|

IN BRIEF

|

Supplementary health insurance is an essential element to guarantee optimal coverage of your medical costs. With Allianz, you benefit from quality support going beyond the services of thehealth insurance. Thanks to diversified options adapted to your needs, you will not only be able to reduce your remains responsible, but also access enhanced reimbursements in essential areas such asoptical, THE dental and theaudiology. Let’s discover together the advantages of this complete offer and the possibilities available to you.

Allianz supplementary health insurance stands out for its varied offers and guarantees adapted to the needs of policyholders. By analyzing the benefits and the disadvantages of this mutual, you will better appreciate the options available to you for optimal health coverage.

Benefits

Adapted reimbursements

Allianz offers coverage that allows total or partial reimbursement of health expenses that may arise following illness, an accident or even during maternity. Thanks to this additional insurance, you can benefit from effective protection against medical expenses that are often not covered by Health Insurance.

100% Health Guarantee

One of the most advantageous options of Allianz mutual health insurance is 100% Health Guarantee. This means that you can benefit from 0€ remaining charge for optical, dental or audiology care. This type of coverage is ideal for policyholders looking to improve their health without fear of additional costs.

Flexibility of contracts

With Allianz, policyholders have the possibility of subscribing to contracts that can be personalized according to their specific needs. The varied options allow everyone to choose the formula that suits them best, whether for routine care or for more expensive procedures.

Financial strength

Allianz mutual health insurance is recognized for its financial strength, which reassures policyholders about the sustainability of their coverage. This not only ensures stability of repayments, but also confidence in the services offered.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Potentially high prices

A possible disadvantage of Allianz supplementary health insurance is that, depending on the options chosen, the contribution rates can be relatively high compared to other mutual insurance companies. It is therefore essential to carefully assess your needs before subscribing.

Fee overruns

Although Allianz mutual insurance can cover certain excess fees, it does not systematically provide this coverage. These overruns may result in additional costs for policyholders, which is important to take into account when selecting your health plan.

Complexity of guarantees

Due to the diversity ofguarantees available, it may be difficult for some policyholders to clearly understand which options are included and which are not. This often requires careful analysis to choose the most suitable contract.

Allianz supplementary health insurance is an effective solution to protect your health and that of your family. By offering full or partial reimbursements of health costs, it makes it possible to considerably reduce the remaining costs after the intervention of health insurance. This article guides you through the benefits And options of Allianz mutual health insurance, in order to optimize your health care.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The advantages of an Allianz complementary health insurance

The Allianz complementary health insurance is distinguished by several benefits notable. First of all, it guarantees rapid and efficient reimbursement of health expenses due to illness, accident or maternity. Depending on your contract, you may benefit from 100% refunds for certain treatments in optical, dental And audiology thanks to the guarantee 100% Health.

Additionally, Allianz offers support for fee overruns, which represent the difference between the agreed rate and the rate charged by certain healthcare professionals. This means you are better protected and can access care without worrying about additional costs.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Customizable Allianz Health Insurance Options

With Allianz, it is possible to adapt your health insurance according to your personal needs and your budget. You can choose from different repayment options that will allow you to manage your remains responsible optimally. This customization also includes choices for preventative care or for specific services which are sometimes not covered by traditional health insurance.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Allianz corporate health insurance

For businesses, Allianz also offers solutions collective mutual health insurance. This type of contract allows you to protect your employees while reducing their health costs. Indeed, thanks to company mutual insurance, your staff can benefit from enhanced coverage and access to health guarantees adapted to their needs.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Access Allianz services

Another strong point of Allianz complementary health insurance is the accessibility to its online services. They allow you to manage your contract at any time, view your reimbursements, as well as access practical advice to better understand your health rights. For more information on the different health insurance options offered by Allianz, you can visit their site here.

Opinions of policyholders on Allianz mutual health insurance

Feedback from policyholders plays an essential role in choosing your complementary health insurance. Generally, Allianz mutual health insurance is well rated for its financial strength and the diversity of its guarantees. To consult customer reviews and feedback on Allianz, go to evaluation platforms, in order to have a clear vision of the associated benefits and costs.

When it comes to health, expenses can quickly add up and it becomes essential to know how to insure yourself effectively. L’Allianz supplementary health insurance offers solutions adapted to everyone, guaranteeing optimal reimbursement of medical costs not covered by Health Insurance. This article guides you through the benefits and options of this mutual, to help you choose the plan that best meets your needs.

