|

IN BRIEF

|

There complementary health from Allianz represents an essential solution for those who wish to optimize their medical coverage. In fact, this health insurance supplements the reimbursements of thehealth insurance, taking charge of uncovered expenses and thus reducing the remaining burden for policyholders. Whether for medical consultations, hospitalizations or specific care, Allianz offers prices and guarantees adapted to each need. Thanks to the possibility of personalizing your contract, you ensure optimal protection for your health and that of your loved ones. Discover the different aspects of this complementary health insurance to get the most out of it.

Allianz complementary health insurance represents a wise choice for those who wish to supplement Health Insurance reimbursements. It covers all or part of uncovered medical expenses. This article presents its benefits and his disadvantages, to help you better understand this essential product.

Benefits

Allianz complementary health insurance stands out for several benefits notable. First of all, it offers attractive reimbursements, going up to €150 per day for hospitalization in a private room and up to €120 for consultations with specialists. This can significantly reduce your healthcare costs, giving you greater peace of mind in the event of a medical need.

Then, Allianz offers a personalized health insurance that adapts to your needs. You can choose from different options and guarantees, which allows you to tailor your coverage according to your personal situation. This flexibility is essential to benefit from coverage that perfectly meets your expectations.

In addition, access to a free online quote allows you to quickly assess the costs and benefits you could obtain. This pricing transparency is a strong point, because it will help you compare the different options available on the market. You can thus better target your needs and optimize your choices.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages. One of the main points to consider is the price contributions, which can be relatively high depending on the level of coverage chosen. This can be a barrier for some people, especially those on a limited budget.

Another aspect to take into account is the complexity of guarantees. The multitude of options available can make it difficult to understand the different levels of coverage and associated reimbursements. Taking the time to carefully analyze contracts is therefore essential before making an informed choice.

Finally, certain services may not be fully reimbursed, in particular care deemed unnecessary or certain specific medical procedures. It is therefore important to be well informed about the refund conditions before subscribing to complementary health insurance.

Allianz complementary health insurance is an essential solution to ensure optimal protection against health expenses. By covering all or part of the costs not reimbursed by health insurance, it significantly reduces your out-of-pocket costs. In this article, we will explore the different characteristics, advantages and options of the complementary health insurance offered by Allianz in order to help you make an informed choice for your health coverage.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

What is complementary health insurance?

There complementary health is an insurance contract which supplements health insurance reimbursements. It covers part of the expenses not covered by the latter, thus ensuring that you benefit from adequate medical coverage. Allianz offers several options tailored to your specific needs, whether for consultations, hospitalizations or routine care.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Reimbursements with Allianz

With the complementary health insurance from Allianz, you can benefit from a wide range of reimbursements. For example, for your hospitalization in a private room, you can obtain reimbursement of up to 150€ per day. Likewise, for consultations with a specialist, reimbursements can go up to 120€ for all doctors.

Services not reimbursed by Health Insurance

In addition to current expenses, Allianz supplementary health insurance can also cover a certain number of services not covered by health insurance, in particular excess fees and certain alternative medicine procedures such as osteopathy. To find out more about Allianz’s osteopathic partner networks, visit this link.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Quote and personalization of your complementary health insurance

Get a estimate for your complementary health insurance is simple and quick with Allianz. In less than a minute, you can find out the rates adapted to your personal situation. In addition, it is possible to customize your contract to meet your specific needs, whether you are a business wishing to protect your employees or an individual seeking individual coverage.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Access your Allianz customer area

To manage your contract and your reimbursements, Allianz provides you with a online customer area. This portal allows you to track your reimbursements, download documents and personalize your coverage. Simply log in to your account via this link.

Solidarity complementary health insurance

There complementary solidarity health is an important aid which allows you to cover all of your health expenses if you meet certain resource conditions. She is there to ensure that everyone has access to the care they need, without worrying about their finances. For more information, see This item.

Conclusion on Allianz and its offers

Allianz stands out for the diversity of its offers in terms of complementary health, responding to contemporary health protection issues. Whether for classic or specific needs, Allianz effectively supports you on the path to financial security in terms of health. Don’t hesitate to explore further and make a choice that makes you feel completely secure.

There complementary health from Allianz is designed to offer you additional protection against health expenses not covered by health insurance. Whether you need routine medical care, hospitalization or even specific options, it is essential to explore the many guarantees offered by this mutual to guarantee your well-being and financial security.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

What is Allianz complementary health insurance?

There complementary health from Allianz completes your reimbursement of medical expenses after the intervention of health insurance. This means that, depending on the contract chosen, you could benefit from total or partial reimbursement of certain treatments, consultations or hospitalization costs. By opting for mutual insurance adapted to your needs, you can anticipate your expenses and treat yourself in the best conditions.

