|

IN BRIEF

|

Discover the world of mutual GFP, a well-known player in the field of health insurance. Through the opinions and testimonials of policyholders, let’s dive into the heart of the experiences of those who have chosen GFP for their health coverage. What are the strengths and weaknesses of this mutual? What do policyholders really think of its services and guarantees? In this article, we offer you insight into the feelings of members of the GFP community in order to help you better understand what this mutual has to offer.

The GFP mutual, now known as NoveoCare, aroused keen interest among policyholders. In this article, we will explore the notice And testimonials of those who have chosen this mutual health insurance. We will highlight the benefits as well as the disadvantages to provide an honest and enlightening overview for everyone looking for suitable health coverage.

Benefits

One of the main benefits of the GFP mutual, or NoveoCare, is the quality of reimbursements. Many policyholders report high satisfaction with the processing times of their reimbursement requests. They often mention the speed and efficiency of customer service, which gives them peace of mind in times of need.

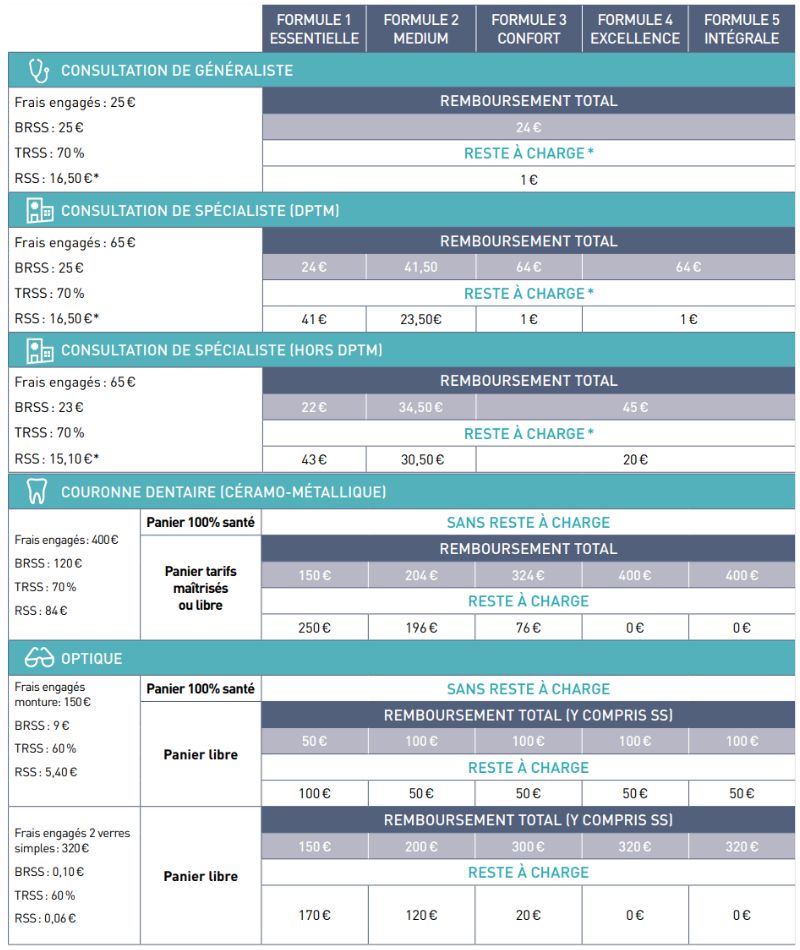

Another point discussed by users is the diversity of guarantees proposed. Indeed, the GFP mutual offers a wide range of formulas which allow each insured person to find an option which corresponds to their specific needs, from the most basic to the most comprehensive. The options of prevention and of well-being, such as the coverage of alternative medicines, are often appreciated by policyholders.

Disadvantages

disadvantages. A point often raised in the testimonies concerns the cost of contributions, which can be relatively high compared to other mutual insurance companies on the market. Some policyholders believe that the prices are not always in line with the level of coverage offered.

Additionally, some users express frustrations regarding the complexity of administrative procedures. Navigating their site and understanding the different levels of coverage can seem confusing for some policyholders. This sometimes leads to a feeling of dissatisfaction with the overall experience.

To learn more about the experiences of other policyholders, do not hesitate to consult the reviews on Soaring or study the specific testimonials concerning the GFP mutual. Whether to evaluate the refunds or to explore the customer services, these resources can help you make an informed decision.

There mutual GFP, now known as NoveoCare, is a player in the health insurance sector which receives numerous opinions from its policyholders. In this article, we offer you an overview of the feedback from those who have chosen this mutual insurance company. The testimonials and opinions collected will allow you to better understand the advantages and disadvantages of PFM.

Feedback from policyholders

Making an informed decision about your mutual insurance requires relying on the opinions of other policyholders. Feedback regarding GFP are varied. Some policyholders express their satisfaction, highlighting the quality of customer service and the speed of reimbursements. A notable testimony evokes the responsiveness of an advisor who knew how to answer all questions. GFP therefore stands out for the attention paid to its customers.

