|

IN BRIEF

|

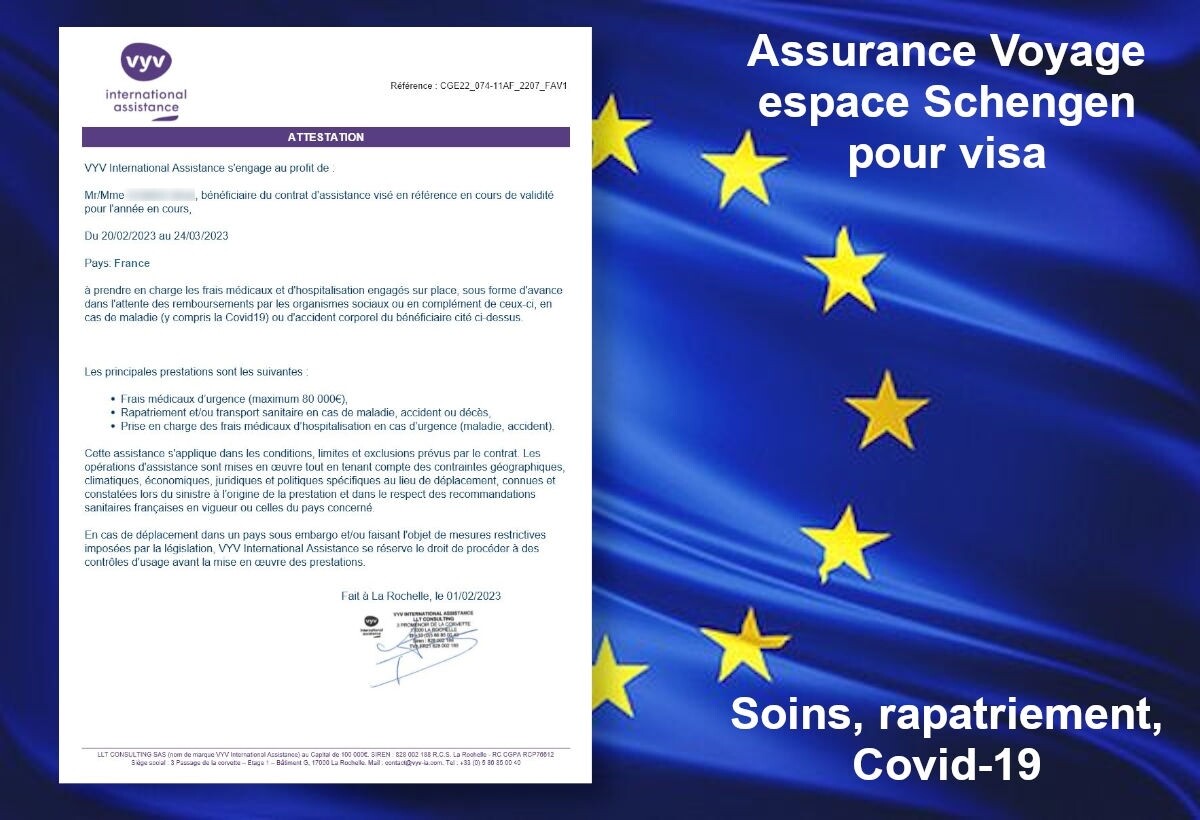

When traveling abroad, it is essential to take care of your health and your security. A mutual travel insurance adapted can make all the difference in the event of a medical problem. By choosing the right coverage, you can travel with peace of mind, knowing that you will be protected against the unexpected. Find out everything there is to know about your options mutual, possible refunds and practical advice to guarantee a peaceful experience during your stays abroad.

When you go abroad, have travel insurance is essential to protect you against unforeseen medical emergencies. Your health should be a priority, no matter where you are in the world. This article presents the advantages and disadvantages of mutual travel abroad, in order to help you make the most informed choice for your next adventures.

Benefits

Cover medical expenses

One of the main advantages of subscribing to a mutual travel insurance is coverage of medical expenses. In the event of illness or accident, you will not have to worry about paying large sums of money up front. Your mutual insurance company can cover the costs of consultations, hospitalization or even necessary surgical procedures.

