|

IN BRIEF

|

L’ wage loss insurance is an essential element in protecting your financial situation in the event of a major blow, such as illness or accident. At the house of AXA, this insurance offers you the security necessary to compensate for the loss of your income when you are unable to work. Understanding how this coverage works, the steps to take to benefit from it, and its benefits can make all the difference to your peace of mind. This article explores in detail everything you need to know about this crucial insurance.

L’wage loss insurance offered by AXA is an essential solution to guarantee your financial security in the event ofwork stoppage due to illness or accident. This article explores in depth the main benefits And disadvantages of this insurance, so that you can make an informed decision about protecting your income.

Benefits

Financial protection in the event of the unexpected

One of the main benefits of AXA’s salary loss insurance is that it allows you to maintain a stable level of income in the event of a hard hit. In the event of sick leave, the daily allowance can be up to 50% of your basic daily salary, providing you with essential financial support when you need it most.

Simplicity of declaration procedures

AXA facilitates the process of declaring your sick leave, with clear procedures to allow you to receive your compensation without hassle. In three simple steps you can report your situation and start receiving your compensation quickly.

Coverage flexibility

This insurance also offers flexibility appreciable, with the possibility of adapting your contract according to your specific needs. Whether you are self-employed or employed, AXA offers personalized solutions to ensure you are always protected.

Insurance for expatriates: the importance of flexibility in your choices

In a constantly changing world, and with the resumption of expatriation expected in 2025 after the slowdown caused by the Covid-19 pandemic, the role of expatriate insurance has never been more crucial. Companies must now ensure that their employees, spread…

Disadvantages

Limitation of the amount of compensation

Despite its numerous benefits, AXA’s wage loss insurance presents certain disadvantages. For example, the maximum daily allowance amount is capped at €56.35 per day, which may not be enough to cover your usual expenses in some cases.

Exclusions and waiting periods

There are also exclusions that may not cover specific situations. Additionally, waiting periods may apply before you can start receiving benefits, which can be a problem if you urgently need cash.

Contributions and costs

Finally, it is important to take into account the contributions associated with this insurance. While it provides significant protection, costs can add up, especially if you opt for additional coverage options. It is therefore advisable to evaluate your budget before subscribing.

Loss of salary insurance is an essential contract that allows you to secure your financial future in the event of illness or accidents leading to work stoppage. AXA offers you these pension solutions to compensate for the loss of income suffered during difficult periods. In this article, we will explore the different facets of this insurance, how it works, as well as the steps to follow to benefit from it.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

What is wage loss insurance?

L’wage loss insurance is a financial protection mechanism which intervenes in the event of work stoppage following illness or accident. This contract aims to make your daily life easier by continuing to cover part of your income, as well as your financial obligations, even when you cannot work. By subscribing to this insurance, you protect yourself against unforeseen events that could affect your financial stability.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

How salary loss insurance works at AXA

At the house of AXA, loss of salary insurance allows you to receive daily allowances based on your reference salary. In the event of sick leave, the amount of your compensation is generally calculated on the average of your gross wages for the last three months. In 2022, this compensation can reach €56.35 per day, but it is crucial to note that this depends on your income. AXA is committed to supporting you in these difficult times by offering you a financial solution adapted to your needs.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Steps to declare a work stoppage

