|

IN BRIEF

|

When you plan to travel or settle abroad, it is essential to understand how the international health insurance card. This precious sesame allows you to benefit from a health coverage abroad, thus guaranteeing your access to medical care. Whether it’s vacation, study or professional reasons, it is crucial to know your rights and the steps to follow to obtain this card. Whether you are a student, an expat or simply looking for an adventure, master the details of your social protection internationally is a major asset for traveling with peace of mind.

Going abroad can be an exciting adventure, but it also raises crucial questions about health protection. There international health insurance card is an essential tool to guarantee access to medical care during your stays outside your country of origin. In this article, we’ll explore the pros and cons of this card, to help you make an informed decision before you leave.

Benefits

When traveling internationally, have a international health insurance card presents several major advantages. First of all, it facilitates access to medical care in many countries, allowing you to receive treatment quickly if necessary. In fact, this card certifies your rights to health insurance, which can reduce the administrative procedures linked to the provision of care.

Furthermore, the international health insurance card often covers a diverse range of services, including medical consultations, hospitalizations and some treatments. This gives you peace of mind, knowing that you are protected in the event of the unexpected, whether that be an acute illness or an accident. Finally, it can also be applied to chronic diseases and specific care such as pregnancy or post-partum care, as long as the reason for your stay is not exclusively linked to this care.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, the international health insurance card also has disadvantages. One of the most important points to consider is the geographic coverage of the card. This is because some cards can only be used in specific countries, and there may be exclusions from coverage in other regions. This means that, without thorough research, you could find yourself unprotected in certain areas of the world.

Another possible disadvantage concerns the cost, as obtaining an international health insurance card may require a significant initial investment. This may include monthly or annual contributions, which vary depending on your age, health and services covered. In addition, some insurance policies may have a deductible, which means you have to pay a portion of the medical costs before the insurance takes effect.

Finally, it is crucial to mention that understanding the repayment options can be complex. Depending on the insurance organization, the process of reimbursement for medical care abroad may require specific procedures, which can be an additional obstacle in an emergency situation.

When you go abroad, whether for studies, a trip or an installation, have a international health insurance card is essential to guarantee your access to health care. This guide presents the different aspects of this card, how it works, its importance and the steps to follow to obtain it.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

What is an international health insurance card?

There international health insurance card is a document that certifies your rights to health coverage when you are outside your country of origin. It facilitates access to medical care and ensures that medical costs are covered, whether you are on vacation or on mission.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Why is it necessary?

Having an international health insurance card allows you to be protected against unforeseen medical emergencies when traveling abroad. It is particularly important if you need to receive care for a chronic disease or in the event of an accident. In addition, it can also cover pregnancy and childbirth if the stay does not aim for this objective.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Rights covered by the card

The coverage offered by the card varies depending on the country of residence and the type of care you may need. In general, the international health insurance card can cover:

- Medical consultations

- Hospital care

- Medication costs

To benefit from these rights, it is essential to know the terms specific to your situation. For example, if you reside in a country inEuropean Union or theEuropean Economic Area, you can benefit from the European Health Insurance Card (EHIC).

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

How to get an international health insurance card?

To obtain your international health insurance card, you need to follow a few simple steps. First of all, find out about the steps to take from your health insurance fund before your departure. You can also consult the information available on the Health Insurance website for a simplified approach.

Processes to follow in the event of treatment abroad

It is important to note that your rights may differ depending on your destination. Before leaving your country, make sure you understand the reimbursement procedures and how to report treatment received abroad to your insurance. Find more details on the subject in this link here.

Additional insurance: a good plan

Have a mutual which covers your expenses abroad can be a great idea. This will allow you to benefit from enhanced health protection. To find out more about international mutual insurance coverage, you can consult this practical source.

If you are about to travel abroad, taking the time to obtain an international health insurance card is an essential step for your health and safety. This will allow you to travel with peace of mind, knowing that you will be taken care of if necessary.

Going abroad is often an exciting adventure, but it is essential to be well prepared, especially with regard to your international health insurance. Whether you are a student, an expatriate or traveling, understanding the issues surrounding your health coverage is essential to avoid inconvenience in the event of illness or accident. In this article, we will guide you through the essential aspects of the international health insurance card and how to get it.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

What is an international health insurance card?

