|

IN BRIEF

|

With changing health needs, choosing a complementary health adapted is more crucial than ever. L’AXA supplementary health insurance stands out for its flexible offers and advantageous reimbursements. Whether you are an employee, student or self-employed, AXA offers solutions that meet your specific expectations. In this article, we reveal everything you need to know about the advantages and options of AXA complementary health insurance, to allow you to access the care you need with peace of mind.

In our search for the best health insurance, it is essential to look at the options available, particularly those offered by AXA. This article gives you an overview of its offers in terms of complementary health. We will examine the main benefits as well as the disadvantages of AXA health coverage to help you make an informed decision.

Benefits

Free online quote

AXA simplifies the process of subscribing to a complementary health by offering the possibility of obtaining a free online quote. This allows you to compare different formulas without obligation.

Access to à la carte care

With AXA, it is possible to choose health insurance adapted to your specific needs. THE offers start from €9.04/month, making it an attractive option in terms of cost.

Refunds and zero remaining charges

Policyholders can benefit from 0 € remaining charge on certain medical equipment compatible with the program 100% Health. This program guarantees expanded access to care at no additional cost.

Transparent guarantee tables

AXA provides you with guarantee tables detailed, allowing a better understanding of reimbursements for routine care, hospitalization, as well as costs related to dental, optical and hearing care.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Complexity of choice

With several plans available, it can be difficult to choose the most suitable offer. The sometimes plethora of options can complicate the decision.

Budget to be defined

It is crucial to determine the budget that you can devote to complementary health insurance before choosing. This may limit the options available depending on your income and health priorities.

Renewal conditions

To continue to benefit from the coverage, the renewal request must be made to the Health Insurance fund 2 to 4 months before the expiry date. This process may require prior organization.

