|

IN BRIEF

|

In a world where healthcare costs can quickly exceed the budget, opt for a mutual health insurance is essential to protect your wallet and guarantee optimal access to care. AXA, a major player in the insurance sector, offers insurance solutions complementary health adapted to everyone. Understanding the advantages of mutual health insurance means ensuring peace of mind regarding costs that are not covered by the Social security. Thanks to customizable guarantees and efficient reimbursements, AXA offers you the possibility of choosing coverage that perfectly meets your needs and those of your family.

When it comes to health, it is essential to be well covered. AXA mutual health insurance offers a multitude of suitable guarantees to everyone’s needs. This text will allow you to discover the benefits and the disadvantages to join a complementary health with AXA, so that you can make an informed choice for your health coverage.

Benefits

Optimized reimbursements

Opt for the complementary health insurance AXA means benefiting from a refund service efficient and fast. Reimbursements can include costs for medical consultations, pharmacies, and even dental or optical care. The guarantee tables offered by AXA allow you to clearly visualize the level of coverage for each type of expense.

Flexibility of offers

AXA offers a à la carte health insurance, with options starting from just €9.04/month. This model gives you the freedom to choose the level of guarantees that corresponds to your specific health expenses, ensuring personalized protection which adapts to your situation

Remains at zero charge

For employees benefiting from collective complementary, AXA guarantees remaining charge of 0 € since 2020. This means that you benefit from routine care without any additional expenses, a considerable advantage for your health budget.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Pricing of advanced options

Although AXA offers competitive rates, some options advanced coverage can be costly. If you opt for superior guarantees, it is crucial to carefully evaluate your health profile and your specific needs in order to avoid possible excessive costs.

Complexity of offers

The multitude of options and offers that AXA makes available to you can sometimes make it understanding of the products more complex. It is therefore recommended to do your research and use online quote tools to easily compare the different options before making a decision.

Possible exclusions of guarantees

As with any mutual insurance, it is important to read the general conditions carefully to know the warranty exclusions possible. Certain medical practices or specific pathologies may not be covered, which could lead to surprises during reimbursement. AXA advisors are available to answer all your questions.

To learn more about the complementary health offered by AXA, you can consult their website: AXA Complementary Health.

There mutual health insurance has become essential to guarantee optimal coverage of your medical costs. With Axa, you have access to guarantees adapted to your health needs, allowing you to benefit from efficient reimbursement. In this article, we will explore the many advantages of complementary health insurance with Axa, while helping you make the best choices for your health coverage.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The fundamentals of mutual health insurance

A complementary health comes in addition to reimbursements provided by health insurance. It is designed to cover medical expenses that remain your responsibility, such as doctor’s consultations, medications or even certain medical procedures. Axa offers you mutual insurance which covers all of these expenses, thus avoiding you having to worry about outstanding payments after the intervention of Social Security.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The advantages of choosing Axa

An affordable price

With Axa, you can subscribe to a complementary health from €9.04 per month. This advantageous rate allows you to access a wide range of guarantees while respecting your budget. By comparing the different levels of coverage, you will be able to select the plan that best suits your personal needs.

Modular guarantees

The flexibility of Axa mutual insurance is a major asset. You have the possibility to personalize your health coverage by choosing the level of guarantees most appropriate to your expenses. Whether you need high reimbursement for routine care or want to move towards more specific options, Axa meets your expectations.

Fast and efficient reimbursement

Did you know? Your complementary health Axa acts as a real reimbursement service, offering maximum comfort. With optimized processing times, you can count on rapid reimbursement of your healthcare costs, allowing you to focus on your well-being and recovery.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Choose your health insurance carefully

To make the right choice, it is essential to examine several criteria. Axa makes this process easier by providing you with a free online quote. This will allow you to compare the different options and get the information you need to make an informed decision. Do not hesitate to also consult the guarantee tables and reimbursements available on the Axa website for a clear view of what you can expect.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The differences between mutual insurance and health insurance

It is essential to understand the distinctions between mutual And complementary health. Although these two concepts aim to complement Social Security reimbursements, they have specific functionalities. Mutual insurance is often more general, while complementary health insurance can offer targeted services depending on your profile. For more details on these differences, visit the website Economy.gov.

Advantages of joining a complementary mutual fund

Joining a mutual fund like that offered by Axa not only ensures financial security in the event of unforeseen expenses, but also privileged access to quality care. THE complementary health offer you peace of mind, reassuring you that your ongoing medical expenses will be covered. In addition, you benefit from a network of committed partners who direct you to qualified health professionals.

