|

IN BRIEF

|

In a context where it is crucial to protect yourself well, choosing the right insurance for 2024 is becoming a major issue. With Uneo, you have access to a wide range of health guarantees and of prevention specially designed to meet your needs. In order to make an informed choice, it is essential to understand the different prices And offers available. In this article, we offer you a complete overview of the guarantees and refunds to help you select the coverage that best suits you.

In a constantly changing environment, it is essential to stay informed to make the best insurance choices. In 2024, the Unéo price stands out with its varied offers and guarantees adapted to the specific needs of policyholders. This article highlights the advantages and disadvantages of Unéo to help you make the choice that best suits your situation.

Benefits

Adapted guarantees

Unéo offers a overview of guarantees which meets various needs, whether for health or foresight. The tables of refunds and supported are clearly detailed, allowing you to quickly understand what you are eligible for.

Multiple options

You can choose from several options to strengthen your protection, particularly in the event of death or disability. This allows you to personalize your coverage based on your personal situation and expectations.

Attractive reimbursements

At Unéo, the reimbursement of your health costs are complete. Whether for routine care or for more specific procedures (optical, dental, prevention), the mutual guarantees care that is accessible and effective. For more information on reimbursement of expenses, see this page: Justice reimbursements.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Limited packages in certain categories

It is important to note that some annual packages are limited to an overall amount, which may restrict reimbursements for specific care such as psychology or the psychotherapy. This may be a disadvantage for those looking for expanded coverage in these areas.

Prices vary depending on the options chosen

If Unéo offers a wide range of choices, this also results in a variation of prices depending on the options selected. It is therefore essential to carefully assess your needs before committing in order to avoid unforeseen costs.

Subscription conditions

Subscription to certain plans may be conditioned by various criteria, in particular age or state of health. This may make it difficult to access certain offers for specific profiles.

Ultimately, Unéo presents a wide range of options suitable for military and civilian use, but it is crucial to carefully analyze each formula to select the one that best meets your expectations and coverage needs. To find out more about the different Unéo plans and prices, you can consult their official website at the following address: Overview of Unéo guarantees.

Choosing the right insurance for 2024 may seem complicated, but with Unéo you can make informed decisions. This article presents Unéo’s prices and guarantees, explaining how each plan can be adapted to your specific needs. Discover the essential information to optimize your health and welfare coverage.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understanding health and welfare guarantees

To choose your insurance carefully, it is essential to understand the health guarantees And prevention offered by Unéo. The organization provides a detailed overview and reimbursement tables, which helps you compare the different options available. Benefits are designed to meet a variety of needs, from routine care to emergency situations.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Formulas adapted to your needs

With Unéo, you have access to several customizable plans. You can choose an option that strengthens your protection in the event of death ordisability following an accident. Among the options, we find for example Uneo-Targeting, which offers three levels of coverage for delicate situations.

