|

IN BRIEF

|

In an increasingly connected world, foreign residents in France must find out about the options for mutual health insurance which are available to them. Whether for an extended stay or occasional visits, it is crucial to understand the eligibility criteria, the necessary procedures and the different coverages available. This guide will enlighten you on devices such as CMU, L’SOUL and many others, in order to facilitate your choices and ensure your health security during your stay in France.

The question of a mutual health insurance for foreign residents in France is crucial, especially if you plan to live or work on French territory. Foreign residents should inform themselves about the options available to them in order to benefit from adequate health coverage. This guide will help you understand the advantages and disadvantages of these mutual insurance companies, as well as the steps to follow to choose the best plan adapted to your situation.

Benefits

Opt for one mutual insurance for foreign residents presents several notable advantages:

Coverage tailored to specific needs

THE mutual health insurance designed for foreign residents offer tailor-made guarantees, taking into account the realities of the French health system. They may include specific care which is not always covered by Social Security in France.

Access to rapid care

Have a mutual makes it easier to access medical care without worrying about costs. In addition, some mutual insurance companies offer refunds rapid, which ensures continuous medical monitoring.

Administrative support

Most organizations offer support during administrative procedures, thus facilitating access to health services. This often includes assistance in understanding French legislation and care procedures.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite their advantages, mutual insurance for foreign residents also have disadvantages to consider:

Costs

THE bonuses to pay for suitable mutual insurance can be high, depending on the coverage chosen. It is essential to compare offers to avoid excessively large amounts.

Complexity of contracts

The contracts of mutual can often seem complex, with conditions and exclusions that can confuse new residents. It is crucial to read each clause carefully to fully understand the commitments.

Various reimbursements

Reimbursement rates may vary from one company to another, and some mutual may not cover all costs. This can lead to unexpected additional costs during medical visits.

In conclusion, it is essential to be well informed about the mutual insurance for foreign residents that exist, and compare the different options in order to choose the coverage best suited to your health needs in France.

If you are a foreign resident wishing to live in France, it is essential to understand how the mutual health insurance. This guide will provide you with all the necessary information on the coverage options available, the procedures to follow and the regulatory specificities concerning the health of expatriates in France. Whether you are a student, professional or retired, knowing your rights and the resources available will allow you to benefit from adequate health protection.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The different coverage schemes for foreigners

In France, several systems must be taken into account when it comes to health coverage foreigners. Among them, the Universal Health Coverage (CMU), theState Medical Aid (AME) and the Universal Health Protection (PUMA) are the most notable. These systems aim to protect people without direct access to Social Security, each option having its own eligibility criteria and specificities.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The steps to benefit from mutual insurance

To benefit from a mutual health insurance, it is crucial to follow a few steps. First of all, you must register for French social security if you are eligible. Then, it will be necessary to search for the mutual which best suits your needs. Don’t forget to compare the guarantees offered and find out about the waiting periods. For in-depth assistance, consult the various specialist sites.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Eligibility conditions

Eligibility conditions vary depending on your status in France. Foreign students, expatriate workers Or asylum seekers : each category has its own rules. For example, students can benefit from CMU if they meet specific conditions, while workers must have stable employment to benefit from full coverage.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The tax on mutual insurance companies

It is also important to know the additional solidarity tax (TSA) which applies to complementary health insurance contracts. This deduction is mandatory and must be taken into account when subscribing to mutual insurance. Find out about the financial implications linked to this tax, in particular to anticipate your health budget.

