|

IN BRIEF

|

THE student mutual societies are essential to cover health costs during your years of study. With a multitude of offers available, it can be difficult to determine which one best meets your specific needs. Between the money back guarantees, coverage options and value for money, it is crucial to be well informed before making a choice. In this article, we offer you a comparison of student mutual insurance companies to help you navigate this complex world and find the solution best suited to your situation.

In a world where health is often put to the test, choosing the right student mutual is crucial. With a varied range of offers, it is important to know how to navigate among them to find the best option. This article presents a comparison of student mutual societies, including the pros and cons of each option, to help you make an informed decision.

Benefits

Opt for one student mutual presents many benefits. First of all, these mutuals are generally adapted to the needs of a young public, offering advantageous rates that are often lower than those of traditional mutuals. For example, certain mutual insurance companies such as Heyme offer plans starting from €9.90/month, making access to health less expensive.

Then, the guarantees The benefits offered are often designed to cover common health costs encountered by students, such as medical consultations, medications, or even dental care. To learn more about the best mutuals for students, you can consult dedicated sites, such as lesfurets.

Additionally, flexibility is another advantage not negligible. It is possible to adjust the guarantees according to your needs, by choosing additional options such as optical or dental. This allows you to personalize your coverage and tailor the cost to your budget.

Disadvantages

Despite these many advantages, student mutual societies also present disadvantages. First of all, certain contracts may include deficiencies, i.e. waiting periods before certain guarantees apply. This situation can be frustrating for students who need urgent care from the start.

Furthermore, it is not uncommon for refunds do not live up to expectations. Students must therefore be vigilant when choosing their mutual insurance, making sure they understand what is covered. For a quick simulation accompanied by advice on the best options, sites like mutualhealthinternational may prove useful.

Finally, although some mutual may seem attractive due to their prices, they could also exclude certain important guarantees. So be sure to carefully assess your needs before making a choice. To delve deeper into the question, comparisons like the one on the site UFC What to Choose can provide you with the necessary information.

In summary, choosing the best student mutual in 2024 requires in-depth reflection on your specific needs and a rigorous comparison of the different options available. Take the time to inform yourself and simulate the quotes to find the one that suits you best.

Choose your student mutual can quickly become a real headache for young people looking for the best health coverage. In 2024, with a multitude of offers available, it is essential to understand the important criteria that will guide your decision. In this article, we offer you a comparison of student mutual insurance companies, as well as practical advice for finding the option that suits you best.

Understand your health needs

Before diving into the comparisons, it is crucial to identify your specific health needs. Do you have any pre-existing health conditions? Do you often see specialists? These questions will help you determine which guarantees are essential for your coverage.

Compare student mutual insurance offers

Once your needs have been identified, the next step is to compare the different mutual insurance offers. Online comparison platforms, such as GoodAssur, allow you to view quotes in the blink of an eye, and in just a few minutes! This approach can save you up to 45% on your health insurance contracts.

Take into account reimbursement levels

THE reimbursement levels vary considerably from one mutual fund to another. For certain expenses, such as medical consultations or dental care, check the reimbursement percentages offered. Sometimes, reimbursement supplements can make all the difference. Also be sure to see if specific packages for certain services are available.

Evaluate the cost of mutual insurance

Obviously, the mutual insurance rate constitutes a major selection criterion. Student mutual insurance companies offer a wide variety of prices. For example, Heyme offers plans starting at €9.90/month, but it is essential to ensure that the price does not come at the expense of guarantees.

Distinguish between mutual insurance companies suitable for students

THE mutual insurance for students such as LMDE or Smerep are specially designed to meet the needs of young people. However, it is important to be wary of past dysfunctions and do thorough research before selecting an organization. View comprehensive resources on student mutual societies.

Conclusion: make the right choice

In summary, choose the best student mutual should not be an insurmountable task. By identifying your needs, comparing offers, taking into account reimbursements and prices, you will be able to make an informed choice. To further your research, don’t forget to also consult comparators like The Insurance Comparator. Your health deserves the best care!