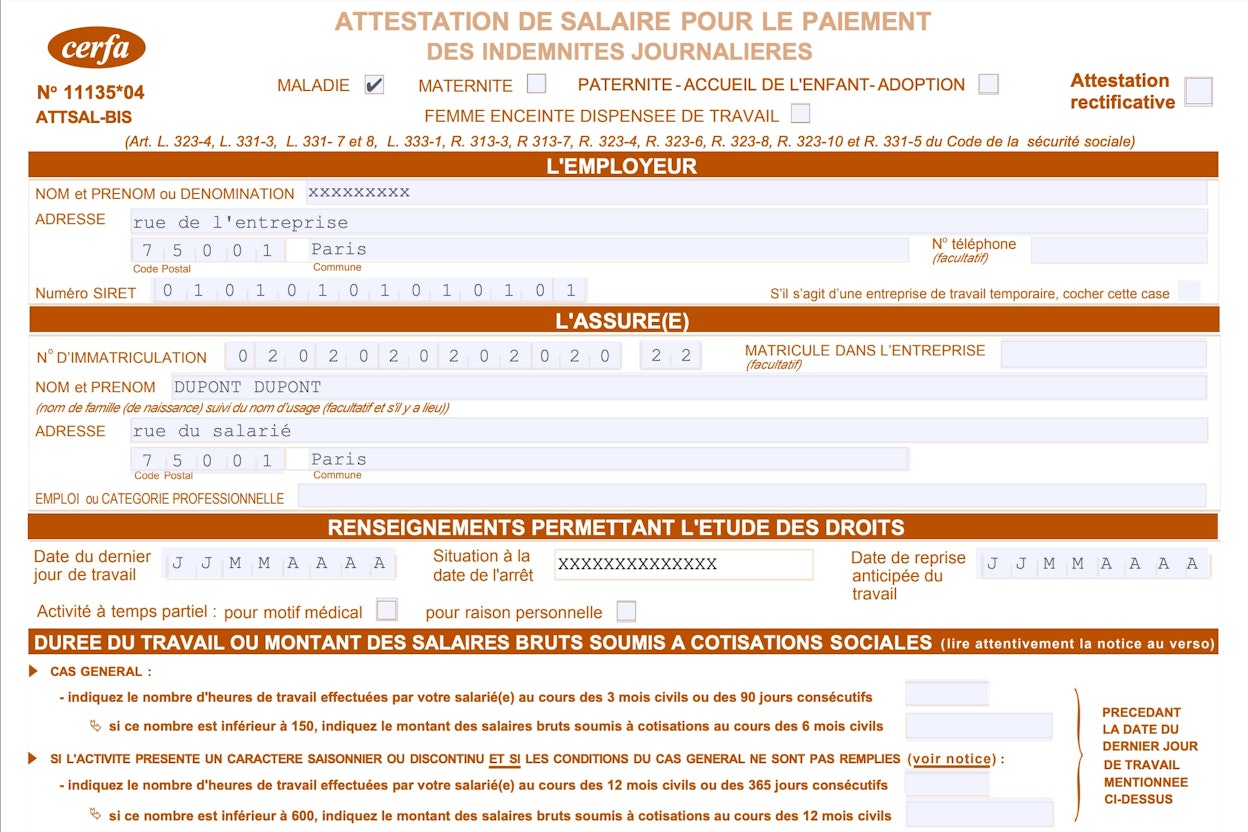

When you must declare a work stoppage to benefit from your daily allowances, here are the steps to follow:

1. Inform your employer

It is essential to inform your employer of your inability to work as soon as possible. This allows your employer to take the necessary steps to manage the absence.

2. Go to the doctor

Consult a doctor who will provide you with a medical certificate justifying your sick leave. This document is essential to initiate the compensation claim procedure.

3. Send the documents to AXA

Finally, send all the necessary documents, including the medical certificate, to the dedicated AXA service, ensuring that you respect the deadlines set for your insurance.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The advantages of salary loss insurance with AXA

By opting for salary loss insurance with AXA, you benefit from several advantages. First, this insurance allows you to maintain a sufficient level of income despite an inability to work. Second, AXA offers extensive coverage, including a lump sum paid to the family in the event of death. Additionally, the reporting and tracking process is simplified with dedicated support. These advantages provide you with essential serenity during destabilizing situations.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Why take out salary loss insurance?

Life is full of unexpected events, and an illness or accident can happen without warning. By subscribing to thewage loss insurance with AXA, you provide yourself with a safety net that will allow you to face periods of financial uncertainty. Don’t let a disruptive event jeopardize your finances; choose AXA, which provides you with pension solutions adapted to your needs. To learn more, feel free to check out resources like this dedicated page.

Foresight is essential to navigate through life’s ups and downs. By choosing salary loss insurance from AXA, you ensure financial peace of mind that is worth its weight in gold. Take the time to fully understand your insurance options and rely on the protection that AXA can offer you.

L’wage loss insurance is an essential protection to face life’s unexpected events. Whether due to a disease, of a accident or disability, this insurance offers you vital financial support. AXA, one of the leaders in the field, offers adapted solutions to guarantee your financial comfort even in the event of work stoppage. Here’s everything you need to know about this insurance.

