Are you planning a trip abroad and wondering what are the key elements to consider before purchasing international health insurance? Discover the essential information you need to know to leave calmly and safely!

Difference between National and International Health Insurance

National and international health insurance: What is the difference?

Health insurance is a vital subject for everyone, whether they are sedentary or globetrotting. For those who travel or relocate frequently, it is crucial to understand the difference between domestic health insurance and international health insurance. Let’s decipher these two concepts to help you better understand their specificities.

Geographic coverage

One of the key differences between domestic health insurance and international health insurance is geographic coverage. National health insurance is limited to your country of residence. If you are in France, your national health insurance generally does not cover you for care received abroad.

Types of care covered

With national health insurance, the care covered is generally restrictive and focused on local services. You will have access to consultations with approved doctors, hospital care, and often certain dental and optical services. The list of covered treatments is established by the country’s legislation and may be limited.

Ease of access to care

With national health insurance, access to care can sometimes be limited by waiting lists, specific care networks or prior authorizations for certain medical procedures.

On the other hand, international health insurance generally gives you access to a global network of healthcare providers. You can often consult specialists without needing a prior recommendation. Additionally, some policies include a 24/7 concierge service to help you find doctors and care centers regardless of your location.

Administrative management

The administrative management of national health insurance is often centralized and well regulated, which can sometimes lead to long and complex procedures. You often have to follow strict procedures to obtain reimbursement or coverage for your healthcare costs.

On the other hand, international health insurance focuses on simplicity and speed. Administrative procedures are often digitalized, making it possible to submit reimbursement requests online and obtain rapid responses. Additionally, some international insurers offer mobile apps to easily manage your policies wherever you are.

Cost of insurance

Cost is another notable difference. National health insurance is often subsidized by the state, which reduces the cost for policyholders. However, additional formalities and user fees often apply, adding to indirect costs.

International health insurance generally has higher premiums, reflecting their extensive coverage and the additional services they offer. However, for those who travel a lot or live abroad, this additional investment can prove valuable in ensuring complete protection and eliminating health concerns.

Understand the importance of mutual insurance for travel abroad

IN BRIEF There travel mutual is essential to cover the medical expenses abroad. Unlike the EHIC, it is essential for stays outside Europe. Always check the support of your mutual insurance before leaving. A supplementary health insurance can cover the…

Health insurance for foreigners in France: what you need to know

IN BRIEF Health insurance for the foreigners In France Steps to follow when Required supporting documents: identity card, passport, residence permit European health insurance card (CEAM) for the holidays Options blanket for extended stays Process for expatriates Access to the…

Geographic Coverage and Excluded Regions

What is International Health Insurance?

International health insurance is a comprehensive solution for people living or regularly traveling abroad. It provides medical protection by covering health costs incurred in various countries. This is especially useful for expats, frequent travelers, and nomadic workers.

Geographic Coverage of International Health Insurance

One of the essential features of international health insurance is the geographic scope of coverage. Generally, these policies provide worldwide coverage, but significant variations exist between insurers and plans purchased. It is crucial to understand the details of the coverage to avoid any unpleasant surprises.

- Worldwide Coverage: Most plans offer medical coverage in almost every country in the world, ensuring you receive quality care wherever you are.

- Regionalized Plans: Some insurers offer cheaper plans, but only for specific regions like Europe, Asia or North America.

Factors to Consider for Geographic Coverage

When you choose your international health insurance, several geographical criteria must be taken into account:

- Travel frequency: If you often travel between continents, global coverage is recommended.

- Geographic Areas of Activity: Your choice should also depend on the areas where you plan to spend the most time.

- Cost : Plans with comprehensive worldwide coverage are often more expensive but offer maximum security.

Commonly Excluded Regions

It is also crucial to note that some international health insurance plans may exclude certain regions of the world. Reasons may include high risks, prohibitive healthcare costs, or regulatory restrictions.

- Conflict Zones: Countries at war or subject to significant unrest, such as Syria or Afghanistan, are often excluded.

- High Cost Countries: Some insurers exclude countries with extremely high medical costs, such as the United States, unless a higher premium is paid.

- Regulatory Restrictions: Some regions may be excluded due to local regulations, making it difficult for insurers to operate.

Options to Bypass Exclusions

If you plan to travel to regions that are generally excluded, several solutions can be considered:

- Cover Specific Events: Some policies allow you to purchase temporary extensions for specific trips.

- Local Insurance: In addition to your international insurance, take out local health insurance for the period of your stay.

- Surplus: Some insurers offer higher cost options to include high risk or high cost areas.

Tips for Choosing International Health Insurance

To make the right choice, it is crucial to compare the available offers and carefully assess your specific needs. Here are a few tips :

- Evaluate your frequent destinations: Make sure the majority of areas you visit regularly are covered.