To find out more about the different guarantees and options, do not hesitate to consult the table of guarantees offered by Axa here: Axa guarantee and reimbursement tables.

Health is paramount and the financial security that comes with it is just as important. By opting for a AXA mutual health insurance, you benefit from reliable protection adapted to your specific needs. This article will enlighten you on the multiple advantages linked to membership in complementary health insurance, from understanding reimbursements to the importance of tailor-made cover.

Reinforced coverage for your healthcare costs

There complementary health plays a crucial role in filling the gaps left by Health Insurance. In fact, this does not always cover all of your medical costs. With AXA mutual health insurance, you can have peace of mind regarding the costs of medical consultations, medications or preventive measures. You will discover that certain levels of guarantee allow costs to be covered up to 400% compared to the Social Security reimbursement base. For more information on the classification of the best mutual insurance companies, consult this link: best mutual health insurance.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Personalized guarantees adapted to your situation

Every individual has different health needs. The great strength of complementary health insurance AXA is the possibility of choosing a level of guarantees based on your profile and your expectations. Whether you are employed, self-employed, or retired, AXA offers tailor-made plans that allow you to benefit from appropriate coverage, for guaranteed peace of mind.

Transparent cost assessment

When considering mutual health insurance, it is essential to evaluate the cost/guarantee ratio. THE calculating the price of your complementary health insurance is based on various criteria, including your family situation, the level of guarantees chosen, and management costs. AXA provides you with practical tools to understand the price of your mutual insurance and adapt your choice accordingly. Learn more about pricing calculations here: mutual health price calculation.

Responsive and effective support

Join the AXA mutual health insurance it means having attentive customer service. If you have any questions, AXA offers frequently asked questions detailed to answer all your questions regarding your reimbursements and the guarantees offered. Your peace of mind is a priority for AXA, and it is essential to benefit from quality support during your health journey. To view the FAQ, click here: AXA frequently asked questions.

A wise choice for the future

Opt for one mutual health insurance is a wise choice that is not just limited to reimbursements. Additional services such as prevention, health programs or personalized advice allow you to optimize your daily well-being. By investing in a mutual fund adapted by AXA, you are choosing a peaceful and protected future from the vagaries of life.

The advantages of AXA mutual health insurance

| Features | AXA benefits |

| Competitive price | From €9.04/month for suitable coverage. |

| Fast refunds | Efficient service guaranteeing rapid reimbursements for your healthcare expenses. |

| Flexibility | Choose the level of guarantees according to your specific needs. |

| Full coverage | Coverage of costs not reimbursed by Social Security. |

| Customizable options | Possibility of adding options for specific treatments. |

| Easy membership | Free quote and simplified online subscription. |

| Accessibility of care | 0 € remaining charge for routine care with group insurance. |

| Customer support | Support available to answer your coverage questions. |

Testimonials on Axa Assurances Mutuelle: Understanding the Advantages of a Mutual Health Insurance

Being well covered when it comes to health is a concern for many of us. Thanks to the complementary health insurance AXA, many have found a solution adapted to their specific needs. Marie, a nurse, testifies: “With my job, I encounter significant health costs. AXA allowed me to choose a level of guarantees à la carte which effectively covers my consultation and medication expenses. For only €9.04 per month, I have peace of mind! »

Jean, a young father, also shares his experience: “I subscribed to the AXA mutual insurance mainly to protect my family. Reimbursements are quick and offer a good level of comfort. Knowing that my children’s care is covered is a huge relief to me. AXA has clearly thought of everything to make our procedures easier. »

Another aspect highlighted by these policyholders: the transparency of the offers. Sophie, retired, explains: “What I appreciate at AXA is the clarity of the management tables. guarantees and refunds. Understand what is supported by the Social security and what remains at my expense was a real plus in choosing my complementary health insurance. »

When it comes to dental and optical coverage, Pierre says: “Healthcare is a significant budget, especially for glasses or braces. Thanks to AXA, I was able to benefit from attractive reimbursements that helped me reduce the bill. It’s a peace of mind that I can’t trade!”

Finally, for those considering a group health insurance, Amélie explains: “My company offered me to subscribe to AXA’s supplemental health insurance. It was a great opportunity! I benefited from coverage with €0 remaining to pay, which is invaluable during frequent medical visits. AXA really knows how to adapt to everyone’s needs.”

Understanding the benefits of AXA health insurance

Choosing health insurance that is adapted to your needs is essential to benefit from optimal protection. AXA, recognized for its expertise in the field of insurance, offers tailor-made solutions to cover your health expenses. In this article, we will explore the benefits of joining an AXA health insurance plan, the criteria to consider when making your choice, as well as the guarantees offered to bring you peace of mind and comfort on a daily basis.