There international health insurance card is a document which proves your right to medical coverage during your stays abroad. It is essential for accessing medical care and facilitating administrative procedures. Depending on your situation and your destination, there are several types of cards, including the European Health Insurance Card (EHIC), which allows citizens of the European Union to benefit from healthcare in member countries.

Who can benefit from this card?

Everyone can benefit from a international health insurance card, provided you are affiliated to a social security system. This includes workers, retirees, as well as students staying abroad. The terms and conditions may vary depending on the country of residence and the status of each person. Find out about your rights before you leave to avoid any surprises.

How to obtain your international health insurance card?

To get your international health insurance card, it is important to follow a few simple steps. If you are in France, you can apply for European Health Insurance Card directly online via the Ameli website. To do this, simply log in to your personal account and fill out the dedicated form. Delivery times vary, so it is advisable to make your request several weeks before your departure.

What to do in the event of a medical emergency abroad?

In the event of a medical emergency abroad, present your international health insurance card to health establishments. They can thus verify your rights and direct you to the appropriate care. Be sure to keep a copy of receipts and medical documents, as these items will be necessary for reimbursement by your health insurance fund upon your return.

Understand your insurance limitations

It is crucial to understand that some international health insurance do not cover all costs or care, particularly if you are planning risky activities. Additionally, if you have chronic illnesses, it is best to explicitly verify that these conditions are covered. Do not hesitate to ask your insurer questions to avoid misunderstandings.

Additional insurance options

Although the European health insurance card is useful in Europe, it does not replace a supplementary international health insurance, especially for stays outside the EU. These policies may offer more extensive coverage, including medical repatriation and emergency care. Shop around and choose the one that best meets your needs.

Important reminders before you leave

Before you leave, make sure you have electronic and paper copies of your international health insurance card. Also find out about the care available in your destination country and the emergency numbers to contact if necessary. Prepare yourself for the unexpected, this will allow you to enjoy your stay abroad with peace of mind.

For more information on the procedures and rights related to health insurance, consult the resources on Ameli or other specialized sites.

Comparison of International Health Insurance Cards

| Card Type | Features |

| European Health Insurance Card (EHIC) | Covers medical care in the EU and EEA, valid for temporary stays. |

| International Health Insurance | Protects against medical expenses abroad, including hospital care. |