Access to a network of health professionals

Insurance companies often offer a network of healthcare facilities that they work with. This can make it easier for you to access quality care, wherever you are, and often gives you access to services tailored to your situation.

Repatriation assistance

In the event of serious illness or accident requiring an urgent return to France, some mutual insurance companies include coverage of medical repatriation costs, which is a guarantee of peace of mind during your travels.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Cost of contributions

One of the downsides to consider is the cost of dues. Some mutual insurance plans can be expensive, especially if you travel regularly. It is therefore essential to compare the different offers available to find the one that best suits your budget.

Possible exclusions of guarantees

Another potential constraint is that some mutual may have specific exclusions. It is crucial to read the general conditions carefully before subscribing, as certain treatments or activities (such as extreme sports) may not be covered.

Complexity of reimbursement procedures

Finally, the administrative procedures to obtain a reimbursement can sometimes be complex and lengthy. This may vary depending on countries and situations. Make sure you are well informed about the procedures to follow to avoid unnecessary stress during your trip.

Choosing the right mutual travel insurance abroad is essential to leave peacefully. Take the time to learn about the different offerings and make sure they meet your specific needs.

When traveling abroad, it is essential to understand the importance of mutual travel insurance. This coverage protects you against unforeseen medical events, allowing you to leave with peace of mind and fully enjoy your stay. In this article, we will explore the different facets of travel insurance, its advantages, and how to choose the best option for your travels.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Why take out travel insurance?

Accidents and illnesses can happen at any time, even when traveling abroad. Subscribe to mutual travel insurance allows you to protect yourself against often high medical costs, particularly in certain countries. By opting for a suitable mutual insurance policy, you benefit from adequate coverage which can include hospitalization costs, medical consultations, and even medical repatriation if necessary.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

What type of coverage for your trip?

The choice of mutual will depend on your destination. If you go to a country in the European Union, the European Health Insurance Card (EHIC) is essential, but it does not cover everything. In other countries, especially outside the EU, it is crucial to have a additional insurance to avoid unpleasant financial surprises. To learn more about the different types of coverage available, visit this link.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Essential guarantees to consider

A good mutual travel insurance must include several essential guarantees. These include coverage of medical expenses, repatriation costs, legal assistance abroad, and coverage of lost baggage. It is therefore important to review all the options offered by your mutual in order to choose the one that best meets your specific needs.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Steps to follow to be well covered

Before leaving, take the time to compare the different mutual available online. Use mutual insurance comparators to find the most advantageous option taking into account your destination and your personal situation. Remember to read the terms and conditions carefully to avoid hidden fees. Click here to access a detailed method on creating your cover abroad: Mutual Advice.

The risks of traveling without mutual insurance

Travel without mutual may pose considerable risks to your health and your wallet. Indeed, medical costs abroad can quickly become prohibitive. You may be required to advance large sums and not be reimbursed if your coverage is insufficient. To avoid this, it is strongly recommended to take out mutual insurance before hitting the road. For more information on risks, visit this site: Risks to be aware of.

Preparing for a trip abroad involves taking into account several elements, with the mutual travel insurance at the top of the list. By following these tips and being proactive in your search for coverage, you can ensure a stress-free and safe stay.

Being well covered when traveling abroad is essential to avoid unexpected medical hassles. A mutual travel insurance protects you against unexpected health costs and ensures your well-being during your international stays. Here’s everything you need to know to choose the ideal blanket.

Why is mutual insurance essential?

When you go abroad, medical expenses can quickly add up, especially in the event of an accident or illness. A travel insurance is essential to avoid having to pay large amounts that could weigh on your budget. In addition, some countries may not accept your social security card, making adequate coverage necessary.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

How to choose your travel insurance?

Before you leave, it is crucial to compare the options available for your travel insurance. Take into account your destination, as the level of coverage can vary. For stays in Europe, a European Health Insurance Card (EHIC) is often sufficient, but for other destinations, opt for more comprehensive insurance.

