|

IN BRIEF

|

In a world where travel abroad is increasing, choosing the mutual insurance for foreigners adapted to your needs becomes a priority. Whether you are an expatriate or simply passing through, reliable health coverage is essential to protect you against the unexpected. This comprehensive guide offers you practical advice and criteria to consider when selecting the best international health insurance. From comparing guarantees to the particularities of care in your destination country, we will support you step by step in your approach.

When considering living or staying abroad, choosing a mutual insurance for foreigners becomes essential. It is essential to fully understand the different options available to you in order to guarantee health coverage adapted to your needs. This article offers you a detailed comparison of benefits and disadvantages linked to mutual insurance for expatriates, to help you make the best choice.

Benefits

Opting for mutual insurance for foreigners presents many benefits. First of all, the possibility of benefiting from coverage adapted to your geographical location is crucial. Indeed, health care can vary considerably from one country to another, and a good mutual insurance company will be able to adjust to these differences.

Then, mutual insurance companies for expatriates often offer high-end options, including access to specialized care networks. This includes services such as single rooms during hospitalizations or consultations with expert doctors recognized in your host country.

In addition, these mutual insurance companies generally offer emergency assistance, which can be invaluable when you’re away from home. This assistance includes, among other things, covering your medical expenses, medical evacuation if necessary and even repatriation to your country of origin.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages when choosing mutual insurance for foreigners. One of the main points to consider is the cost international health insurance. Depending on the guarantees chosen, premiums can quickly become high, especially if you opt for more comprehensive coverage.

Another disadvantage lies in the complexity of insurance contracts themselves. The clauses can be difficult to understand, and it is essential to read the terms and conditions carefully to avoid unpleasant surprises when reporting a claim.

Finally, some mutual insurance companies may have geographic restrictions or strict admission requirements. It is therefore crucial to check whether your future country of residence is covered by the envisaged mutual insurance company, as well as the types of care that could be excluded from coverage.

For more information on mutual insurance companies suitable for expatriates, do not hesitate to consult resources such as this guide, or to use online comparators which will allow you to find the best option according to your needs.

When considering living abroad, it is essential to choose a adapted mutual to their health needs. This comprehensive guide helps you make an informed decision regarding health coverage for expatriates, taking into account the specificities of care abroad. Whether it’s comfort, rates or guarantees, we address all the crucial aspects to help you choose your mutual insurance.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understanding health coverage needs abroad

Before choosing your mutual insurance for foreigners, it is important to clearly understand your needs. Consider whether you plan to use medical care frequently, have specific needs, or travel to countries where care may be costly. Anticipating these needs will allow you to select coverage that truly fits your situation.

Premium options and comfort

THE high-end options offer expanded coverage, including services such as single rooms hospital or access to specific care networks for expatriates. These services can guarantee not only optimal quality of care, but also comfort during your stay abroad.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Comparison of mutual insurance offers

