|

IN BRIEF

|

In a world where every penny counts, choosing cheapest mutual insurance becomes an essential issue for preserving your health budget. The market is full of tempting offers, but it can be difficult to navigate. This guide accompanies you through the twists and turns of supplementary health contracts, providing you with valuable advice to make the choice best suited to your needs, without sacrificing the quality of reimbursements. Prepare to navigate between the options and find the mutual that will save you money while guaranteeing effective coverage!

In a world where healthcare costs can quickly become a financial burden, it is essential to find the cheapest mutual insurance adapted to your needs. This guide will help you understand the benefits and the disadvantages to opt for an economic mutual, in order to make an informed choice. Whether you are a student, young worker or retiree, here is everything you need to know to select the most advantageous mutual insurance!

Benefits

Opt for one cheap mutual insurance presents several undeniable advantages. First of all, it allows you to make significant savings on your health budget. With offers starting from €3.31/month, as is the case with options such as Acheel, it is entirely possible to benefit from basic health coverage without breaking the bank. In addition, these mutual insurance companies are often very suitable for young people and students who seek to limit their costs while accessing essential care.

Another positive point is the diversity of offers available. By consulting comparative sites like lesfurets.com, you can quickly identify the mutual that meet your criteria while respecting your budget. This flexibility also makes it possible to adjust the levels of guarantees to obtain tailor-made coverage. Finally, several insurers offer promotions and discounts that make membership even more attractive!

Disadvantages

limited warranties. It is therefore crucial to carefully analyze the contract and check reimbursement levels, particularly for specific treatments such as dentistry or optics. For example, some contracts only cover 100% of costs, which may prove insufficient in the event of significant expenses.

In addition, reimbursement times may be longer with certain economic mutuals. This can be frustrating, especially when you need urgent care. So remember to read the evaluations mutual insurance companies, like those found on quechoisir.org, in order to get an idea of the processing times for reimbursement requests.

Ultimately, choose the cheapest mutual health insurance requires a balance between affordability and adequate coverage. Take the time to compare the different offers and do not hesitate to explore the options available to you online, as on mutualsanteinternationale.com. Whether you are an individual or a healthcare professional, there is a solution adapted to your needs and your budget!

Are you looking for a mutual health insurance at a low price without sacrificing the quality of the guarantees? You are in the right place! This guide reveals the essential tips and advice for finding the cheapest mutual insurance that meets your needs. From analyzing offers to understanding options, follow our advice for an informed choice.

Why choose health insurance?

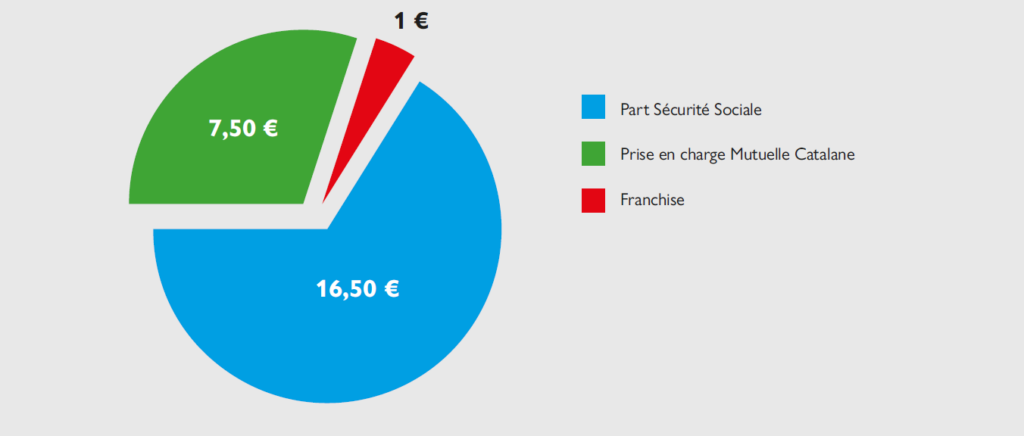

Have a mutual health insurance is essential to benefit from optimized reimbursements on your medical expenses. Whether you are a student, working or retired, a complementary health insurance voucher helps cover part of the costs not covered by social security. In addition, a cheap mutual insurance can save you from unpleasant surprises when it comes to paying for care.