With the start of the school year, many students find themselves faced with a crucial choice: which student mutual select to effectively cover their health costs? Between the different offers on the market, it is sometimes difficult to shed light on what is really interesting. This article offers you a comparison of student mutual insurance companies through practical advice to find the best option that meets your needs and your budget.

Identify your specific needs

Before launching into the jungle of student mutual societies, first take the time to take stock of your health needs. Are you a heavy consumer of medical care or are you mostly healthy? Do you need reimbursements for specialties, dental equipment or glasses? Answering these questions will help you direct your search towards best options.

Compare offers online

Nowadays, there are many online tools to compare different student mutual societies. Use a insurance comparator can save you considerable time. In just a few clicks, you will be able to discover the various features and prices of each offer, while helping you identify the one that suits you best.

Pay attention to important details

When comparing, don’t be seduced by price alone. Check the guarantees included, coverage of routine care, as well as reimbursement deadlines. Each mutual offers different levels of coverage. Sometimes the cheapest mutual insurance do not reimburse the most significant costs. Also keep an eye on deficiencies possible in the management of files, as this may affect your access to care.

Take into account the mutual rate

Obviously, price is a deciding factor, especially for students who are often on a limited budget. Consider comparing prices over a period of one year and checking whether discounts are possible for scholarship students. For example, you can find out about the free mutual insurance or those that offer a reduced rate. For advice on selecting a cheap mutual insurance, do not hesitate to consult specialized sites.

Evaluate customer service

Finally, customer service deserves your attention! Having easily accessible advice and support can make all the difference. Find out the level of satisfaction of other students regarding the support and support offered by the mutual. Reviews and testimonials can help to get a clearer idea.

In summary, choose the best student mutual in 2024 will take some time and thought, but by following these tips, you will be able to make an informed decision that will meet your specific needs. For more information and advice, check out the resources available like Reassure me or the Que Choisir file on student mutual societies.

| Selection criteria | Details |

| Monthly cost | From €9.90 depending on the offer chosen |

| Reimbursement level | Up to 100% of health costs depending on the type of care |

| Solutions for scholarship holders | Specific offers may be free or at a reduced rate |

| Online services | Access to a platform to manage your reimbursements |

| Medical assistance | Online consultations and health advice available |

| Duration of coverage | Temporary coverage options available for internships |

| Agreement with professionals | Partner network for reduced fees |

| Additional guarantees | Options for mental health and well-being |

| Simplicity of procedures | Fast, paperwork-free underwriting process |

| Adaptability | Ability to adjust guarantees according to personal needs |

The keys to choosing the best student mutual insurance

Choosing the right student mutual can be like a real quest. Between the different offers, the varied guarantees and the prices which fluctuate, it is not always easy to find your way around. Here are some testimonials which illustrate this obstacle course but also shed light on the different decision stages.

Marie, a literature student, shares her experience: “I compared several mutual insurance companies online and I was surprised by the price differences. Some proposals were very attractive, but it was essential for me to check the quality of the reimbursements.” She strongly recommends using online comparators: “This allowed me to save almost 200 euros per year with full health coverage.”

Antoine, for his part, approaches the subject from another angle: “I didn’t really know where to start. I first asked my friends who had already chosen their mutual insurance for advice.” His tip? “Don’t hesitate to find out about offers designed specifically for students, as they often offer attractive benefits.”

During this time, Clara decided to opt for mutual insurance better suited to her needs: “As a medical student, I needed rapid and efficient reimbursements. So I chose a mutual insurance company that offered me good coverage for routine care and medications.” She highlights the importance of looking at the essential guarantees when making your choice.

Finally, for Lucas, the price played a central role. “Being on a stock market, I was looking for a mutual fund that didn’t weigh too heavily on my budget. I found an option for less than 10 euros per month that suited me perfectly!” He adds that some mutual insurance companies offer discounts for students on scholarships or in special situations, which can be a real asset.