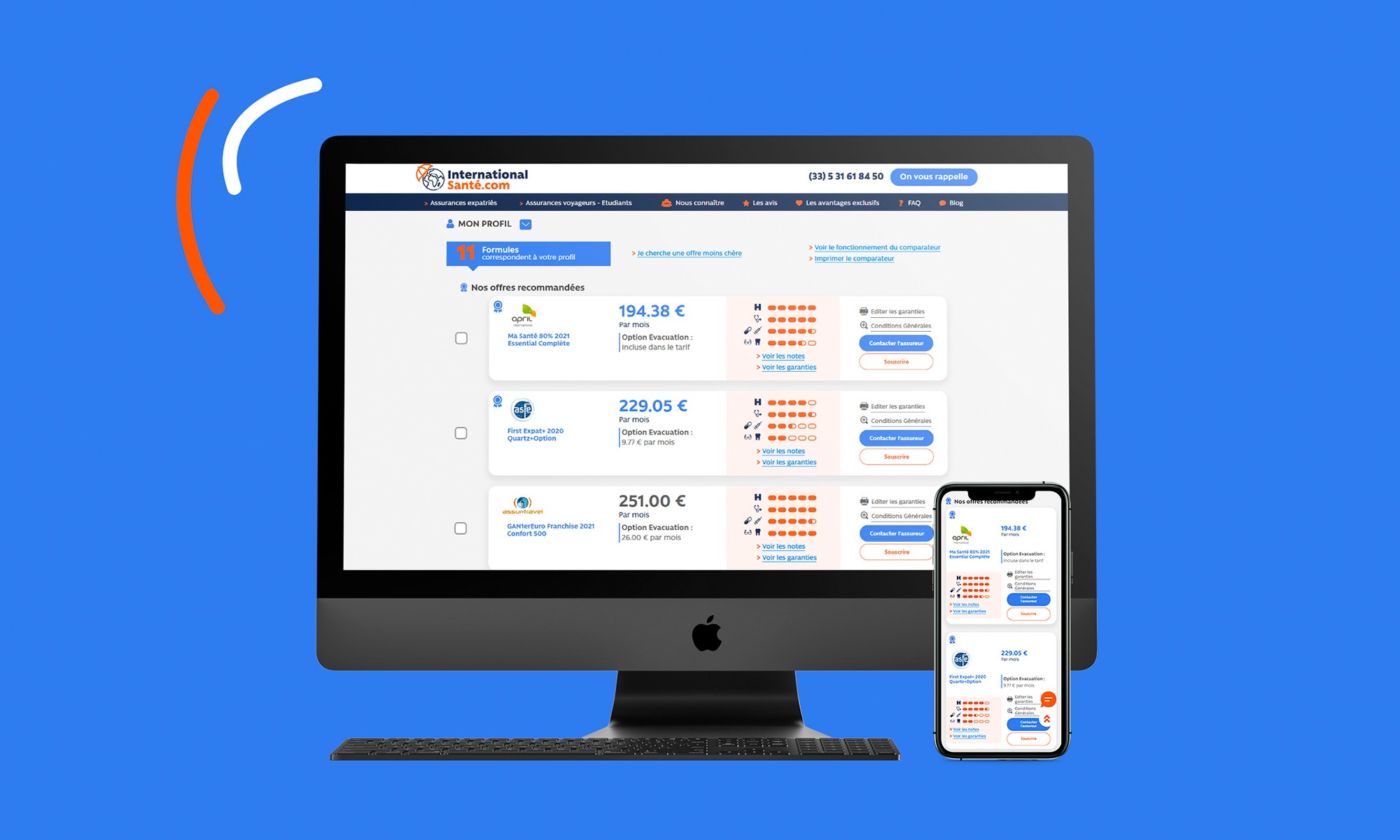

It is crucial to make a comparison of offers available. Specialized agencies often offer online tools to carry out these comparisons. Take the time to check reimbursements for the care that concerns you, in order to become aware of the limits and conditions of compensation.

Choosing the right coverage

To choose your international medical coverage, start by requesting several quotes. Compare not only prices, but also guarantees which are proposed. Some mutual insurance companies cover more extensive care than others. Be sure to read the fine print regarding exclusions and waiting periods.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Anticipate health risks

Before your departure, it is important to anticipate the health risks linked to the country of destination. This includes knowledge of necessary vaccines, local diseases and health infrastructure. These factors directly influence the type of mutual insurance you should choose.

Where to find reliable information

To help you in your choice, several sites such as Reassure me Or Alptis offer detailed guides on mutual insurance for expatriates. These resources will provide you with clear information about warranties, prices and the possible consequences of your choice.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

What about mutual insurance for foreigners in France?

If you are a foreigner living in France, it is essential to inform yourself about the mutual insurance available. Some French mutual insurance companies offer interesting options, adaptable to the needs of expatriates. Platforms like International Health Mutual can help you navigate the different options available.

Conclusion on choosing your mutual insurance company

Remember, choosing your international mutual health insurance is a crucial step to guarantee your health security during your stay abroad. Take the time to carefully assess your needs, compare offers, and don’t hesitate to ask questions to ensure that you are making the best possible choice for your situation.

When you expatriate, choose a mutual insurance for foreigners adapted to your needs is essential to benefit from optimal health coverage. This guide offers practical advice and tips for making the best choice from the many options available.

Coverage options available

When you choose your mutual, it is crucial to understand the different coverage options. You can opt for high-end options, offering access to comfort care such as a single room, or opt for more basic options, depending on your budget and your needs.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Compare offers

It is recommended to take the time to compare the different international health insurance. An online comparator can help you evaluate the guarantees, reimbursements and costs associated with each mutual insurance company. Be sure to read reviews and feedback from other expats to make an informed decision.

Evaluate your specific needs

Before subscribing to a mutual, take stock of your personal medical needs. Consider your care habits, any necessary treatments and health risks in the host country. This will allow you to target the guarantees that will suit you best.

