|

IN BRIEF

|

The prices of the AXA mutual insurance are often a source of questions for many policyholders, keen to find health protection suited to their needs and their budget. Understand the criteria which influence the price of your complementary health is essential to making an informed choice. Whether you are a young worker looking for an economical option or an elderly person wanting optimal guarantees, AXA offers varied and flexible packages, from €9.04/month. Let’s find out together the different levels of cover, the reimbursements available and what you need to know to select the best offer that meets your expectations.

AXA mutual insurance stands out for its varied range of offers which adapt to the specific needs of each insured person. Whether you are a young worker, a family or a senior, AXA offers competitive rates which take into account your profile as well as level of guarantees wish. In this article, we will explore in detail the benefits And disadvantages rates from AXA mutual insurance to help you make the best choice in terms of complementary health insurance.

Benefits

Flexibility of offers

AXA offers a à la carte health insurance, allowing you to choose the guarantees that best suit your needs. Prices start from €7.32 per month for basic formulas and can go up to €73.73 for complete coverage. This flexibility is a major advantage for policyholders who wish to avoid paying for services that they will not use.

Attractive reimbursements

THE refunds offered by AXA are particularly competitive. For example, you can benefit from up to €520 reimbursed in optics And €450 in dental. These amounts demonstrate the effectiveness of the coverage, providing peace of mind to policyholders.

Access to free quotes

It is easy to obtain a free online quote, thus allowing total transparency on prices and services. This allows you to compare the different options before making an informed choice. You can consult the offers from AXA mutual on their official website here.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Variable contributions depending on profile

THE prices of AXA mutual insurance can vary considerably depending on your age, your family situation and your place of residence. For example, a 25-year-old single man living in Paris can pay €33.43 per month, while a 30-year-old single woman in Lille could be offered a rate of €41.02 per month. These differences can affect the budgets of policyholders.

Complexity of options

Although the modularity of the offers is a advantage, it can also be perceived as a inconvenience because of the complexity of the choices to be made. Policyholders must spend time selecting the appropriate coverage, which can be confusing for some.

Warranty Exclusions

Finally, some policyholders may be disappointed by possible exclusions from guarantees which are not always clearly indicated. It is essential to read contract conditions carefully to avoid unpleasant surprises during reimbursements. For more information, you can consult AXA mutual reviews on comparison sites here.

AXA mutual offers a diversified range of prices in order to meet everyone’s needs. Whether you are a student, working or senior, AXA adjusts its offers according to your profile, of the guarantees chosen and the specificities of your health expenses. Discover the elements that influence the cost of your complementary health insurance and the options available to make the best choice.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Criteria for calculating rates

When it comes to determining the price of your complementary health, several criteria are taken into account. Among the most important are your profile, which includes your age, marital status and location, as well as the level of guarantors that you select. Other elements such as management fees can also influence the amount of your contribution.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

A free online quote for an informed choice

To help you make a decision, AXA offers a free online quote. This allows you to obtain a personalized estimate of your health insurance from €9.04 per month. Do not hesitate to explore this opportunity to understand the examples of reimbursements that apply to your medical expenses.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The different price ranges at AXA

AXA mutual health insurance prices vary depending on the offers chosen. We can find plans starting from €32.50 per month, while more complete options can reach €73.73 per month. For young adults, for example, coverage can start around €33.43 per month in Paris. These prices are adjusted according to the desired guarantees.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Reimbursements offered

THE refunds offered by AXA are also a key element to take into consideration when choosing your mutual. For example, support for fee overruns for hospital care is partial, but it is accompanied by advantageous packages of up to €520 for optical deadlines and €450 in dental.

Additional options to personalize your coverage

AXA allows you to personalize your mutual health insurance thanks to additional options. Whether to strengthen hospitalization care, or to better cover your current care, you have the flexibility to adapt your contract to your specific needs. This helps you find the best solution economic while ensuring a good level of protection.

To further explore AXA pricing, check out these resources: doctor prices, AXA reviews and guarantees, and to learn more about free quote settings, visit Mutual My Health.

AXA mutual insurance offers a wide range of rates and guarantees adapted to everyone’s needs. Whether you are young, senior, student or family, understand the criteria that influence the cost of your complementary health is essential. In this article, learn pricing details, coverage levels, and tips for choosing the best option for you.

The pricing criteria of AXA mutual insurance

The price of your complementary health AXA depends on several key elements. Among them, your profile, which includes your age, family situation, and place of residence, plays a major role. In addition, the level of guarantees chosen will also influence the final cost. Another factor to take into account is management fees, which vary depending on the offers.