- Compare the costs: Balance the cost of the premium with the coverage offered for each region.

- Check the exclusions: Go through the contracts to understand which regions are excluded and if extensions are possible.

- Consult experts: Do not hesitate to seek advice from a broker specializing in international health insurance.

Remember to carefully check the specific conditions linked to your insurer and the level of coverage offered for each specific region. Good preparation is the key to avoiding unpleasant surprises and ensuring optimal protection when traveling abroad.

Travel insurance abroad: everything you need to know before leaving

IN BRIEF Check your coverage area before you go Contact your health insurance to find out what guarantees are offered European Health Insurance Card (EHIC): get it before you go Understand your insurance policy and the claims procedures Medical assistance…

Understanding AXA mutual health insurance: benefits and options available

IN BRIEF Informed choice : key elements for selecting your complementary health insurance Full coverage : reimbursement of hospitalization costs and consultations Negotiated rates : better reimbursements in a large healthcare network Various options : formulas adapted to needs, including…

Types of Medical Care Covered

Primary Medical Care Coverage

Primary medical care is generally included in all international health insurance policies. This care includes GP visits, routine check-ups, as well as common diagnostic tests such as blood tests and x-rays. By purchasing international health insurance, you will be covered for essential medical visits to treat or prevent common illnesses.

Urgent Care

Specialized Care

In addition to primary and emergency care, international health insurance often covers specialized care. This includes visits to specialists such as dermatologists, cardiologists or neurologists, as well as specific treatments required for particular conditions. The ability to consult specialists without delay is a considerable advantage for managing your health abroad.

Hospitalization

Hospitalization can represent a considerable cost, especially abroad. Most international health insurance policies include coverage for hospitalization costs, whether for short-term stays or major surgical procedures. This coverage covers room costs, nursing care, as well as necessary treatments and medications during your hospital stay.

Dental and Optical Care

Dental and optical care are often additional options in international health insurance. They cover consultations, preventive treatments, complex dental care, and eye consultations. This may also include discounts or partial coverage for the purchase of glasses or contact lenses. Expats often find this coverage beneficial, as it allows them to maintain optimal oral and vision health without excessive expenses.

Vaccinations and Preventative Care

Maternity Care

For expats planning a family, coverage for maternity care is essential. International health insurance policies often include prenatal consultations, ultrasounds, childbirth, as well as postnatal follow-up. Such coverage gives you peace of mind and allows you to manage the costs associated with maternity, whatever your destination.

Rehabilitation Services

After surgery or a serious injury, rehabilitation services such as physical or occupational therapy are often necessary. Coverage for these services allows you to benefit from the best recovery care, promoting a faster return to normal life. Make sure your international health insurance includes coverage for these essential services for successful rehabilitation.

When choosing international health insurance, it is crucial to understand the different types of medical care covered in order to fully meet your health needs while traveling or staying abroad.

Mutual insurance abroad: everything you need to know before leaving

IN BRIEF Declaration of departure to your French health insurance fund Verification of guarantees insurance for your destination Obtaining the European Health Insurance Card (EHIC) Consultation of necessary vaccines before departure Reimbursement of care medical services abroad: steps to follow…

Axa mutual health insurance in Morocco: what you need to know

IN BRIEF Compulsory Medical Insurance (AMO): Basic coverage required for all citizens. SEHASSUR: Complementary health insurance to the AMO offered by AXA. Expatriates: Health solutions adapted to the needs of expatriates in Morocco. Refund: Flexible reimbursement options (80% to 95%)…

Payment and Reimbursement Terms

Payment facilities for international health insurance

For a French expat working abroad, flexibility and simplicity of payment terms are essential when it comes to taking out international health insurance. Insurers generally offer several options to facilitate the payment of premiums.

Common payment methods include:

– Automatic direct debit: allows monthly payments without manual intervention.

– Bank card: quick option, often used for quarterly or annual payment.

– International bank transfer: useful if you want to pay via a foreign bank account.

Some international health insurance plans also offer discounts for annual payments, encouraging one-time payment to benefit from optimal coverage at a lower cost.

Repayment deadlines and flexibility

Reimbursement of medical expenses is a crucial aspect of your international health insurance. Deadlines vary depending on the insurer, but most guarantee rapid processing to avoid any financial constraints.

It is essential to check the procedures for processing reimbursement requests before subscribing. Look for insurers offering:

– A fast refund, often within 5 to 10 business days.

– A mobile app or online portal to submit requests easily.

– Customer service agents available to assist with questions.

Some insurers even allow expensive treatments to be pre-approved, making the reimbursement process even smoother.

