|

IN BRIEF

|

When we approach the subject of refunds When it comes to health, it is essential to be well informed to optimize your spending. There mutual Allianz positions itself as a key player in the field of complementary health insurance. In this article, we will explore the different aspects of how it works, detailing the reimbursement terms, the different levels of coverage as well as the steps to follow to benefit from a refund fast and efficient. Whether you are looking for a personalized health insurance or information on the treatments covered, here you will find everything you need to know to get the most out of your mutual insurance.

In a world where health is essential, choosing the right mutual becomes essential to benefit from optimal protection. There mutual Allianz stands out for its various reimbursement proposals adapted to a varied range of care. This article provides you with a comprehensive overview of the advantages and disadvantages of its reimbursement mechanisms.

Benefits

Reimbursements tailored to your needs

One of the main assets of the mutual Allianz is its ability to offer personalized reimbursements. Depending on the type of contract you choose, you can benefit from 100% coverage on certain health services, significantly reducing your remains responsible.

Easy access to reimbursements

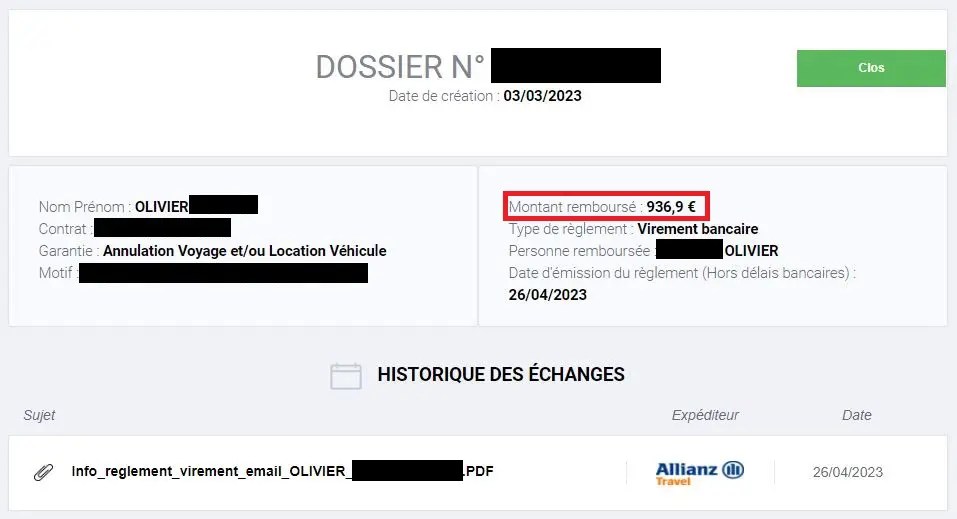

The reimbursement process is simplified thanks to the Allianz online portal. You can easily send your refund requests via the app or website from Allianz, without requiring a paper form. This makes the process faster and more accessible.

Reimbursement of specialized care

Allianz offers attractive reimbursements for specific care such as dental care, optics or even audiology, thanks to the 100% health reform. This initiative allows access to certain equipment without out-of-pocket costs, which is a real advantage for policyholders.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Potentially high prices

One of the notable disadvantages of mutual Allianz lies in its prices which can be perceived as high compared to other companies. It is therefore crucial to assess the value for money of your choice based on your specific health needs.

Variety of reimbursement levels

Although the mutual Allianz offers several levels of refund, the diversity of options can sometimes confuse policyholders. Everyone must take their time to understand which formula best meets their needs, which can lead to confusion.

Limitations on certain reimbursements

THE fee overruns may not be fully reimbursed depending on the level of coverage chosen. It is important to find out about the reimbursement conditions relating to excesses to avoid any surprises during medical consultations.

The system of refund of Allianz mutual insurance is designed to offer you optimal health coverage. Whether you are faced with routine care or more specific medical expenses, understanding how these reimbursements work is essential. This guide will enlighten you on the reimbursement terms, the steps to follow as well as the different levels of coverage available.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understanding Social Security reimbursement

Before talking about the mutual Allianz, it is important to familiarize yourself with how Social Security works. The basis of reimbursement for a standard medical procedure is 26.50€, on which health insurance reimburses you 70%. However, this rate may vary depending on the services and type of care required.

