|

IN BRIEF

|

In the world ofinsurance, there franchise is an essential concept that can sometimes be confusing. It represents the sum which remains the responsibility of theinsured in case of sinister, after the insurer has taken charge. Understanding the excess is crucial for policyholders, as it plays a key role in managing the risks and costs associated with insurance contracts. In this article, we will explore the definition of the franchise, its different types, as well as the resulting issues for policyholders.

There franchise in insurance is an essential concept that deserves to be mastered to better understand how coverage for a claim works. It represents the amount that remains the responsibility of the insured when a loss occurs, after compensation from the insurer. In this article, we will examine the different facets of the insurance franchise, highlighting its benefits and his disadvantages.

Benefits

The main advantage of the insurance deductible is that it allows you to reduce insurance premiums. Indeed, if you choose a higher deductible, the insurer may offer a lower contribution in return for the increased risk it bears. This is particularly interesting for drivers who do not have an accident history and want to save on their insurance costs.

Another positive point is the sharing of risk between the insured and the insurer. The deductible encourages policyholders to be more careful, because they are financially involved in each loss. This can help reduce the number of unfounded claims and keep insurance rates more competitive in the long term.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

However, the franchise also presents disadvantages. The first and most obvious is that in the event of a loss, the insured will have to personally cover part of the costs. This can cause financial stress, especially if the amount of the deductible exceeds the expectations or budgetary capabilities of the insured.

In addition, it is important to note that certain situations may result in having to pay a deductible even if the accident is not your fault. For example, in the case of a no-fault accident, the insured could be forced to advance the sum of the excess, which may seem unfair. This situation can lead to complex claims and frustration for policyholders.

For an even more in-depth understanding of this topic, you can consult resources on deductibles offered by insurance companies, such as service-public.fr Or lemagdelassurance.com, which also discuss the benefits and challenges of deductible insurance.

There insurance deductible is a central concept that influences claims management and the relationship between the insured and the insurer. This tutorial aims to clarify what franchising is, its types, how it works, and the issues that arise from it. Understanding this mechanism is essential to better understand your insurance contract and optimize your financial protection.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

What is the insurance excess?

There franchise is defined as the part of the loss which remains the responsibility of the insured. In other words, it is the amount that the insured must pay out of his own pocket before the insurer intervenes. This principle is provided for by the Insurance Code and is fundamental in the sharing of risks between the insured and the insurer.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

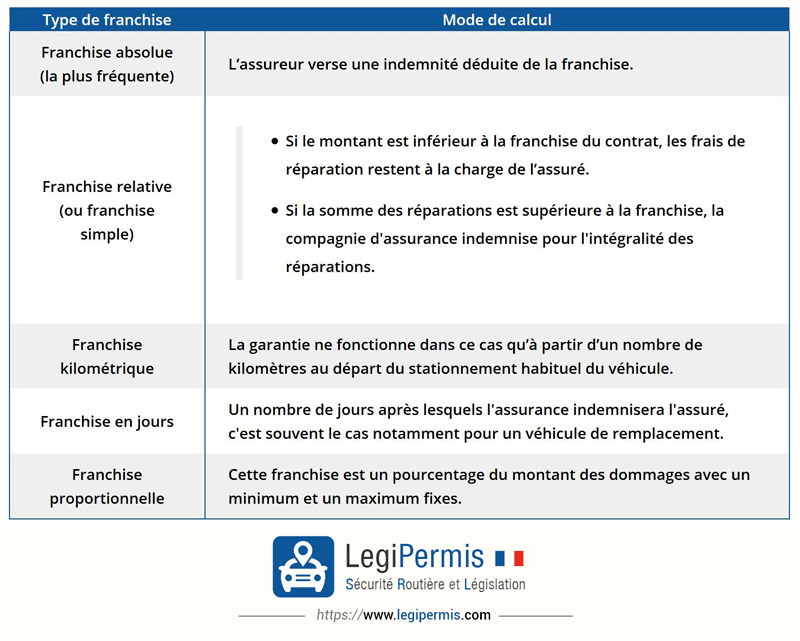

Franchise Types

There are several types of franchises, but the two main ones are simple franchise and the relative franchise. In the case of the simple deductible, the insurer covers all costs if the cost of the claim exceeds the amount of the deductible. On the other hand, with the relative deductible, this means that if the amount of the claim is less than the deductible, the insured will bear the entire cost.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

How the franchise works

When a loss occurs, the insured must assess the damage and report the loss to their insurer. Once the amount of the loss has been determined, the insurer deducts the excess from the total compensation. Thus, if the accident caused generates costs of 1,500 euros and the excess is 300 euros, the insured will receive 1,200 euros reimbursement.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The challenges of franchising

Understanding the issues surrounding franchising is crucial for several reasons. First of all, it makes it possible to manage unexpected expenses and anticipate potential costs in the event of a disaster. In addition, being aware of how the deductible works can influence the choice of an insurance contract, because a higher deductible can lead to lower premiums, but implies increased financial risk in the event of an accident.

