|

IN BRIEF

|

Traveling abroad is a rewarding experience, but it is essential to be well prepared, especially when it comes to your health insurance coverage. Whether you are leaving for vacation, studies or a new job, know your rights and procedures regardinghealth insurance is crucial to ensure your security and peace of mind. In fact, the terms and conditions may vary depending on your Country of Residence and your status, making it essential to have a good understanding of the options available and possible steps to take before your departure. In this article, we will show you everything you need to know to easily navigate the world ofhealth insurance abroad.

When considering traveling or settling in a foreign country, the question of health insurance is essential. Understanding the different coverage options is essential to keeping you and your family safe during your stay. In this article, we’ll explore the pros and cons of overseas health insurance coverage, to help you make informed decisions.

Benefits

A health insurance coverage abroad offers several undeniable advantages. First of all, it guarantees rapid access to medical care, even in emergency situations. With good insurance, you can benefit from medical services quality without having to worry about the costs to be incurred. This greatly contributes to your peace of mind during your stay abroad.

Another advantage is the flexibility of the options available. Whether you are traveling on business, on vacation or abroad, you can choose coverage that meets your specific needs. Many insurance companies offer policies tailored to user requirements, ranging from minimum health protection up to comprehensive coverage including services such as medical repatriation and legal assistance.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, health insurance coverage abroad also has some disadvantages. First, cost can be a deterrent. Insurance premiums can vary significantly depending on the level of coverage desired and country of residence. It is essential to compare offers carefully to avoid paying too much for protection that may not be entirely necessary.

In addition, some countries may impose specific restrictions or exclusions regarding medical care cutlery. It is therefore crucial to read the conditions of your insurance policy carefully to avoid unpleasant surprises should the need arise. Administrative procedures can also be complex, especially if you have to navigate between the social security of your country of origin and that of the country in which you are.

In short, although overseas health insurance coverage is essential for your safety and well-being, it requires careful consideration of the options available and their implications. For more information on coverage depending on the country of stay and the specifics of each contract, do not hesitate to consult reliable resources such as those offered by health insurance experts.

When venturing abroad for work, study or even vacation, it is essential to learn about your health insurance coverage. Whether you are an expatriate or simply traveling, knowing your rights and your options will allow you to travel with peace of mind. This guide tells you everything you need to know to protect your health internationally.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Why is it important to have health coverage abroad?

The health system varies from country to country, and being protected when it comes to health is essential. Adequate coverage will save you a lot of worry in the event of illness or accident. It is crucial to understand what your current insurance covers and whether it includes treatment abroad.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The different health coverage options

Compulsory health insurance

Depending on the country where you settle, you could benefit from a compulsory health insurance. If you go to live in a country in the European Economic Area (EEA) or in Switzerland, you retain your rights to health insurance. However, it is necessary to find out how it works and what steps to take before leaving.

Private insurance

For those who do not have sufficient coverage or would like additional protection, a private health insurance may prove wise. This option allows you to obtain health care adapted to your needs, including services not covered by public insurance. To find out more about private insurance, you can consult this complete guide.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Rights and procedures

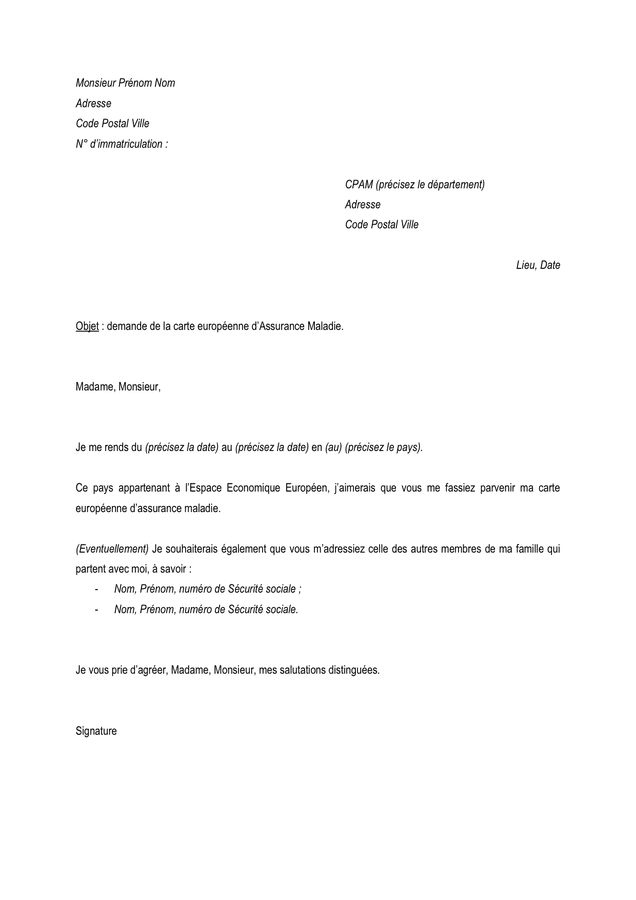

Before you leave, it is essential to know your rights and the steps to take. Be sure to ask for your European Health Insurance Card (EHIC), which will allow you to certify your rights and obtain care according to the legislation in force in the country of stay.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