The role of complementary health insurance

There complementary health, like that offered by Allianz, supplements this basic reimbursement by covering the copayment. If your mutual offers a reimbursement rate of 100% for certain services, this means that you will not have to pay anything for care in these specific categories.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Steps to request a refund

Applying for reimbursement for treatment may seem complicated, but Allianz makes it easy. You can submit your requests online via your ameli account or the dedicated MyHealth application, without needing to complete paper forms. Simply log in and select the treatments to be reimbursed.

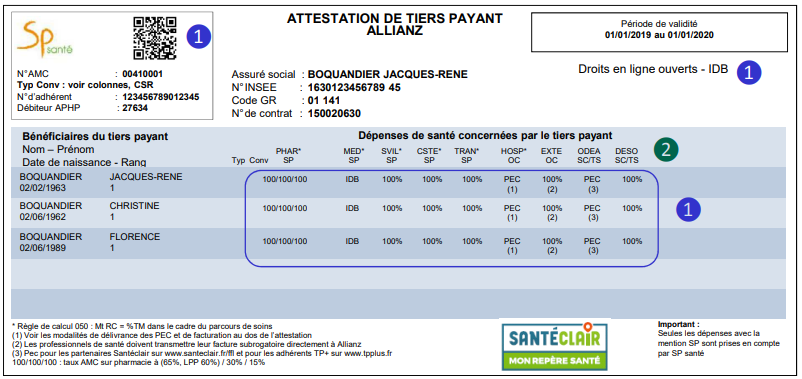

Track your reimbursements

With Allianz, it is possible to track your health reimbursements online. Thanks to the intuitive interface, you can download your health counts, consult your third party payment certificates and check the amounts reimbursed. These tools give you quick and easy access to your reimbursement information.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Reimbursements for care and equipment

THE dental care, medical consultations and equipment may have specific reimbursement terms. For example, reimbursement for dental care is often done per semester and sometimes requires a request for prior agreement to Social Security.

The 100% health reform

Furthermore, the recent 100% health reform aims to improve access to care by allowing zero out-of-pocket costs for certain equipment in optical, audiology And dental. This initiative is a big step towards more equitable health coverage for all.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Reimbursement options at Allianz

Allianz offers a personalized health insurance with different levels of reimbursement. For example, at level 7, you can benefit from a maximum reimbursement of one piece of equipment per ear every four years. This demonstrates the mutual’s commitment to meeting the varied needs of its policyholders.

Factors influencing reimbursements

THE reimbursement factors vary depending on the type of care, the level of coverage chosen, and the specific reimbursement rate. It is vital to carefully assess your personal health needs to choose the Allianz mutual that suits you best.

To learn more about reimbursement options and how Allianz fits your healthcare needs, check out their online documentation and helpful tips.

When you subscribe to Allianz mutual insurance, it is important to know the different aspects of the refunds proposed. Whether for medical consultations, dental care, or optical and hearing equipment, Allianz mutual insurance stands out with options adapted to your needs. This article guides you through the intricacies of reimbursements to maximize your coverage.

Understand how reimbursements work with Allianz

There Social security plays a key role in the reimbursement process. In general, the reimbursement basis for a medical consultation is 26.50€. Of this amount, health insurance reimburses 70%, which leaves a co-payment payable by you. However, depending on your health insurance contract with Allianz, your supplement may cover all or part of this remaining cost.

Coverage of medical care

When you consult a healthcare professional, you can assess the amount of your refund depending on the type of service and the conditions of your contract. A mutual fund like Allianz can cover the co-payment for the majority of care. To make the process easier, you can send your refund requests via the Allianz reimbursement application. It is generally not necessary to fill out a form, which makes the process quick and efficient.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Reimbursement of dental and optical care

Regarding the dental care, it is important to know that these treatments sometimes require a request for prior agreement from Social Security. For better coverage, Allianz offers specific reimbursement levels, which can go up to 100% for certain treatments. To learn more about dental reimbursement, see this information on the Allianz website.

