|

IN BRIEF

|

At a time when health occupies a preponderant place in our lives, choosing the right mutual health insurance becomes essential. The offers are multiplying and it can be difficult to navigate. Among the major players in the sector, Groupama offers tailor-made quotes that adapt to each profile, whether you are a senior, with family or single. But how do you navigate this ocean of options to select the coverage that best meets your needs? Let’s decipher together the key steps to optimize your choice and benefit from the advantages of Groupama’s mutual health insurance.

Navigate the world of mutual health insurance can sometimes resemble a real obstacle course. Between coverages, prices and options, it’s essential to understand how to choose the coverage that’s best for you. This article presents the advantages and disadvantages of Groupama mutual quote, in order to enlighten you in your decision.

Benefits

The first advantage of the Groupama mutual health insurance lies in the diversity of its offers. Whether you are senior, Single or family, Groupama offers packages adapted to the specific needs of each profile. By browsing their site you can get a online quote in just a few clicks, saving you valuable time.

Another unmissable advantage is the ability to adjust your reimbursement location level. Thanks to the different levels of guarantees, you determine how much you wish to pay for your medical expenses. For each position (hospitalization, optical, dental, etc.), you will be able to choose the coverage that is closest to your needs, while taking into account your budget.

In addition, Groupama offers a decreasing price which could appeal to families. In fact, from the second insured, a reduction of 5% applies. This detail can make the difference if you are looking to insure several members of your household without breaking your budget.