Medical Coverage Options

Good international health insurance should offer comprehensive coverage for medical care. This includes :

– Consultations with a general practitioner or specialist.

– Hospital care, including surgical interventions.

– Emergency treatment during business trips abroad.

Some insurance plans even offer specific coverage for chronic illnesses, prescribed medications and maternity care. Be sure to read the terms and conditions carefully to understand the extent of coverage.

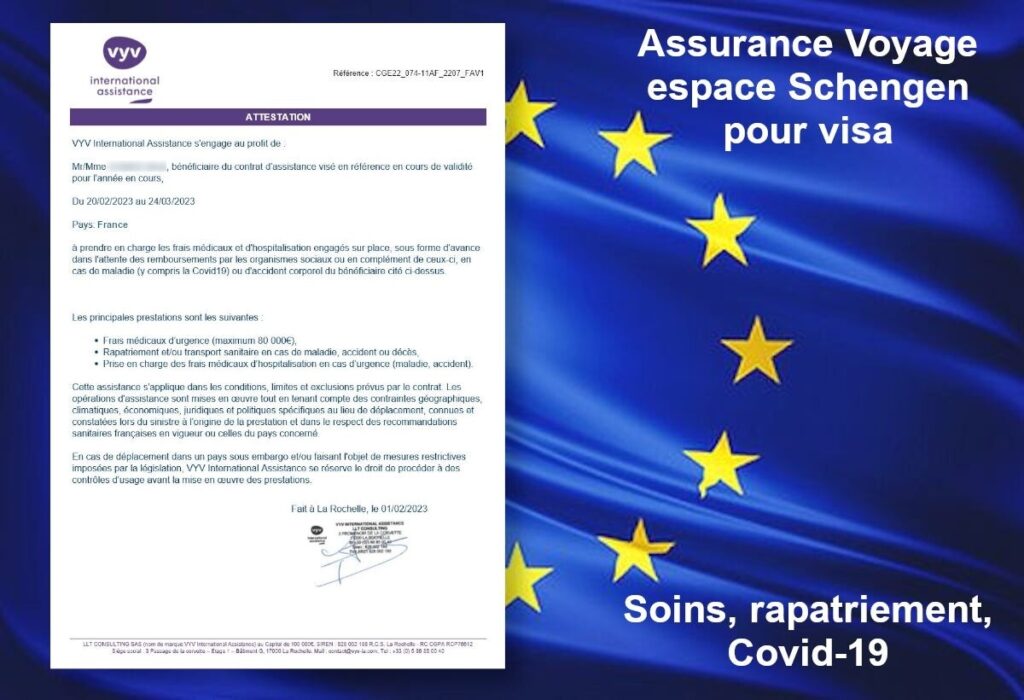

Using the European Health Insurance Card

When traveling within the European Union, the European Health Insurance Card (EHIC) is a valuable asset. It allows you to benefit from care under the same conditions as residents of the country visited. However, it does not replace international health insurance, which offers broader protection.

Exclusions and limitations

No health insurance is complete without mentioning exclusions and limitations. These vary from insurer to insurer, but can include:

– Care received in specific geographic areas.

– Treatments for certain pre-existing illnesses.

– Aesthetic treatments and certain types of alternative therapies.

Be sure to read these clauses carefully to avoid any unpleasant surprises should the need arise.

Practical advice for choosing the right international health insurance

To make the best choice, here are some tips:

– Compare several offers to find the one that best suits your needs and your budget.

– Opt for insurance with customer support available 24/7.

– Check the reviews of other users to assess the quality of the service.

By adopting these reflexes, you will ensure complete peace of mind when it comes to health coverage abroad.

AXA mutual health insurance: everything you need to know

IN BRIEF Mutual health insurance AXA: a suitable choice for everyone Blankets health Varied available Support services in journey and abroad Refunds fast and simplified Customizable options according to your needs Access to a network of health professionals Savings on…

Axa mutual health: how to easily get an online quote

IN BRIEF Supplementary health adapted to your needs. Get a free quote online in just a few clicks. Services online health to simplify your procedures. Choose an à la carte contract from €7.39/month. Approach a AXA advisor for a personalized…

Duration of Coverage and Renewal

Duration of Coverage in International Health Insurance

The duration of international health insurance coverage is an essential element to take into account when subscribing. Generally, contracts are offered on an annual basis, renewable by tacit agreement. However, some insurers offer policies tailored to specific needs, such as short stays or periods of study abroad.

For expats who travel frequently, it is crucial to check that the duration of coverage corresponds to their travels. Continuous coverage without interruption ensures that any unexpected medical expenses will be taken care of, even during periods of transition between different countries or stays.