Examples of rates

To give you an idea of the prices charged by AXA, here are some examples: an entry-level offer starts around €32.50/month, while more comprehensive coverage can reach up to €73.73/month. For example, a 25 year old single man living in Paris can expect a rate around €33.43/month, while a 30-year-old woman in Lille can see her cost be around €41.02/month.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

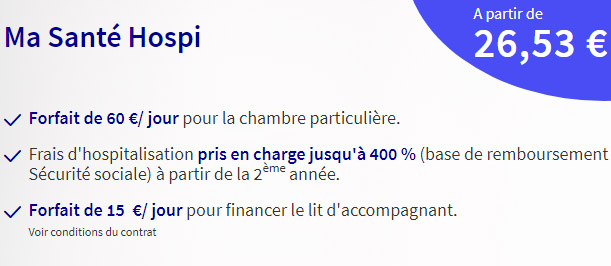

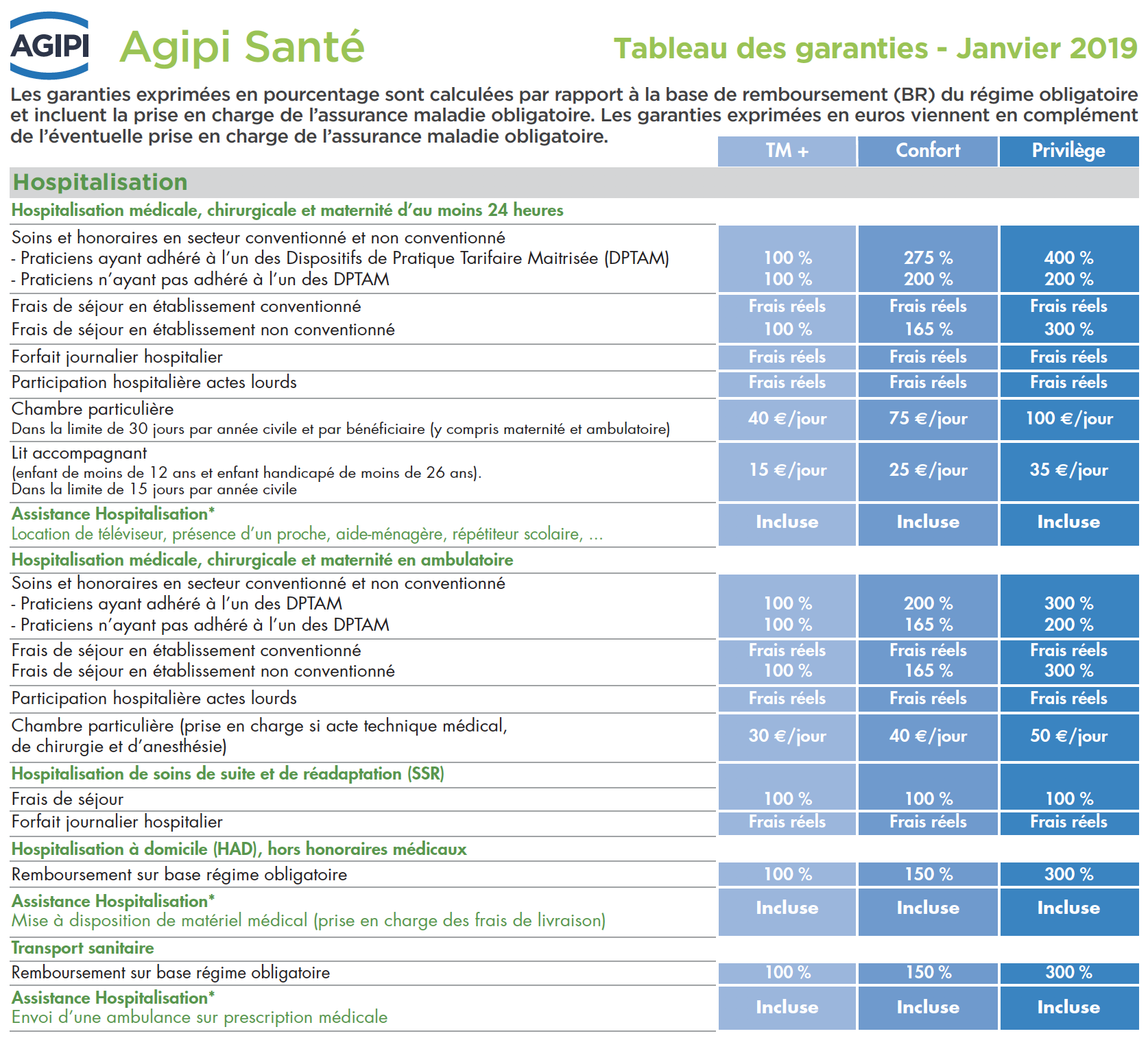

Guarantees included in the prices

AXA offers several plans adapted to your health needs. Depending on the offer selected, reimbursements can reach up to 400% in hospitalization, and notable amounts in optics (up to €520) and dental (up to €450). These guarantees ensure a good level of coverage for your health expenses, whether for routine care or hospital costs.