Disadvantages

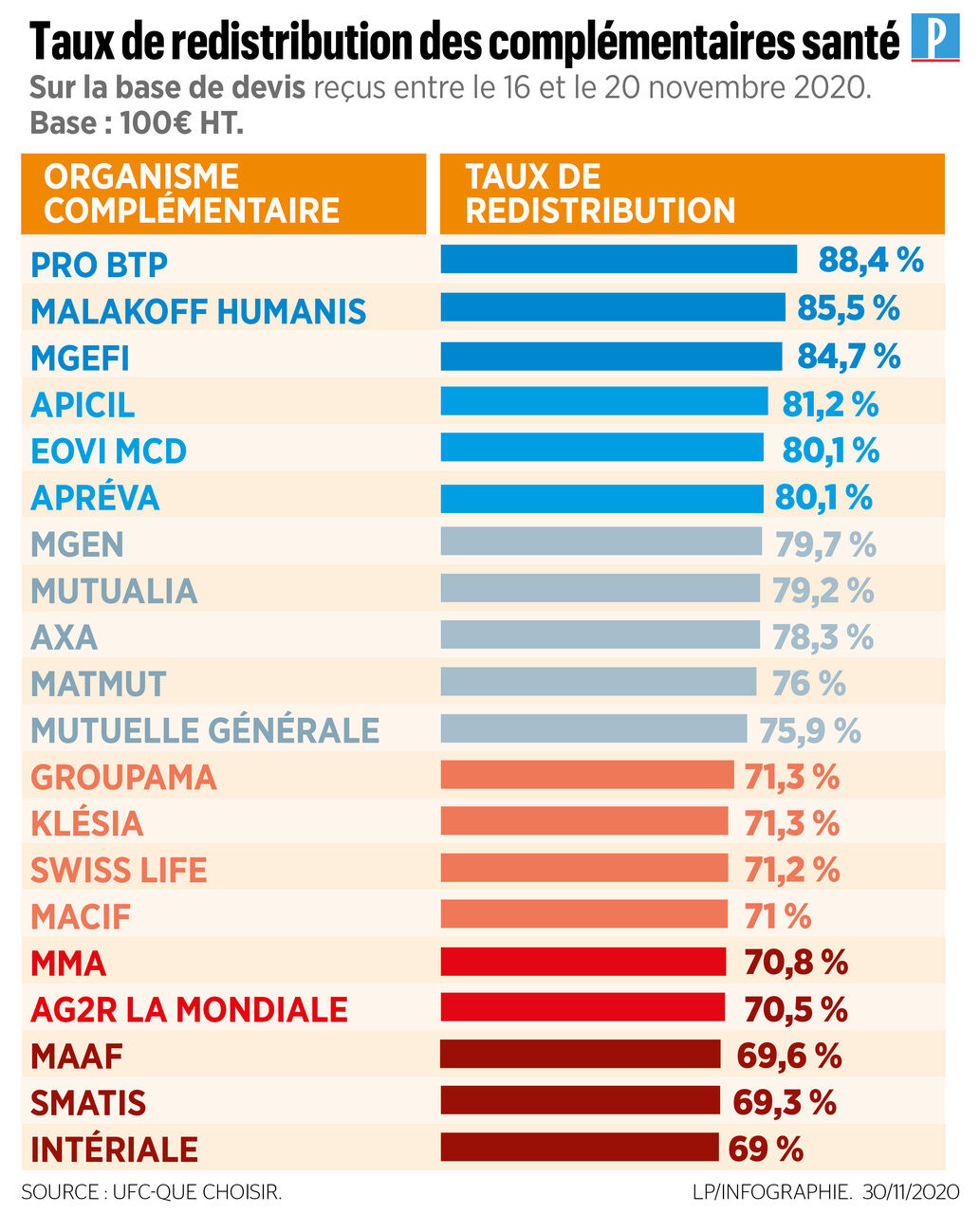

Despite its advantages, Groupama mutual health insurance also has some disadvantages to consider. First of all, the price of contributions may be considered high compared to certain competing offers. It is therefore crucial to compare the prices offered to those of other companies to avoid unpleasant surprises. Use comparators like those found here can help you evaluate the market.

Then, although Groupama offers different levels of guarantees, there can be a certain complexity in reading the contracts. It is essential to read the general conditions to capture exclusions and limitations. A misunderstanding could lead to disappointments when it comes to reimbursements.

Finally, one last point to note is customer service. While most policyholders report positive experiences, some testimonials mention fairly long response times in the event of a dispute or questions about the contract.

In short, choose the mutual health insurance which suits you requires careful analysis, in particular of the quotes offered by Groupama. By considering both the pros and cons, you will be able to select the coverage that best meets your needs. Don’t forget to check out the options available on the Groupama website here to find out more about reimbursements and guarantees adapted to your situation.

Choose the better health coverage is a crucial step to guarantee optimal coverage of your medical costs. With Groupama, you can create a quote for your mutual health insurance online, in just a few clicks. This article guides you through the process of selecting the right coverage for your needs with quotes and practical advice.

Why choose Groupama?

Groupama offers a wide range of formulas mutual health insurance, offering varied guarantees depending on your expectations. Whether you are a senior, a family or a single person, Groupama has a solution for everyone! By subscribing to their mutual insurance, you also benefit from an advantageous rate, including a 5% reduction from the second insured. Benefits that deserve to be explored closely!

How to get a quote online?

To obtain a mutual quote online with Groupama, simply go to their official website and follow the steps indicated. In just a few clicks, you can define your needs, select the desired guarantees and view the associated prices. For more information, visit this link.

Identify your needs

Before you start looking for your complementary health, it is essential to analyze your specific needs. Take into account your personal and family situation, as well as your healthcare consumption habits. This will help you choose the reimbursement level that suits you best and avoid unnecessary expenses.

Criteria to consider

When making your selection, several criteria must be examined to ensure an informed choice:

- Coverage levels: Various options are offered according to your needs, whether to consult a specialist or for dental care.

- The amount of contributions: Compare the prices of the different plans, keeping in mind that they may vary depending on the age and status of the insured.

- Reimbursement deadlines: Check how quickly your expenses will be reimbursed, a key factor in avoiding financial inconvenience.

Compare offers

To ensure that you are making the best choice, do not hesitate to use insurance comparators. These allow you to quickly evaluate the different offers of mutual health insurance, including those of Groupama. Additionally, it is often a good idea to check online reviews to learn about the experiences of other policyholders. You can consult these reviews.

In summary, choose the best mutual health insurance at Groupama requires identifying your needs, comparing offers and making a suitable quote. With these elements in hand, you will be able to select the coverage that will give you peace of mind and optimal health protection. Don’t wait any longer to discover Groupama’s offers and get your quote on their website !

Choosing health insurance can seem like a real obstacle course, especially with all the options on the market. But don’t worry! This article guides you through the different steps to select the health coverage adapted to your needs, in particular thanks to the Groupama mutual quote. We will explore together the essential criteria to consider to make the best choice, while allowing you to benefit from the advantages offered by this renowned mutual insurance company.