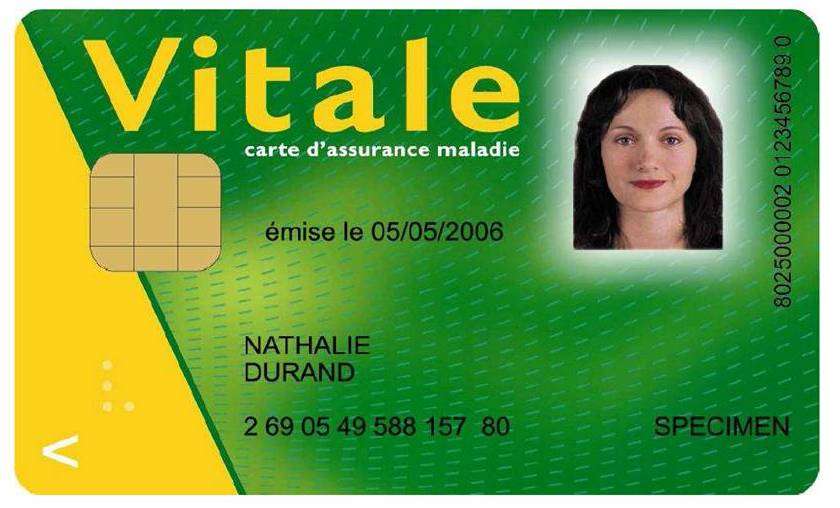

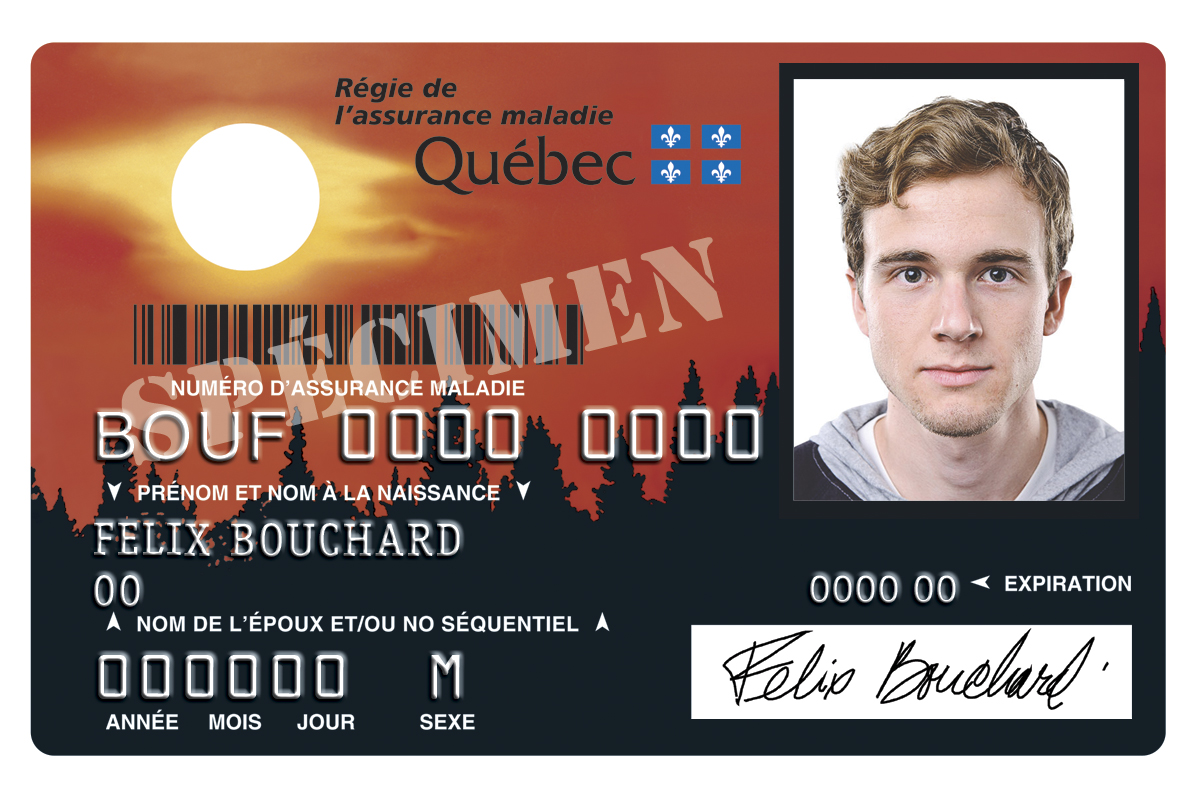

| International Vitale Card | Certificate of affiliation with Social Security, necessary for care in France. |

| Form S1 | Allows health coverage if you reside abroad permanently. |

| Travel Insurance | Supplements the EHIC with options such as cancellation and loss of baggage. |

| Student Insurance | Adapted to international students, covering health and accidents throughout the stay. |

| Mutual Coverage | Guarantees reimbursement for care not covered by basic insurance. |

Testimonials on the International Health Insurance Card

During my stay abroad, the international health insurance card was a real asset. Thanks to this coverage, I was able to receive quality medical care without having to worry about exorbitant costs. It’s invaluable peace of mind when you’re away from home.

A friend, who studied in Spain, told me that the European health insurance card allowed him to cover his health costs, even in the event of consultation for a pre-existing health problem. This encouraged him to take full advantage of his experience, without the fear of unexpected costs.

For my part, during my vacation in Italy, I needed emergency care. There international health insurance card allowed me to consult a doctor without having to pay significant fees. The process was simple, and I was able to resume my vacation with peace of mind after my treatment.

Another acquaintance moved to Switzerland and shared with me the importance of health insurance card in his new country of residence. She explained to me that even though she had basic coverage, her international health insurance card allowed him to access superior quality care in private establishments.

Finally, a couple of friends recently traveled to Asia, and they pointed out that preparing their international health insurance before departure was crucial. They even found that with the right coverage, they were able to enjoy peace of mind throughout their journey, knowing they were protected should the unexpected happen.

Introduction to the international health insurance card

When you go abroad, whether for studies, a professional stay or vacation, it is essential to understand the issues surrounding your health and your medical coverage. There international health insurance card is an essential tool that facilitates access to care in many countries. This article will provide you with key information on how it works, how to obtain it and the benefits it provides.

What is the international health insurance card?

