|

IN BRIEF

|

In an increasingly globalized world, choose the best international mutual insurance company has become an essential issue for expatriates and travelers. Being far from home can cause fears about health and medical care. To help you navigate this complex industry, this comprehensive guide offers practical advice and clear steps. Defining your specific needs, comparing available options and analyzing guarantees are all keys to finding the coverage suited to your situation. Arm yourself with all the information you need to make an informed choice and protect your health, wherever you are in the world.

Choose the best international mutual is essential to guarantee your health and safety during your travels or expatriation. This guide aims to guide you through the different aspects of international health insurance by presenting their advantages and disadvantages, in order to help you make an informed decision.

Benefits

One of the main benefits to take out international health insurance lies in its ability to offer you coverage adapted to your specific needs. Whether you are an expatriate or simply traveling, these mutual funds are designed to adjust to the requirements of your situation.

Another significant advantage is access to an extensive healthcare network. Most international mutual insurance companies collaborate with health establishments in many countries, guaranteeing you quality care, wherever you are. You can view the details of best options available to have a precise overview of the networks offered.

Furthermore, a international mutual provides you with rapid assistance in the event of a medical emergency, which is especially crucial when you are far from your home country. You will be able to receive support around the clock, including medical advice or repatriation arrangements if necessary.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

While there are many benefits, there are also disadvantages to consider before choosing an international mutual insurance company. For example, the cost can be a barrier for some, because insurance premiums can vary considerably depending on the guarantees desired. Indeed, more comprehensive coverage often results in higher costs.

Furthermore, the complexity of insurance contracts can be confusing. Technical terms, as well as warranty disclaimers, may be difficult to understand for the uninitiated. It is therefore crucial to carefully read and analyze the general conditions of contracts before committing. To help you in this process, several online resources offer practical advice on selecting the mutual insurance company suited to your needs.

Finally, there may be waiting periods before certain coverages take effect, which can be a problem if you need urgent care early on in your contract. Make sure you understand these deadlines to avoid any unpleasant surprises.

Choose the best international mutual is not a task to be taken lightly. Whether you are an expat or a regular traveler, it is crucial to assess your specific needs to secure adequate health coverage. This comprehensive guide will help you understand the essential elements to take into account when choosing the international mutual which will best meet your expectations.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Define your specific needs

Before you begin your search to find the best international health insurance, it is essential to define your specific needs. Think about your expatriate status, the length of your stay abroad, and any activities or trips you are planning. Every situation is unique, and this will influence the type of coverage you need.

Analyze your personal situation

To optimize your choice, examine your state of health, the composition of your family and your possible medical history. Some mutuals offer more family-friendly options, while others focus on individualized services. Understanding your particularities will help you narrow down your options.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