Identify your specific needs

Before diving into the world of quotes, start by identify your health needs. Consider your medical habits, the care you or your family may need, and the frequency of those visits. For example, if you are a fan of regular visits to the doctor, a extended coverage is recommended. A good assessment of your requirements will help you avoid paying for unnecessary guarantees.

Compare quotes online

To obtain the best price, it is recommended to compare quotes online. Groupama offers an online simulator that allows you to view several formulas in a few clicks. Just click on this link to make your free mutual health quote. Taking the time to review the different options is essential to finding the one that best fits your budget.

Analyze guarantees and prices

THE guarantees offered by Groupama vary from one plan to another. Be sure to carefully examine what is covered: consultations, hospitalizations, dental care, and optics are among the essential items. Don’t forget to compare the prices offered for each level of coverage. It’s a good idea to opt for a plan that offers the best value for your money, especially if you plan to ensure the health of your loved ones in the future.

Think about discounts and benefits

Another tip for choosing your mutual is to inform yourself about the discounts and benefits offered. Groupama, for example, offers a 5% reduction from the second insured in your contract. This can be particularly beneficial if you plan to cover your entire family. Also ask about additional services, such as health advice, that are often included with some plans.

Check reviews and comments

Do not hesitate to consult the reviews from other customers concerning the Groupama mutual insurance company. Sites like GoodAssur offer you feedback which can be very revealing. For example, on the platform Opinion-Insurance, you will be able to discover the strengths and weaknesses of this mutual. This will give you a clearer idea of what to expect.

In summary

Choose the right one mutual health insurance requires time and thought. By identifying your needs, comparing quotes and analyzing all the guarantees, you will be on the right path to making an informed choice. Don’t forget to check the benefits and consult the opinions of other policyholders for even safer support. For more details on the senior mutual insurance Groupama or other options, explore the available resources!

Comparison of criteria for choosing Groupama mutual health insurance

| Criteria | Advice |

| Contribution prices | Compare prices for different plans. |

| Coverage level | Choose the level that matches your medical needs. |

| Refunds | Review the reimbursement rate for routine care. |

| Guarantee for seniors | Opt for guarantees adapted to the needs of retirees. |

| Additional options | Check out options for dental and vision care. |

| Family discounts | Take advantage of discounts for additional members. |

| Online services | Use online account management services. |

| Opinions of policyholders | Check reviews to gauge customer satisfaction. |

Testimonials on choosing the best health coverage with Groupama

Choose one mutual health insurance can be like a real treasure hunt, especially with the many options available. For example, Julie, a young mother of two children, wanted to find a blanket suitable for her family. She says: “After comparing several quotes, I opted for Groupama because their offer was clear and well structured. The prices were competitive and the guarantees corresponded to our needs.” His experience highlights the importance of identifying your family’s needs before choosing a mutual insurance company.

For his part, Marc, a retired senior, shares his discovery of mutual health quote online: “I was pleasantly surprised by the simplicity of the process at Groupama. In a few clicks, I was able to create a quote for my mutual insurance company and contextualize the guarantees that I really needed. This allowed me to better understand what suited me.” The digital experience can be an essential link for seniors, don’t hesitate to explore it!

Claire, an active single, also wanted to give her opinion. “I had a bunch of criteria in mind: the level of reimbursement, the price of contributions, and also the possibility of reducing my expenses. Groupama offered me appropriate levels of guarantees. Thanks to the clear advice, I was able to make an informed choice.” She highlights the importance of clearly defining your priorities to find the best health insurance.

Finally, Louis, an expatriate living abroad, saw things differently. “Obtaining a mutual quote with Groupama was a lifesaver. I needed coverage that included international care. Their flexibility and the options they offer allowed me to find the ideal solution and adapted to my specific needs.” His testimony demonstrates that Groupama also meets the expectations of policyholders living outside French borders.

In summary, whether you are a family, a senior or a young worker, the Groupama health quote appear to meet a variety of needs and help you choose the right coverage. Don’t hesitate to explore the different offers to find the one that suits you best!

Choose one mutual health insurance adapted to its needs is an essential and sometimes complex task. In this article, we guide you through the key steps to get a quote from Groupama and optimize your health coverage. Whether you are a senior, a family or a single, our goal is to help you make the best choice.