THE optical equipment also benefit from attractive support, especially thanks to the 100% health reform. This reform aims to reduce or eliminate the remainder payable for essential equipment. Be sure to check the details of your mutual insurance company to optimize your reimbursements in this area.

Reimbursement and hospitalizations

In the event of hospitalization, Allianz can also offer full or partial reimbursement. Whether for a simple stay or for surgical procedures, it is essential to understand the terms of care provided for in your contract. Do not hesitate to consult the Allianz portal to find out about the options available to you.

Access your reimbursements online

To save time, you can track your health reimbursements online via your user account. On the portal, you will have access to your health statements and your third-party payer certificate. In addition, you can easily search for approved health professionals to maximize your refunds.

In summary, Allianz mutual offers a multitude of reimbursement options to meet your health needs. Whether for routine care or hospitalizations, it is fundamental to understand how to navigate the process to obtain optimal coverage.

The Different Types of Reimbursements at Allianz

| Type of Care | Reimbursement Details |

| Medical Consultations | Reimbursement of 70% of the reimbursement base by Social Security, supplemented by Allianz. |

| Hospitalizations | Reimbursement of user fees and additional costs depending on the level of guarantee chosen. |

| Dental Care | Reimbursement of dental costs according to a specific scale, with the possibility of prior agreement. |

| Hearing Aids | Maximum repayment every 4 years, depending on the level of coverage, with an annual ceiling. |

| Optical | Reimbursement according to the 100% health reform, allowing zero out-of-pocket costs for certain equipment. |

| Pharmacy | Partial reimbursement on prescribed medications, based on the basic reimbursement rate. |

| Paramedical acts | Reimbursement in addition to the amounts covered by Health Insurance. |

| Maternity | Reimbursement of pregnancy-related costs, according to the coverage levels offered by Allianz. |

Testimonials on Allianz mutual: everything you need to know about reimbursement

I recently subscribed to a Allianz mutual health insurance and I am pleasantly surprised by the simplicity of the process refund. After a medical consultation, I quickly submitted my application online, without having to fill out complicated forms. Within a few days, I received a notification on my ameli account telling me the amount refunded. It really saves time!

What I particularly appreciate is the fact that the Social security reimburses at least 70% of my health care costs. This allows me to plan my medical expenses, knowing that my complementary health will take care of the copayment. It’s very reassuring to know that I am covered for the majority of costs.

Another positive experience concerns my dental care. Thanks to the 100% health reform, I was able to benefit from a full refund for certain prostheses. My dentist even took care of sending the request for prior agreement to the Social security. It was a relief to not have to worry about this process. Transparency on reimbursement rates is also a strong point of the mutual Allianz.

For hearing equipment, I opted for the level 7 reimbursement. I was fully reimbursed for my hearing aids, which allowed me to return to a more pleasant quality of life. The fact that Allianz provides reimbursement every two years for this type of care is really an asset, especially to avoid unexpected costs.

Regarding hospitalization, I was impressed by the speed of reimbursements. Consultations and costs incurred at the hospital were covered effectively. Allianz offers assistance with procedures and reimbursements, which is extremely useful during stressful times such as hospitalization.

For those who have questions about the fee overruns, I can say that the mutual Allianz partially covered me. Although this is not always complete support, the options for refund offered are advantageous compared to other mutual insurance companies. This helps to mitigate these additional costs.

Everything you need to know about reimbursement from Allianz mutual insurance

If you are looking for a mutual health insurance that is easy to understand and use, the mutual Allianz might just be what you need. With a range of reimbursements tailored to your needs, it is essential to understand how these reimbursements work to get the most out of your health cover. In this article, we shed light on various aspects of the reimbursements offered by Allianz, from coverage by Social Security to personalized options.

Coverage by Social Security

Before discussing the specifics of the mutual Allianz, it is important to understand how reimbursement by the Social security. Each treatment has a reimbursement basis, which for many consultations amounts to €26.50. Social Security generally reimburses 70% of this base, which means you have one copayment to pay. This amount, often considered a significant expense, may persist if you do not have complementary health insurance.