Essential guarantees to consider

Your travel insurance should cover hospital expenses, medical care, consultations and, in some cases, medical repatriation. Be sure to also check coverage for dental care and ambulance costs, which can often be overlooked but which, in an emergency, prove crucial.

Reimbursement of care and procedures

The reimbursement system depends on your mutual insurance company and the destination. Find out about the procedures to follow to be reimbursed for your medical expenses. It may be useful to keep all receipts and documents. In general, reimbursement can be done upon presentation of the invoices upon return, so be organized.

The risks of traveling without mutual insurance

Traveling without adequate mutual insurance exposes you to significant risks. A simple accident or an unexpected illness can result in very high costs. In some destinations, these costs can be insurmountable. Don’t let a lack of coverage ruin your travel experience. For more information on the right mutual insurance companies for your trips abroad, explore these resources:

Mutual coverage abroad ,Why is travel insurance essential? ,Health insurance abroad , AndComparator of mutual travel insurance abroad .Guide to mutual travel abroad

Essential elements

| Details | Type of coverage |

| Includes medical care, hospitalization and reimbursement of expenses. | Destination |

| The guarantees vary depending on whether you are traveling in Europe or outside Europe. | European health insurance card |

| Essential for care in EU countries; avoids advance fees. | Medical repatriation |

| Check if your contract covers repatriation if necessary. | Exclusions |

| Find out about the specific conditions and exclusions of each contract. | 24/7 support |

| A support service that can be crucial in the event of a medical problem. | Reimbursement procedures |

| Know the procedures for rapid and efficient reimbursement. | Comparison of mutual insurance companies |

| Use online comparators to choose the best financial option. | discover our foreign travel mutual insurance, ideal for protecting your projects while offering you complete coverage during your international travel. benefit from appropriate assistance and travel with peace of mind. |

Marie, 32 years old, regular traveler

: During my last trip to Spain, I decided to opt for amutual travel insurance . I had a slight infection and was able to see a doctor without stress. Thanks to my mutual insurance, I was quickly reimbursed for my medical expenses. This really allowed me to enjoy my vacation peacefully, without worrying about unexpected expenses.Thomas, expatriate in Australia

: As an expatriate, I quickly understood the importance of having good health coverage. Mymutual insurance abroad covered me for all my medical care. Even outside the framework of French Social Security, I was able to benefit from satisfactory reimbursement. It’s an essential comfort that every traveler should consider before leaving. Sophie, exchange student abroad

: Before going on a university exchange, I was worried about my health coverage. After making a comparison ofmutual , I chose an option that well covered care abroad. One day, I needed to go to the hospital, and I simply presented my health insurance card. Everything went well, and I was reimbursed without any problem. It really made my stay easier.Julien, globetrotter

: As I frequently travel around the world, the issue of health safety concerns me a lot. Before each trip, I take the time to check theguarantees of my mutual insurance. During my last trip to Thailand, I had to seek treatment following a minor accident. Fortunately, the coverage was adequate, and I was able to get treatment quickly. I will never leave without my mutual travel insurance .Clara, mother

: Organizing a trip abroad with children can be stressful. By subscribing to amutual insurance for travel , I was able to guarantee better protection for my entire family. Our trip to Portugal went very well, and we were covered for a small sporting incident. Thanks to mutual insurance, we were able to receive care without disproportionate costs. This is something I highly recommend to all traveling parents.When considering going abroad, it is essential to think about your

mutual travel insurance . In fact, adequate coverage protects you against unforeseen medical emergencies that could arise during your travels. This guide will provide you with all the information you need to choose the mutual insurance company suited to your needs, informing you about guarantees, reimbursement procedures and practical advice for traveling with peace of mind.Why take out travel insurance abroad?