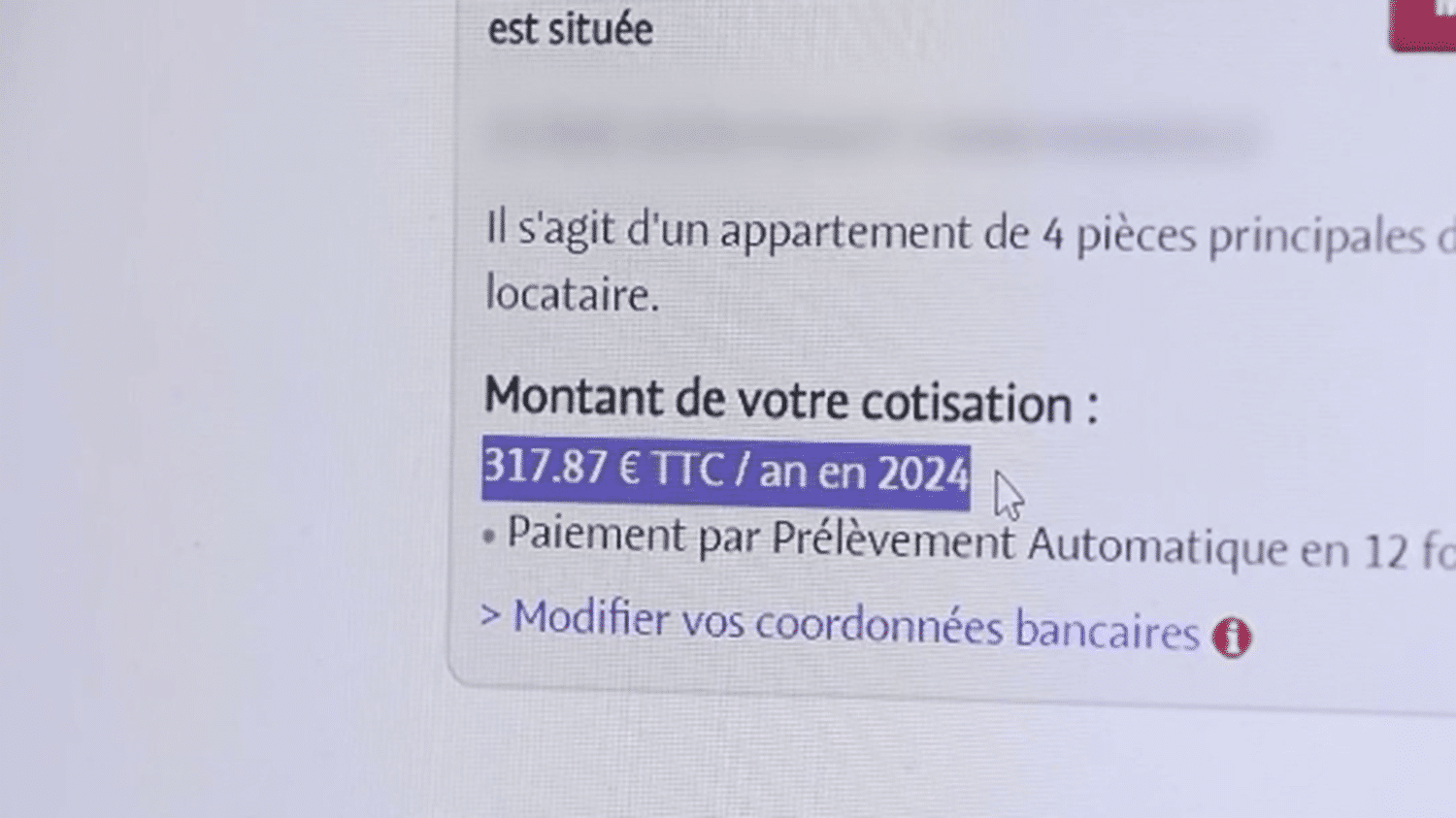

Prices from 2024

Unéo prices for 2024 are designed to be accessible. You can find formulas from€1.20/month. Each offer is specifically tailored to members of the armed forces, guaranteeing optimal coverage based on your needs. Detailed pricing information is available in the official PDF which you can view here.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Reimbursements and healthcare costs

When choosing Unéo, it is crucial to find out about refunds health costs. Unéo guarantees coverage for all routine medical procedures, including urban care, optical, dental, and even preventive procedures. If necessary, you can check the reimbursement table to get a clear idea of the amounts that will be reimbursed to you.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Tips for informed underwriting

Before subscribing, it is important to assess your personal and family needs. Take the time to compare the formulas, checking what is included or not, particularly in matters of mental health such as psychology and the psychotherapy. You can consult the details of the formulas Essential Unéo-Reference to better understand what is on offer.

Commitment and support

Joining Unéo means benefiting from a personalized support and a supportive environment. The insurance also offers the opportunity to join a close-knit community, where you can interact with other members and get advice. More than a mutual insurance company, Unéo offers you a real support to pass the different stages of your life peacefully.

Choosing insurance suited to your needs in 2024 may seem complex, but with Unéo, you have the opportunity to access offers designed to respond to each situation. Whether you are an active worker, a soldier or a retiree, understanding the different prices and guarantees is essential to optimize your health and welfare protection.

