|

IN BRIEF

|

In the jungle of mutual health insurance, Allianz emerges as a major player. What do policyholders think of this health coverage? While many opinions are positive regarding the choice of guarantees offered, some customers express concerns, particularly regarding the price high, especially for the elderly. Let’s dive into the feedback from Internet users to better understand the strengths and weaknesses of Allianz mutual health insurance.

When it comes to choosing a mutual health insurance, many criteria come into play, including prices, guarantees offered and feedback from policyholders. Allianz mutual health insurance, a major player in the sector, is no exception. In this article, we will explore the benefits and the disadvantages of this mutual based on the opinions of Internet users. This will allow you to make an informed choice for your health coverage.

Benefits

One of the main benefits of Allianz mutual health insurance lies in the diversity of guarantees which can meet the varied needs of policyholders. Customers appreciate the ability to personalize their contract to suit their personal situation, whether it be routine care or specific treatments.

In addition, Allianz offers attractive reimbursements, particularly for optical, dental and audiology. Thanks to the guarantee 100% Health, policyholders can benefit from 0€ remaining charge for a certain number of services. This represents a real advantage, especially for families looking for comprehensive coverage without unpleasant financial surprises.

Customer reviews of Allianz are generally positive, highlighting the reputation of the company and the quality of its customer service. With a rating of 4.8/5 on eKomi, it is obvious that many policyholders are satisfied with the services offered.

Insurance for expatriates: the importance of flexibility in your choices

In a constantly changing world, and with the resumption of expatriation expected in 2025 after the slowdown caused by the Covid-19 pandemic, the role of expatriate insurance has never been more crucial. Companies must now ensure that their employees, spread…

Disadvantages

Despite its many strengths, Allianz mutual health insurance also has its disadvantages. One of the criticisms frequently heard concerns the price, which can be considered exorbitant, especially for older people. The latter note that certain mutual insurance companies specially designed for EHPADs, for example, are up to four times cheaper while offering similar guarantees.

Many policyholders also express frustrations regarding the management of refunds, emphasizing that there can sometimes be errors. Some Internet users report long processing times and the need to manage incidents themselves, which can be particularly painful.

Finally, although the majority of reviews are positive, there are a handful of negative comments that deplore an unsatisfactory experience with Allianz, so much so that some advise to “run away”. Despite this, at Allianz it is important to note that each situation is unique, making experiences varied among policyholders.

Allianz mutual health insurance attracts the attention of Internet users with its various offers and its commitment to its policyholders. However, opinions are divided and it is crucial to analyze both its advantages and disadvantages. This article offers you an overview to better understand what users think of Allianz mutual health insurance.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Positive opinions from policyholders

Overall, many customers are satisfied with the services offered by Allianz mutual health insurance. The reviews highlight the diversity of guarantees available, which allows everyone to find coverage that suits them according to their specific needs. Indeed, the score of 4.8/5 on the eKomi platform, based on nearly 76,000 reviews, demonstrates the recognition of their services by a wide audience.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Negative points raised

However, some policyholders express notable dissatisfaction. Recurring complaints concern errors in reimbursements which often have to be settled by the customer himself. This can cause significant delays in processing refunds, a particularly frustrating factor for users.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Prices and competition

Another often criticized aspect is the price of Allianz mutual health insurance, sometimes considered expensive, especially for the elderly. Comparatively, specific mutual insurance companies such as those for EHPADs display prices of up to four times less

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

100% Health and associated benefits

It is important to note that Allianz offers hedging solutions 100% Health, allowing policyholders to benefit from reimbursements without out-of-pocket costs for care such as optical, dental or audiology. This represents a huge benefit for those looking to reduce their medical costs.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

How to choose your health insurance?

