|

IN BRIEF

|

When considering traveling abroad, the question of medical coverage is essential. There international mutual card proves to be an essential asset to guarantee your health safety during your stays outside your country of origin. It allows you to access health care while respecting your rights, while ensuring that you will not be faced with unexpected medical expenses. In this article, we will explore the different facets of this card, its advantages and the steps to follow to obtain it, so that you can travel with peace of mind.

There international mutual card is an essential tool for travelers wishing to benefit from health coverage during their stays abroad. This article will allow you to understand the advantages and disadvantages of this card, while guiding you on the steps necessary to benefit from it. Whether you’re taking a business trip or planning a vacation, it’s crucial to know how this card can help you manage your overseas medical expenses.

Benefits

One of the main benefits of the international mutual card is that it allows easier access to medical care in many countries. By having this card, you will generally be reimbursed for emergency or unexpected medical expenses, giving you peace of mind during your travels. In addition, some mutual insurance companies offer assistance services, such as remote medical advice, which constitutes an undeniable asset in the event of an urgent need.

Furthermore, the international mutual card can also cover a wide range of services, including care related to chronic diseases and maternity, according to the conditions of your contract. Which is particularly reassuring for families traveling abroad.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, the international mutual card also has some disadvantages. For example, it may not cover all medical costs, and some countries may impose deductibles or reimbursement limits. It is therefore crucial to read the general conditions of your mutual insurance carefully before leaving.

In addition, it is important to note that the international mutual card does not replace the European health insurance card (CEAM). While the latter is suitable for a temporary stay in EU member countries, the international mutual card is often necessary for extended stays or in countries outside the EU. For more information on the CEAM, you can consult the website of Health Insurance.

Finally, the cost of this coverage can vary considerably from one mutual insurance company to another. It is therefore important to do in-depth research and compare offers to find the solution best suited to your needs.

The map international mutual is an essential tool for anyone planning to travel abroad, whether for vacation, study or temporary work. It facilitates access to health care by guaranteeing adequate coverage, while allowing you to benefit from reimbursements for your medical expenses. In this article, we will guide you through the different facets of the international mutual card, its advantages, and how to obtain it.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

What is an international mutual card?

A international mutual card allows policyholders to benefit from the coverage of their medical costs abroad. Unlike the European Health Insurance Card (EHIC), which only applies to member countries of the European Union, this card provides coverage in more distant destinations where healthcare may be needed.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Why get an international mutual card?

Obtain a international mutual card is crucial to ensuring your safety and peace of mind while traveling. In fact, it protects you against unforeseen events related to your health. In the event of an accident or illness, you will be able to seek treatment without having to incur huge costs. It’s a safety net that allows you to fully enjoy your stay.

The advantages of the international mutual card

The international mutual card offers several advantages. First of all, it allows you to benefit from rapid access to medical care in the country where you are. In addition, it makes it easier to reimburse your health expenses. If you suffer from chronic illnesses, know that this card can also cover your regular treatments, thus ensuring continued care.

The covers offered

The types of healthcare covered by an international health insurance card vary between insurers, but in general, you can expect coverage for emergency care, hospitalizations, and sometimes even preventative healthcare. It is important to check the details of your contract to understand exactly what is included.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

How to get an international health insurance card?

To get your international health insurance card, simply contact your insurer or visit their website. Typically, you will need to provide personal information and, possibly, medical documents. Make sure to do this well in advance of your departure to avoid any unpleasant surprises.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Where to use your international health insurance card?

The international health insurance card is particularly useful in countries where the healthcare system does not work in the same way as in France. It is essential to check whether your card is accepted in the chosen destination. Also, find out about healthcare practices in the host country so that you are prepared in case of need.

Tips for traveling with an international health insurance card

Before you leave, make sure that your international health insurance card is up to date and that you have all the necessary documents. Consider making copies of your card and keeping them separately from the original. Finally, find out about reimbursement procedures and keep all your receipts to facilitate the process once you return home.

If you want to learn more, don’t hesitate to consult resources such as this link on health insurance to discover how to optimize your medical expenses abroad.

When traveling abroad, it is essential to guarantee your medical safety. There international mutual card is an essential tool that allows you to benefit from appropriate health coverage. This article guides you through the steps to follow, the advantages of this card and tips to get the most out of it.

What is the international mutual card?