Coverage Renewal Criteria

The renewal of international health insurance can sometimes include specific criteria imposed by the insurer. Policyholders must pay particular attention to the renewal conditions in order to avoid unpleasant surprises.

Some policies require an annual medical re-evaluation which, depending on the results, may result in a change in the terms of coverage or premiums. Other insurers can impose automatic renewal conditions without the need for administrative procedures, which greatly simplifies the life of expatriate policyholders.

Automatic Renewal Options

Automatic renewal is an option that appeals to many expatriates looking for simplicity and peace of mind. This option allows you to maintain coverage without having to undertake complex administrative procedures each year.

To benefit from this type of renewal, it is generally sufficient to accept an automatic renewal clause when initially subscribing to the contract. This guarantees continuity of coverage without interruption. However, it is recommended that you regularly check the terms and conditions of the policy to ensure that they still meet your needs.

Flexibility of Administrative Procedures

Flexibility in administrative procedures is a criterion of choice for good international health insurance. Expatriates often seek to avoid administrative hassles and favor insurers offering online services for managing their contract, reporting claims or updating their personal information.

Having access to responsive, multilingual customer service is also a huge advantage. In the event of a problem or question, being able to quickly obtain help in French greatly simplifies the management of your insurance, especially in emergency situations.

Management of Medical Expenses

Managing medical expenses is a fundamental aspect of international health insurance. Insurers generally offer platforms for submitting supporting documents online, making the reimbursement process quick and efficient. Some insurance companies even offer third-party payment services abroad, allowing treatment to be paid directly with the medical establishment without advance payment.

International payment cards like the Visa Premier Card can also offer attractive additional coverage, particularly for emergency care while traveling.

Conservation of Social Coverage in France

It is also possible to keep your vital card abroad under certain conditions, which can advantageously complement international health insurance. Understanding the rights and duties linked to the portability of health guarantees allows you to optimize your medical coverage.

In conclusion, choosing international health insurance requires a good understanding of the duration of coverage and renewal terms. By combining this coverage with other devices, such as international payment cards, expatriates can guarantee their medical security while simplifying administrative procedures as much as possible.

Study Options and Compare Insurers

What is International Health Insurance?

When it comes to moving or spending a lot of time abroad, taking out international health insurance is an essential step that should not be overlooked. This insurance allows you to benefit from comprehensive medical coverage anywhere in the world, whether for routine consultations or emergency care. Unlike local insurance, it is specifically designed to meet the needs of expatriates, nomadic workers and frequent travelers.

Why Is It Crucial to Compare Insurers?

Comparing international health insurance quotes is a crucial step in ensuring you get the best possible coverage at the best price. Different insurance companies offer a variety of plans, each with their own benefits, exclusions and prices. Don’t rush to the first offer that comes along, as a thorough comparison can save you considerable amounts of money and offer you additional benefits.

How to Assess Your Health Insurance Needs

Before choosing international health insurance, it is important to assess your specific needs. Here are some criteria to take into account:

– Travel Frequency : If you travel often, opt for coverage that includes emergency care abroad.

– Family situation : Insurance needs may vary if you are traveling alone or with your family.

– Country of destination : Each country has different medical costs, choose suitable coverage.

– Duration of Residence : The length of your stay may influence the type of coverage you need.

Criteria to Consider When Choosing Your Insurer

To select the best expatriate mutual insurance, here are some criteria to examine:

– Geographic coverage : Make sure the insurance covers all the countries you might travel to.

– Reimbursement Ceilings : Check the reimbursement limits for different types of care.

– Services Included : Some plans include additional services such as medical repatriation or telemedicine consultations.

– Waiting period : Be attentive to periods during which certain services are not covered.

– Flexibility : Opt for insurance that allows you to change your coverage easily.

Tools and Resources to Help You Compare

There are several online tools to compare different insurers and their offers. You can use insurance comparators to get a clear view of the options available. Specialized articles, such as those in Insurance comparator, offer detailed analyzes and advice on making the right choice.

Pitfalls to Avoid When Subscribing

There are some common pitfalls to avoid when selecting your international health insurance:

– Neglecting the Small Lines : Always read the general conditions to avoid unpleasant surprises.

– Underestimating Your Needs : Don’t choose minimum coverage to save money, it could cost more in the long run.

– Opt for the Cheapest : The best offer is not always the cheapest; it must also meet your needs.

Administrative Aspects and Simplicity of Management

The simplicity of administrative procedures is an often neglected but crucial aspect. Check if the insurer offers online services for managing your contract, reimbursement of medical expenses and access to advisors if necessary. This can make a big difference in comfort and peace of mind.

By taking the time to assess your needs, compare offers and choose suitable coverage, you can ensure you are well protected whatever your destination. For more advice, you can consult the Student website dedicated to the social protection of expatriates.