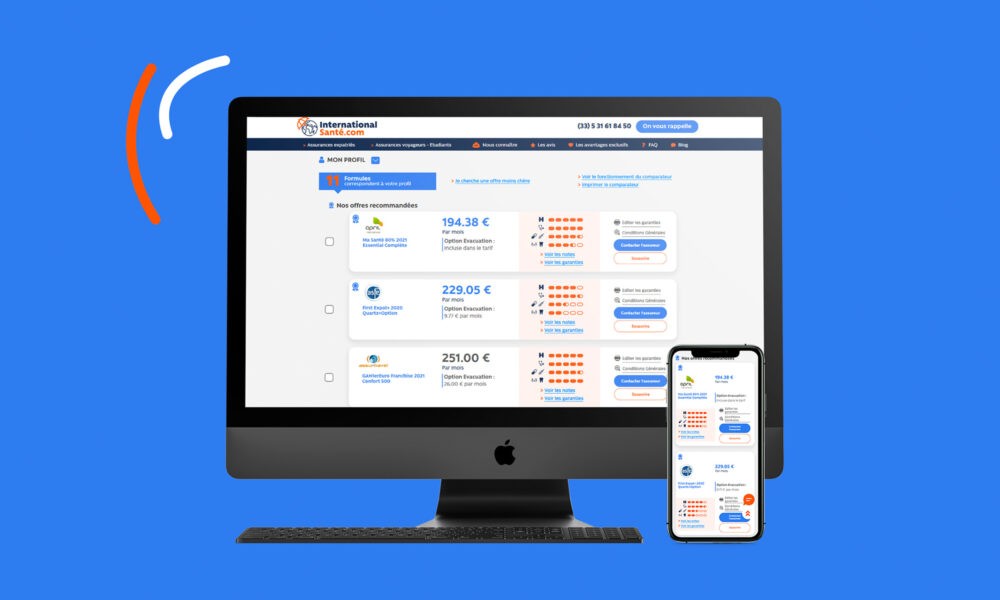

The best mutual insurance options for expats

To make the right choice regarding your mutual health insurance, it is advantageous to turn to organizations offering specific solutions for expatriates. These options include guarantees adapted to your personal and professional situation. You can explore offers from organizations such as Magnolia.fr which offers targeted options for foreigners.