The advantages of Allianz complementary health insurance

One of Allianz’s main strengths is the financial security that it provides to its policyholders. With a mutual fund recognized for its solidity, it ensures optimal protection against health expenses. Furthermore, thanks to the 100% Health Guarantee, it is possible to have 0€ remaining charge in optics, dentistry or audiology, allowing you to access quality care without worrying about costs.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Allianz complementary health insurance options

THE coverage options are varied and can be personalized according to your specific needs. You may choose to include additional warranties that cover fee overruns with certain practitioners or to expand your reimbursement figures for specific treatments. Allianz also offers a individual health insurance, designed to reimburse costs linked to illness, accidents, or even maternity, thus offering a valuable complement to basic benefits.

Flexibility and online services

Allianz provides its policyholders with a online platform which makes it easier to manage your contract. There you can consult your reimbursements, request personalized quotes or access practical health advice. This flexibility is particularly appreciated because it allows you to have better control over your healthcare expenses and quickly access the information you need.

Subscribe to Allianz mutual health insurance

To comfortably navigate the subscription process, it is recommended to take the time to understand the different options offered. Whether you are an individual looking for a complementary individual health or an employer wishing to protect its employees with company mutual insurance, Allianz offers you several options. Check out resources like Selectra to have an overview of the prices and better visualize the different offers available.

Compare the Benefits and Options of Allianz Supplementary Health Insurance

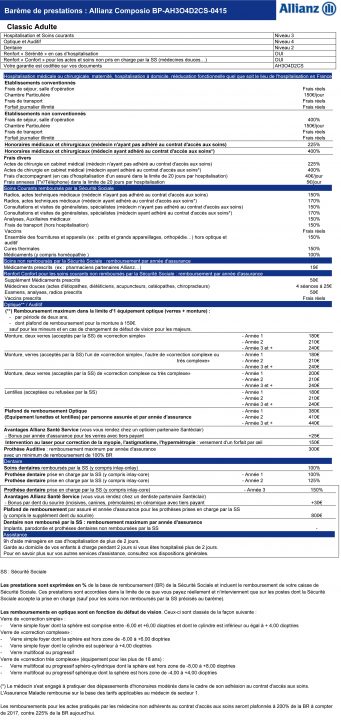

| Criteria | Description |

| Refund | Total or partial reimbursement of health expenses after intervention by Health Insurance. |

| 100% Health Option | Access to optical, dental and audiological care with 0€ out-of-pocket cost. |

| Fee overruns | Coverage of overruns for consultations, thus providing greater flexibility. |

| Company mutual insurance | Collective protection for employees, reducing their health costs. |

| Personalization | Options adaptable to your specific needs, allowing tailor-made coverage. |

| Financial strength | Insurance recognized for its stability, guaranteeing security to policyholders. |

| Ease of subscription | Fast subscription process, facilitating access to health coverage. |

| International assistance | Protection for care abroad, essential for expatriates or frequent travelers. |

| Access to a network of professionals | Support with partner health professionals for advantageous offers. |

Getting started in the world ofsupplementary health insurance may seem complex, but the advantages offered by Allianz mutual health insurance are undeniable. Many policyholders report notable satisfaction thanks to personalized options that meet each individual’s specific needs. A customer says: “Since I subscribed to Allianz, I no longer have to worry about unexpected costs. Reimbursement is quick and efficient, especially in the event of high dental and optical expenses.”

Another policyholder explains: “The guarantees of complementary health from Allianz, particularly the 100% Health program, are incredibly reassuring. This allowed me to access quality care without a single euro out of pocket. I highly recommend this mutual to anyone looking for comprehensive coverage.”

Testimonies are multiplying around the concept of refund. A mother shares her experience: “The costs related to maternity can quickly add up. Thanks to my Allianz complementary health insurance, not only was I well reimbursed, but I also had access to services that I would not have otherwise had. never thought I could afford it.”

In addition to traditional reimbursements, Allianz mutual health insurance stands out for its ability to cover fee overruns. A health professional says: “It’s a real relief to know that my complementary health covers part of these costs. This allows me to choose the practitioner I want, without having to worry about additional costs.”

Finally, a testimonial from an employer highlights the benefits of collective mutual health insurance : “By offering Allianz health insurance to my employees, I noticed a clear improvement in their well-being. They feel supported in their health efforts, which has a positive impact on their motivation and productivity.”

Allianz supplementary health insurance offers a varied range of services to better cover your health expenses. Thanks to its options adapted to each need, it aims to reduce the remaining costs after Health Insurance reimbursements. In this article, we will explore the different benefits and options that make Allianz complementary health insurance a wise choice.