The testimonies of these students highlight the importance of comparing, informing oneself and carefully evaluating one’s needs. In 2024, choosing the best student mutual insurance takes a little time but can make all the difference in terms of health and budget!

Choosing a student mutual insurance company can seem like a real headache, especially in 2024 where the offers are numerous and varied. Between the different guarantees, prices, and reimbursements, it is crucial to find your way around to make the right choice. This article offers you a comparison of student mutual insurance companies, accompanied by practical advice to guide you towards the best option, adapted to your specific needs.

Why subscribe to student mutual insurance?

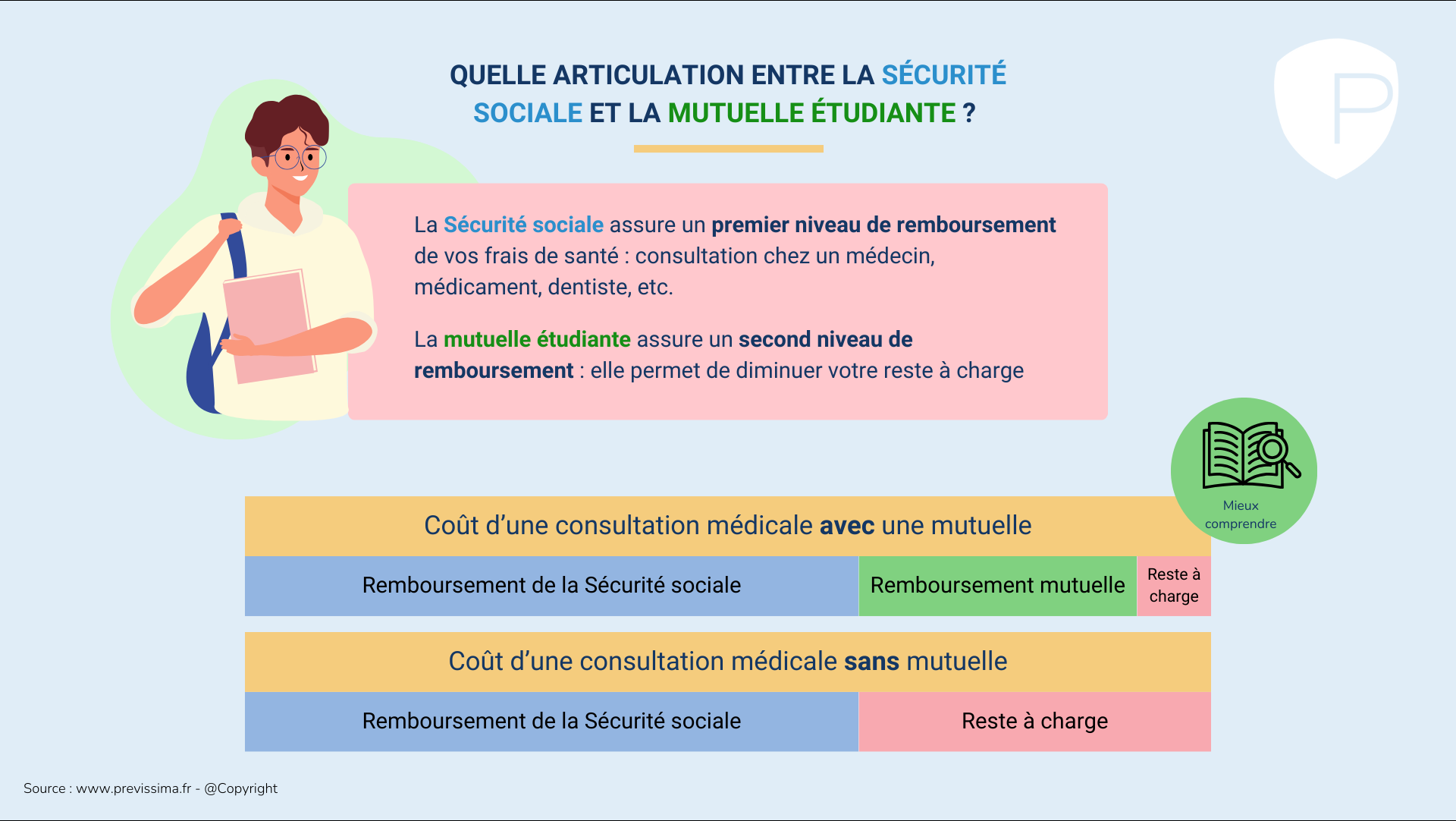

There student mutual is a supplementary health insurance which allows you to cover medical costs not covered by Social Security. As a student, choosing a mutual insurance company is essential to benefit from better reimbursement in the event of medical consultations, purchases of medicines or hospitalizations. In addition, with health costs often higher than expected, having a suitable mutual insurance can save you from unforeseen expenses.

Criteria to consider when making your choice

Before you start looking for your mutual insurance company, here are some criteria to take into account:

1. The guarantees offered

THE guarantees of each mutual insurance company vary. Some offer attractive reimbursements for routine care, while others may offer specific options such as optical or dental care. It is essential to carefully read the conditions of each offer in order to select the one that best meets your health needs.

2. The mutual rate

THE price is a fundamental criterion in your search. There are mutual insurance companies from €9.90 per month, but be wary of hidden costs or excesses payable by the insured. Comparing prices can save you a lot of money, especially if you can get a quote online in minutes.

3. The level of reimbursement

Find out about the reimbursement rate for different types of care. A mutual fund may seem attractive at first glance, but if reimbursement for medical consultations or optical costs is low, this may not be enough. Choose a mutual that offers adequate reimbursements for the care that interests you most.

Use a mutual insurance comparator

To facilitate your choice, it is strongly recommended to use a mutual insurance comparator. These online tools allow you to view multiple offers at a glance. In addition to saving you time, they highlight the differences in guarantees and prices between the different options. This helps you make an informed decision.