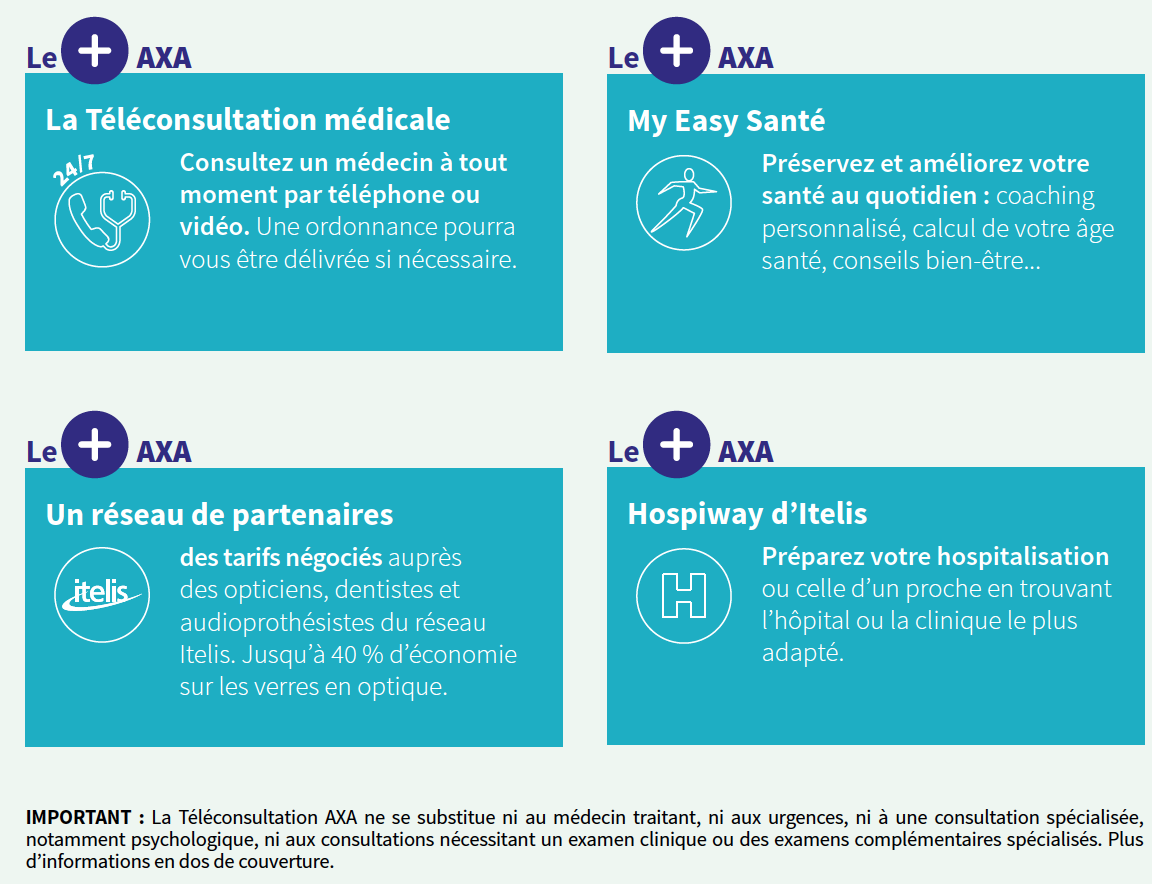

Various online services

Although AXA offers online services, it can sometimes be difficult to navigate the platform effectively to access all the information and support needed.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

In summary

Choose one complementary health is a crucial issue for your financial security in the face of health expenses. AXA presents a set of advantages that may appeal to many policyholders, while raising some disadvantages to consider. To go further in your reflection, do not hesitate to consult additional resources on advantages of complementary health insurance or on the AXA reputation.

If you are looking for a complementary health that adapts to your needs and your budget, AXA could be the ideal solution. Thanks to its flexible offers, AXA offers varied reimbursements for your healthcare expenses while meeting the demands of your daily life. This article will guide you through the essentials to know about the health coverage options offered by AXA.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

AXA’s complementary health offers

AXA provides you with up to €9.04 per month to benefit from a tailor-made health insurance. These offers allow you to choose the guarantees that suit you best, whether for routine care, consultations, or even hospitalizations. In terms of refunds, AXA facilitates your access to care with solutions adapted to your specific needs.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The advantages of AXA mutual health insurance

One of AXA’s particularities is the possibility of benefiting from a 0 € remaining charge on certain medical equipment compatible with the device of the 100% Health. This means you can access high-quality care at no extra cost, helping to improve your health without impacting your budget.

Choose your health insurance carefully

Before subscribing to mutual or complementary health insurance, it is crucial to define a budget. Think about how much you are willing to dedicate each month to your health coverage. AXA offers you options to align your choices with your financial capacity while preserving the quality of health services.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

How to anticipate your health needs

Asking the right questions is essential to choosing the right health coverage. Whether to anticipate potential dependency or to cover specific medical needs, AXA is there to advise you. Investing in complementary health insurance means ensuring peace of mind in the face of life’s unexpected events.

AXA online services

To help you manage your health budget, AXA provides you with various online services. You can easily assess your needs and choose the healthcare professionals who best suit you. These tools allow you to optimize your expenses while benefiting from quality care.

Understanding healthcare reimbursements with AXA

AXA differentiates itself through the clarity of its guarantee tables and the reimbursements it offers. In general, the reimbursement base is set at €25, of which 70% is covered by the Social security, or €16.50 after deduction. It is important to understand this aspect to maximize your health coverage.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Contact and additional information

For any questions relating to your complementary health insurance, you can consult the websiteAXA or even contact customer service. In addition, to explore the services offered in more depth, do not hesitate to visit the AXA health offers page.

Taking care of your health is a priority for each of us, and choosing the right complementary health is essential. AXA positions itself as a trusted player, offering solutions adapted to your needs. In this article, we will explore the different aspects of Axa’s supplementary health insurance, including coverage, prices, and advice for choosing your contract.

