|

IN BRIEF

|

Allianz mutual stands out for its offers, but what do Internet users really think about it? Before you commit, it is crucial to review customer reviews on the rates ,services and coverages offered. In this article, we present the key points to know to help you make an informed decision about Allianz. https://www.youtube.com/watch?v=KaTPDmSMY5Y

mutuelle positions itself as a popular choice among the different offers available on the health market. However, before making a decision to join, it is crucial to explore both its pros and cons , as well as the opinions of consumers who have experienced this coverage. Below, we present an overview of the key elements to consider.Pros

One of the strong points of Allianz is undoubtedly the

competitiveness of its rates . For companies, the employer contribution to group health coverage is often at least 50%, which makes the offers attractive to employees. This provides comprehensive protection at a reduced cost to employees.Many people express

general satisfaction with regard to the services offered by Allianz. The guarantees are often considered adequate to cover a wide range of health needs, ranging from routine care to more specific expenses. Indeed, prompt refunds are often cited in customer returns, although times can vary. Disadvantages

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

disadvantages to take into account. Many customers have noticed that

prices can be high , especially for the elderly. They note the availability of special mutual insurance companies for EHPADs, which can offer rates up to four times lower while offering similar guarantees.Another concerning aspect is the quality of customer service. Some users have shared unfortunate experiences, citing processing times of up to three weeks for refund requests. This led to a perception of

lack of efficiency and competence within the management team, which can be frustrating for policyholders. In short, although Allianz may present

undeniable advantages , it is essential to carefully weigh the pros and cons. Inform yourself and read various opinions to inform your choice before committing to this mutual health insurance.Before choosing complementary health insurance, it is essential to find out about the different offers available on the market. The Allianz mutual, recognized for its experience and its diversity of products, can appeal to many policyholders. In this article, we will look at user reviews and highlight the key aspects to consider when making an informed choice.

Allianz mutual insurance prices

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

When it comes to mutual health insurance,

the prices are often at the heart of the concerns of future subscribers. Although the mutual Allianz offers competitive options, some feedback from Internet users highlights that prices can be high, particularly for older people. Comparatively, specific mutual insurance companies for EHPADs can offer similar guarantees for a cost of up to four times cheaper .Guarantees and services

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Before subscribing, it is crucial to carefully analyze the

guarantees offered by Allianz mutual insurance. Customers generally appreciate the services varied options offered, which include reimbursements on various health expenses. However, it is recommended to compare these offers with other mutual insurance companies to ensure that specific needs are covered. Feedback from policyholders

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Reviews of Allianz mutual customer service vary. Some users report

refund request processed in less than 72 hours, while others complain of long delays of up to three weeks. In addition, several clients highlight a lack of responsiveness on the part of managers, suggesting that it would be necessary to improve this line of service. Allianz corporate health insurance

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Allianz also stands out for its

corporate health insurance . For employers, it is imperative to offer additional health coverage to their employees. The employer’s contribution is at least equivalent to 50% of the contribution, which represents a significant advantage for employees and encourages them to choose Allianz for their health coverage.General assessment of Allianz mutual insurance

Overall, feedback on

Allianz mutual health insurance are mixed. While some customers are satisfied with services provided, others express concerns about the reactivity customer service. Users are therefore encouraged to take the time to evaluate their priorities before committing. discover the opinions on the allianz mutual insurance company: analyze the testimonials of the insured, compare the offers and find the health coverage that suits you. make the informed choice for your well-being and your financial security.

mutual health insurance company , it is essential to find out about the different options available. TheAllianz mutual insurance company , recognized on the market, attracts attention with its varied offers. However, before making a decision, it is crucial to explore the feedback from customers and compare theguarantees and rates offered. Internet users’ opinions on the Allianz mutual insurance company

Many customers share their opinions on the Allianz mutual insurance company, and these opinions can be very informative. However, their experiences are often contrasting. Some users praise the quality of the

services and the rapid reimbursements, while others report difficulties with customer service, which could be improved according to several testimonials. Comparison of rates The

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

rates

of the Allianz mutual insurance can be high, especially for the elderly. Comparison with other options, such as special EPHAD mutual insurance, sometimes reveals significant differences. The latter can offer similar guarantees at much lower prices, making it essential to think carefully about the choice of mutual insurance. The competitiveness of Allianz company mutual insuranceFor employees, the

Allianz company mutual insurance

offers interesting advantages, including an employer contribution of up to 50% of the premium. This can make this type of coverage more accessible, but it is important to check the guarantees included and ensure that they correspond to your personal and family needs. Reimbursement times and customer service Another point often mentioned by policyholders concerns the

reimbursement times

. Allianz claims to process requests within 72 hours, but many users note that delays can sometimes extend. This highlights the importance of evaluating not only safeguards, but also the reactivitycustomer service, a crucial aspect for a good experience. The specificities of Allianz senior mutual insurance For retirees, the