The advantages of Allianz guarantees

Allianz offers various guarantees which can include reimbursement of hospitalization costs in a private room, consultations with specialists, and even procedures not covered by Social Security. Depending on your contract, you can get up to 150 € per day for hospitalization or €120 for consultations with doctors. This allows you to choose quality care without worrying about additional costs.

How does complementary health insurance work?

The main mission of your complementary health is to pay the portion of expenses not reimbursed by health insurance, often called “moderatory fees”. Thanks to a free quote, you can quickly estimate the cost of your mutual insurance and the reimbursements to which you are entitled.

Expand your coverage with Allianz

Allianz also offers additional options to enrich your health coverage. Depending on your medical prescriptions and your personal preferences, you can choose to add specific guarantees such as reimbursement for alternative medicine, optics or even dental care. This allows you to adapt your mutual insurance to your real needs.

Who can benefit from complementary solidarity health insurance?

There Supplementary solidarity health from Allianz is a valuable aid intended for people in precarious situations. It covers all health expenses, allowing beneficiaries to access the necessary care without financial constraints. To find out if you are entitled to it, you can consult the information available online.

Make your online procedures easier

The steps to obtain your complementary health are simplified thanks to Allianz digital services. You can request a quote in just one minute on their site. This allows you to quickly access all the information you need to make an informed choice. Do not hesitate to take advantage of this tool by going to here !

Personalized coverage for everyone

Whether you are a student, employee or retiree, Allianz offers solutions adapted to all profiles. There mutual health insurance is essential to ensure your well-being and that of your family. For more information on the complementary health insurance intended for students, see this link: everything you need to know.

By choosing Allianz complementary health insurance, you are choosing quality insurance, adapted to your needs and your budget. The benefits offered will help you take care of your health with complete peace of mind.

Comparison of Allianz Health Supplement

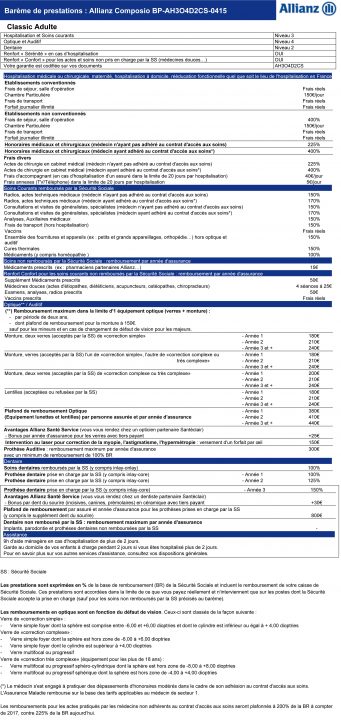

| Criteria | Details |

| Types of guarantees | Reimbursement of routine care and hospitalization. |

| Refunds | Up to €120 for specialized consultations. |

| Private room | Reimbursement of up to €150 per day in hospitalization. |

| Options | Customization of guarantee levels according to needs. |

| Pricing | Quick online quote to estimate the price. |

| Supplementary solidarity health | Coverage of health expenses for eligible people. |

| Assistance | Access to a partner care network, including osteopaths. |

| Waiting periods | Variable depending on the guarantees chosen. |

| Customer access | Online customer area for tracking reimbursements. |

| Type of insured | Availability for individuals and businesses. |

Testimonials on Allianz complementary health insurance

I am very satisfied with my complementary health Allianz. One of the aspects I like the most is the speed of processing reimbursement requests. After consulting a specialist, I was pleasantly surprised to receive my refund in less than a week. This allowed me to not have to worry about remaining medical costs.

With my mutual health insurance Allianz, I can choose services that perfectly match my needs. For me, the possibility of benefiting from a stay in private room in the hospital is essential. Thanks to my contract, Allianz covers up to €150 per day, which gives me great peace of mind in the event of hospitalization.

What I also like is the transparency of the prices and guarantees. I was able to obtain a free quote online which helped me understand exactly what my complementary health insurance covered. The options were clear and I was able to customize my contract according to my personal requirements.

As an entrepreneur, I was also able to benefit from offers fromindividual health insurance offered by Allianz. This allowed me to better manage my health expenses, while having the assurance that I would be well reimbursed for my medical consultations, even with specialists.

Finally, I would like to emphasize the existence of the Supplementary solidarity health for those who need it. This demonstrates Allianz’s commitment to accessible healthcare. It is reassuring to know that full support is available for the most vulnerable, allowing true equality of access to care.