The strong points of the GFP mutual

For many users, guarantees proposed by GFP are really interesting. Policyholders also praise the ease of use of the website for making reimbursement requests. Coverage options tailored to specific needs, such as those for seniors or families, also seem to meet the expectations of a broad clientele.

Criticisms and points for improvement

Despite these many positive reviews, some criticisms surface. Some policyholders deplore the complexity of certain procedures, particularly with regard to subscribing to additional services. In addition, some negative opinions concern the reimbursement terms, which are sometimes considered unclear. This feedback reveals a certain frustration and highlights the need for more transparent communication.

How to contact the GFP mutual?

For any questions regarding your mutual insurance or to make a complaint, you can contact the NoveoCare via their form accessible online on their site at the following address: Contact us. Advisors are generally available and ready to help you with your efforts.

To conclude

Opinions on the mutual GFP are varied, but the majority of policyholders seem satisfied with the quality of the services offered. However, as with any insurance choice, it is crucial to be well informed and read reviews to make the decision that best suits your needs. If you want to investigate further, more detailed reviews can be found on platforms such as Opinion-Insurance or in various online comparators. Take the time to compare and choose the mutual that suits you best.

In the world of mutual health insurance, it is essential to have a clear idea of the benefits and services offered. The GFP mutual, now known as NoveoCare, has attracted numerous opinions from its policyholders. This article offers you an overview of feedback, highlighting the strengths and weaknesses of this mutual, in order to help you make an informed decision.

Positive Reviews: What do policyholders like?

Many policyholders express a favorable opinion regarding the mutual GFP. One of the points often highlighted is the quality of service of the staff. Customers report that the contact by telephone is fast and pleasant, which is a real asset. Reimbursements would also be processed efficiently, allowing policyholders to relieve themselves of financial concerns related to their health.

Guarantees and refunds appreciated

Policyholders highlight the guarantees proposed, particularly with regard to routine care. One testimonial speaks of satisfactory reimbursements for common medical procedures, which makes daily life more peaceful. For those considering subscribing to this mutual insurance, it may be interesting to consult insurance comparisons which include GFP, in order to have a global vision of the offers.

Negative Reviews: What reviews come up often?

Despite the positive feedback, negative opinions remain. Some policyholders express frustration regarding the speed of refunds in specific situations, particularly for care abroad. These delays can have serious consequences for certain people requiring urgent care. Other testimonies mention communication difficulties with certain managers.

Expectations sometimes disappointed

Although mutual insurance has many followers, it is important to keep in mind that expectations regarding health coverage may vary. Some policyholders suggest reading the contract clauses carefully and finding out beforehand about all the reimbursement conditions. Resources like this site can be useful to better understand how mutual insurance works.

Conclusion: What to remember from the opinions on the GFP mutual fund?

Opinions on the mutual GFP offer an interesting overview of the experiences of policyholders. While some praise the quality of customer service and fast refunds, others point out negative aspects that are worth considering. For an informed choice, it is recommended to compare the offers and deepen your research by visiting LesFurets or other specialized platforms. Each situation is unique, so take the time to carefully assess your health insurance needs before making your choice.

| Opinions of policyholders | Concise comments |

| Fast refunds | Policyholders appreciate the speed of reimbursements. |

| Efficient customer service | Easy telephone contacts with attentive staff. |

| Full guarantees | The coverage options offer good peace of mind. |

| Competitive rates | The attractive prices attract many beneficiaries. |

| Reported disadvantages | Management problems sometimes noted by some. |

| Ease of use | The online platform is appreciated for its simplicity. |

| Recent changes | The transition to NoveoCare has raised concerns. |

| General satisfaction | A majority of policyholders say they are satisfied with their choice. |

Testimonials about Mutuelle GFP: What do policyholders say?

When looking for mutual health insurance, it is essential to base yourself on authentic testimonials. This is how Mutuelle GFP stands out by collecting varied opinions from its policyholders. Their feedback echoes the experience of many users, whether positive or negative.

First of all, we note that certain policyholders particularly appreciate the customer service. Several testimonials highlight the responsiveness of the team: “I contacted GFP with a question about my reimbursement, and I was pleasantly surprised by their speed and efficiency! » It goes to show that good interpersonal skills can change the situation.

However, not all reviews are so glowing. Policyholders have expressed their dissatisfaction with the repayment deadlines. One user said: “After submitting my application, I had to wait several weeks to receive my refund, which was very frustrating. » These testimonies highlight aspects to improve for the mutual.

But Mutuelle GFP does not just listen to its policyholders, it also seeks to improve. Some opinions highlight the warranty options interesting, which allow a good level of coverage. One policyholder noted: “The reimbursement options are flexible and adapted to my needs. I feel well protected. » This is one of the strong points that users appreciate, despite some drawbacks regarding delays.

Finally, the method of sorting reviews on Mutuelle GFP allows new customers to form their own opinion. They can easily view the best and worst feedback. This demonstrates a desire for transparency and honesty on the part of GFP, a crucial element in the choice of mutual health insurance.

In conclusion, whether we are seduced by their customer service or disappointed by reimbursement delays, the opinions on Mutuelle GFP are rich and varied. Each feedback is a piece of the puzzle that helps future policyholders make an informed choice.