What is wage loss insurance?

Wage loss insurance allows you to receive a daily allowance in the event of temporary incapacity due to an unforeseen event. This contract is designed to compensate part of your income when you cannot work. By purchasing it from AXA, you benefit from financial security during difficult times, allowing you to focus on your recovery.

How does compensation work?

When you are off work, AXA calculates the amount of your compensation taking into account your basic daily wage. In general, this amount is approximately 50% of your salary, based on the average gross salary for your last three months. However, it is essential to declare your situation quickly and follow the necessary steps to avoid delays in payment.

Steps to follow to declare a work stoppage

To receive your compensation, it is crucial to follow a few simple steps. First, inform your employer of your situation as soon as possible. Then, send AXA the required documents, such as your medical certificate and any other supporting documents requested. Finally, make sure to stay in contact with your insurer to obtain information regarding the follow-up of your file.

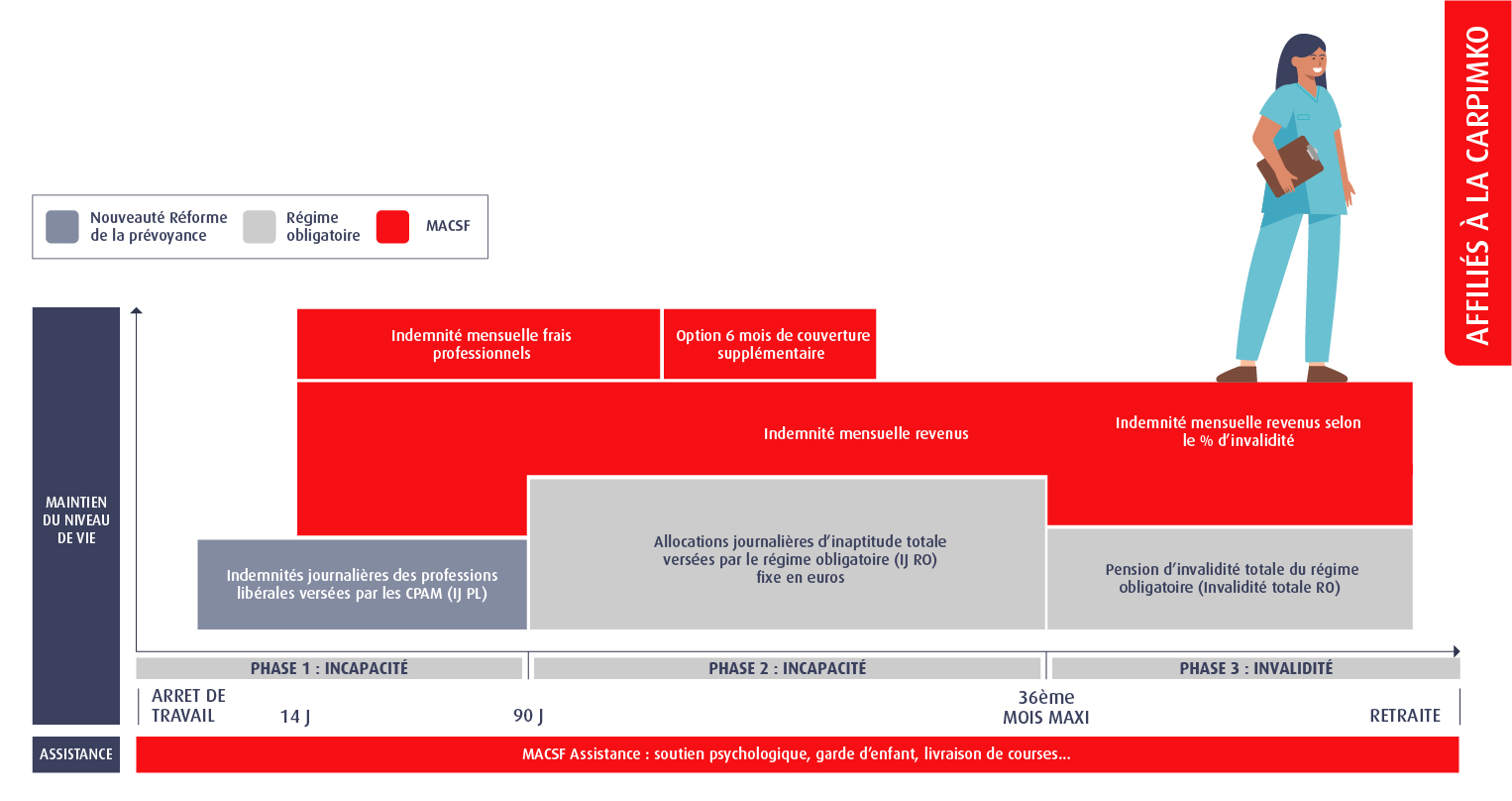

The advantages of pension insurance

The pension insurance offered by AXA goes beyond simple coverage for work stoppage. It may also include a disability protection, often by paying a capital or an annuity to guarantee your long-term income. In the event of death, AXA also provides financial compensation to your loved ones, thus providing serenity extra in tragic moments.

Why choose AXA?

AXA stands out for its expertise and commitment to its clients. By taking out your salary loss insurance with them, you benefit from personalized support and options adaptable to your specific needs. Their advisors will help you better understand your rights and choose the most appropriate coverage for your situation.

Additional Resources

To better understand the different insurance options and the precise steps to follow to benefit from them, consult the resources available on the AXA andAXA international insurance. You can also learn more about loss of income insurance on the website of the GMF and other welfare organizations.

Comparison of the benefits of AXA wage loss insurance

| Profit | Description |

| Daily allowance | Payment of 50% of the basic daily salary in the event of work stoppage. |

| Death benefit | Payment of capital to the family in the event of the death of the insured. |

| Disability pension | Payment of an annuity to ensure regular income in the event of disability |

| Income protection | Stable maintenance of income even in the event of an unforeseen event. |

| Financial security | Covers part of the professional expenses that continue to accrue. |

| Administrative assistance | Support in reporting procedures to receive compensation. |