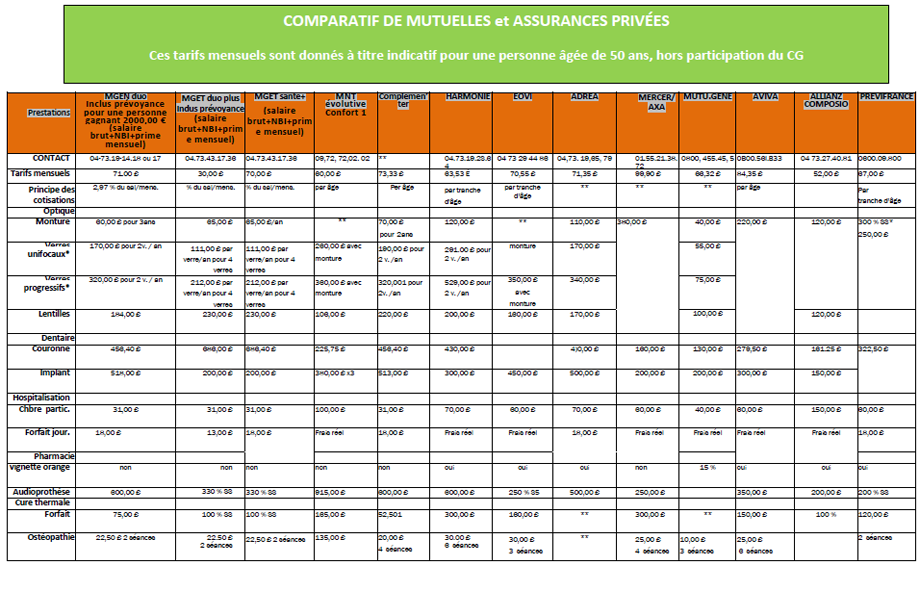

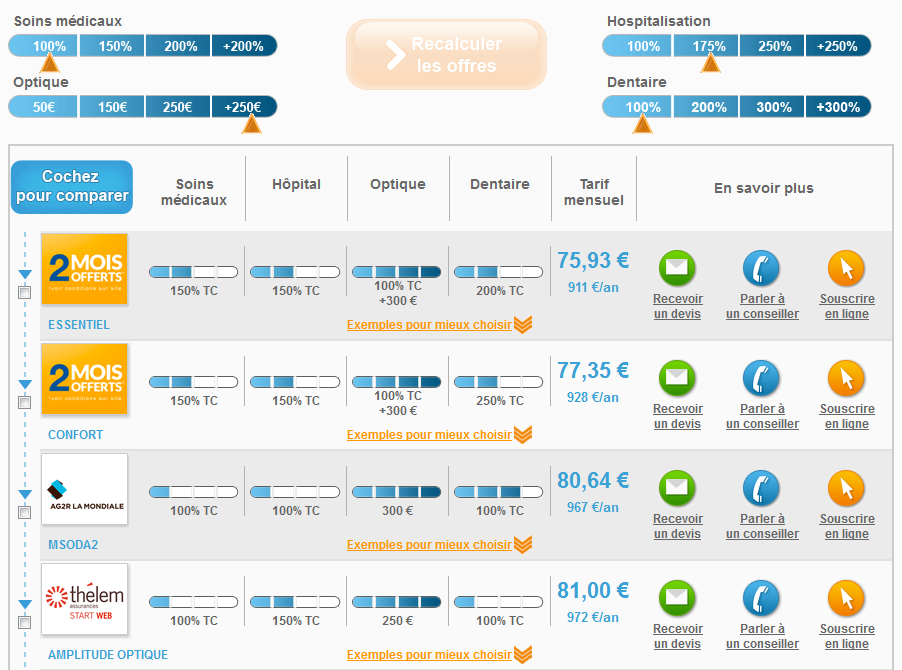

Use a health insurance comparator

Once your needs have been identified, it is advisable to use a health insurance comparator. These online tools will allow you to evaluate different offers on the market, compare guarantees, exclusions and prices. Thanks to a comparator, you will have access to an overview of the available options, thus simplifying the selection process.

Consult reviews and feedback

Beyond the information provided by insurers, do not hesitate to consult notice other expatriates or travelers. Their feedback can guide you towards the most reliable mutual insurance companies and adapted to your situation. For example, sites like French of the World provide valuable insights.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Check the guarantees offered

The guarantees offered by an international mutual are essential. Make sure the policy covers hospitalization costs, doctor visits and other essential medical services when needed. Don’t forget to check the preventive care coverage, which is equally essential for maintaining your health in good condition while traveling.

Assistance and repatriation

Do not neglect the importance of assistance effective. In the event of an emergency, fast and efficient assistance can be essential. Think about what you would do in the event of an accident or serious illness. Some mutual insurance companies offer health insurance services repatriation which can prove to be a considerable asset during a stay abroad.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Examine the price of mutual insurance

THE price of the mutual must also be taken into account in your choice. Compare prices while keeping in mind that the cheapest is not always the best. Evaluate the services offered in relation to the cost to ensure good value for money. Affordable options can sometimes offer very limited guarantees, while more comprehensive contracts may seem more expensive but offer vital security.