The advantages of Allianz supplementary health insurance

One of the main advantages of Allianz supplementary health insurance is the possibility of obtaining a total or partial refund health costs. Whether for illnesses, accidents or maternity-related expenses, Allianz strives to compensate the remaining portion payable by you.

By subscribing to Allianz complementary health insurance, you also benefit from 100% Health guarantees, which fully cover certain optical, dental and audiology equipment. This option allows you to access quality care without additional financial investment, which is a real plus for your health budget.

Customizable options

Allianz offers a personalized health insurance which allows you to adapt your contract to your specific needs. Depending on your personal situation, you can choose additional coverage for sectors such as alternative medicine, hospitalization, and excess fees.

In addition, the repayment options can be modulated according to your preferences. This way, you can choose a reimbursement rate that suits you, whether for routine treatments or for more extensive care. This flexibility allows you to have coverage that truly meets your expectations.

Reduction of the remainder payable

Managing healthcare costs is often complex and unpredictable. Thanks to Allianz, policyholders can save thanks to adapted and competitive prices. This includes the ability to benefit from a one-minute rate, making the process quick and easy.

In addition, companies that choose a collective mutual health insurance for their employees help to considerably reduce the remaining costs incurred by their teams. This type of contract also makes it possible to create a more peaceful and protected working environment, which is beneficial for productivity.

Opinions of policyholders

Reviews of Allianz supplementary health insurance are generally positive. Many customers testify to the financial strength of the company, which ensures stability in reimbursements and efficient customer service. Feedback shows that policyholders appreciate the clarity of the offers and the excellent value for money of Allianz contracts.

In summary

Choosing Allianz supplementary health insurance means opting for solid coverage that is adaptable to your needs. With customizable options, advantageous guarantees and a substantial reduction in remaining costs, Allianz is a leader in the field of complementary health. Whether you are an individual or a business, this mutual health insurance is designed to offer you security and peace of mind.

Insurance complementary health of Allianz presents itself as an ideal solution for those who wish to reduce their health expenses. In fact, this mutual insurance is designed to reimburse the portion of medical expenses not covered by theHealth Insurance, particularly in the event of illness, accident or maternity-related intervention. One of the advantages of this cover is its ability to offer total or partial reimbursement, thus relieving you of often significant out-of-pocket costs.

Another notable advantage of Allianz supplementary health insurance is the possibility of accessing the guarantee 100% Health. This option allows you to benefit from full reimbursement for essential care in optical, dental And audiology, without any fees to pay out of your pocket. This represents a valuable opportunity for individuals wishing to guarantee their well-being without worrying about costs.

Furthermore, Allianz offers different custom options that adapt to your particular needs. Whether you are working, retired or have specific health needs, Allianz knows how to adjust to your situation. It is also possible to choose various levels of coverage according to your budget, which offers significant flexibility.

Finally, it is important to underline the financial solidity of Allianz, a guarantee of security for its policyholders. This mutual is recognized for its stability, which is essential when considering a long-term subscription. By integrating Allianz complementary health insurance into your health plan, you make an informed and secure decision for your future and that of your loved ones.

FAQs about Allianz supplementary health insurance

What is supplemental health insurance? This is a contract that allows you to supplement Health Insurance reimbursements for your health expenses.

What are the advantages of subscribing to Allianz health insurance? The advantages include enhanced coverage, varied guarantees and the possibility of accessing 100% health care without any out-of-pocket costs.

How does reimbursement work with Allianz? Allianz reimburses the portion of health expenses not covered by Health Insurance, whether in full or in part depending on the case.

Does Allianz mutual insurance cover excess fees? Yes, the mutual insurance company can cover all or part of the excess fees, offering you more flexibility and financial security.

What types of expenses are reimbursed by complementary health insurance? Supplementary health insurance covers costs related to medical consultations, dental care, optics, audiology, and other health expenses.

What is the price of Allianz complementary health insurance? The price varies depending on the guarantees chosen, but you can obtain a quote in 1 minute to find out the cost adapted to your needs.

What is the 100% Health Guarantee? This is a guarantee that allows you to benefit from a full reimbursement for certain optical, dental and audiology equipment, with no additional charges.

Is Allianz mutual health insurance suitable for seniors? Yes, Allianz offers specific plans for seniors, with guarantees adapted to their health needs.

How to subscribe to an Allianz supplementary health insurance contract? You can easily subscribe online or by contacting an Allianz advisor who will help you choose the most suitable plan.

What opinions do policyholders leave about Allianz mutual health insurance? The opinions of policyholders often highlight the financial solidity of the mutual as well as the quality of its guarantees and its customer service.