Allianz senior mutual insurance

offers suitable formulas. However, it is essential to carefully analyze the refunds proposed, as well as the price , before making a choice. Reviews from retired customers can provide valuable information on the quality of services. Provisional conclusion on Allianz mutual insuranceBefore committing to Allianz mutual insurance, it is therefore essential to do your homework, compare offers and take into consideration feedback from policyholders. By visiting sites like

International Health Mutual

or by consulting comparisons such as Indeed , you will be able to better understand all the complexity of this decision. Evaluation axisDetails

| Prices | Allianz mutual insurance prices are judged |

| students | , particularly for the elderly compared to other mutual insurance companies. RefundsRefunds are announced within 72 hours, but significant delays have been reported. |

| Customer service | Reviews report a |

| bad customer service | , with very long response times. GuaranteesTHE |

| guarantees | There are many options available, but it is essential to study them carefully before registering. Company mutual insurance Competitive with employer participation often above 50%. |

| Comparison | Specialized mutual insurance companies, such as those for EHPADs, can offer better rates. |

| Overall satisfaction | Many customers declare themselves |

| satisfied | services, despite some criticism. discover reviews of Allianz mutual insurance and obtain valuable information on its offers, prices and quality of service. Compare testimonials from policyholders to make the best health choice. View this post on Instagram |

attracts the attention of many policyholders. However, feedback shared by users reveals important aspects to consider before committing. Indeed, the question of price is frequently raised, particularly by older people. Many testimonials indicate that the prices can be exorbitant , in comparison with the offers of specialized mutual insurance companies for EHPADs, which can be four times cheaperfor similar guarantees. Another point often mentioned by customers concerns the customer service

from Allianz. Several policyholders deplore delays in refund which do not correspond to the initial promises. Although Allianz advertises processing times of 72 hours, many users report situations where these refunds took up to three weeks , causing concern and frustration. On the other hand, some customers express their satisfaction with the services offered by Allianz mutual health insurance. They highlight a wide range ofguarantees

, which can meet the varied needs of policyholders. However, it is crucial to carefully analyze these offers and find out about the prices, because the price difference can influence the final choice. Another aspect often mentioned concerns the Allianz mutual company. Many point out that employer participation is often at least50%

contributions, thus allowing employees to access relatively competitive plans. This could be an advantage for those who choose to subscribe to mutual insurance as part of their employment. Finally, even if Allianz is a recognized insurer, it is essential to be vigilant. Opinions are divided and it is therefore wise to compare the different options on the market before making a decision. By taking the time to analyze all of these elements, it is possible to make an informed choice regarding your mutual health insurance

. Before subscribing to themutual Allianz

, it is essential to know the opinions and feedback of policyholders. This article provides an overview of the main features of the Allianz offering, its value for money, as well as reviews regarding customer satisfaction. You will also discover the criteria to take into account to make the best choice in terms of complementary health insurance. The guarantees offered by Allianz mutual insuranceThere

mutual Allianz

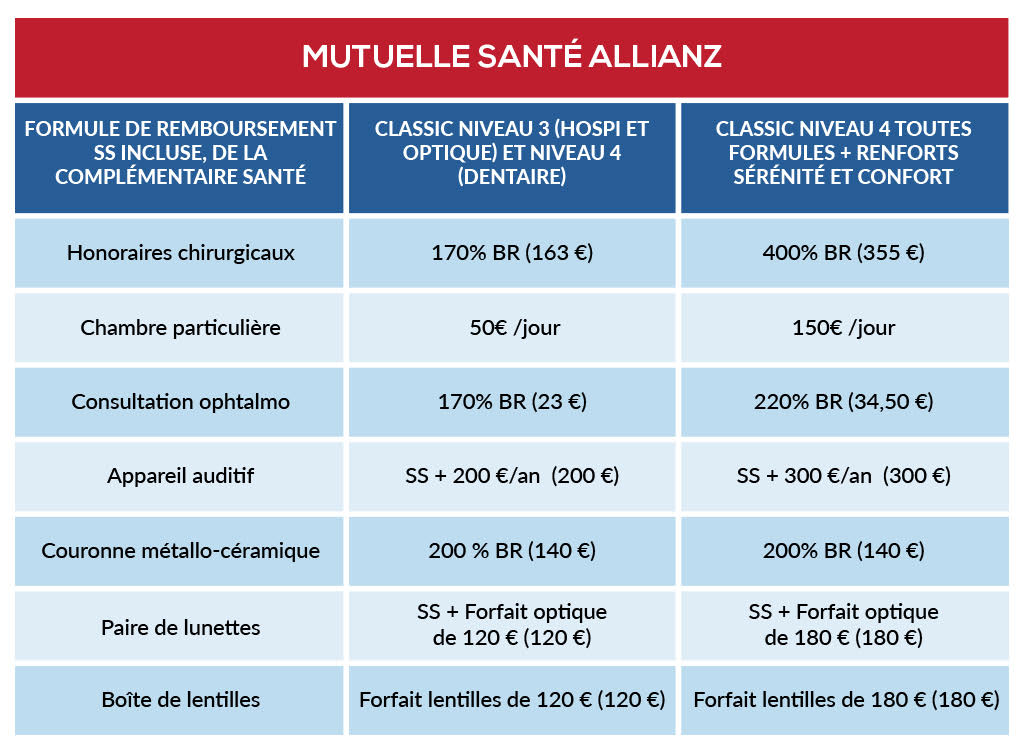

is distinguished by a wide range of guarantees adapted to different profiles of policyholders. Reimbursements include common medical expenses, such as doctor’s visits, dental care, and optics. It is essential to understand the guarantees included in each contract before making a final choice. Indeed, certain guarantees may vary from one contract to another, while additional options may be offered such as coverage for alternative medicines. Pricing and comparisons with other mutual insurance companies It is important to note that the