Understand the guarantees offered by Unéo

THE guarantees offered by Unéo are available in several options, each aimed at strengthening your financial security if necessary. From now on, it is crucial to carefully analyze the overview of guarantees which includes reimbursement tables that precisely specify what is covered, including routine care, optical and dental. This will allow you to compare and select the formula that best meets your expectations.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Prices adapted to each profile

One of the determining factors for your choice is the Unéo 2024 price. In fact, prices vary depending on the packages chosen. For example, the “Natural” guarantee offers a global annual package that exceeds certain amounts, allowing you to anticipate your health costs. Consider assessing your specific needs, as there are options from €1.20/month in certain categories. For more specific advice, do not hesitate to consult the tables available on their site.

Additional protections in the event of death or disability

Unéo provides you with formulas for targeting which protect you not only in the event of an accident, but also for unforeseen events such as death or disability. It is essential to evaluate these options in order to choose the level of coverage that is right for you. Subscription is particularly simple and allows you to adapt your protection to your needs.

What to remember when making your choice

To make the best choice, be sure to carefully analyze the details of each formula. Keep in mind that the refunds related to medical care are also a determining criterion. Reimbursement limits can vary considerably from one guarantee to another, so remember to check these elements before subscribing. Detailed reimbursement tables are available to guide you in your approach.

Use online resources for your choice

Don’t underestimate the importance of online resources. Specialized sites, such as Uneo, offer you comparison tools and guarantee tables which can facilitate your selection. In addition, additional information on other types of supplementary insurance is available, such as on MSI Insurance or even on the repatriation insurance.

Comparison of Unéo 2024 Offers

| Formula | Main Features |

| Natural | Overall annual package of €140 for routine care, excluding psychology. |

| Optimal | Extended coverage for higher health costs, amount from €170. |

| Essential | Affordable formula for young soldiers, favorable for a first subscription. |

| Family Reinforcement | Protection for the whole family, adapted to specific situations. |

| Death | Death benefit adjusted according to the formulas, protects your loved ones in the event of an accident. |

| Health Reimbursement | Covers all common medical procedures, with precise prices. |

| Support | Simplified management of reimbursements, with clear information for policyholders. |

| For whom? | Accessible to military personnel, families, and those seeking enhanced coverage. |

| From | Prices starting at €1.20/month for the base, increasing depending on the plan chosen. |

Testimonials on Unéo Tariff 2024: What you need to know to choose the right insurance

In 2024, the choice of health insurance becomes a crucial issue, and many policyholders share their experience with Uneo. They first emphasize the overview of guarantees proposed, which allows everyone to quickly visualize the protections available. These testimonies show real satisfaction with the reimbursement tables, offering appreciated transparency on support.

Some policyholders within the military community express their satisfaction at having had access to different formulas such as reinforcement of protection in the event of death or disability. Their feedback indicates that the choices are adapted to various situations, which makes subscribing to a mutual Uneo very accessible and customizable.

Another crucial aspect mentioned by users is the complete protection for healthcare costs. Numerous testimonies reveal that thanks to Unéo, they benefit from coverage for all routine medical procedures, whether optical, dental or even prevention. This considerably helps policyholders to better manage their health budget, an essential element these days.

Some customers also highlighted the competitive prices ofUneo in 2024, highlighting that it is possible to access quality coverage options at reasonable prices. Plans starting at €1.20/month demonstrate a real desire to make services accessible to everyone, in particular for the armed forces and their families.

The satisfaction is also palpable when it comes to a very important aspect: the death benefit. Testimonials demonstrate great peace of mind, knowing that if necessary, Unéo provides effective financial protection for loved ones. This shows how much the choice of insurance is decisive in guaranteeing the future of his family.

Going through these experiences, it becomes clear that choosing Uneo for its mutual health insurance in 2024 is a decision motivated by criteria of security, clarity and adaptability. Feedback from policyholders attests that with Unéo, it is possible to find insurance that really meets the specific needs of each person.

Choosing your health insurance in 2024 is essential to guarantee your peace of mind and that of your loved ones. With Uneo, several formulas and guarantees adapted to soldiers and civilians are offered. Therefore, it is essential to find out about the prices, THE guarantees and reimbursement options to make an informed choice. This article presents an overview of the offers offered by Uneo and the elements to consider when selecting the insurance that suits you best.