Axa’s complementary health offers

AXA offers a à la carte health insurance, accessible from €9.04 per month, allowing you to personalize your coverage according to your needs. You can choose from a range of options that suit your personal situation and budget. For example, reimbursements apply to various expense items such as routine care, dental costs or even specialized consultations.

Refunds and support

A considerable advantage of Axa is its approach to remains responsible. Thanks to the 100% Health program, you can benefit from €0 off-payment on certain medical equipment. This represents an excellent opportunity to reduce your expenses, while benefiting from easier access to care.

How to choose your complementary health insurance

Before signing a contract, it is essential to carefully evaluate your budget. The amount you can invest monthly in your health insurance should be determined based on your income and personal priorities. AXA also offers you tools and advice to make the best choice based on your specific needs. Consult AXA advice page for more information.

Understanding your health coverage

To avoid any surprises, it is crucial to understand the details of your supplemental health insurance contract. Coverage options, as well as exclusions, must be clearly defined. Remember to contact AXA for any questions relating to your coverage or administrative procedures, particularly for the renewal of your contract.

Online services and management of your health

AXA also offers online services to help you manage your health budget. From covering healthcare costs to finding suitable professionals, these tools are designed to make your life easier. You can find out the details of these services by visiting Axa customer area.

By choosing AXA for your complementary health insurance, you are opting for honest and customizable insurance. Whether through optimized reimbursements or tailored advice, AXA is committed to supporting you in managing your daily health.

| Axis of comparison | Details |

| Average cost | From €9.04/month |

| Medical equipment reimbursement | 0 € remaining charge on 100% Health |

| Types of expenses covered | Routine care, consultations, hospitalization, dental, optical and hearing costs |

| Online services | Access to tools to choose healthcare professionals |

| Anticipation of dependence | Answers to questions related to dependence in complementary health |

| Guarantee tables | Free download of guarantee tables |

| Basic reimbursement | Basis for reimbursement €25, 70% covered by Social Security |

| Coverage for businesses | Solutions adapted for complementary health employees |

Testimonials on AXA supplementary health insurance

Many policyholders are seduced by the offers of complementary health of AXA, boasting a à la carte health insurance from €9.04 per month. This allows each contract to be tailored to individual needs, ensuring excellent value for money. A customer says: “Thanks to AXA, I was able to personalize my health coverage according to my needs, thus avoiding paying for services that I did not need. »

Policyholders also appreciate the advantages linked to refunds, particularly for medical equipment. A user says: “I benefited from €0 off for the purchase of my glasses thanks to the 100% Health program. It’s a relief not to have to pay for my health costs. »

Choose the right one complementary health is essential, and AXA offers useful advice to its policyholders. “The first thing to do is to determine a budget that suits you, and AXA helped me realize that I could invest a little more for quality care,” shares another customer. This underlines the importance of health coverage adapted to each person’s personal situation.

AXA’s online services make it easier to manage your daily health budget. A customer says: “I regularly use their platform to choose my doctors and manage my reimbursements. Today it is much simpler and faster. »

Reimbursements are a topic that concerns many people. One policyholder recalls the importance of understanding your coverage: “AXA explained to me perfectly how reimbursements work. Now I know exactly what I’m going to touch after each consultation. »

Finally, for businesses, AXA offers solutions for complementary health adapted to employees. A boss says: “Offering company mutual insurance with AXA has been a real plus for attracting and retaining talent. My employees feel better protected. »

In a world where health is a priority for each of us, choosing the right complementary health is essential. Axa positions itself as a player of choice with offers adapted to your needs. This article presents the key points to know regarding the guarantees, prices, and support offered by Axa, in order to help you make an informed decision for your health coverage.

Axa’s Personalized Offers

Axa offers formulas of complementary health flexible, adapted to each profile. Whether you are a employee, A student or a self-employed, you can create your own cover from €9.04 per month. The process is simple, accessible online and allows you to obtain a free quote without commitment.