Administrative procedures

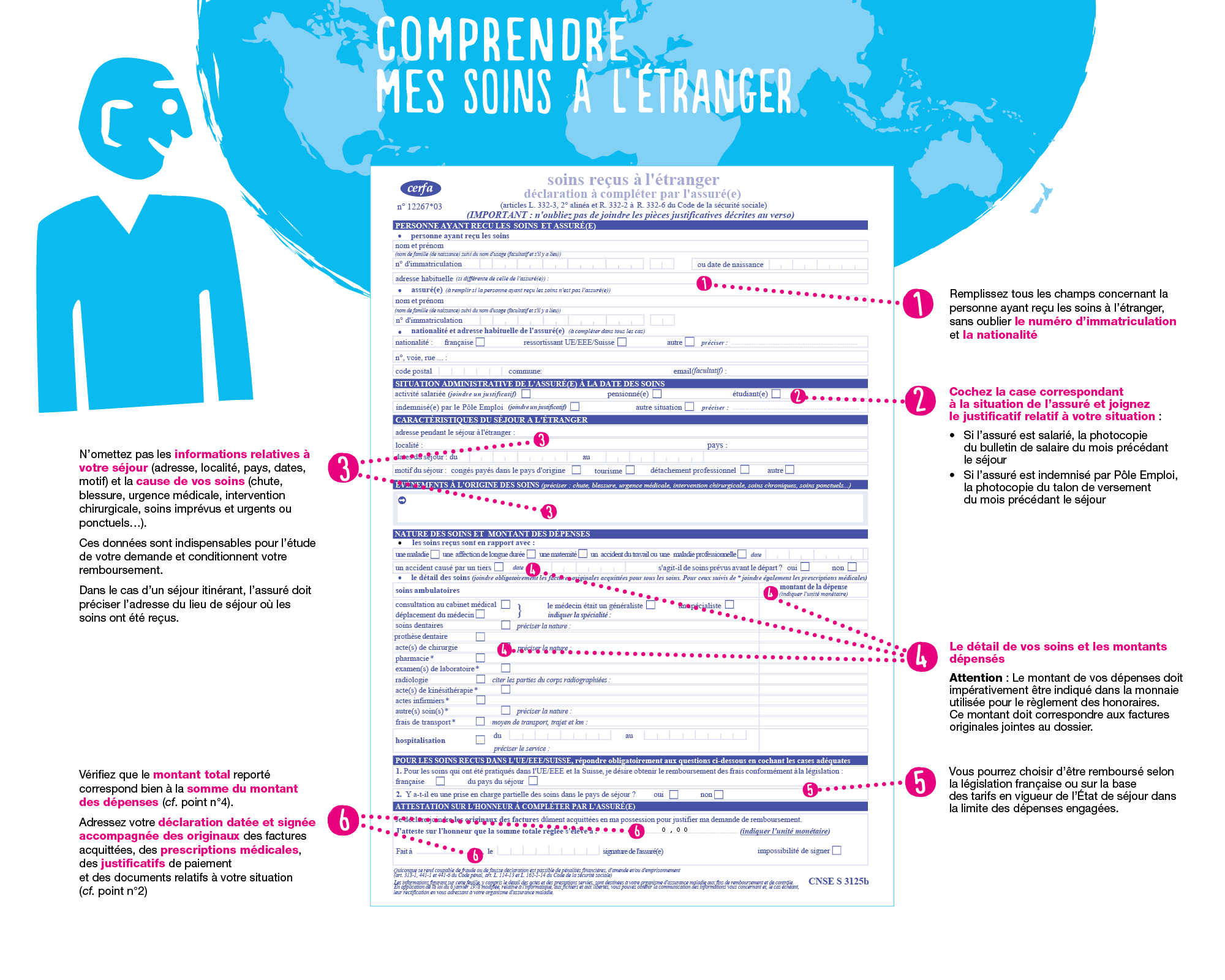

The procedures for obtaining mutual insurance may seem complex, but they are essential to guarantee your health and safety in France. Make sure you gather all the necessary documents, such as your residence permit, certificates of your professional status, and other supporting documents. Organizations like ACS can guide you through this process.

There mutual health insurance is an essential aspect for all foreign residents in France. Whether you are an expat, a student or a professional, understanding the different health coverage options is crucial to benefit from optimal protection. This guide will help you understand the requirements, the steps to follow and the rights to which you are entitled. Let yourself be guided to navigate through this sometimes complex system.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Understanding the different health coverage options

There are several devices for health coverage for foreigners in France. Among them, we find the Universal Health Coverage (CMU), which is intended for stable residents, as well as theState Medical Aid (AME) for those who are in a precarious situation. Finally, the Universal Health Protection (PUMA) is another choice to consider for expat workers. Each of these options has specific eligibility criteria.

The steps to follow to subscribe to mutual insurance

To benefit from a mutual health insurance, you must first put together your file and gather the necessary documents. It is recommended to consult the website of the Social security to find out the precise formalities depending on your situation. Once your file is complete, you will be able to choose a health insurance adapted to your needs. Remember that it is essential to compare market offers carefully to find the coverage that suits you perfectly.

Eligibility for EU nationals and other countries

If you are a national of a country of the European Union or the European Economic Area, the rules of refund of your healthcare costs may vary. It is therefore imperative to inform yourself about your resident status and the existing social security agreements between your country of origin and France. This will help you avoid misunderstandings and ensure adequate protection.

Financing and taxation of mutual societies

In 2024, the mutual tax, or “Additional Solidarity Tax”, applies to all complementary health insurance. It is important to understand this tax, because it influences the cost of your mutual insurance. For more information on developments in this tax, consult reliable resources such as this link.

Temporary residents: what are your options?

If you are in France for a short period, it is crucial to take out a health insurance temporary. This coverage will allow you to benefit from the same rights as permanent residents and to access care without having to worry about prohibitive costs. Insurance options for tourists or students are specifically designed to meet these needs. Don’t forget to check if the insurance you choose corresponds to your particular status.

