|

IN BRIEF

|

Living abroad is a rewarding adventure, but it also carries its share of risks. L’repatriation insurance is an essential element for any expatriate wishing to travel with peace of mind. In the event of illness or serious accident, it offers the guarantee of secure return in his country of origin, at the expense of the insurer. It is crucial to understand that this coverage is not only limited to medical emergencies, but also includes the repatriation of loved ones and even the body in the event of death. Preparing adequately means ensuring peace of mind in the face of the unknown and protecting those close to you. Hire a international repatriation insuranceis choosing security and well-being abroad.

When someone decides to move abroad, it is essential to carefully consider all aspects of their security and well-being. Among the crucial elements, therepatriation insurance stands out for its ability to provide essential coverage in the event of a medical emergency. This comparative article highlights the benefits And disadvantages linked to this form of protection for expatriates.

Benefits

Financial protection in case of emergency

One of the main assets of therepatriation insurance is that it supports early return fees to the country of origin following a medical emergency. This includes not only transportation costs, but also those related to repatriation of bodies in the event of death, as well as the transport of other family members if necessary.

Access to health care

This insurance also guarantees rapid access to quality medical care. In the event of illness or accident occurring abroad, the insured person can receive prompt treatment and be referred to suitable health establishments. This coverage helps alleviate any concerns that might arise when faced with a foreign healthcare system.

Peace of mind

Finally, subscribe to a repatriation insurance provides a serenity of mind invaluable. Knowing that you are protected in the event of an emergency allows you to focus on your expatriate experience and fully enjoy your time abroad.

Best Health Insurance in Ivory Coast: Complete Guide

IN BRIEF Health insurance basic from €87 for a single person aged 30. Price increase to €155 at age 45. Universal Health Coverage (CMU) accessible since October 1, 2019. Majority coverage of care with limits. Comparison of best insurance for…

Disadvantages

Insurance costs

One of the main disadvantages of repatriation insurance is undoubtedly the cost partner. Depending on the guarantees chosen and the level of coverage, costs can increase. It is therefore crucial to carefully assess your needs and compare the different offers available before you commit.

Complexity of procedures

Another point to consider is the complexity of procedures in the event of repatriation being implemented. Administrative formalities can be cumbersome and require a good knowledge of the procedures to follow, which can be a source of stress in an already difficult situation.

Limitations and exclusions

Finally, it is important to take into account that certain insurances may have limitations and exclusions in terms of coverage. For example, pre-existing conditions may not be covered, or certain risky activities may also be excluded. Therefore, it is crucial to carefully read the general conditions of the chosen insurance.

When you go to live abroad, it is crucial to ensure your safety and well-being, in order to fully enjoy this adventure. L’repatriation insurance proves to be an indispensable ally for any expatriate. Not only does it guarantee a quick return in the event of a medical emergency, but it also covers other unforeseen situations. This article presents the issues and advantages of this insurance for all those who live outside their country of origin.

Everything you need to know about health insurance for expatriates at 1 euro

IN BRIEF International health insurance from the 1st euro: immediate reimbursement of medical expenses. No membership required Fund for French People Abroad (CFE). Ideal for expatriates wanting complete protection. Covers costs in the event of death, disability And work stoppage.…

What is repatriation insurance?

L’repatriation insurance is a guarantee which aims to cover the medical transport of an individual to their country of origin if necessary. If you suffer an illness or accident abroad, this insurance covers the costs associated with your return to France, as well as the transport of your body in the unfortunate event of death. This avoids exorbitant costs that can quickly add up in emergency situations.

Loss of salary insurance: everything you need to know about AXA

IN BRIEF Pension insurance : financial protection in the event of an unforeseen event (illness, accident). Daily allowances : compensate for loss of salary with an amount setting a percentage of your basic daily salary. Simplified procedures to declare a…

Essential coverage for your safety

Make the choice of one repatriation insurance allows you to travel with peace of mind. Indeed, the risk of accidents or illnesses is always present, and it is important to be prepared. Health conditions may vary from one country to another, making it all the more necessary to subscribe to a health insurance adapted. If anything goes wrong, you can be confident that your situation will be handled professionally and quickly, allowing you to focus on your recovery.

AXA healthcare professional mutual insurance: everything you need to know

IN BRIEF Effective health coverage adapted to the needs of healthcare professionals High value added services for better management of your health Simplified management of contributions and the Nominative Social Declaration (DSN) Access to prices services offered by healthcare professionals…

Guarantees adapted to expatriates

The offers ofrepatriation insurance vary depending on the needs of expatriates. Many insurance plans include the repatriation of other members of your family, which is an important aspect if you are going abroad with your loved ones. In addition, some insurance plans offer additional options, such as coverage of medical expenses, which can be very useful in the event of hospitalization.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage for foreigners in France essential Request from form S1 for registration to the social security Foreign students : compulsory registration for health insurance European Health Insurance Card (CEAM) for holidays in France Different rights depending on…

The difference between international health insurance and repatriation assistance

It is essential to understand the difference between a international health insurance and repatriation assistance. Although these two types of insurance offer coverage during your stays abroad, not all health insurance plans provide for repatriation in the event of a serious problem. It is therefore crucial to choose a contract that specifically includes this type of guarantee, in order to ensure complete protection during your expatriation.