Introduction to Allianz complementary health insurance

There complementary health is essential to better manage health expenses not covered by health insurance. Whether you are an individual, a professional or a student, Allianz offers you suitable solutions to offer you optimal reimbursements. This article explores the different facets of complementary health of Allianz, including how it works, reimbursements and the benefits it offers.

How complementary health insurance works

The fundamental role of complementary health is to cover the remaining medical costs after social security reimbursements. This allows you to avoid unforeseen expenses that could weigh on your budget. When you consult a doctor, for example, Health Insurance reimburses part of the costs, but there often remains a is your responsibility. This is where the complementary health comes into play, covering all or part of these costs.

Coverage tailored to your needs

Allianz offers different formulas of complementary health in order to adjust to your specific needs. Whether you need reimbursements for routine consultations, dental care, or even hospitalization costs, Allianz has a tailor-made offer that adapts to your personal situation. For example, the support of a hospitalization in a private room can reach up to €150 per day.

Reimbursements and guarantees

THE guarantees of the complementary health Allianz vary depending on the formulas chosen. In general, you will receive reimbursements for a wide range of medical care, including visits to doctors. specialists which can go up to 120€. In addition, Allianz also covers certain expenses not reimbursed by Health Insurance, such as alternative medicine or health products.

Free quote and personalized options

To find out the cost of your complementary health, Allianz offers a free quote online. This allows you to quickly assess the price that meets your expectations and your budget. Additionally, customization options give you the freedom to choose additional guarantees, according to your specific needs. This includes solutions for students, seniors or even for self-employed workers.

Solidarity complementary health insurance

Allianz also offers complementary solidarity health, which aims to reduce health costs for people with low incomes. This system covers all health expenses, thus contributing to equal access to care. This allows beneficiaries to receive treatment without worrying about costs.

Conclusion on Allianz complementary health insurance

Choose one complementary health like that of Allianz, it means investing in your financial security and well-being. Thanks to its competitive rates and numerous customization options, you will be able to find the coverage that suits you best. Do not hesitate to consult the different formulas available to optimize your health protection.

There complementary health from Allianz represents an essential solution for those who wish to optimize the management of their medical expenses. Based on a reimbursement which complements the interventions of thehealth insurance, Allianz makes it possible to significantly reduce the remainder payable by its policyholders. This type of coverage is particularly valuable in the context of routine health care, but also during hospitalizations or during consultations with specialists.

One of the significant advantages of Allianz complementary health insurance is its ability to offer personalized guarantees. Indeed, each insured person can choose the options that suit them best, whether for hospitalization costs in a private room, medical consultations or dental and optical care. Allianz is committed to providing a competitive reimbursement rate that adjusts to your specific needs.

Additionally, Allianz offers quotes free online, allowing potential policyholders to easily compare the different plans and opt for the coverage that suits them best. Prices are transparent and adjusted according to needs, which facilitates decision-making.

People with modest incomes can also benefit from the complementary solidarity health, which covers all healthcare costs for those who are eligible. This illustrates Allianz’s commitment to making health accessible to all. Ultimately, opting for Allianz complementary health insurance means choosing peace of mind when it comes to healthcare expenses and guaranteeing optimal access to quality care.

FAQ about Allianz complementary health insurance

What is the main function of complementary health insurance? There complementary health aims to cover all or part of the expenses not covered by health insurance.

What types of reimbursements does Allianz supplementary health insurance offer? Allianz offers a range of reimbursements, notably for hospitalizations (up to €150 per day) and consultations with specialists (up to €120).

How does the reimbursement of health costs work? Supplementary health insurance reimburses the portion of expenses remaining the responsibility of the insured person after intervention by health insurance.

What expenses are covered by complementary health insurance? It can cover medical costs not reimbursed by social security, such as a private room or certain specific treatments.

What is complementary health insurance? There complementary solidarity health is assistance that fully covers your uncovered health expenses, thus facilitating access to care.

Is it possible to obtain a quote for complementary health insurance online? Yes, Allianz offers a additional online health quote, allowing you to compare guarantees and options according to your needs.

Is complementary health insurance compulsory? There company health insurance is compulsory for employers, but subscribing to individual supplementary health insurance remains an option for self-employed workers.

What are the specific features of Allianz’s individual offers? The Allianz Santé TNS product is designed to reimburse remaining health costs and adapts to the needs of each individual.

Does Allianz complementary health insurance cover specific treatments such as osteopathy? Yes, Allianz offers reimbursements for treatments such as osteopathy, depending on the guarantees taken out.

How to compare the different complementary health offers? To choose wisely, it is advisable to examine the reimbursement levels, ceilings and benefits covered by each health insurance.