Travel without

mutual can be risky. Medical costs abroad can be very high, and most basic health insurance plans do not cover care outside the home country. A mutual travel insurance thus offers you essential financial protection in the event of illness, accident or hospitalization in a foreign country. The different coverage options

There are several types of coverage that a

mutual travel insurance . This may include health and hospitalization costs, as well as medical repatriation. Therefore, it is crucial to fully understand your specific needs based on yourdestination and the length of your stay. Essential guarantees to consider

Before choosing your mutual insurance company, take into account the following guarantees:

Medical expenses:

- Check that the mutual covers a wide range of medical care including consultations, medications and emergency procedures. Repatriation :

- In case of urgent need, make sure that your mutual insurance company covers repatriation to your country of origin. 24/7 support:

- Assistance available at all times is crucial for receiving advice and help in emergency situations. Understanding reimbursement for care abroad

The reimbursement system varies from

destination to another. In most European Union countries, the European Health Insurance Card (EHIC) can entitle you to reimbursement of your health costs. However, outside of Europe it may be necessary to make an advance payment and then request reimbursement on your return. Find out about country-specific procedures before you leave. Tips for choosing the right travel insurance

To choose the mutual insurance company that suits you, it is recommended to:

Compare offers:

- Use online comparators to evaluate different mutual insurance companies and choose the one that offers the best value for money. Read the reviews:

- Take a look at other travelers’ reviews of mutual insurance to find out their experience. Check exclusions:

- Become aware of situations or types of care that are not covered by mutual insurance. Prepare before departure

Before you travel, make sure you have a copy of your

mutual contract and an assistance card, if available. Also remember to find out the contact details of health centers near your place of stay. If problems arise, knowing your resources can save you a lot of hassle. In short, international travel insurance is an essential element to take into account before embarking on your adventures. Adequate coverage will allow you to travel with peace of mind, knowing that you are protected against unforeseen medical emergencies.

discover our foreign travel mutual insurance for optimal protection during your travels. benefit from comprehensive health coverage, repatriation assistance and peace of mind, wherever you are in the world. leave calmly and safely.

mutual travel insurance adapted allows you to travel with peace of mind, knowing that you are protected against unforeseen medical emergencies. Before you leave, it’s crucial to assess your specific needs based on your destination, as healthcare costs can vary significantly from country to country. To choose your mutual insurance, start by making an online comparison. This will help you find a

cheap mutual insurance that meets your requirements. If you are traveling to Europe, the European Health Insurance Card (EHIC) may offer you some coverage, but it is recommended to check whether this is sufficient depending on the care you may require there. THE

essential guarantees to consider include reimbursement of medical care, medical repatriation and assistance in the event of an accident. Pay attention to the general conditions of your contract which specify what is included or excluded depending on the various medical contexts. Don’t forget to pay particular attention to the length of your stay, as some mutual insurance companies have a time limit. Finally, it is important not to underestimate the risks associated with traveling without adequate coverage. If you need medical care abroad, costs can quickly add up. To avoid unpleasant surprises, a good

mutual travel insurance is a valuable investment that will allow you to fully enjoy your stay. Unforeseen events can arise, so be prepared to travel with peace of mind. FAQ about travel insurance abroad

What is the importance of mutual travel abroad?

To travel peacefully, it is essential to have a mutual which covers health costs abroad. This helps avoid unexpected expenses in the event of illness or accident. How to choose mutual insurance for a trip abroad?

It is crucial to take into account your destination and the guarantees offered by the mutual insurance company. Compare the options available online to find the coverage that suits you best. Does the mutual insurance company cover care abroad?

Yes, most mutual insurance companies can cover the costs of medical care abroad, depending on the agreements between France and the country visited. What steps should I take in the event of care abroad?

Depending on your destination, you will often only need to present the European Health Insurance Card (EHIC)to be reimbursed, or to follow the protocols of your mutual insurance company. Is medical repatriation covered by my mutual insurance company? The possibility of

medical repatriation depends on the conditions of your mutual insurance company. It is therefore important to check the specific mentions on this subject in your contract. Do you need additional insurance in addition to the mutual insurance company to travel abroad? This depends on the guarantees of your

mutual insurance company. Some insurance supplements the mutual insurance coverage for unforeseen events that may occur during your trip.How does the coverage vary depending on the destination? The terms of the coverage

may change depending on where you are traveling, particularly between countries in the European Union and those outside Europe. How can I find out about my mutual insurance’s guarantees for abroad? Consult the general conditions of your mutual insurance contract

or contact their customer service to obtain details on the specific guarantees abroad.