that everyone can receive quality care, no matter where they are.

Expatriate seniors and their health insurance needs

For expatriate seniors, adequate health coverage is of crucial importance. Seniors may require more frequent and specialized care. Thus, international health insurance should cover a wide range of care, including regular consultations, prescription drugs and long-term care.

Additionally, some seniors are choosing to spend their retirement in attractive destinations such as Mauritius. For them, it is essential to have solid social protection that allows them to live their retirement without worry. Good international senior health insurance should also include options for hospital stays, rehabilitation and chronic disease management.

Choosing the right international health insurance offer

When choosing international health insurance, it is crucial to compare the different options available. Malakoff Humanis, for example, offers an expat pack which can be adapted to the needs of expatriate families and seniors.

Here are some criteria to consider when making your selection:

- Extent of coverage: Check what types of medical care are covered, including routine and emergency care.

- Flexibility: Conditions must allow for easy adjustments based on changes in family or medical situation.

- Accessibility: Make sure the insurance offers broad geographic coverage, including all countries where you may travel or reside.

Additional benefits for peace of mind

Some insurance companies offer additional services which can be very useful. For example, access to tele-medical consultations can provide valuable assistance in times of need. In addition, insurance policies such as those detailed on specialist social protection sites for expatriates often provide multilingual assistance, thus facilitating communication with healthcare professionals abroad.

Finally, keep in mind that the needs of each family member or expatriate senior may change over time. Choosing flexible and comprehensive international health insurance is the best guarantee to fully enjoy expatriate life without unnecessary hassle.

The legal implications of health insurance for expatriates in different countries

Understanding the Legal Requirements for Expatriate Health Insurance

When deciding to live abroad, it is crucial to know the legal requirements regarding health insurance specific to each country. Each nation has its specific insurance regulations, and these differences can have significant consequences for expats.

In France, expatriates must often join the Caisse des Français de l’Étranger (CFE) to benefit from coverage similar to that of Social Security. However, in other countries, public coverage may not be accessible, making it necessary to purchase international health insurance.

Types of Mandatory Coverages in Various Countries

Health coverage requirements can vary widely:

– Europe : In several European countries, private health insurance is recommended, although some countries offer public coverage to foreign residents.

– UNITED STATES : Here, private health insurance is essential due to the high cost of medical care.

– Asia : In China or Japan, expats often have to sign up for local insurance, while countries like Singapore require international health insurance.

Every expatriate must understand the specificities of their host country to avoid unforeseen medical expenses.

How to Choose the Best Health Insurance as an Expatriate

To effectively select international health insurance, it is essential to:

– Analyze personal needs : What medical coverage is necessary? What are the risks linked to the lifestyle and the host country?

– Compare offers : Review the details of different insurance plans to see which ones offer the best coverage for specific needs.

– Check flexibility : Opt for insurance that allows you to adjust coverage based on travel.

The Legal Impacts of Not Purchasing Insurance in Accordance with Local Regulations

Failing to take out health insurance that complies with local requirements may result in sanctions:

– Fines and penalties : In some countries, non-compliance with health insurance obligations can result in high fines.

– Restricted access to care : Lack of adequate coverage can limit access to medical services, putting health at risk.

– Legal consequences : Non-compliance may also affect residency status in certain countries.

To avoid these complications, it is essential to inform yourself and comply with local laws.

Resources for Understanding Expat Health Insurance

[Le Nouvel Economiste]There are several resources for expats looking to better understand their health insurance obligations and options. For example, (https://www.lenouveleconomiste.fr/lesdossiers/protection-sur-mesure-pour-les-expatries/) offers detailed information on the protections available to expatriates. Furthermore, the site (https://www.boursorama.com/patrimoine/fiches-pratiques/expatriation-quelles-consequences-pour-votre-couverture-sante-578150f7945200411e097fd948493a8d) explores the consequences of expatriation on health coverage, providing tips for choosing the right insurance. [Boursorama]

By consulting these resources and finding out about local laws, expatriates can secure their health and that of their loved ones, thus ensuring a peaceful and trouble-free expatriation.