The importance of mutual health insurance for expatriates

For expatriates, a mutual health insurance is essential, because it covers not only medical expenses in France, but also during trips abroad. Unlike the Social security French which is not applicable outside the country, a good mutual provides you with financial support for all your health expenses. Learn about the best options available to secure your future.

For all your questions about the mutual health insurance, do not hesitate to consult specific resources, such as those found on this site, or to contact specialized organizations. They can help you make the best choice based on your individual situation.

Mutual insurance for foreign residents

| Axis of comparison | Concise Details |

| Health Coverage | Ensures reimbursement of medical expenses in France and abroad. |

| Eligibility Conditions | Stable residence, regular professional status, or student. |

| Types of Mutuals | CMU-C, AME, PUMA and adapted private mutual insurance companies. |

| Travel Assistance | Coverage for emergency care while traveling. |

| Costs and Contributions | Vary depending on the level of coverage chosen and age. |

| Specific Advantages | Options for foresight and protection of loved ones. |

| Reimbursement Deadlines | Fast reimbursement, often within 48 hours. |

| Response to Needs | Covers the specific needs of expatriates. |

Testimonials on mutual insurance for foreign residents: what you need to know

Maria, Brazilian student: When I came to study in France, I knew that my health needs would change. I discovered that the Universal Health Coverage (CMU) was an option for me. The procedures were simple and I was able to benefit from health protection adapted to my student status. I feel much more peaceful, knowing that my medical expenses will be covered.

Jean, expatriate on professional mission: When I moved to France for a long-term mission, I was lost when faced with the different options of mutual health insurance. I opted for a mutual insurance company which offers comprehensive coverage, including specific care such as maternity and specialist consultations. This allowed me to concentrate on my work without worrying about healthcare costs.

Sophie, French retiree living abroad: Having decided to spend my retirement in Spain, I had to find out about the health insurance specific for expatriates. Thanks to good mutual insurance, I was able to continue to benefit from quality care while remaining abroad. Fast refunds and overseas support are a real plus. This reassured me and allowed me to fully enjoy my life in Spain.

Tarek, refugee: After requesting asylum in France, I quickly understood the importance of CMU-C and theSOUL. These devices allowed me to access health care without worrying about my finances. It’s a real breath of fresh air in a time of stress and uncertainty. I was finally able to focus on my reintegration.

Lucie, young professional: As a non-EU citizen who moved to Paris for work, I had to choose a mutual health insurance adapted to my situation. The options were numerous, but by taking the time to compare guarantees and coverage levels, I found the ideal package. Having mutual insurance that covers all my care allows me to be reassured and to enjoy my new life in Paris.

Understanding mutual health insurance for foreign residents

Mutual health insurance for foreign residents is an essential subject to address to guarantee optimal health protection. Whether you are an expatriate, a student or simply staying in France, it is crucial to understand the options available to you. In this article, we offer you a detailed guide on the different possibilities available, the eligibility conditions, as well as the steps necessary to benefit from suitable health coverage.

The different health coverage options

When it comes to mutual health insurance, foreign residents in France have several options, including:

- Universal Health Coverage (CMU) : Intended for residents without professional activity, this coverage offers access to health benefits. To benefit from it, it is necessary to meet certain specific conditions.

- Universal Health Protection (PUMA) : This system allows people living in France to benefit from reimbursement of their health costs, provided they can demonstrate stable and regular residence.

- State Medical Aid (AME) : For foreigners in an irregular situation, the AME offers health coverage, but it is subject to specific conditions. It is important to consult the eligibility criteria to benefit from it.

Who can benefit from mutual health insurance?

The eligibility criteria for foreign residents vary depending on the schemes. Generally, it is required to:

- Be a stable and regular resident in France.

- Have a recognized professional status, whether as an employee, self-employed, student, or even job seeker.

- Meet the specific conditions related to each scheme, such as the length of stay or financial proof.

The steps to follow

To benefit from mutual health insurance, it is essential to follow specific steps:

- Gather the necessary documents : Gather all the required documents, such as proof of residence, professional situation, and identity.