How reimbursements work with Allianz

There complementary health from Allianz is designed to offer you total or partial coverage of remaining expenses after Social Security reimbursement. Depending on the contract you sign, you can benefit from a reimbursement of up to 100% of the costs incurred. This coverage applies to various treatments, ranging from medical consultations to surgical needs, while taking into account possible excess fees.

Steps to obtain a refund

To quickly obtain your reimbursements, you have several practical options. Thanks to your account ameli, you can make a reimbursement request online, where you will be informed of the deadlines and amounts. In addition, Allianz also offers its own online platform, such as the portal MyHealth, which makes it easy to send your requests without needing to fill out a traditional form. Simply log in to your account to track your repayments in real time.

Reimbursements linked to specific care

There mutual Allianz offers differentiated reimbursements based on care. For example, for dental care, it is often required to send a request for prior agreement to Social Security, particularly for major treatments. In terms of optics and audiology, the recent 100% health reform has made it possible to improve access to care without out-of-pocket costs for certain equipment, which is a notable advantage of your mutual insurance company.

Then, how do I know what Allianz reimburses?

To have an overview of the reimbursements offered by your mutual Allianz, you can consult a reimbursement table which details each treatment and its reimbursement rate. This will allow you to assess the level of coverage you have and possibly adjust your contract to best meet your expectations. Custom options also exist; thus, it is possible to supplement your coverage according to your specific needs, whether for routine care or less frequent treatments.

Allianz Contact and Support

If you have any questions or need assistance with the refund request process, Allianz customer service is available to help. Whether you wish to ask a question about reimbursement for a treatment or to obtain information about your contract, do not hesitate to contact them by telephone or email. You will find concrete results and answers to your concerns.

There mutual Allianz positions itself as a major player in the field of complementary health, offering a wide range of reimbursements adapted to the various needs of policyholders. By understanding the subtleties of refunds, members can make the most of their health coverage while controlling their expenses.

The basis for reimbursement of Social security, generally set at €26.50, plays a fundamental role. Concretely, thehealth insurance reimburses 70% of the costs incurred, leaving a remainder to be borne by the mutual health insurance compensates. This means that for each consultation or treatment, it is essential to understand how the different levels of coverage influence the amount reimbursed.

The management of refund requests is also simplified thanks to digital tools. Using the portalinsurance or the mobile application, policyholders can submit their requests without having to fill out complex forms. This approach makes it easier to monitor reimbursements and ensures greater transparency regarding deadlines and amounts.

Another important aspect to remember is the 100% health reform, put in place to guarantee a no remaining charge on certain optical, audiology and dental equipment. This initiative demonstrates Allianz’s commitment to improving access to care for all.

In short, the mutual Allianz offers varied reimbursement options adapted to the different profiles of its members. Whether it concerns medical consultations, hospitalizations or specific care, Allianz’s complementary health insurance is designed to meet everyone’s needs, thus making the reimbursement process both accessible and efficient.

FAQ: Allianz mutual insurance and reimbursement

What is the basis for Social Security reimbursement? The basis of reimbursement is frequently 26.50€ depending on the care.

What is the health insurance reimbursement rate? The standard reimbursement rate for health insurance is 70% for a multitude of common health benefits.

How does Social Security reimbursement work? Coverage depends on several criteria, such as the type of care, the level of coverage and the reimbursement rates applied.

What does complementary health insurance cover? A mutual health insurance covers at least the amount of the copayment, thus guaranteeing significant financial support to policyholders.

How to request a refund? You can make your refund request online on your account ameli, which allows you to access the associated deadlines and amounts.

Are there specific reimbursement options for hearing aids? Yes, with certain mutual insurance companies, such as level 7, reimbursement can be maximum once every two years, limited to one piece of equipment per ear.

How do I track my health reimbursements online? It is entirely possible to consult and follow your reimbursements via the application or the portal MyHealth without having to fill out any form.

What is the reimbursement for dental care? Dental reimbursements work on a semester basis, and a request for prior agreement from Social Security is necessary for approval.

Does Allianz cover fee overruns? Allianz offers reimbursement options for fee overruns, depending on your service contract. complementary health.

How to get reimbursed from Allianz? You can make your reimbursement request directly online on the platform. Allianz refund request.