The different Uneo formulas

Uneo provides you with several options, including the Natural formula, there Optimal formula and the Family reinforcement. Each of these options is designed to meet specific and diverse needs. For example, the Natural formula is ideally intended for people attached to alternative medicine, while Optimal formula offers a higher level of protection for those who want expanded coverage.

The guarantees offered

Uneo’s guarantees are designed to offer complete protection in terms of health and of foresight. They cover all routine medical procedures, including care in optical And dental, as well as the costs linked to prevention. Please note that the guarantees do not only apply to medical care, but also to incidents related to your health such as disability following an accident. There death guarantee, which is part of some formulas, is also an aspect to take into account.

Reimbursements of health costs

A crucial aspect in choosing your insurance is the level of reimbursement that will be applied to health costs. With Uneo, an overview of reimbursements allows you to clearly visualize what will be covered. For example, a consultation with a GP is reimbursed up to €16.55 out of a rate of €26.50 by Social Security. By opting for Uneo, you ensure that you benefit from additional reimbursement which can make a significant difference depending on your medical situation.

How to choose the best formula for you

Faced with the diversity of offers, how can you choose the formula that best suits your needs? It all starts with an assessment of your personal situation. Analyze your medical needs and those of your family, and take into account any costs not covered by Social Security. Additionally, examine the ceilings of annual packages which apply to each guarantee. For example, the Natural guarantee is limited to a flat rate of €140 per year, which can be a decisive element depending on your use of alternative medicine.

Uneo insurance prices in 2024

Uneo prices for 2024 vary depending on the plans chosen, from €1.20/month for basic coverage to more comprehensive options adapted to specific needs. Take the report into account price-quality is therefore essential. Do not hesitate to compare the coverage criteria of each plan to find the one that will offer you the best protection at the best price.

Uneo Prices 2024: What you need to know to choose the right insurance

When we approach the subject of insurance rates, it is crucial to find out about the different offers available in order to make the decision best suited to your needs. In 2024, the Unéo mutual insurance company offers several formulas that meet the specificities of defense professionals, thus allowing them to benefit from tailor-made guarantees in case of death ordisability.

One of the key elements to take into account is the overview of guarantees proposed by Unéo. The latter highlights the different annual packages for each category, giving everyone the opportunity to quickly understand the level of coverage they have. Furthermore, the tables of refunds and of supported provide valuable information on healthcare costs. It is therefore essential to consult them to objectively assess the costs payable by you.

THE healthcare reimbursement also represent a significant aspect. The services covered include routine care, as well as procedures related tooptical, At dental, and at the prevention. Thus, by choosing Unéo, you ensure total health protection.

Finally, considering the Unéo 2024 price, it is important to compare these offers with market prices to ensure optimal coverage without additional cost. By taking all of these criteria into account, you will be able to make an informed choice that will bring you the necessary serenity in your life journey.

FAQ: Uneo Prices 2024

Q: What are the key elements to consider when choosing my Uneo insurance in 2024?

A: To choose your Uneo insurance, it is essential to compare the guarantees, THE refunds offered and the formulas available according to your personal and professional needs.

Q: What are the different packages offered by Uneo?

A: Uneo offers several packages, including the Natural guarantee, there Essential guarantee and options for protective reinforcement in the event of death or disability.

Q: What is the Uneo guarantees overview?

A: The Uneo guarantees overview presents a detailed overview of health coverage And foresight, thus facilitating your understanding of the services available.

Q: What are the prices of the guarantees for mutual health insurance at Uneo in 2024?

A: Prices vary depending on the package chosen, with packages limited annually, for example, €140 for the Natural guarantee.

Q: How do health expense reimbursements work with Uneo?

A: The refunds d’Uneo cover various medical procedures, including routine care in town, optical and dental, allowing you to be effectively protected.

Q: What criteria should I look at to evaluate the best health insurance for a military member?

A: It is important to examine the specific conditions and the suitable options to the military, as well as the prices of the different formulas on the market.

Q: How can I cancel my Uneo mutual insurance if I want to change contract?

A: To cancel your Uneo mutual insurance, you must follow the terms and conditions of termination stipulated in your contract, generally with a few weeks’ notice.

Q: Who can benefit from Uneo mutual health insurance offers?

A: Uneo mutual health insurance offers are accessible to anyone meeting the eligibility criteria, including military personnel and their families.