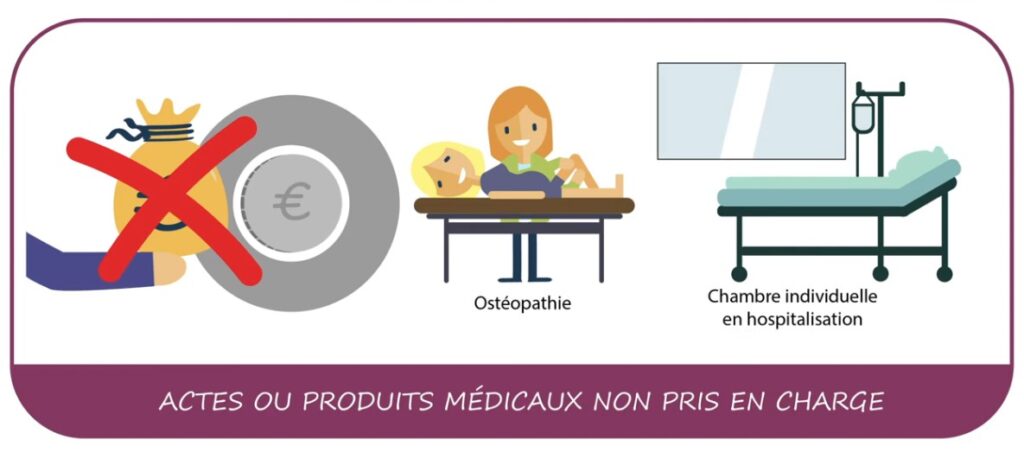

Exclusions to know

Each mutual contract has specific exclusions. Be sure to read the terms and conditions carefully to understand the limits of your coverage, particularly with regard to pre-existing care and specific accidents. Don’t leave any gray areas that could cost you dearly later.

Coverage of care abroad

Make sure that the mutual that you choose covers care abroad. Some guarantees are only valid in France, while others cover treatments carried out in different countries. This is an essential aspect to check before your departure.

Take into account repayment deadlines

Reimbursement times may vary from mutual to the other. Find out about these deadlines so you know when you can expect to be reimbursed. This will save you inconvenience and financial pressure if you have to pay significant medical expenses.

Choose insurance suited to your situation

If you are a French expatriate, offers like CFE can be particularly interesting. Other formulas specifically target foreigners living in France or French people living abroad. Please feel free to explore these options based on your personal situation.

To go further in your research, you can consult the resources on international health insurance or discover the details on Easy mutual. Also consider visiting ACS for recommendations on expatriation insurance and advice on choosing your coverage.

Finally, for any questions about the AXA mutual insurance or how to contact them easily, go to this link.

Mutual insurance for foreigners: selection criteria

| Criteria | Description |

| Type of coverage | Basic insurance or premium options for added comfort. |

| Refund | Compare the reimbursement rate for each type of care. |

| Access to healthcare networks | Check partner providers in your destination country. |

| Assistance abroad | Medical assistance service available 24/7 in your language. |

| Warranty Exclusions | Identify the care or situations not covered by mutual insurance. |

| Pricing | Analyze the monthly cost against your specific needs. |

| Subscription conditions | Ask about requirements, such as age or health status. |

| Waiting periods | Ask about the waiting time before coverage applies. |

Testimonials on Mutual Insurance for Foreigners: Complete Guide to Choosing Well

When I decided to emigrate, choose my mutual insurance for foreigners was one of the priorities on my list. I quickly understood that the right choice would determine my peace of mind on site. By comparing various options, I was able to select coverage tailored to my specific needs, particularly regarding medical care abroad. Every detail counts, and the possibility of benefiting from a single room in a healthcare establishment played a crucial role in my decision.

Another expatriate mentioned the importance of turning to a international health insurance comparator. This allowed him to clearly visualize the different offers and to concentrate on those which offered appropriate guarantees to its status. Thanks to this tool, she was able to assess healthcare reimbursements based on the countries visited, thus guaranteeing appropriate protection during her travels.

A young couple shares their experience, saying that it is essential to anticipate the health risks of each destination. They advise carefully analyzing what the policy actually covers. mutual health insurance selected, because some high-end options offer exclusive access to expat care networks, making their stay abroad much more stress-free.

Finally, a professional mentions that relying solely on price evaluation is not enough. He recommends looking at the services included, such as remote consultations and rapid reimbursements. These elements can significantly influence the quality of care you will receive as an expat and make all the difference when it comes to dealing with an unexpected illness or accident.

Choose one mutual insurance for foreigners is a crucial step in ensuring your peace of mind during extended stays abroad. This article presents the essential elements to consider in order to select the coverage that best meets your needs. Whether you are considering a move, a study trip or a business trip, the criteria for choosing a suitable mutual insurance should be explored carefully.