Identify your specific needs

Before you start looking for a quote, it’s crucial to determine what your healthcare needs are. Ask yourself questions such as: what types of medical care do you use most often? Do you have special needs such as frequent consultations with a specialist or dental care?

By taking these elements into account, you will be able to better direct your choice towards an offer that adequately covers your needs. Thinking about the future is also important; If you are nearing retirement or have family members with specific needs, be sure to include them in your thinking.

Understand the formulas offered by Groupama

Groupama offers several packages adapted to different profiles. These formulas are classified into guarantee levels. This means that the more options you subscribe to, the more your healthcare costs will be covered. Take the time to review each tier and compare what it offers.

Don’t be intimidated by technical jargon! Terms such as “annual commitment”, “100% healthcare costs” or “reimbursement cap” should be clarified before finalizing your choice. Contact an advisor if necessary for full explanations of warranties.

Compare contributions and reimbursements

When evaluating quotes, it is essential to look not only at the amount of the contributions but also the reimbursement rate. Some mutuals, although cheaper, may offer low reimbursements which could cost you in the long run.

Groupama offers a 5% reduction from the second insured person in the same contract, which can be advantageous for families. Do not hesitate to simulate quotes online to compare different options and see what seems most interesting to you in terms of value for money.

Opinions of policyholders

Before committing, consult the reviews from current customers from Groupama. Testimonials can be very revealing about the quality of after-sales service, reimbursement times and the overall satisfaction of policyholders. Comparative studies of mutual health insurance companies can also give you an idea of Groupama’s performance compared to other players on the market.

Finalize your choice with peace of mind

Once you have assessed your needs, understood the formulas, compared contributions, and taken into account the opinions of other policyholders, you are ready to make your choice. Do not hesitate to request quotes online for Groupama, allowing you to obtain real-time information on the available offers.

In short, choosing your health coverage with Groupama requires rigor and reflection. Take the time necessary to explore the different options to ensure optimal health protection for you and your family.

Conclusion on the choice of health coverage with Groupama

Choose the best health insurance is a crucial step to guarantee adequate protection against the vagaries of life. When we examine the mutual quote offered by Groupama, it is essential to take into account several key criteria in order to make an informed choice. Whether you are a senior, a family or a Single, each profile has specific healthcare needs that are worth considering.

Before committing, it is strongly recommended that youidentify your specific needs and those of your family members. This will allow you to request suitable quotes and compare the guarantees offered. The diversity of coverage levels at Groupama is an asset, allowing you to adjust the level of support to your budget. In addition, take advantage of reductions for several policyholders which can reduce your bill if you subscribe for several members of the same family.

Another variable that should not be overlooked in your thinking is the level of customer satisfaction. Reviews from current policyholders can provide valuable insight into the pros and cons of different plans. By combining the analysis of prices, of the guarantees, and feedback, you will position yourself to make a relevant choice.

In summary, obtaining a health insurance quote from Groupama is quick and easy. By spending the time necessary to assess your real needs and compare offers, you will be able to select the coverage that will give you the peace of mind you need to fully enjoy your health.

FAQ on Mutuelle Groupama Quotes

How to get a mutual quote from Groupama? To obtain an online, real-time quote for Groupama’s complementary health insurance, simply visit their website and fill out a simple form.

What are the criteria to consider when choosing your health insurance? It is essential to take into account the price of contributions, reimbursement levels, the guarantees offered and your specific health needs.

Is it possible to make a quote for the whole family? Yes, Groupama allows you to create quotes suitable for seniors, families and even singles in just a few clicks.

What types of reimbursements does Groupama offer? By subscribing to Groupama’s mutual health insurance, you can opt for a level of care that corresponds to your budget and your medical requirements.

Are there any discounts when subscribing? Yes, policyholders benefit from a reduction of 5% from the second insured, which makes coverage more affordable.

How do I choose health insurance suitable for my retirement? It is recommended to select essential guarantees and to anticipate by opting for coverage that meets your future needs.

How do you know if Groupama is a good mutual? To assess whether Groupama is a good option, examine its customer reviews, its level of satisfaction, as well as the quality of its guarantees.

What are the advantages of Groupama’s mutual health insurance? Groupama’s mutual health insurance offers better coverage of medical costs, varied formulas and options adapted to almost all insured profiles.