What to do in case of health problems abroad?

In the event of illness or accident, it is crucial to know how to access healthcare. It is advisable to keep all medical documents and follow the reimbursement procedures related to your health insurance. In the event of complications, referring to your CPAM or your mutual insurance company can resolve potential problems. Practical advice can be found here: Administrative Guide.

Useful resources for your health coverage abroad

There are many resources to help you navigate the complexities of health insurance abroad. Specialized sites such as APRIL and Ambrelia provide essential information to choose the best coverage adapted to your situation.

Know the limits of your insurance

Before leaving, it is crucial to understand the limits of your coverage, including exclusions and reimbursement ceilings. This will allow you to avoid unpleasant surprises and plan your healthcare abroad effectively.

For a more comprehensive overview, also explore this guide to international health insurance and other resources available online.

When venturing outside your country, it is essential to understand the health insurance coverage that applies to your situation. Whether you are going on vacation, studying, or have decided to settle abroad, there are key things to know to ensure your health and peace of mind . This article will guide you through the various health insurance options available to you when you are abroad.Understanding your health insurance rights

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Your

rights to health insurance when you live abroad depend mainly on your country of residence and your status. If you move to a country in the European Economic Areaor to Switzerland , you do not lose your health insurance rights. Be sure to find out about yourspecific rights and the steps to take. European Health Insurance Card (EHIC) Before you leave, it is crucial to obtain the

European Health Insurance Card

(EHIC). This card will allow you to prove your rights to health insurance and to access medical care on site according to local regulations. Consider doing this a few weeks before your departure. Choosing the right health insurance There are several types ofhealth insurance

for traveling abroad. Before you go, carefully review the policies available to choose the one that best suits your needs. Some insurances offer comprehensive coverage, including, for example, medical

repatriationand legal assistance. Specific coverages to consider When evaluating your options, take into account potential medical expenses, such as hospitalization costs and medical consultations. Also check for

exclusions

and reimbursement limits. Understanding these points can avoid unpleasant surprises during your stay abroad. Steps to follow in case of need If you encounter a health problem abroad, it is important to know what steps to take perform. Keep your insurance information and contact details for local healthcare providers handy. If necessary, contact your insurer for assistance with specific provisions related to your coverage.

Medical Assistance

Most international health insurance plans offer a medical assistance service. This may include coverage for

transport to a hospital

, as well asmedical repatriationif necessary. Don’t leave your health to chance, make sure you’re covered! Additional ResourcesTo enrich your understanding of health insurance abroad, don’t hesitate to consult sites like Mutuelle Santé Internationale or

Itandi

. They offer comprehensive information on your rights and the steps needed to benefit from coverage adapted to your situation. Comparison of Health Insurance Coverages Abroad Type of Coverage DetailsBasic Health Insurance

Covers emergencies and essential health care, depending on the country.

| Private Health Insurance | Increases coverage for care not reimbursed by social security. |

| Travel Insurance | Protection against unforeseen medical expenses, repatriation and cancellations. |

| European Health Insurance Card (EHIC) | Facilitates access to care in the European Economic Area. |

| Medical Repatriation Insurance | Covers transport to a medical facility or the country of origin. |

| Rights according to Status | Insurance rights vary depending on place of residence and status. |

| Legal Assistance and Death | Assistance service in the event of medical disputes or requiring repatriation. |

| discover everything you need to know about foreign health insurance: international health coverage, adapted options, practical advice and essential information for travelers and expatriates. | Testimonials on Health Insurance Coverage Abroad |

| When I moved to Spain, I didn’t really know what to expect regarding my | health insurance coverage |

health insurance rights

were maintained. It was a real relief to know that I could get essential medical care without worrying about exorbitant costs. When I moved to Australia for work, I was a little lost with the multitude of travel options.health insurance . I quickly learned that it was fundamental to choose a international health insurance