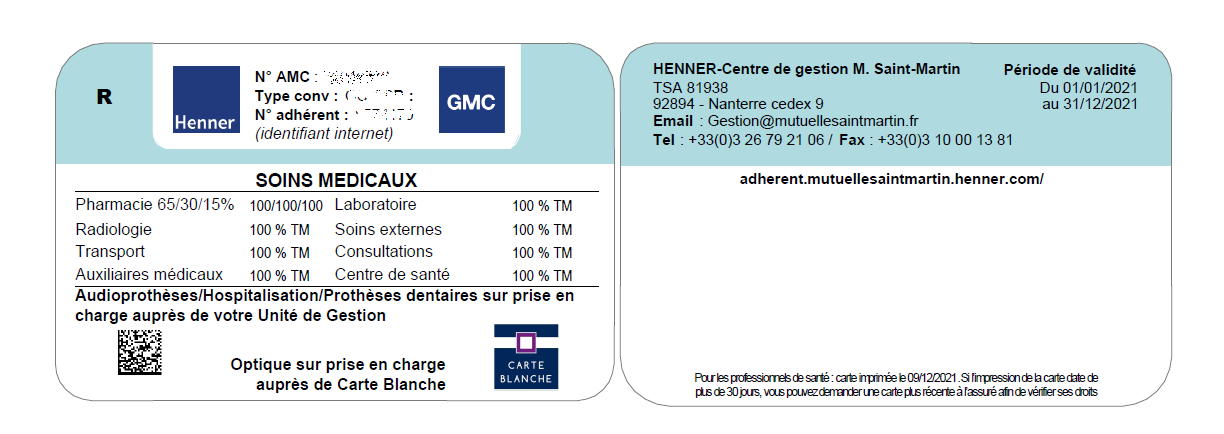

There international mutual card is proof of your membership in a health coverage plan that applies when you travel abroad. It allows you to access necessary medical care in many countries, while facilitating the reimbursement of your health costs. Find out about the conditions of use as well as the countries where it is recognized to avoid unpleasant surprises if necessary.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Why is it essential during your stays abroad?

Own a international mutual card is crucial for several reasons. First, it allows you to receive medical care without having to pay the full cost. In addition, it covers not only medical consultations, but also emergency care and hospitalizations. Also remember to carefully check the people and services covered, particularly if you have chronic diseases or if you are pregnant.

How to obtain an international mutual card?

To get your international mutual card, simply contact your mutual or your health insurance company and make a formal request. It is recommended to do this several weeks before your departure in order to receive the card on time. In addition, you can request to receive a digital version, which makes it easier to use when traveling.

Best practices for using your card abroad

When you use your international mutual card, keep in mind a few good practices. Always carrying a copy of your card and insurance documents with you can save the day in case of loss. Also remember to find out beforehand about the health establishments in your destination, as not all of them support mutual cards. And finally, make sure you keep all your payment receipts to facilitate reimbursement upon your return.

The differences with the European Health Insurance Card (EHIC)

It is important to distinguish the international mutual card of the European Health Insurance Card (EHIC). While the EHIC is mainly used within the European Union, the mutual card can cover you in a wider range of countries, both within and outside the EU. Depending on your destination, it may be wise to travel with both cards for a optimal coverage.

Before embarking on a trip abroad, make sure you are well informed about your international mutual card. By preparing in advance and knowing your rights, you will be able to enjoy your stay with complete peace of mind.

Comparison of the characteristics of international mutual cards

| Features | Details |

| Blanket | Necessary medical care abroad |

| Disability and chronic illnesses | Support usually included |

| Use | Usable within the EU and in some partner countries |

| Validity period | Variable, often limited to one year |

| Procedure for obtaining | To request from your mutual or health insurance |

| Access to care | Direct access to public health services |

| Refund | Support according to local legislation |

| Emergency assistance | Often provided during the stay |

| Possible franchise | May apply depending on the contract |

| Customer service | Multilingual support often available |

Testimonials on the international mutual card

During my last trip to Europe, I needed urgent medical attention. Thanks to my international mutual card, I was able to quickly access quality care without having to worry about exorbitant costs. The peace of mind this gave me was invaluable.

I always had pre-existing health conditions, which made me nervous about going abroad. However, by obtaining my mutual health card, I discovered that it even covered my chronic diseases. This allowed me to enjoy my vacation stress-free, knowing that I was taken care of if needed.

Before leaving for my vacation, I took the time to get my European health insurance card. This process was simple and quick, and it allowed me to prove my rights toHealth insurance In France. I highly recommend doing this before any trip, as it makes all the difference when needed.

As a frequent traveler, international mutual card has become an essential part of my preparations. Whether for urgent medical care or consultations, knowing that I can benefit from coverage abroad is essential for me. I won’t be able to travel without it again.

For those who are still hesitant, remember that the international mutual card is not just limited to emergency care. It also covers costs incurred for necessary medical care during temporary stays. This comprehensive coverage allows you to travel with peace of mind.