Anticipate possible changes

Finally, stay attentive to the evolution of your personal and professional situation. If you are planning a change of country, a transfer or an extension of your stay, it may be wise to review your contract. For example, check out other insurance companies to re-compare available options.

To help you in your process, you can consult additional resources such as international mutual insurance forms or use a online comparator to refine your selection. Every detail counts to guarantee your peace of mind abroad.

Choose the best international mutual may seem like a challenge, but this guide will provide you with practical advice to make an informed decision. Whether you are an expat or planning a trip abroad, it is essential to understand your health insurance needs. You will discover the different options available and the criteria to consider to select the coverage that suits you best.

Define your specific needs

Before you begin your search, it is crucial toidentify your specific needs. Think about your personal and professional situation. Are you a long-term expat, a frequent traveler, or a student abroad? The extent of your coverage will depend on your health care status and expectations. Check out resources like this guide for expats which details the different options available.

Use health insurance comparators

A health insurance comparator is a valuable tool for comparing different international mutual insurance companies. These platforms can help you quickly visualize the guarantees offered by each insurer, their prices, and the services included. Using a comparator can save you considerable time and allow you to identify the best offers matching your criteria. To explore more options, visit this site dedicated to international health insurance.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Analyze the guarantees offered

Don’t limit yourself solely to the price when examining mutual insurance companies. It is essential to carefully analyze the guarantees offered. Look for information on reimbursed expenses, reimbursement ceilings, as well as coverage for preventive care, medication, or even hospitalizations. The more comprehensive the guarantees, the more your health protection will be adapted to your needs. To better understand the important aspects to consider, refer to this practical guide.

Check the reputation and reviews of insurers

The reputation of your insurer is a determining factor in your choice. Take the time to check customer reviews on different international mutual insurance companies. Feedback from other expats can enlighten you on the quality of customer service, the speed of reimbursements, and the seriousness of the insurer. A good reputation is not to be neglected, especially when it comes to your health. Consider consulting different forums and review sites to gather this information.

Anticipate your future needs

When making your selection, also consider anticipating your future needs. If you plan to move countries, expand your family or have specific medical needs, make sure that your international mutual insurance plan can adapt to these changes. Flexible contract options can be particularly advantageous to adjust to your changing circumstances.

| Selection criteria | Details |

| Medical coverage | Check if it covers routine care, hospitalization and medication. |

| Medical repatriation | Make sure that the repatriation service is included in the event of an emergency. |

| Deductible | Choose a mutual insurance plan with a deductible that fits your budget. |

| Freedom of choice of doctors | Choose coverage that allows you to consult doctors at your convenience. |

| Additional guarantees | Check out options like dentistry, optics and alternative medicine. |

| 24/7 support | Important to have access to medical assistance at all times. |

| Pricing | Compare prices to get the best value for money. |

| Duration of commitment | Opt for mutual insurance without long-term commitment if possible. |

| Ratings and Reviews | Consult the feedback of other expats and travelers to make an informed choice. |

Are you planning to go abroad for a long stay or an expatriation? It is essential to choose your international health insurance to ensure your safety and peace of mind. Sometimes the multitude of options available can seem overwhelming, but with a clear method, choosing the best international mutual becomes accessible.

It all starts with a precise understanding of your specific needs. What is your status? Are you alone, with family, or are you leaving for professional or personal reasons? This first step is crucial to guide your choice. By defining your travel plan, you will be able to identify the necessary guarantees, such as medical repatriation or cover adapted to care abroad.

Use a health insurance comparator is a very effective tip. These tools allow you to quickly visualize the differences between the contracts offered. In just a few clicks, you can compare the price, THE guarantees and the services offered. This not only helps you save time, but also helps you make a more informed choice.