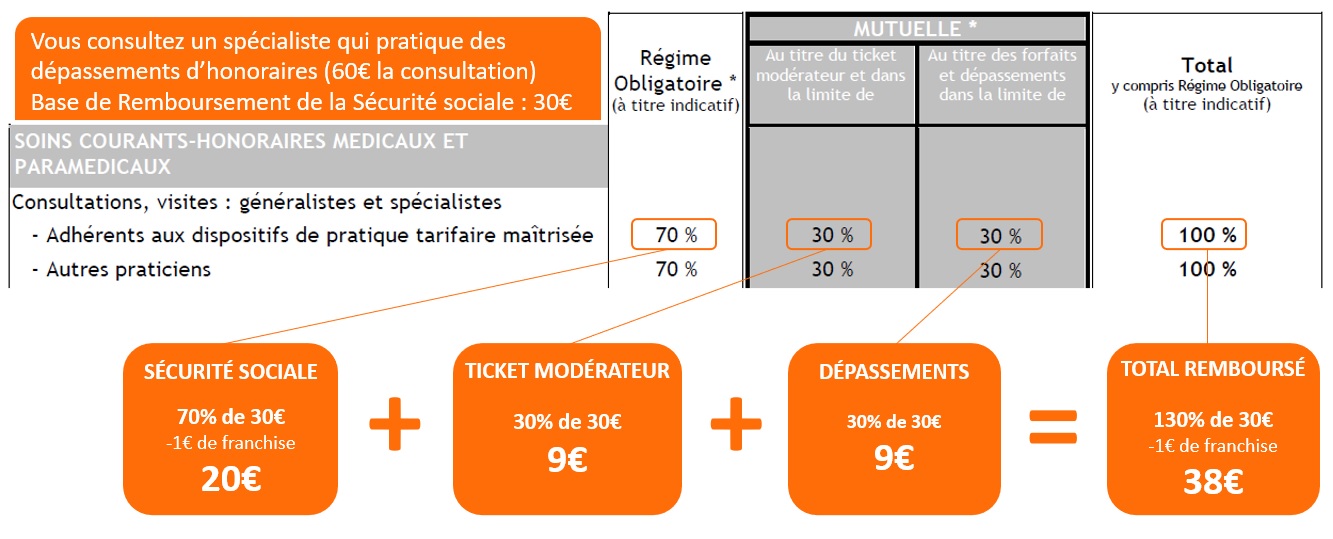

Take the time to compare offers mutual health insurance before making your choice. The site Selectra offers comparison tools that will help you find the ideal plan for your situation. Additionally, it is important to understand the relationship between mutual health and social security, in order to make an informed choice.

By keeping in mind the different feedback and analyzing your needs, you will be better equipped to choose a health insurance plan that will meet your expectations while respecting your budget.

When considering taking out mutual health insurance, it is essential to obtain reliable information to make the best choice. Allianz health insurance is one of the options available on the market, but what is the general opinion? Through this article, we will highlight user opinions in order to better understand the advantages and disadvantages of this health supplement.

The diversity of guarantees offered

One of the points often highlighted by Allianz policyholders is the wealth of guarantees proposed. Customers appreciate the flexibility that allows them to adapt their contract according to their specific needs, whether for optical, dental or audiology. Thanks to the 100% Health Guarantee, it is possible to benefit from 0€ remaining charge for certain benefits, which is a real asset for those who face high health costs.

Prices to study carefully

However, several users have expressed reservations regarding the prices charged by Allianz. In comparison with other mutual insurance companies, particularly those intended for the elderly or specific to EHPADs, some customers find that the prices are exorbitant. Indeed, it has been reported that senior options can be up to four times more expensive than other solutions on the market with similar guarantees. It is therefore crucial to compare before committing.

Customer feedback on refunds

Another data to take into account is linked to the refunds. Although reviews are generally positive, some policyholders report negative experiences with reimbursement errors. It seems that the management of reimbursement files can sometimes prove complex and require prolonged monitoring. It is advisable to find out about reimbursement procedures and to keep all invoices and supporting documents.

The importance of Internet users’ opinions

To get a more precise idea, it is interesting to consult the user reviews. On platforms like The Insurance Comparator Or Trustpilot, it is possible to read numerous testimonials from policyholders. This makes it possible to note the strengths and weaknesses of the mutual based on the experiences of others. This feedback is essential to making an informed decision.

Conclusion on the opinions of Allianz mutual health insurance

In short, Allianz mutual health insurance offers undeniable advantages in terms of various guarantees, but it is not without criticism, particularly on its prices and reimbursements. Therefore, it is essential to assess your own needs and consult the available opinions before signing a contract. For those who want to deepen their knowledge, sites like International Health Mutual also offer valuable advice on selecting the best options.

| Criteria | Description |

| Prices | Prices can be considered as students for the elderly, particularly in comparison with specialized mutual insurance companies. |

| Refunds | Of the frequent delays and errors in reimbursements are often reported by policyholders. |

| Assistance | Customers emphasize the reactivity and the availability of Allianz customer service. |

| Guarantees | A wide range of guarantees is offered, meeting various health needs. |

| Ratings | Overall, reviews positive with an average rating of approximately 4.8/5 on evaluation platforms. |

The experience of policyholders with Allianz mutual health insurance varies considerably, which provides an interesting insight into the pros and cons of this coverage. Many customers highlight the quality of the guarantees offered, which makes it an attractive choice. Indeed, the reimbursement options foroptical, THE dental and theaudiology can be very interesting, notably thanks to the guarantee 100% Health which allows you to have 0€ left to pay.

However, digging a little deeper, some users share their dissatisfaction. For example, several policyholders report frequent difficulties with refunds which can take months and require diligent monitoring. This observation can be frustrating and lead to a certain dissatisfaction, which is reflected in the reviews left online.

The question of prices also deserves to be raised. Many Internet users consider Allianz’s prices to be exorbitant, in particular for elderly people who can find special mutual insurance for EHPADs four times cheaper, while offering similar guarantees. This raises questions about the competitiveness of Allianz’s offers on the market.