Mutuelle GFP: An Overview of Policyholders’ Opinions

When it comes to health, choosing the right mutual insurance company is essential to guarantee coverage adapted to your needs. There mutual GFP, now known as NoveoCare, attracts numerous opinions, ranging from laudatory testimonials to more nuanced criticisms. Through this article, we will explore the different aspects of this mutual insurance by dissecting the opinions of policyholders and providing you with recommendations to better navigate this sometimes complex world.

The Positive Points of Mutuelle GFP

Many policyholders appreciate the guarantees offered by the GFP mutual. Testimonials show rapid and efficient coverage of medical costs. Indeed, several policyholders highlight the simplicity of procedures reimbursement, which is often a crucial point for users. The options of refund varied and flexible formulas adapted to everyone’s needs are also major assets, allowing you to find the right shoe for you.

Responsive Customer Service

Customer service seems to be another strong point. Many people report a accessibility appreciable, whether by telephone or by email. Reviews testify to warm and professional staff, ready to help policyholders with their procedures. This helps create a feeling of trust and satisfaction among the members of the mutual.

Disadvantages to Consider

Although many opinions praise the strengths of the mutual, some critiques highlight areas for improvement. Among the negative feedback, we find in particular repayment deadlines which can sometimes seem long. Some policyholders also regret that the coverage does not always meet their expectations, particularly for specific care.

Coverage Limitations

It is essential to carefully analyze the offers proposed by GFP. If the mutual seems to offer attractive packages, it is important to carefully read the guarantees to ensure that they meet individual health needs. Testimonies indicate that some policyholders realized that their coverage was not enough to cover all their medical costs, leading to disappointment.

Tips for Maximizing Your Experience with PFM

To get the most out of your health insurance, here are some recommendations. First, take the time to compare the prices And guarantees of the GFP with those of other mutual societies. Carrying out a comparison can help you choose the formula best suited to your situation.

Contact Customer Service

Do not hesitate to contact customer service to ask your questions before joining. This step will allow you to clarify certain points and check if the mutual really meets your expectations. Many policyholders advise not to be afraid to voice doubts or concerns, as staff are generally receptive and willing to offer advice.

The GFP mutual, now NoveoCare, presents a set of undeniable advantages, but also points to watch out for. Policyholder reviews highlight efficient customer service and valuable guarantees, while some feedback highlights repayment deadlines or limitations in coverage. By taking the time to inform yourself and ask the mutual directly, you will maximize your experience and the value for money of your health contract. Make sure you make an informed choice, because your health is priceless!

Conclusion on Mutuelle GFP: opinions and testimonials from policyholders

After an in-depth analysis of the opinions and testimonials of policyholders on the Mutual GFP, it appears that this mutuality gives rise to varied opinions. On the one hand, some policyholders highlight the quality of customer service and the speed of reimbursements. This feedback demonstrates attentive listening from advisors, as well as personalized support, which pleases more than one policyholder.

On the other hand, criticisms persist, in particular concerning the complexity of reimbursement procedures and some disputes linked to the management of files. These difficulties are often reported by frustrated policyholders who are waiting for clearer and faster answers for optimal coverage of their medical costs. Transparency of information regarding guarantees and pricing remains another point of discussion, with some wanting more clarity.

Ultimately, it is essential to remember that the choice of mutual health insurance must be made according to the specific needs of each person. There Mutual GFP offers various advantages, but each future member should carefully weigh the pros and cons, and read the general conditions carefully. The opinions of policyholders can serve as a guide, but are primarily based on unique personal experiences.

For better decision-making, we advise each individual to explore different testimonials and familiarize themselves with the guarantees offered. By doing this, each policyholder will be able to find the solution best suited to their expectations and benefit from health coverage that really suits them.

FAQ about Mutual GFP: Opinions and Testimonials from Insured Members

What are the opinions of policyholders on Mutuelle GFP?

Opinions of policyholders on Mutuelle GFP vary considerably. Many policyholders find the mutual services satisfactory, particularly with regard to quick refunds and the quality of customer service. However, some highlight areas for improvement, such as difficulty reaching customer service at certain times.

What are the advantages of Mutual GFP?

Among the advantages most often mentioned, policyholders appreciate the various guarantees proposed by GFP and the competitive rates for the services. Additionally, the options for adapted reimbursement to the needs of policyholders are also highlighted.

Are there any disadvantages to subscribing to Mutuelle GFP?

Some policyholders expressed their dissatisfaction regarding the processing time for refund requests in certain situations or the complexity of contracts. This can be a source of frustration, especially for new members.

How to get reimbursed with Mutuelle GFP?

The process of refund with Mutuelle GFP is generally straightforward. Policyholders must submit their invoices and supporting documents via their personal space or by email. The repayment period is often specified on the site.

How to contact Mutuelle GFP customer service?

To contact customer service, policyholders can call the number indicated on their mutual insurance card or their online space. They also have the option of sending a e-mail or fill out a contact form on the GFP website.

What are the Mutuelle GFP prices?

Mutuelle GFP prices depend on the chosen guarantees and the specific needs of each insured person. It is advisable to request a personalized quote to obtain precise information on the costs associated with each formula.