Varied Guarantees

Axa’s guarantees cover a wide range of health expenses: from routine care to hospitalizations, including expenses dental, optical And auditory. You also have the possibility to choose specific options to strengthen your coverage according to your needs. For example, medical equipment compatible with the device 100% Health leave no out-of-pocket costs, a considerable advantage for controlling health care costs.

How to Choose Your Health Supplement

To choose your complementary health, start by defining a favorable budget for your health coverage. Evaluate your income and determine how much you can invest each month. Axa allows you to personalize your guarantees according to this budget, helping you to adapt your coverage to your priorities.

Anticipate Your Health Needs

It is essential to anticipate your future health needs. Whether it concerns preventive actions, regular care or the need for long-term care, Axa offers options and advice so that you are not caught off guard. By informing you about the guarantees possible, you can avoid unexpected costs.

Managing Your Health Budget

AXA provides you with various online services to effectively manage your health budget. These tools allow you to select the healthcare professionals best suited to your needs. In addition, with the guarantee tables offered by Axa, you can easily view the reimbursements to which you are entitled, thus facilitating your decision-making.

Clear and Accessible Coverage

Transparency is at the heart of Axa’s values. You can consult the reimbursement tables to understand exactly how and when you will be reimbursed. By knowing the Basis of reimbursement for each medical procedure, you can better manage your healthcare expenses and maximize your savings.

Customer Service and Support

AXA has responsive customer service that listens to you. If you have any questions about your contract or your reimbursements, do not hesitate to contact them. They are committed to providing you with quick and clear answers so that you can get the most out of your complementary health.

By choosing Axa as your health insurer, you are opting for coverage that adapts to your needs, while benefiting from valuable advice and support for your well-being and financial serenity. Take full advantage of the guarantees offered to guarantee your health and that of your loved ones.

There complementary health AXA stands out for its flexibility and accessibility. From just €9.04 per month, you can benefit from tailor-made health coverage, perfectly adapted to your specific needs. Thanks to this offer, you can easily manage your healthcare expenses while having the certainty of being well reimbursed.

One of AXA’s major assets is its commitment to “100% Health”. With certain guarantees, it is possible not to have remains responsible on your medical equipment, thus guaranteeing you access to quality care without unforeseen costs. This initiative encourages both prevention and optimal care.

To choose your complementary health insurance, it is essential to clearly define your budget and your medical priorities. AXA offers personalized support and advice to guide you towards the solutions best suited to your needs and those of your family. Each situation is unique, and AXA intends to use its expertise to answer all your questions, particularly on the guarantees to take or the anticipations to make for a peaceful life.

AXA also provides you with online services practices to easily manage your health coverage, choose the health professionals that suit you, and optimize your budget. With its full range of services ranging from routine care to hospitalization, including dental, optical and hearing costs, AXA guarantees reimbursement covering all of your needs.

FAQs about AXA supplementary health insurance

- What is the main difference between mutual insurance and complementary health insurance? Mutual insurance is a type of complementary health insurance that operates on the principle of solidarity between its members, while complementary health insurance can include various types of contracts and options, thus offering greater flexibility.

- What types of reimbursements are offered by AXA? AXA offers reimbursements for a variety of healthcare expenses, including routine care, THE medical consultations, L’hospitalization, as well as the costs training, optics And hearing.

- How does the 100% Health system work with AXA? With 100% Health, AXA allows you to benefit from 0 € remaining charge on certain medical equipment, thus facilitating your access to essential care.

- How do I set the budget to devote to my health insurance? It is crucial to take into account your income and your regular health expenses to establish a realistic budget that you can devote to your health coverage.

- What advice does AXA offer to help you choose your health insurance? AXA supports you by guiding you on the guarantees best suited to your needs and by helping you anticipate possible future dependencies. How can I manage my health budget with AXA?

- AXA provides you with online services to help you choose the health professionals best suited to your needs and thus better manage your expenses. When should I request the renewal of my AXA health coverage?It is recommended that you submit your

- renewal request to the Health Insurance Fund between 2 and 4 months before the expiry of your contract.