The benefits of joining an AXA health insurance plan

Joining an AXA health insurance plan means benefiting from enhanced coverage. First of all, this complementary health insurance is designed to cover the costs that Social Security does not. Whether it is for your medical consultations, your medications in the pharmacy or your dental care, AXA ensures you a quick and efficient reimbursement, allowing you to reduce your health expenses. Secondly, with the

AXA complementary health insurance , you have the freedom to choose your level of cover. You can select a contract that perfectly matches your specific medical needs. Whether you are a young professional, a family or a senior, AXA offers a variety of plans to meet everyone’s requirements and maintain quality medical monitoring without worrying about costs.Personalized coverage

AXA’s strength also lies in the ability to adapt your

supplementary health insurance . Starting at €9.04 per month, you can take out a contract that guarantees youreimbursement à la carte. Whether you require special monitoring or specific interventions, AXA allows you to adjust your coverage according to your anticipated health expenses. Understanding the selection criteria

To choose your mutual health insurance wisely, it is essential to know the

criteria that influence the price and guarantees. Among these criteria, your profile (age, state of health, family situation), the desired level of coverage, as well as the management fees play a crucial role. So, taking the time to assess your personal needs will help you make an informed choice. Distinguishing mutual and supplementary health insurance It is also useful to understand the difference between a mutual and a supplementary health insurance. Although they have similar roles,

mutual health insurance

is a non-profit scheme while supplementary health insurance can be offered by insurers, such as AXA, with the intention of making a profit. Both solutions mainly complement Social Security, but AXA stands out for the diversity of its offers and the quality of its customer service. Rates and reimbursements The question of rates remains central. The

rates

of mutual insurance companies such as those offered by AXA vary depending on the guarantees chosen, the reimbursement levels, as well as the terms of membership. Thanks to the tables of guarantees clear and transparent information offered by AXA, you can easily compare the options and select the one that best meets your financial and health expectations. Finally, it is imperative to be well informed about the refunds

associated with each service. AXA is committed to providing effective reimbursements, allowing you to benefit from support that goes beyond the basic Social Security. This also includes covering costs that are little or not covered by it. discover the many advantages of mutual health insurance, including better medical coverage, optimized reimbursements and access to quality care. protect your health and that of your family with mutual insurance adapted to your needs. The Advantages of an AXA Mutual Health Insurance

complementary health

is now essential in a health system where the costs of care continue to increase. AXA offers tailored solutions to support everyone in managing their expenses. Thanks to its offers, you can choose tailor-made coverage that perfectly meets your specific needs and those of your family. There complementary health insurance AXA

stands out for its flexibility. From just €9.04 per month, you can access a wide range of guarantees. Whether for medical consultations, pharmacy reimbursements or even dental care, AXA is there to reduce your health budget. These effective reimbursements allow you to live more peacefully and to concentrate on the essential: your health. Another major asset of this mutual lies in the suitable guarantees

. Each member can select the level of insurance they want, based on their actual health expenses. This customization allows you to control your budget while benefiting from optimal security. In addition, AXA makes a point of informing its customers about the understanding of their health coverage, for total transparency. Turning to AXA also means opting for an efficient reimbursement structure. Every expense caused by an illness or accident will be taken care of efficiently, reducing the stress linked to unexpected expenses to zero. Whether you are self-employed, employed or running a business, there is aAXA solution

adapted to each situation, thus strengthening the well-being of all its policyholders. Frequently Asked Questions about Axa Assurances Mutuelle What are the advantages of joining AXA health insurance?

AXA mutual health insurance offers a wide range of guarantees adapted to your needs, allowing you to benefit from optimal reimbursement of your health costs.

How do reimbursements work with AXA complementary health insurance? AXA supplementary health insurance intervenes to cover expenses not reimbursed by Social Security, thus ensuring maximum financial comfort for your medical care.

Can I personalize my AXA supplementary health insurance contract? Yes, AXA allows you to choose the level of guarantees most appropriate to your health expenses and your expectations, while offering you tailor-made insurance.

What costs are covered by AXA complementary health insurance? AXA supplementary health insurance covers various medical expenses, such as medical consultations, medications and dental care, to help you reduce your out-of-pocket costs.

How do I calculate the cost of my health insurance at AXA? The price of your mutual health insurance depends on several criteria, including your profile, the level of guarantees chosen, as well as the management costs linked to your contract.