Free online quote

To better understand your options and associated costs, do not hesitate to request a free online quote on the AXA website. This will allow you to obtain a precise and personalized estimate of your complementary health, and compare the different formulas according to your expectations and your budget.

Modular options and customization

AXA mutual insurance stands out for its flexibility and modular options. You can choose to add guarantees according to your specific needs. For example, if you want higher dental or optical reimbursements, this can be integrated into your contract at a reasonable additional cost.

Impact of Social Security coverage

It is also important to know the impact of Social Security reimbursements on your mutual insurance rate. The reimbursement basis is generally €25, and 70% of this is covered by Social Security, which means that your mutual insurance company must supplement the rest to ensure optimal coverage.

Compare and choose wisely

Before making your decision, don’t forget to compare the different offers available on the market. Use online comparison tools to evaluate different prices, guarantees and reimbursement levels. This will allow you to choose the contract that best suits your health needs while respecting your budget.

To learn more about refunds, you can view detailed information here and for the precise calculation of your mutual insurance here.

Finally, do not hesitate to explore the guarantee and reimbursement tables here for a clear vision of what AXA can offer you.

Comparison of AXA mutual insurance prices

| Type of coverage | Description of rates |

| Basic formula | From €7.32/month, ideal for young adults. |

| Standard formula | Average price at €51.77/month with a good level of guarantees. |

| Premium formula | From €73.73/month, maximum coverage with no outage. |

| Hospitalization | Covers up to 400% of the reimbursement basis. |

| Routine care | Reimbursement up to 100% of the reimbursement basis. |

| Optical | Reimbursement up to €520 per year. |

| Dental | Reimbursement up to €450 per year. |

| Senior rate | Adapted prices, from €32.50/month. |

| Assistance | Included in certain coverage plans. |

Testimonials on AXA mutual insurance prices

I recently became a customer of AXA mutual insurance and I would like to share my experience regarding prices. As a young man of 25, single, living in Paris, I opted for a plan at €33.43/month. I was pleasantly surprised by the value for money. For this rate, I benefit from correct coverage which allows me to manage my health expenses.

My sister, who is 30 years old and lives in Lille, chose a slightly more complete formula. For €41.02/month, she has access to a wide range of guarantees and of refunds, particularly for dental and optical care. She told me that she felt more serene since she took out this mutual insurance, because the level of support is really satisfactory.

A close friend chose the most economical offer from AXA, namely €32.5/month. Although he was a little skeptical at first about the level of coverage, he was surprised to discover that the reimbursements met his expectations. He was able to benefit from support for current expenses which allowed him not to have too much impact on his budget.

As for me, I also appreciated the fact that we could count on health insurance à la carte from €9.04/month. This shows that AXA offers options for every budget, regardless of one’s personal situation. This is an approach that seems really advantageous to me, especially at this time when it is essential to control your expenses.

Finally, I noticed that the management fees are reasonable and transparent, which adds to my satisfaction. The accessibility of prices and the clarity of the formulas make it possible to find an option adapted to each need without too much difficulty and this is what really makes the difference for policyholders.

In a world where health is essential, it is essential to choose your complementary health insurance carefully. AXA mutual insurance prices vary depending on several criteria, including your profile, the desired level of guarantee and the associated management fees. In this article, we will provide you with detailed information on the pricing options offered by AXA, so that you can make an informed choice for your health and that of your loved ones.

Criteria for calculating prices

To determine the price of your complementary health insurance at AXA, several factors are taken into account. First of all, there is your profile personal: your age, your family situation and your place of residence are crucial elements. For example, prices can vary considerably between a young single living in Paris and a family with children living in the provinces.

Then, the level of guarantees that you wish to subscribe also influences the amount of your contribution. AXA offers several plans, ranging from basic offers to more comprehensive options that cover a wide range of care, including hospitalization, routine care and many others.

The prices offered by AXA

AXA offers flexible solutions adapted to every need. THE monthly contributions start from 7.32 euros, which allows access to minimum guarantees, and can go up to 73.73 euros for maximum coverage without any charges. You can choose a formula according to your budget and your expectations.