Understand your health coverage needs

Before you start looking for a expatriate health insurance, it is important to assess your specific care needs. Take into account your general health, any necessary treatments and the frequency of your medical visits. If you have special needs, such as dental or optical care, make sure that the mutual covers these aspects satisfactorily.

Compare available offers

An in-depth study of the different offers is essential to choose the best international health insurance. In order to make a judicious comparison, list the insurance companies and their offers. It is advisable to consult online comparators to have an overview of the prices, the guarantees offered and the options available. Don’t forget to check what is included in each plan and what deductible you might be subject to.

The essential guarantees

When making your choice, pay particular attention to the essential guarantees that a mutual insurance abroad must cover. Among these, we find hospitalization costs, consultations with general and specialist medicine, as well as prescribed medications. Also check if the cover includes access to an expat care network or the possibility of home care, which may be particularly important depending on where you live.

The importance of health networks

One of the criteria not to be neglected is access to a care network quality. Some mutual insurance companies offer exclusive networks where health costs are negotiated in advance. This can be financially beneficial, but make sure these networks are available in the country and regions where you are staying. This ensures that you can receive quality care at a reduced cost.

Anticipate local particularities

When you choose your international mutual, it is crucial to inform yourself about the particularities of the health system of the country in which you find yourself. In some countries, for example, the cost of care can be exorbitant, making comprehensive coverage essential. Also find out about any support conditions. This will allow you to prepare for any unforeseen health situations.

Check reviews and recommendations

Finally, take the time to read the opinions of other expatriates on the different mutual insurance companies. User testimonials can shed light on the quality of services provided, the speed of reimbursements and the claims management process. This can give you a clearer vision on choosing your mutual insurance for expatriates, helping you avoid unpleasant surprises.

When we are expatriate, the choice of a adapted mutual is essential to benefit from a health coverage optimal. It is essential to evaluate its specific needs, particularly depending on medical care common in the country of residence. Good preparation will allow you to navigate the world of international health insurance.

Before making your choice, do not hesitate to compare the different mutual insurance offers. Each company offers guarantees various, ranging from single room to access to specialized care networks for expatriates. Take the time to study the premium options And comfort that can really improve your medical experience abroad.

On the other hand, it is also crucial to anticipate health risks. These vary from country to country and should be taken into consideration when making your selection. Furthermore, it is recommended to check how your mutual works abroad, particularly with regard to repayment period and the care procedures.

Finally, to make the most informed choice, it may be wise to use a health insurance comparator. This can provide you with personalized quotes and help you weigh the advantages and disadvantages of each formula. By taking these precautions, you will be able to find the best mutual for expatriates, adapted to your situation and where you live.

FAQ about Mutual Insurance for Foreigners

What is the importance of having mutual insurance for foreigners? Have a mutual insurance for foreigners is essential to benefit from appropriate medical coverage during your stay abroad. This protects you from high medical costs and gives you peace of mind.

How to choose the best mutual insurance for expatriates? To choose the best mutual insurance company, it is recommended to compare the guarantees, THE price and the repayment period of the different companies. Also assess your specific care needs.

What guarantees should you look for in an international mutual insurance company? You should look for warranties that include specialized medicine, hospitalization, and medical repatriation. Depending on your situation, the dental care reimbursement and optics may also be important.

Does my French mutual insurance work abroad? It all depends on your insurance contract. It is important to check whether your French mutual insurance covers treatment abroad, as not all do.

How do I assess my international health insurance needs? Evaluate your needs based on your destination, the length of your stay and your state of health. Also prepare a list of care you may require during your time abroad.

Are the prices of mutual insurance companies for foreigners high? Prices vary depending on insurance and guarantees proposed. It is advisable to compare several offers to find the one that best suits your budget.

What documents are needed to take out mutual insurance for expatriates? Generally, you will need identification, proof of address, and often information about your health. Check with the insurance company for specific documents required.

Can you take out mutual insurance for foreigners online? Yes, many companies offer the possibility of subscribing to a mutual insurance for foreigners online, making the process easier and allowing you to easily compare available options.

What are the common exclusions in mutual insurance contracts for expatriates? Exclusions may include cosmetic treatments, undeclared pre-existing conditions, and certain non-urgent treatments. It is crucial to read the terms and conditions carefully.

How do I cancel my foreigner mutual insurance if necessary? To cancel your mutual insurance, consult the conditions of your contract. Generally, advance notice is required, and the request must be made in writing to your insurer.