Compare offers to find the best mutual

To find the cheapest mutual insurance, the first instinct to have is to compare the different offers. Sites like LeLynx.fr allow you to make an effective comparison of mutual insurance companies based on your specific needs. Don’t forget to explore the many online mutual insurance who can offer more competitive prices.

Assess your health needs

Before you start looking for mutual insurance, take the time toanalyze your care needs. If you often consult a doctor, specialists or if you need dental and optical care, it is crucial to choose a mutual insurance company that covers these aspects. The less care you need, the more you can opt for basic mutual insurance.

Guarantee levels

THE guarantee levels vary from one mutual fund to another. It is therefore essential to understand what each contract covers. Opt for plans which, although less expensive, guarantee an acceptable minimum for routine care as well as hospitalization. This way you can avoid paying for options you don’t need.

Stay vigilant about promotions and discounts

Looking for promotions? Keep an eye on the special offers and discounts offered by insurers. Some companies offer discounts for students or families. Compare the mutual market to see if additional discounts can lower the price of your contract.

Use online tools

Instead of going to an insurer, online tools become valuable allies. Platforms like International Health Mutual allow you to get quotes in the blink of an eye. No need to waste time, everything is just a click away!

Conclusion: make the right choice!

Choose the cheapest mutual insurance is no easy feat, but by following these tips, you are now equipped to make the best choice. Do not hesitate to use online comparators, analyze your needs and stay attentive to promotions. With a little diligence, you should quickly find the complementary health insurance that suits you without blowing your budget. For more information on the different contracts, go to Hyperassure Or Mutual Advice.

Choose one mutual health insurance can be a real headache, especially if you are looking to save money without sacrificing the quality of the guarantees provided. This guide will enlighten you on the best strategies for finding the cheapest mutual insurance, adapted to your specific needs. Whether you are a young worker, retired or independent, let’s find out together how to navigate this ocean of offers!

Understand your needs

Before diving headlong into the world of cheap mutual insurance, it is essential to assess your health needs. Are you in mostly good health, or do you have regular medical needs? Ask yourself questions about your dental, optical and hospital care. The good mutual insurance company is the one that covers your needs, without charging you for unnecessary options.

Analyze your usual care

Take stock of your health expenses over the past few years. This will help you determine what type of coverage will benefit you most. For example, if you frequently consult a specialist, choose a mutual which limits the remaining liability in these cases.

Compare offers

The market is full of offers, and prices can vary from one to two. Use an online comparator like BestRate is a great way to get an overview of available rates. These tools will allow you to quickly observe the cheapest mutual insurance based on your search criteria.

Prioritize transparency

Make sure coverage and pricing information is clear and transparent. This will save you from unpleasant surprises. Check in particular the options and the guarantees offered for routine care, and possible exclusions which could reduce the interest of a low-cost contract.

Review warranty levels

A mutual health insurance is generally available in several formulas, ranging from the most basic to the most complete. Basic offers may seem attractive in terms of price, but do not underestimate the importance of reimbursement levels, especially when it comes to hospitalization or recent care.

Adjust guarantees to reduce costs

If you’re on a tight budget, consider adjust your guarantees. For example, increasing the out-of-pocket amount for specific care can significantly reduce your monthly premium. This strategy should be approached with caution and in accordance with your needs.

Anticipate changes in your situation

Your personal situation may change: marriage, arrival of a child, change of job… Consider choosing a mutual insurance company that allows you to easily adjust the contract. Certain mutual insurance companies, such as those listed in the ranking proposed by Assurland, offer more flexibility than others. Don’t get stuck in an offer that will no longer meet your future needs.

Mutual insurance companies that reimburse well

Finally, cheap mutual insurance is not synonymous with poor quality. Some companies, such as those identified by The Parisian, are both affordable and well rated in terms of refund. Compare consumer reviews and rankings to make an informed choice.