Allianz mutual insurance rates

may be perceived as high, especially for older people. Several Internet users testify that mutual insurance companies specifically designed for EHPADs are up to 4 times cheaper while offering similar guarantees. Before you decide, it is wise to study the prices carefully and compare them to other offers available on the market. Do not hesitate to request quotes to better evaluate your options. Customer satisfaction and feedback Concerning customer satisfaction, reviews on the

mutual Allianz

are mixed. On the one hand, many customers appreciate the services, the reimbursement rate and the diversity of the offers. However, certain criticisms emerge around reimbursement times. Several policyholders report delays of up to 3 weeks, while the company generally promises reimbursement within 72 hours. It is therefore crucial to find out about these aspects in the context of your choice. Quality of Allianz customer service Another point of concern for customers is customer service. Some testimonies speak of a lack of efficiency in the management of requests. Response times considered too long and customer service sometimes considered not very competent tarnish the overall experience. Before committing, it may be useful to test customer service to gauge their responsiveness and competence.

Company mutual health insurance: a significant advantage

For those working in the private sector, the

company health insurance

of Allianz represents a considerable advantage. It is now mandatory for employers to offer additional health coverage, and the employer’s contribution must be at least 50% of the contribution. This can make Allianz mutual membership more accessible and attractive to employees. Finalizing your choice To make the most informed choice possible regarding the

mutual Allianz

, it is essential to compare different offers, analyze the guarantees and take into account the opinions of policyholders. Also think about your specific needs, particularly in terms of health and budget. By informing yourself correctly, you will be able to make a decision that truly corresponds to your expectations and your personal situation. discover our detailed analysis of the opinions on the mutual allianz. find out about the advantages, disadvantages, and feedback from policyholders to choose the health coverage that suits you best.Before subscribing to the

, it is essential to find out about several critical aspects. Internet users’ opinions show a diversity of feedback, with some customers being satisfied with the services and guaranteesoffered, while others express concerns about the rates and quality of customer service. First of all, it is important to note that the rates

of the mutual Allianz may seem high, especially for the elderly. Indeed, some mutuals specializing in EHPADs, for example, turn out to be up to four times cheaper while offering equivalent guarantees. This underlines the need for a rigorous comparison before making a decision. Regarding reimbursements, the deadlines indicated by Allianz may vary. Although the company advertises reimbursement within 72 hours

, many policyholders have experienced much longer delays, sometimes up to several weeks. This can cause financial stress for those who rely on these rapid reimbursements for their healthcare. In terms of customer service, reviews are also mixed. Several Internet users describe an unsatisfactory experience, deploring a lack of responsiveness and competence on the part of managers. This can lead to frustration, especially when it comes to processing urgent reimbursement requests.Finally, despite these criticisms, many customers appreciate the overall services offered by Allianz mutual insurance and highlight its strengths. Before committing, it is therefore advisable to carefully analyze the

offers

, read the feedback and ask yourself the right questions about your own health needs. Frequently Asked Questions about Allianz Mutual InsuranceWhat is the general opinion on Allianz Mutual Insurance?

Many customers express their satisfaction with the services offered by Allianz Mutual Insurance. However, some criticisms should be taken into account.

Are Allianz Mutual Insurance rates competitive? Yes, Allianz stands out for its competitive rates, particularly for company mutual insurance where the employer’s contribution must be at least 50% of the contributions.

Are the rates suitable for seniors? Several Internet users point out that the prices can be exorbitant for seniors, compared to other specific mutual insurance companies that are up to four times cheaper for the same guarantees.

What is the reimbursement period for health costs? Allianz promises a refund within 72 hours, but some customers have experienced delays of up to three weeks, which can be frustrating.

How is Allianz customer support? Reviews of customer service are mixed, with several users calling it “zero” and reporting inefficient handling of requests.

What are the main guarantees offered by Allianz mutual insurance? Before subscribing, it is crucial to find out about the guarantees offered, which can vary depending on the contracts chosen.

Is Allianz mutual insurance a good option for seniors? Allianz offers senior mutual insurance, but it is important to compare reimbursements and rates before making a decision.

Why is it important to be well informed before subscribing to Allianz? Find out about guarantees, prices and reviews from other customers to avoid unpleasant surprises and find the coverage that suits you best.