Another important aspect is to consider the user reviews and feedback. This can give you a clear idea of services and the quality of service of the various mutual insurance companies. Relying on the word of other expatriates can be very informative in detecting details that sales brochures do not always mention.

Also consider evaluating the flexibility of your contract. This includes things like the ability to adjust your coverage along the way, or add options based on your evolving needs. A good mutual insurance company must be able to adapt to your situation, whether it is a temporary incapacity to work or an increased need for care.

Finally, keep in mind that the price should not be the only criterion of choice. Low-cost coverage may seem attractive, but it may come with restrictions which would not suit your situation. Make sure that the mutual chosen meets your requirements in terms of health while staying within your budget.

Introduction to the best international mutual insurance company

Choose the best international mutual may seem complex, but with the right advice and a structured approach, it becomes much simpler. In this comprehensive guide, we offer recommendations for identifying health coverage suited to your specific needs, whether you are an expatriate or simply traveling. Insight into the issues and options available will allow you to make an informed decision and travel with peace of mind.

Define your specific needs

Before diving into the choice of mutual insurance, it is essential to define your specific needs. What types of care are you considering during your stay abroad? Do you have any preferences for particular treatments or specialized doctors? Your medical needs must be clear, because each mutual insurance company offers different guarantees. Answering questions like these will help you refine your searches and avoid unsuitable options.

Use a health insurance comparator

To facilitate an in-depth analysis of the market offer, use a health insurance comparator. This tool allows you to view and compare many mutual insurance companies in just a few clicks. You can quickly identify the offers that best match your budget and your expectations. Be sure to carefully check the letters of the guarantees offered by each mutual insurance company, in particular the coverage of health costs which can vary considerably.

Examine the guarantees offered

Once you have filtered the options using a comparator, it is time to scrutinize the guarantees offered by each mutual insurance company. Check the care included such as medical consultations, hospitalizations, dental and optical care, as well as emergency services. Some mutuals may also offer assistance services such as medical repatriation, which can be a significant plus, especially for a long expatriation.

Analyze the value for money

The price of an international mutual should not be the only decisive criterion in your choice, but it is still important to compare the value for money. Sometimes, a cheaper mutual may offer insufficient guarantees, which would result in additional costs in the event of care. Take the time to study each option to see if the cost is justified by the services offered.

Adapt your choice to your personal situation

Each expatriate or traveler has a unique situation. If you are leaving for an extended stay or if you are leaving with family, look for options that align with your personal situation. Some mutual insurance companies offer plans adapted to families, while others target professionals on mission. Make sure you opt for the most suitable coverage to optimize your experience abroad.

Check reviews and recommendations

Finally, do not hesitate to consult the online reviews and to exchange with other expatriates about their experiences with specific mutual insurance companies. Feedback can prove very valuable in avoiding disillusionment and choosing a reliable mutual. Good customer service and effective support are essential elements to consider in your selection.

Choose the best international mutual is an essential step for expatriates and travelers wishing to benefit from adequate health protection during their stays abroad. Through this guide, it is clear that the first step to making an informed decision is to understand your specific needs. Each individual has different expectations depending on their lifestyle, of his destination and the duration of his stay. Take the time to think about the types of health care you might face and the safeguards needed to deal with these situations.

Next, it is crucial to explore the different options available in the market. By using an insurance comparator, you can quickly visualize and analyze the different mutual proposed. This will allow you to identify those that offer the best value for money, while taking into account the guarantees offered and prices. Also take into consideration the health professional networks that each insurer offers, because access to qualified doctors can greatly influence your healthcare experience.

Finally, don’t forget to look at reviews from other users. Feedback can provide valuable insights into the reactivity and the quality of service of a mutual insurance company. By taking all of these elements into account, you will be able to make an informed choice, tailored to your unique needs, and benefit from a optimal health protection during your stay abroad. The key is not to rush your decision, in order to find the mutual insurance company that will give you the peace of mind you deserve.