In conclusion, the search for cheapest mutual insurance requires a fair analysis of your needs, a rigorous comparison and an understanding of the guarantees. Taking the time to evaluate these criteria will undoubtedly lead you to the ideal contract, meeting both your budget and your expectations in terms of care. Do not hesitate to explore more information to perfect your choice and guarantee your well-being!

Cheapest mutual insurance: guide to choosing wisely

| Criteria | Importance |

| Monthly Cost | Choose a mutual insurance company adapted to your budget. |

| Guarantee levels | Evaluate the care covered: hospitalization, optical, dental. |

| Refunds | Check the reimbursement rate for each type of care. |

| Options available | Consider the additional options offered. |

| Geographic area | Prices may vary depending on your location. |

| Age and profile | Your age and profession can influence the price. |

| Current promotions | Keep an eye out for special offers from insurers. |

| Waiting periods | Find out about delivery times before pick-up. |

| Accessibility of services | Favor mutual insurance companies with responsive customer service. |

Testimonials on the cheapest mutual insurance: guide to choosing wisely

With the multitude of choices available, finding the cheapest mutual insurance can be compared to a real quest. Many have shared their experiences, offering valuable advice. Here are some testimonials which, we hope, will help you see things more clearly.

Marie, 28, recently chose low-cost mutual insurance: “I absolutely wanted to reduce my expenses, but without neglecting my healthcare needs. By comparing several offers, I quickly found a mutual 12€/month which covers my running costs well. I feel reassured knowing that I have a good reimbursement without breaking the bank! »

Jean, an independent entrepreneur, also testifies: “At first, I was lost among the many options. I analyzed my care consumption and realized that I did not need excessive guarantees. By focusing on the essentials, I found complementary health insurance for €8.48/month which perfectly meets my expectations. »

Sophie, a mother, shares her experience: “For my family, I compared mutual insurance companies online and I was surprised to see how much the prices can vary. Finally, I found an offer that provides good optical and dental coverage while remaining affordable. It was a real relief not to sacrifice quality for price. »

Antoine, 65, approaches the subject in a different way: “When you are retired, every euro counts. I took the time to read the contracts carefully and evaluate the options offered. I am delighted to have opted for a mutual insurance company which offers me a voucher refund while respecting my budget. It’s like having a safety cushion, especially when you have medical expenses. »

Finally, Claire, a student, talks about her choices: “It was important for me to find a mutual health insurance affordable while being well covered. Thanks to comparators, I found a special student offer for only €3.31/month ! This leaves me room for my leisure activities while remaining calm for my care. »

These testimonies highlight the importance ofanalyze your needs and of compare offers. Whether you are a student, parent or retired, there are solutions suitable for everyone. Take the time to make the right choice for your health and your budget!

Choose one mutual health insurance adapted to your budget is a real headache for many French people. With the multitude of offers on the market, it is essential to see more clearly, especially if you are looking for the cheapest mutual insurance. In this guide, we will give you practical advice for comparing offers, identifying your needs and selecting the complementary health insurance that best suits your financial situation.

1. Know your health needs

Before you start looking for the cheapest mutual insurance, it is crucial to make a list of your health needs. Analyze your and your family’s medical history, as well as the care you use regularly. For example, if you need frequent orthodontics or dental care, do not hesitate to mention this in your analysis. This will help you assess what coverage you really need and avoid paying for unnecessary options.

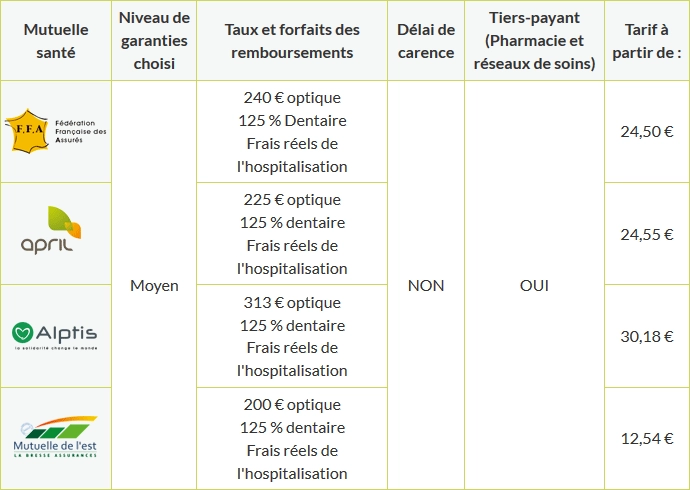

2. Compare mutual insurance offers

Once you have defined your needs, it is time to compare offers. Many specialized sites are at your disposal to help you find the cheapest mutual insurance companies. Take the time to use these comparison tools, because they will allow you to quickly evaluate the prices and guarantees offered by each insurer. Don’t forget to check the reviews of other policyholders to get an idea of satisfaction with the services offered.