When you consider travel abroad, it is crucial to understand the importance of international mutual card. This document is essential to guarantee optimal medical coverage when traveling. This article covers the main aspects of the international mutual card, including how it works, its advantages, and the steps necessary to obtain it.

What is an international mutual card?

There international mutual card is a tool that allows you to benefit from access to medical care when you are abroad. Unlike the European health insurance card, which is reserved for temporary stays within the EU, the international mutual card offers more extensive coverage, which may include care outside the European Union.

It acts as a bridge between your health insurance French and the health systems of the countries visited, thus ensuring that your medical expenses are covered.

The advantages of the international mutual card

An international mutual card has many advantages for travelers. First of all, it guarantees reimbursement of medical expenses engaged abroad, which may include consultations, treatments, surgical procedures, as well as hospitalizations.

Then, it offers a personalized support, with a help service that guides you through the steps to follow in the event of a health problem, thus facilitating access to the necessary care. In addition, some mutual insurance companies also offer options for medical repatriation in case of emergency, thus reinforcing your peace of mind during your stays abroad.

How to obtain an international mutual card?

To obtain a international mutual card, it is generally necessary to maintain an active warranty within a mutual health insurance which offers this type of coverage. You will need to contact your organization to check if this option is available and what the conditions are.

Once you have confirmed your eligibility, you can apply for a card from your mutual insurance company. This can often be done online or over the phone, and it is advisable to do this well in advance of your departure so that you have all the necessary documents.

Steps to follow before departure

Before going abroad, make sure you have all the relevant documents related to your health insurance as well as your international mutual insurance card. Check that your coverage is adequate depending on the country you are going to visit.

Also remember to contact your mutual insurance company to clarify the terms of reimbursement for treatment abroad. Some mutuals require you to pay up front and then apply for reimbursement, while others may have direct agreements with international healthcare providers.

Beware of exclusions

Finally, it is essential to read the general conditions of your international mutual card, in particular the exclusions of guarantees. Certain events, such as high-risk sporting activities or care related to chronic illnesses, may not be covered.

In summary, the international mutual card is an essential tool for traveling with peace of mind. By being well informed, you will be able to enjoy your travels with peace of mind, knowing that your health is protected.

When considering traveling abroad, it is essential to understand the importance of international mutual card. This valuable document facilitates access to healthcare and ensures that you have adequate coverage in the event of a medical need. Whether for vacation, business or study, having relevant health insurance is essential to avoid possible inconveniences.

The international mutual card is often linked to your health insurance and allows you to receive reimbursements for healthcare costs in many countries. When you travel within the European Union or in countries with specific agreements, this card provides coverage for your medical care. So, in the event of an accident or illness, you won’t have to worry about exorbitant costs because you will be covered.

Before leaving, it is crucial to check that your mutual card is up to date and valid. The procedure for obtaining this card is generally simple: simply contact your mutual to take the necessary steps. Also remember to find out about the specifics of the coverage depending on the countries you plan to visit, as certain services may vary.

Additionally, remember that the European Health Insurance Card (EHIC) can be a complement to your international mutual card, as it offers specific benefits within EU member states. Having both in your possession will allow you to enjoy increased security when traveling.

FAQ International mutual card

What is an international mutual card? The international mutual card is an essential tool that allows you to access health services when traveling abroad. It guarantees that you benefit from coverage adapted to your international situation.

Why is it important to have an international mutual card? This card is crucial to guarantee rapid and efficient coverage of medical costs abroad, depending on your coverage and the agreements in force in the country where you are.

Who can benefit from the international mutual card? Any insured person who has subscribed to a mutual health insurance offering this type of card can request one. It is recommended to check the specific conditions of your mutual insurance company.

How to obtain an international mutual card? To obtain this card, you must request it from your mutual insurance company. This can usually be done online, by telephone or by going directly to an agency.

What costs are covered by the international mutual card? Covered expenses may vary from one mutual insurance company to another, but generally include emergency medical care, hospitalizations and, sometimes, specialized consultations.

Does the international mutual insurance card cover chronic illnesses? It depends on the terms of your contract. Some health plans include coverage for chronic illnesses, while others may have specific restrictions. It is therefore essential to check your contract.

Can I use my international mutual card in all countries? No, coverage may vary depending on agreements established between your mutual and the health systems of foreign countries. It is advisable to find out before leaving.

What should I do if there is a problem using my international mutual insurance card? If you have a problem, contact your mutual immediately. They will be able to guide you and offer assistance depending on your situation. Make sure to have their contact details handy when traveling.

Is the international mutual card valid for a temporary stay? Yes, this card is generally valid for temporary stays abroad, but the period of validity and conditions of use must be confirmed with your mutual insurance company.