Despite these negative points, the majority of comments remain positive. On platforms like eKomi, Allianz obtains a rating of 4.8/5, demonstrating general satisfaction among its customers. This performance could encourage those looking for a complementary health to consider Allianz as a serious option, although caution is required regarding feedback on reimbursement times.

Finally, it is essential to inform yourself and compare the different options available on the market before making a choice. Analyzing prices, guarantees and policyholder reviews can help make an informed decision to choose the mutual health insurance most suited to its needs.

Opinion on Allianz mutual health insurance: an in-depth analysis

Allianz mutual health insurance is one of the major players in the field of health insurance in France. Internet users’ opinions on its services appear to be varied, between satisfaction for a well-managed service and concerns about the price, particularly for the elderly. This article examines the advantages and disadvantages of Allianz health insurance to provide you with a useful overview to make an informed choice.

The advantages of Allianz mutual health

Overall, policyholder reviews of Allianz are mostly positive. Many customers emphasize the diversity of guarantees offered, which allows you to choose coverage adapted to your specific needs. For example, optical, dental and audiology packages benefit from the 100% Health Guarantee, thus ensuring a total reimbursement with no remaining charges.

In addition, Allianz stands out for the speed of its customer service. Management of files refund is often considered effective, even if there is some negative feedback on processing errors. Nevertheless, customers appreciate the fact that they can get a free online quote and in record time, which considerably facilitates decision-making.

Pricing concerns

One of the points most often highlighted by Internet users concerns high prices of the Allianz mutual health insurance, particularly for the elderly. Prices can be considered exorbitant, especially when compared to other options. For example, the specialized mutual insurance companies for EHPADs can cost up to four times less while offering similar guarantees.

This price disparity could potentially dissuade some policyholders from choosing Allianz, even if the company offers an overall well-rated service. It is therefore crucial for consumers to do their own comparison to ensure that they are finding the best value for money.

Contrasted opinions of policyholders

reimbursement errors. It has been reported that for some clients, the process of managing refunds can extend over several months, which generates frustration and dissatisfaction. These intertwined elements can also cause policyholders to spend hours dealing with these issues, which can be discouraging.

Choosing the right health coverage

Faced with these various opinions, it is essential to think carefully before choosing your health insurance. If your needs are simple and you prefer a competitive price, other mutual insurance companies could offer a better solution for your budget. However, if you are looking for a wide range of guarantees and are willing to invest for these services, Allianz may remain a very relevant option.

It is also advisable to consider customer support and ease of access to online services. These elements can greatly enhance your experience with your mutual insurance company. Don’t hesitate to compete and obtain different quotes to better understand the offer best suited to your needs.

When it comes to choosing a mutual health insurance, many insurers appear on the market, and Allianz is often mentioned. User reviews show that this mutual offers varied guarantees, which pleases a majority of its policyholders. Indeed, many emphasize the diversity of options that allow health coverage to be personalized according to the specific needs of each individual.

However, it is important to take into account more critical feedback. Some Internet users express their dissatisfaction, reporting recurring difficulties in terms of refund. Cases of errors in the management of reimbursements are reported, which can cause frustration for policyholders who often have to devote many hours to regularizing these situations.

Another point to consider is the cost of prices offered by Allianz. For the elderly in particular, prices may seem excessive compared to other specialized mutual insurance companies. It is interesting to note that certain mutual insurance companies reserved for establishments such as EHPADs offer solutions up to four times cheaper with similar levels of guarantees. This encourages caution and an in-depth comparison before committing.

For policyholders looking for a complementary health, Allianz undeniably has advantages, notably the promise of a reduced out-of-pocket cost for optical, dental or audiology care, thanks to the 100% Health guarantee. However, each individual will have to evaluate these advantages against the potential disadvantages to determine whether this mutual insurance corresponds to their expectations and their health needs.

FAQ about Allianz health insurance

What are internet users’ opinions on Allianz health insurance? The feedback from policyholders is generally positive, highlighting the diversity of guarantees offered by Allianz.

Are the prices of Allianz mutual health insurance competitive? For older people, prices may seem exorbitant compared to special EHPAD mutual insurance companies, which can offer guarantees similar to four times cheaper.

What reimbursement options are available with Allianz mutual insurance? Allianz allows reimbursement to 100% charging in optics, dental or audiology thanks to the guarantee 100% Health.

Why do some policyholders complain about reimbursements from Allianz? There are feedbacks where policyholders mention reimbursement errors frequent, requiring prolonged monitoring on their part.

How does Allianz rate the quality of its services? Allianz holds the Gold quality label with a rating of 4.8 out of 5 on eKomi, proving significant satisfaction among their customers.

Are there any differences between complementary health insurance and mutual insurance? Yes, one complementary health (also called mutual insurance) mainly covers unreimbursed care by social security.

What coverage options does Allianz offer for seniors? Allianz offers specific rates and guarantees adapted to needs of seniors.