For example, for a 25-year-old man living in Paris, the rate could be 33.43 euros per month, while a 30-year-old woman living in Lille could subscribe to complementary health insurance at 41.02 euros per month. These differences illustrate the importance of considering your personal situation when selecting a mutual insurance company.

Reimbursements offered

One of the most important aspects of a mutual health insurance is its system of refund. AXA has put in place attractive packages offering substantial reimbursements for various types of care. For example, you can benefit from reimbursement of up to 520 euros for optical expenses and up to 450 euros for dental care.

The guarantees also include partial coverage for excess fees and immunized packages for hospitalization. So, even in the event of high medical expenses, AXA ensures that you are not too heavily impacted financially.

Access personalized quotes online

To find the offer that best suits you, AXA offers a free online quote. This service allows you to obtain a price estimate based on your profile and your specific needs. In just a few clicks, you can evaluate the different options and choose the one that suits you best, without obligation.

This online accessibility also makes it easier to compare the different options available, allowing you to make an informed decision regarding your complementary health.

Thanks to its varied range of formulas and its excellent coverage, AXA presents itself as a serious alternative in the field of mutual health insurance. Analyzing prices based on your profile and the desired guarantees is essential to guarantee your well-being and that of your loved ones. Take advantage of online quotes to discover the offer that best suits you.

Choosing complementary health insurance is a major issue in ensuring optimal protection of your health and that of your loved ones. Thus, knowing the AXA mutual insurance rates is essential. AXA’s offers come in several levels, ranging from economical formulas to more comprehensive options, adapted to different profiles and needs.

Prices start around 7.32 euros per month for basic blankets. Furthermore, prices can vary significantly depending on numerous criteria, such as age, place of residence and the level of guarantees chosen. For example, a 25-year-old man living in Paris can subscribe to AXA mutual insurance for around 33.43 euros per month, while a 30-year-old woman in Lille could pay 41.02 euros per month.

THE guarantees offered are modular, allowing everyone to personalize their contract according to their specific needs. Whether for routine care or more specific aspects such as hospitalization, dental or optical reimbursement, AXA provides you with a variety of options. You can benefit from high reimbursements going up to 520 euros for optics and 450 euros for dental, depending on the plan chosen.

It is therefore advisable to carry out free online quotes to compare the different options and narrow down your choice. Thanks to a clear and accessible offer, AXA makes it easier to understand prices and guarantees to allow you to choose the complementary health insurance best suited to your situation.

FAQ on AXA mutual insurance rates

What is the price of AXA mutual insurance? AXA mutual insurance prices vary depending on the plans chosen. For example, the lowest offer starts from €32.5/month, while the average offer is around €51.77/month and the high offer reaches €73.73/month.

What criteria influence the price of my complementary health insurance? Several criteria come into play in calculating the price of your complementary health insurance, in particular your profile, THE level of guarantees desired, as well as the management fees.

Can I get a free quote for my AXA mutual insurance? Yes, AXA offers free online quotes, allowing you to find the health insurance that best suits your needs à la carte, from €9.04/month.

What services are reimbursed by AXA mutual insurance? AXA offers various reimbursements, such as up to €520 for optics, €450 for dental, and partial coverage for excess fees, depending on the plan chosen.

What are the different packages offered by AXA? AXA offers modular plans ranging from basic coverage to enhanced options, allowing you to choose the level of refund adapted to each situation.

How do I determine which mutual insurance company is best suited to my needs? To choose the mutual insurance company that will suit you best, it is advisable to evaluate your health expenses and compare the guarantees offered by the different formulas.

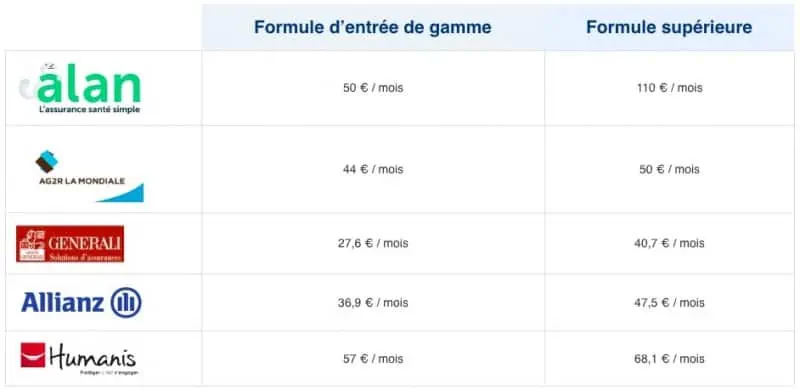

Are AXA mutual insurance rates competitive compared to other insurers? AXA’s prices are generally competitive and their plans are designed to meet a wide variety of needs, which allows informed choice.