Testimonials on Loss of Salary Insurance at AXA

When life throws unexpected things at you, it is essential to have a financial protection who accompanies you. This is exactly what I found with AXA Loss of Salary Insurance. Last year, I had to deal with an illness that forced me to be away from work for several months. Thanks to this insurance, I was able to receive a daily allowance which has significantly eased my financial stress.

I had never thought about the foresight before meeting an AXA advisor. He explained to me how this insurance could help me in the event of an accident or illness. The possibility of maintaining a decent level of income immediately reassured me. So I decided to opt for their pension insurance, and I don’t regret it. Having this coverage allows me to approach the future with confidence, knowing that my financial security is in good hands.

A friend of mine suffered a serious accident a few months ago. Thanks to his wage loss insurance contract with AXA, he was able to benefit from additional income during his work stoppage. Without this help, he would have struggled to meet his financial obligations. He tells me how crucial this insurance was for him and his family during this difficult time.

The ease of declaring my work stoppage was also a real positive point with AXA. In three simple steps, I was able to file my declaration and receive my compensation. This proves to what extent AXA takes into account the simplicity and accessibility in its customer service. I felt supported every step of the way.

Finally, the appearance of the family security is very important to me. AXA doesn’t just compensate for lost revenue; they also provide coverage that helps my family in the event of my death. It’s peace of mind worth its weight in gold. Wage loss insurance not only allowed me to get through a difficult period, but it also protects my loved ones.

Introduction to wage loss insurance

L’ wage loss insurance offered by AXA is a valuable tool that protects you from the vagaries of life. In the event of illness or accident leading to work stoppage, this insurance guarantees additional income essential to meet your financial obligations. Let’s discover together the features, benefits and steps to follow to benefit from this essential insurance.

What is wage loss insurance?

Wage loss insurance is a insurance contract which allows you to compensate for the loss of income resulting from a work stoppage. Whether due to illness, accident or disability, this insurance provides you with financial stability in difficult times.

At AXA, this coverage is available in several options adapted to the needs of self-employed workers, employees and liberal professions. In the event of hospitalization or incapacity to work, you may receive daily allowances which are added to what you receive from social security.