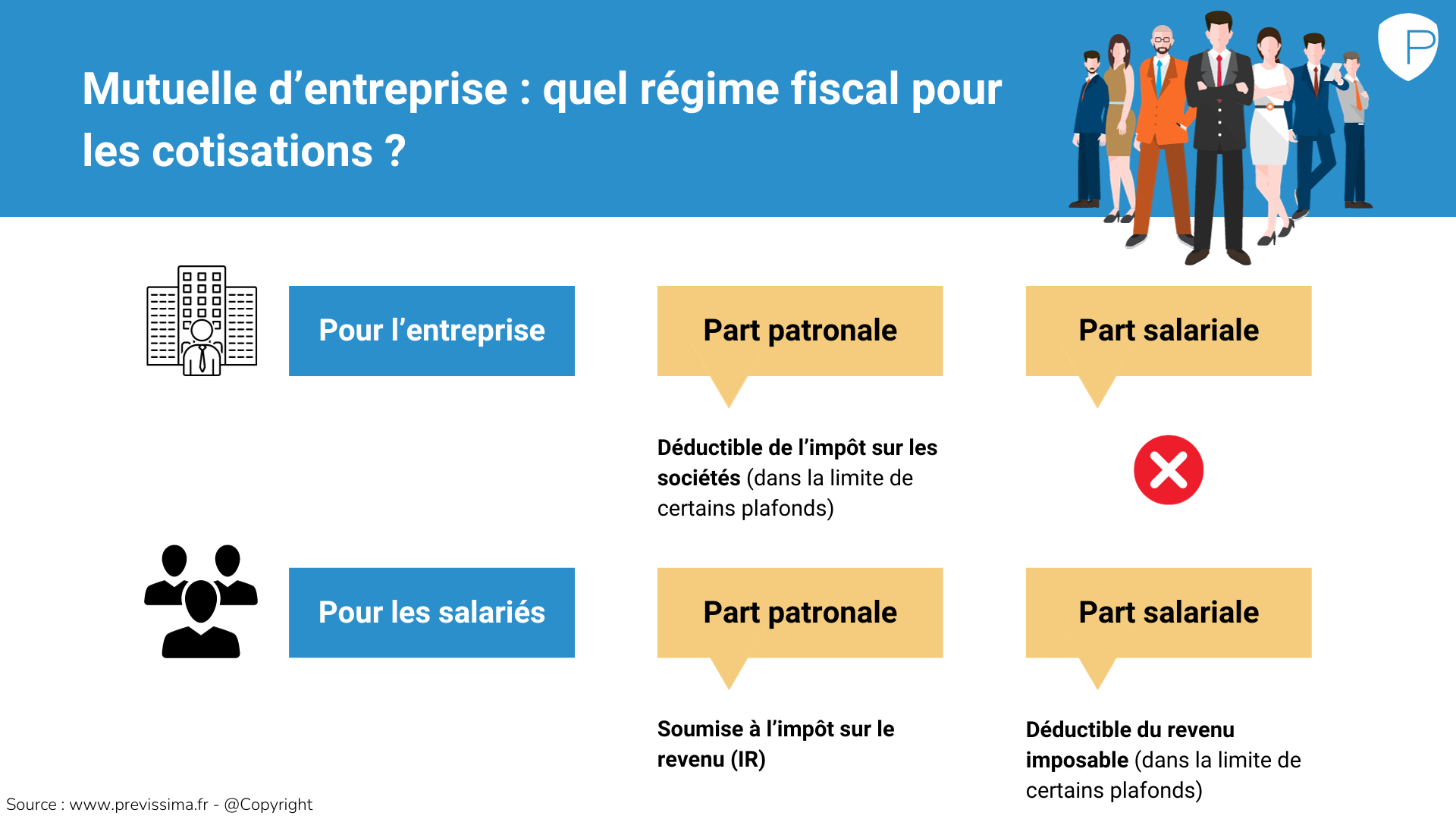

Does AXA offer solutions for companies regarding complementary health insurance? Absolutely. AXA offers complementary collective health solutions for companies, allowing you to benefit from a €0 out-of-pocket payment from the start of 2020 for certain routine treatments.

What are the differences between mutual insurance and complementary health insurance? Although both aim to supplement Social Security reimbursements, mutual insurance is often associative, while complementary health insurance can be a commercial contract, like those offered by AXA.

Is it possible to get a quote online for my AXA health insurance? Yes, AXA offers a free online quote service to help you estimate costs and choose the coverage that best suits your needs.

How do I access my AXA customer area to manage my mutual insurance? You can access your AXA customer area online by logging in with your personal identifiers, which will allow you to easily manage your contract and your reimbursements.