3. Levels of guarantees to consider

When comparing mutual insurance companies, it is essential to look at the guarantee levels associated with each contract. These guarantees may vary depending on the services reimbursed, such as hospitalization, medical consultations, dentistry, or even optics. Pay attention to reimbursement rates and spending limits, as this will directly influence the cost of your care in the future.

4. Evaluate your personal situation

Your personal profile is also a determining factor in the choice of your mutual insurance company. Prices can vary considerably depending on your age, your profession, and even where you live. For example, older people may be offered higher rates due to their increased health needs. So remember to adapt your search according to your situation.

5. Don’t hesitate to ask for quotes

To really understand what each mutual offers you, do not hesitate to ask for information. personalized quotes. This will allow you to better understand the real costs of each guarantee and to assess whether an offer suits you or not. Additionally, some insurers offer promotions or discounts that can make an offer even more attractive.

6. Stay vigilant about lower-cost options

Finally, even if price is an important criterion, it is vital to stay vigilant on lower cost options. Don’t be lured by low prices alone. Make sure that the chosen mutual insurance company offers the essential guarantees for your needs, and also check the waiting periods, the deductibles, as well as the quality of customer service.

Following these recommendations will allow you to choose your health insurance carefully while preserving your budget. Remember, the best choice is the one that combines quality of service and affordable prices!

Conclusion: Opt for the cheapest mutual insurance without compromise

Choose the cheapest mutual insurance should not be an obstacle course. By arming yourself with the right information and following a few key steps, you will be able to select complementary health insurance adapted to your needs while preserving your budget. First of all, it is crucial to understanding your needs in terms of health, in particular by analyzing your healthcare consumption. Do you have frequent optical or dental expenses? These elements must absolutely influence your choice.

Then, do not hesitate to compare offers. Many online platforms allow you to access a wide range of contracts, making it easier for you to find the best deal. Be aware of the different levels of guarantees, as a low-cost contract may not cover you enough, which could lead to unexpected expenses in the future.

Also remember to keep an eye on the promotions and health insurance that offers discounts for certain categories of professionals or for young people. In 2024, various options for less than 10 euros per month are available, but be sure to ensure that the relevant guarantees are included. The key to finding the best mutual is to juggle between low price And best coverage.

Finally, once you have made your selection, it is wise to read the opinions of other policyholders. This can give you a clear idea of the quality of service and reimbursements actually applied by insurers. By following these tips, you will soon be in possession of the ideal mutual health insurance which will meet your expectations without breaking the bank.

FAQ: The cheapest mutual insurance – Guide to choosing well

- What is the cheapest mutual insurance currently? Several options are available to you, with mutual insurance starting from €3.31/month. Pay attention to special offers for the lowest prices!

- How to choose cheap mutual insurance? It is essential to analyze your healthcare consumption, examine the guarantees offered and compare several offers before making your choice.

- What criteria should be taken into account when selecting a mutual insurance company? Think about your profile (age, profession), your specific health needs, as well as the prices which may vary depending on your place of residence.

- Why is it important to compare mutual insurance companies? This allows you to identify the best offers and benefit from optimal reimbursement while paying the lowest price.

- Do cheap mutual insurance companies offer good guarantees? Some economical mutuals can offer attractive reimbursements, but it is crucial to check the guarantee levels before committing.

- What are some tips for paying less for your health insurance? Compare mutual insurance companies, monitor current promotions and adjust your guarantee levels according to your specific needs.

- How do I know if I’m making the right choice? Do not hesitate to request several quotes, read online reviews, and consult buying guides to refine your decision.