When not to pay a deductible?

It is also important to know when the deductible is not due. For example, in the context of a accident not at fault, the insured can be reimbursed for the excess by the insurance of the responsible third party. This represents significant financial relief for the subscriber.

Ultimately, the insurance deductible is a determining element of coverage. To learn more about how it works and to compare options, you can check out online resources like this link which offers a comparison of franchises.

The insurance deductible represents a major issue for all policyholders. It designates the amount that remains your responsibility in the event of a claim, after the insurer has covered part of the costs. Understanding this mechanism is essential to better manage your contracts and anticipate unexpected expenses. In this article, we will explore the different types of franchises and how they work to enlighten the reader on this key concept in insurance.

What is the insurance excess?

There insurance deductible is the portion of a loss that remains the responsibility of the insured. Its amount is specified in your contract, and it may vary depending on the type of insurance concerned (auto, home, health, etc.). In other words, when you suffer a loss, the insurer will only compensate you after deducting this amount from your compensation. This means that you are jointly responsible for the costs incurred, which contributes to sharing the risk between you and your insurer.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Types of insurance deductibles

There are several types of franchises. Two of the most common are simple franchise and the relative franchise. With the simple deductible, if the amount of the claim is less than the deductible, the insured receives no compensation. On the other hand, if the loss exceeds this threshold, the insurer reimburses all costs beyond this deductible. On the other hand, with the relative deductible, the insurer covers the entire loss if its cost exceeds the deductible set in the contract. To learn more about different franchises, you can check out resources like Selectra.

Impact of the deductible on the amount of compensation

The amount of the deductible has a direct impact on your compensation. The higher the deductible, the less compensation you will receive in the event of a claim. It may seem counterintuitive, but a higher deductible can also mean lower insurance premiums. Before choosing your contract, it is therefore crucial to assess your ability to assume this cost in the event of a claim and to understand how this will affect the amount you will be reimbursed by your insurer.

Exceptions: When not to pay the deductible?

It is important to know the situations in which you may not be required to pay the deductible. In certain cases, such as a non-fault accident, your insurer may decide not to apply the deductible. For example, if someone else causes the loss, it is likely that your insurance will cover the damage without deducting the deductible. For more information on these exceptions, see this link at Ornikar.

How to choose your franchise?

Choosing the right franchise involves evaluating several factors. Consider your driving habits, your personal risk and your budget. A high deductible could save you on your premiums, but requires good risk management. Conversely, a lower deductible could be more reassuring in the event of a claim but increase your annual costs. Be sure to read your contract carefully and, if necessary, consult an insurance expert to make the best choice for your situation.

| Franchise Type | Description |

| Simple Franchise | Fixed amount payable by the insured, regardless of the extent of the loss. |

| Relative Franchise | The insurer covers everything if the loss exceeds a certain amount. |

| Absolute Franchise | Amount will never be exceeded, regardless of the extent of the damage. |

| Excess None | No deductible to pay in the event of a claim, the insured is fully covered. |

| Indexed Franchise | Evaluates the deductible according to an index variation, which may fluctuate over time. |

| Impact on Prime | The amount of the deductible generally influences the amount of the insurance premium. |

| Shared risk | The deductible allows the risk to be shared between insurer and insured, promoting responsibility. |

There franchise Insurance is a term that many people hear, but few really take the time to understand. However, it is an essential concept to master to better understand how your insurance contract works. In fact, the deductible represents the part of the costs left to you after a disaster. For example, if you are the victim of a car accident and the repairs amount to 1000 euros, but your contract includes a deductible of 200 euros, the insurer will only reimburse you 800 euros.

It is important to know that there are different types of franchises. Let’s talk, for example, about the simple franchise, where the insurer fully covers the costs if the amount of the loss exceeds a certain threshold. In this case, if the repairs cost 1500 euros and your excess is 200 euros, the insurer will cover 1300 euros. This helps moderate costs in the event of minor accidents, while allowing you to share the risk.

An often overlooked aspect of franchising is its role in risk sharing. In fact, it encourages the insured to take care of their property, because part of the costs will always remain their responsibility. Consequently, the higher the deductible, the more interest the insured has in avoiding small losses and taking precautions. This may also result in a reduction in the insurance premium.

It is also crucial to know in which cases the excess will not be applied. For example, in the event of no-fault accidents, some insurers provide specific conditions which can reduce or cancel the deductible. This can be beneficial to policyholders and may be worth it when selecting an insurance policy.

In short, understanding the insurance deductible is a major ally for anyone who wants to optimize their coverage while keeping an eye on their expenses. It represents a part of the costs that each policyholder will have to anticipate, but a good knowledge of this subject will allow you to better navigate the world of insurance and make informed choices.