There international health insurance card is a document that certifies your rights to medical care when traveling abroad. It is generally issued by your health insurance fund and allows coverage of medical costs in certain countries, thus facilitating your access to care if necessary. Its importance lies in the protection it offers against unforeseen health events abroad.

How to get an international health insurance card?

To get your international health insurance card, you must request it from your health insurance fund. The procedure may vary depending on your status (student, employee, retiree, etc.) and country of residence. It is advisable to prepare the necessary documents such as your social security number, a valid ID and possibly other supporting documents depending on the requirements of your fund.

It is also prudent to make this request several weeks before your departure in order to receive the card on time and avoid any stress related to your health coverage. Remember to check if you can benefit from a version dematerialized of the card, which can sometimes be quicker to obtain.

Rights covered by the international health insurance card

The international health insurance card generally covers a large part of the costs. medical care. This includes medical consultations, hospitalizations, but also care related to chronic diseases or pre-existing (under certain conditions). It is also important to note that coverage may vary depending on the country you are in.

Within the framework of the European Union, the card allows reimbursement of necessary medical care, but does not cover treatments scheduled in advance. Hence the importance of informing yourself about your specific rights depending on your destination.

Limitations of the international health insurance card

Although the international health insurance card is a valuable tool, it does not guarantee complete coverage. For example, if you are staying in a country outside of Europe, you should explore other options. The card also does not cover care related to risky activities, such as extreme sports or other potentially dangerous activities.

It is also essential to research medical practices in your host country, as some services may be billed directly to the patient, even with this card. So be prepared to advance costs in certain situations and have them reimbursed later, according to the rules of your insurance fund.

Why have an international health insurance card?

Have a international health insurance card when you travel, study or work abroad is essential to ensure your peace of mind. If the unexpected happens, you will be able to access medical care without worrying about exorbitant costs, which is particularly important in health systems where expenses can be very high.

In short, this card represents not only a means of protecting your health, but also a guarantee of peace of mind during your travels. Prepare yourself and inform yourself adequately to enjoy your stay abroad with peace of mind.

There international health insurance card is an essential tool for anyone planning to travel or settle abroad. It guarantees access to medical care while simplifying administrative procedures. By having this card, you attest to your rights to social security in the country you are traveling to, making it easier to interact with local healthcare facilities.

It is crucial to know how this card works. Indeed, each country has its own rules regarding the support care. The map European health insurance (EHIC) is a perfect example, allowing coverage in countries of the European Union, the European Economic Area and Switzerland, for emergency or necessary medical care.

To benefit from this coverage, it is imperative to follow certain steps. This starts with the request to your health insurance fund, which is responsible for issuing the card after verifying your eligibility. Also, don’t forget to find out about the specific conditions coverage, particularly with regard to pre-existing illnesses, pregnancy or length of stay.

The international health insurance card does not always replace a additional health insurance, especially if you stay abroad for several months. In these cases, it is advisable to consider a private insurance policy that supplements potential gaps in public coverage. In summary, having an international health insurance card is essential for traveling with peace of mind, ensuring your safety and well-being, no matter where you are.

FAQs about the International Health Insurance Card

What is an international health insurance card? The international health insurance card is a document which certifies your right to health care coverage during your stays abroad, whether for vacations, studies or for professional reasons.

Who can benefit from an international health insurance card? Anyone affiliated to a health insurance system can apply for this card, in particular expatriates, students or internationally mobile workers.

How to obtain this card? To obtain an international health insurance card, you must apply to your health insurance fund, either online or by mail.

Does the card cover all medical expenses abroad? The international health insurance card may cover part of the medical costs, but it is essential to check the details with your insurer, as some services may not be included.

Is the European Health Insurance Card useful outside Europe? The European Health Insurance Card (EHIC) is mainly valid in the European Union; however, it may offer limited protection in some non-member European countries.

Can I use my mutual insurance with the international health insurance card? Yes, your mutual insurance company can supplement the coverage of medical costs not reimbursed by your international health insurance. Check the terms of your contract.

Are there deadlines for making a request? It is recommended to apply several weeks before your departure to be sure to obtain the card on time.

What should I do if I lose my card abroad? In the event of loss, contact your health insurance fund immediately to make a declaration and request a duplicate.

Is it possible to apply for an international health insurance card for a short stay? Yes, even for a short stay, it is advisable to have an international health insurance card to ensure your health coverage during your trip.