to be well covered. Thanks to a suitable mutual fund, I was able to receive care and medical assistance when needed, which allowed me to fully benefit from my experience abroad.I recently traveled to Italy and before leaving I obtained myEuropean Health Insurance Card (EHIC) . This allowed me to benefit from having my care covered on site, and I did not have to pay any costs. Having such coverage reassured me and allowed me to concentrate on my vacation rather than on administrative concerns. During my stay in Switzerland, I had a small incident which forced me to consult a doctor. Thanks to my

health insurance coverage , I was able to quickly obtain the necessary care. I didn’t know that my rights would be so well protected as an expatriate, and this allowed me to go through this ordeal with peace of mind.A friend of mine migrated to Canada and faced hospital bills that would have been crushing without a

appropriate health insurance . His experience taught him the importance of being well informed abouthealth insurance terms

before leaving to live abroad. Today, he promotes the importance of good coverage for anyone considering moving abroad. Introduction to Overseas Health Insurance CoverageTraveling abroad can be an enriching experience, but it is crucial to be well prepared, especially when it comes to your health insurance . Whether you are going on vacation, to study, or even to live abroad, having good health insurance coverage is essential. In this article, we offer you a complete guide on

health insurance coverage

abroad, providing you with practical advice for navigating the complexities of this field. Understanding your current coverageBefore any departure, it is important to check your current health insurance to determine whether it covers medical care abroad. This includes costs for hospitalization, doctors, and other necessary medical services. Consult the terms of your insurance policy to find out the

exclusions

and the reimbursement limits . If you are leaving for an extended stay, it may be wise to think about specific health insurance for abroad. The European Health Insurance Card (EHIC) If you are a citizen of a country of the European Union or the European Economic Area, obtain the European Health Insurance Card (EHIC)is a crucial step. This card allows you to benefit from coverage for your medical care in EU countries, under the same conditions as residents of these countries. Be sure to apply for your EHIC before your departure to avoid any unpleasant surprises in the event of a medical need.

Choosing the right health insurance abroad

For those residing or staying outside the EU, it is essential to choose a international health insurance . Several options are available to you: travel insurance, expatriate insurance, or international mutual health insurance. Each option has its characteristics, so it is important to compare them carefully to ensure they meet your specific needs.

Things to consider

When choosing an insurance policy, consider the following: Coverage of medical expenses:Check what’s included, such as medications and specialist treatments.

Repatriation assistance:

This is essential in the event of an emergency for medical transport or early return.

- Preventative care: Make sure preventative care, like vaccinations or regular checkups, is covered.

- Steps to take Before leaving, it is crucial to prepare the necessary steps for your

- health insurance . Find out about the health system in the country you are traveling to so you know how to access care if needed. Also find out about the formalities to follow to use your health insurance once there, in particular any forms to complete.

Know your rights and duties

Each country has its own rules regarding health coverage. Find out about your

rights

in terms of health insurance and proceduresto be carried out to assert these rights. Researching beforehand will allow you to travel with peace of mind, knowing that you are well covered in the event of a medical need. Properly preparing for health insurance is essential before traveling abroad. By having a clear understanding of your options and educating yourself on the specifics of overseas health insurance coverage, you can enjoy your trip with peace of mind. discover everything you need to know about foreign health insurance: protections, membership conditions and tips for being well covered during your trips abroad. protect your health and your budget during your international adventures. When considering a trip or expatriation, it is essential to understand the subtleties of your health insurance coverage abroad

. Each country has its own healthcare regulations, and policyholder rights can vary significantly from location to location. So, being informed can make all the difference in ensuring your safety and well-being internationally.

current health insurance covers treatment abroad. Often, exclusions apply to health care outside the national territory. Some insurance policies offer extensions forinternational travel

, but it is your responsibility to ensure that your rights are well explained and that you receive adequate protection. For those moving within the European Economic Area or who are heading to Switzerland, it is good to remember that you retain some of your health insurance rights. However, it is recommended to make a request to obtain theEuropean Health Insurance Card (EHIC)

, which will facilitate access to necessary medical care while traveling.In addition, for expatriates, private health insurance options can prove beneficial, especially in countries with different health systems. Taking the time to explore the various offers on the market will allow you to choose adequate coverage, including services such asmedical repatriation

or medical assistance. You will also want to examine the reimbursement limits and any deductibles that may apply. In summary, although the question of health insurance abroad may seem complex, careful preparation and a good understanding of your rights and responsibilities can give you the peace of mind you need to fully enjoy your international adventures. FAQs about health insurance coverage abroad