Finalize your choice with opinions from other students

Read the testimonials and reviews from other students can also give you a good idea of the quality of services provided by a mutual. Don’t hesitate to consult specialized forums or groups on social networks to gather opinions. This feedback can often unlock very useful insights into customer service and insurer responsiveness.

Choosing the best student mutual is a process that takes time and thought. By taking into account guarantees, prices, reimbursement rates, and using a comparison tool, you will be able to make a wise choice. Remember, the goal is to make sure your healthcare expenses are covered during your college years.

Conclusion on the comparison of student mutual insurance companies: how to choose the best option

Choosing a student mutual insurance company can seem like a challenge, especially given the multitude of offers available on the market. However, with the right information and a little method, it is possible to find the solution that perfectly meets your needs. Before making a decision, it is essential to define your priorities in terms of health coverage. This includes assessing your potential health expenses, such as general medicine, dental or even optical costs.

Comparing different options is also crucial. When looking at several mutual insurance companies, remember to pay attention to the guarantees offered, value for money and possible waiting periods. Some mutuals stand out with competitive prices, but it is just as important to ensure that they offer a adequate reimbursement about the routine care you may need.

Once the offers are sorted, take the time to read reviews from other students. Feedback can provide you with valuable information on the responsiveness and quality of customer service of the mutual insurance companies you are considering. In addition, do not hesitate to take advantage of the online tools of comparison to simplify your process. These tools allow you to have a clear vision of the different alternatives, to save money and to make an informed choice.

Finally, keep in mind that the mutual insurance you choose does not have to be definitive. You can always adjust your coverage as your situation changes, especially if you change establishment or your needs. In short, by arming yourself with precise information and analyzing the offers rigorously, you will find the student mutual that will best support you in your academic and personal journey.