There franchise in insurance is an essential concept which influences the cost of your contract and the amount of compensation in the event of a claim. It represents the part of the loss that remains your responsibility, which implies that the insurer only covers part of your losses. This article will guide you through the definition of franchising, its different types, how it works and its financial implications.

What is the insurance excess?

There franchise is defined as the amount of money that the insured must pay out of pocket when he suffers a loss. It is clearly stipulated in the insurance contract. For example, if you have a deductible of 500 euros and you suffer a loss of 2000 euros, your insurer will only compensate you 1500 euros. This risk sharing mechanism aims to make the insured responsible while ensuring adequate coverage.

The different types of franchises

The simple or relative franchise

There simple franchise, often called relative, acts according to the amount of the loss. If the total cost of the claim exceeds the deductible, the insurer covers all costs beyond this amount. For example, with a deductible of 300 euros, if you have a claim of 1000 euros, the insurer will compensate 700 euros. On the other hand, if the loss is lower than the deductible, you will not receive any compensation.

Absolute frankness

There absolute frankness works differently. It remains a constant amount that the insured must always pay before the insurer intervenes. Regardless of the amount of the loss, as long as it exceeds the deductible, the insurer compensates. This means that for a claim of 1500 euros with a deductible of 500 euros, you are responsible for 500 euros and will be compensated 1000 euros.

The financial implications of franchising

The choice of franchise has a direct impact on your insurance premium. Generally, the higher the deductible, the lower the premium. This may seem advantageous in the short term, but it is crucial to carefully assess your ability to cover this expense in the event of a disaster. A high deductible can mean savings on monthly premiums, but can also cause financial stress if a loss occurs.

When not to pay a deductible?

There are situations where you will not have to pay a deductible. One of the most common is a accident not at fault, where you are not at fault. In this case, your insurer can take action against the other party’s insurer to recover the amounts owed. This depends on the terms of your contract, so be sure to research this opportunity.

Conclusion on the insurance deductible

By understanding the deductible and its implications, you can better manage your insurance coverage expectations. Evaluating the amount of the deductible when taking out an insurance policy is essential to optimize your protection while controlling your expenses. Take the time to read your contract carefully and do not hesitate to ask your insurer questions to clarify any points that seem unclear to you. This understanding will allow you to feel safe and confident in the event of a possible disaster.

There insurance deductible is a key element to consider in any insurance contract. It refers to the amount of money the policyholder must pay out of pocket before their insurance company begins to cover the costs associated with a claim. Knowing the nature of this deductible and how it works can help policyholders to better prepare financially in the event of damage.

It is essential to distinguish the different types of franchises. Among them, the simple franchise Or relative is one of the most common. In this case, the insurer covers the entire loss, but only if the amount exceeds a defined threshold. This means that if costs remain below this threshold, the insured is responsible for the full amount. This dynamic of risk sharing between the insurer and the insured occupies a central place in the operation of insurance contracts.

Another issue to take into account lies in the management of deductibles in the event of accidents. In particular, the question of who pays the deductible in the event of a non-fault claim may raise questions. It is crucial to be aware of the provisions of the insurance contract and how they apply depending on the circumstances of each claim.

Finally, the deductible has a direct impact on the amount of contributions. In general, the higher the deductible, the lower the insurance premiums can be. It is therefore vital to make the choice that best suits your personal needs and financial situation.

Insurance deductible FAQ

What is the insurance excess? There franchise in insurance is the amount that the insured must pay out of his pocket in the event of a loss. It constitutes the part not covered by the insurer.

How does the car insurance excess work? In the event of a claim, the insured must pay the franchise, which is deducted from the compensation paid by the insurer. This means that the insured is only reimbursed for the amount of the loss, less the franchise.

What are the types of franchises? There are several types of franchises, including simple franchise Or relative, which allows the insurer to cover the loss in full if its cost exceeds the amount set in the contract.

Do I have to pay a deductible if I am not responsible for the accident? Yes, in most cases the insured must pay the franchise, even in the event of a non-fault accident. However, some insurance policies may provide for exceptions.

Why is there a deductible in insurance contracts? There franchise allows the risk to be shared between the insurer and the insured. This also encourages the insured to exercise caution, as he or she has a personal investment in the risks covered.

How is the amount of the deductible determined? The amount of the franchise is fixed when taking out the insurance contract. It may vary depending on the type of coverage chosen and the preferences of the insured.

Can we avoid paying a deductible? It is often impossible to avoid paying the franchise, but some insurance companies may offer options without excess for specific claims, for a higher premium.

Is the deductible always the same for all claims? No, the franchise may vary depending on the type of loss, the nature of the insurance (car, home, etc.) and the specific clauses of the contract.