The advantages of salary loss insurance at AXA

The decision to opt for a wage loss insurance AXA comes with many benefits:

- Financial security: In the event of work stoppage, you can benefit from compensation which compensates up to 50% of your income. This helps you maintain your standard of living and pay your bills while you are away.

- Disability pension: If your health deteriorates and you become disabled, AXA offers disability pensions to guarantee additional income over the long term.

- Support and services: AXA provides you with assistance and advice services to assist you with administrative and medical procedures.

How to declare a work stoppage?

To benefit from your compensation, it is essential to follow a precise process. Here are the steps to take in three steps:

- Declaration of work stoppage: Inform your employer or the relevant organization as soon as possible.

- Transmission of documents: Gather all the necessary documents to justify your sick leave, such as medical certificates.

- Monitoring your file: Stay in touch with AXA to verify that all formalities have been completed and that your file is being processed.

How are compensation calculated?

The amount of your daily allowance depends on your reference salary. In general, it is calculated on the basis of your last three months of gross salary, and amounts to a maximum of €56.35 per day. This amount may vary depending on the specific conditions of your insurance contract.

It is crucial to fully understand the structure of this compensation to anticipate your financial situation should the need arise. AXA offers you clear visibility on this process, so that you can benefit from the best possible conditions.

Eligibility conditions

To take out salary loss insurance with AXA, certain conditions must be met. You must be an active employee, self-employed or exercise a liberal profession. You will also need to provide specific information regarding your health and income to be able to evaluate your application.

Finally, it is important to understand that each insurability is based on the analysis of your risks and that exclusions may apply depending on your personal situation.

L’wage loss insurance of AXA constitutes a real lifeline for employees faced with unforeseen situations such as diseases or the accidents. Indeed, this foresight is essential to guarantee continued income in the event of inability to work, thus making it possible to meet daily expenses and financial commitments.

The operation of this insurance is based on a simple principle: in the event of work stoppage, AXA undertakes to compensate part of the cost. loss of salary thanks to daily allowances. These are calculated at 50% of the basic daily salary, based on gross salaries for the last three months. Thus, even in difficult times, policyholders can benefit from financial support which allows them to maintain a minimum of comfort.

In addition to daily allowances, AXA also offers options for disability situations. Indeed, if more serious consequences occur, such as lasting disability, additional benefits in the form of capital or disability pension can be paid to provide additional income. This comprehensive approach to risk perfectly illustrates AXA’s commitment to prevention and of financial protection.

It is therefore crucial to fully understand the different terms of this pension insurance. By adequately informing yourself about your rights and how compensation works, it is possible to fully benefit from the advantages offered. Therefore, choosing AXA salary loss insurance means choosing security and peace of mind in times of uncertainty.

FAQ about Loss of Salary Insurance at AXA

What is wage loss insurance? It is an insurance contract that allows you to benefit from compensation in the event of work stoppage due to illness or accident, thus offering you financial protection in difficult times.

How does the payment of daily allowances work? In the event of work stoppage, you can receive daily allowances equal to 50% of your basic daily salary, which is calculated from the average of your gross salaries for the last three months.

What is the maximum amount of daily allowances? In 2022, the maximum amount of daily allowance is €56.35 per day, but this will depend on your actual income.

Who can benefit from pension insurance with AXA? Any employee or self-employed worker wishing to protect themselves against the financial consequences of stopping work due to illness or accident can take out this insurance.

What steps should I take to receive compensation? To benefit from your compensation, it is important to declare your work stoppage quickly to your insurer, providing the necessary documents, such as the medical certificate.

Does life insurance also cover life accidents? Yes, AXA’s life insurance includes coverage for accidents of life, guaranteeing compensation in the event of loss of income due to an unforeseen event.

What are the differences between a death benefit and a disability annuity? The death benefit is paid to the family in the event of the insured’s death, while the disability annuity is paid in the event of disability, providing additional income for the insured.

Can I subscribe to this insurance if I am already on sick leave? In general, it is necessary to be in good health at the time of subscription. If you are already on sick leave, it may be difficult to obtain this coverage.

What are the advantages of AXA life insurance? AXA life insurance offers financial security, compensates for part of the loss of income, and also protects your family in the event of death.