- Fill out the registration forms : Whether for CMU, PUMA, or AME, specific forms must be completed. It is recommended to check the submission deadlines.

- Contact the competent organizations : Do not hesitate to contact social security or a specialized mutual insurance company to obtain advice and additional information.

Choosing the right health insurance

Choosing the right health insurance is a crucial issue. To do this, consider the following elements:

- The guarantees offered : Evaluate the levels of reimbursement for medical care, hospitalizations, and preventive medicine.

- The prices : Compare the available offers, taking into account your budget and the services included.

- The opinions of other expatriates : Find out about the experiences of other foreign residents regarding mutual insurance in order to make an informed choice.

Importance of health insurance

Having health insurance in France is essential to avoid unexpected medical expenses. Whether in the event of illness, accident or simply for regular consultations, this coverage is essential to guarantee your well-being.

In short, taking the time to be well informed and to choose your mutual health insurance is essential to live serenely in France. This will allow you to take full advantage of your experience, whether for studies, work or simply an extended stay.

Mutual health insurance for foreign residents in France is proving to be a crucial issue in ensuring effective health protection. Whether you are in France to study, work or for other reasons, understanding the different options available to you is essential. The Universal Health Coverage (CMU), for example, offers coverage adapted to foreign students, but eligibility conditions and specific procedures are necessary to benefit from it.

In addition, various schemes such as CMU-C,AME and PUMA are available to foreigners residing in France on a permanent basis. Each of these schemes has its own criteria, and it is essential to find out about them in order to choose the solution best suited to your situation.

When moving temporarily to France, it is also mandatory to take out health insurance. This guarantees coverage comparable to that enjoyed by the French, ensuring that you are not caught off guard by unexpected medical expenses. Choosing the right category of insurance according to your status is therefore essential.

When it comes to health protection for expatriates, it is essential to take into account the difference between social security French and mutual insurance companies which allow you to benefit from reimbursements when you are abroad. Robust health coverage is the foundation of a peaceful and successful stay. So, whether for a period of study, work or leisure, a good mutual is the keystone to fully enjoying your experience in France. By informing yourself and anticipating, you ensure optimal protection throughout your stay.

FAQ about mutual insurance for foreign residents

How important is mutual health insurance for foreign residents? Mutual health insurance is essential to guarantee adequate financial protection in the event of unexpected medical expenses, especially for those who live in a country whose health system they are not always familiar with.

What mutual health insurance options are available for foreigners in France? Foreign residents can choose from several options, including specific mutual insurance for expatriates, independent insurance or Universal Health Coverage (CMU) in certain cases.

Who can benefit from CMU as a foreign student? Foreign students can benefit from CMU under certain eligibility conditions, in particular by proving their stable and regular residence in France.

What are the eligibility criteria for the different mutual insurance companies? Eligibility varies depending on the type of mutual insurance, but it generally depends on the status of residence, professional activity, as well as the length of stay in France.

What is the Additional Solidarity Tax (TSA) and who must pay it? The TSA is a compulsory levy on complementary health insurance contracts which must be paid by all mutual health insurance companies and insurance companies, including those of foreigners residing in France.

What protections are offered to foreign residents under the AME system? The State Medical Aid (AME) system allows illegal foreign residents to benefit from health coverage for essential care.

How to choose the best health insurance for an expatriate? It is advisable to take into account criteria such as the level of coverage, the guarantees offered and the contract exclusions to choose a mutual health insurance adapted to your needs.

Are medical expenses reimbursed by mutual insurance if I am in France as a tourist? Generally, a mutual insurance company will not reimburse medical expenses if you are in France as a tourist without having taken out specific health insurance for temporary stays.

Is it necessary to take out mutual insurance even if you are already covered by social security in your country of origin? Yes, because the social security of your country of origin may not cover all medical expenses incurred in France. Supplementary mutual insurance provides better protection.

How to apply for mutual health insurance as a foreign resident? The process of subscribing to mutual health insurance generally involves comparing available offers, completing an application form and providing the required documents, such as proof of residence and identity.