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

How to choose your repatriation insurance?

Choose the right one repatriation insurance may seem complicated, but there are several tips to help you. Before subscribing, it is advisable to compare the offers and carefully read the general conditions of the contracts. It’s also helpful to read testimonials from people who have already used their insurance to better understand the pros and cons of each option. Do not hesitate to find out about the coverage offered by the different companies, in order to opt for a solution that perfectly suits your needs.

Remember that your safety and that of your loved ones cannot be neglected. Subscribe to a repatriation insurance is a valuable investment to live your experience abroad with peace of mind.

For expats, living abroad is often a fascinating adventure filled with new cultures and opportunities. However, this experience can also carry risks, particularly in terms of health. L’repatriation insurance plays a crucial role in ensuring the safety of expatriates in the event of a medical emergency. In this article, we will explore why this coverage is essential to guarantee a peaceful return to France in unforeseen situations.

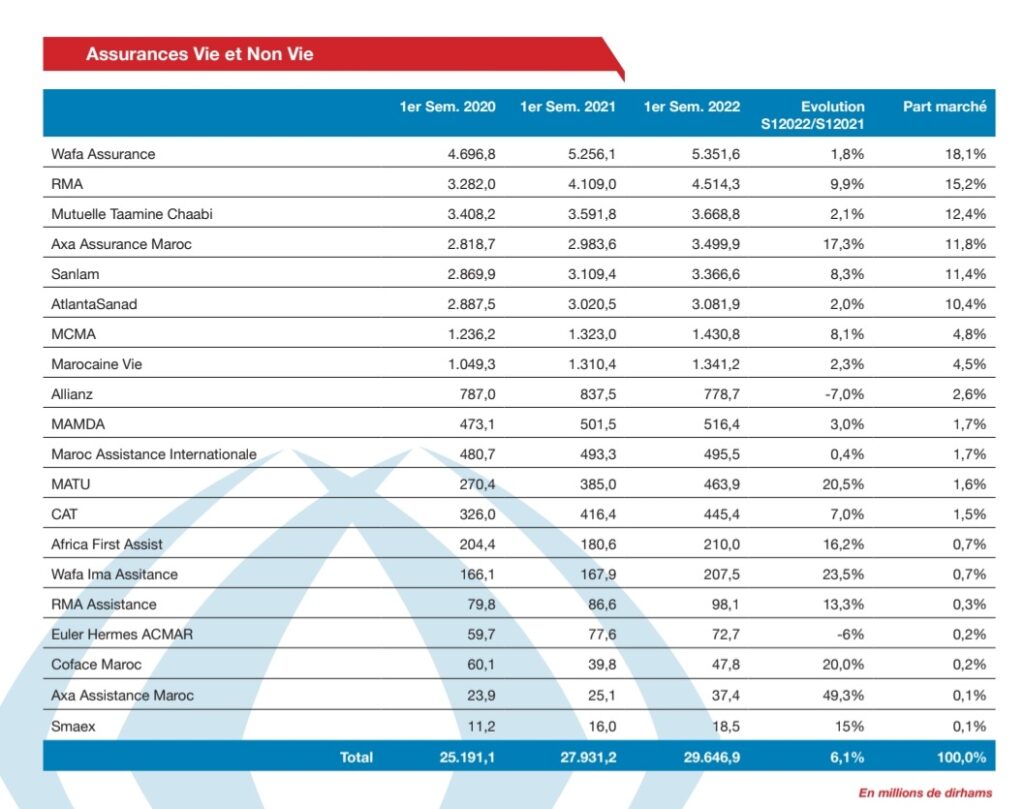

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

Essential protection in the event of a medical emergency

When you’re abroad, unforeseen events can happen, whether it’s a sudden illness, an accident, or an exacerbation of a pre-existing condition. L’repatriation insurance covers the costs associated with your transport to France, allowing you to benefit from appropriate medical care in a familiar environment. This guarantee is reassuring because it allows you to focus on your recovery without worrying about financial costs.

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Obtain the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to the local social protection system. Mutual insurance companies do not cover…

Repatriation of your family

In case of urgent need, it is crucial that your loved ones can accompany you. A good repatriation insurance also supports the return of your family members, facilitating emotional support in difficult times. This helps reduce the stress and anxiety often felt during hospitalization abroad.

A quick return to France

Prompt repatriation is often essential, especially if your state of health requires urgent care. By having subscribed to a repatriation insurance, you ensure a rapid and organized return to your country of origin. Your insurer takes care of all transport logistics, guaranteeing you a hassle-free return.

Covering the specific needs of expatriates

The contracts ofrepatriation insurance must be adapted to the specific needs of each expatriate. Some contracts include essential guarantees such as medical repatriation, mortuary transport in the event of death and even assistance with necessary administrative procedures. It is an essential investment to have peace of mind.

The difference between assistance and insurance

It is important to understand the difference between a repatriation insurance and simple travel assistance. While assistance can offer help in times of need, repatriation insurance guarantees reimbursement of costs related to your transport in the event of an emergency. Carefully reading the terms of your contract is therefore essential so as not to be caught off guard.

Choosing the right insurance

To benefit from optimal coverage, it is crucial to choose your repatriation insurance. Evaluate the different offers available on the market, taking into account the services included, the guarantees offered, as well as the destinations covered. Comparison tables and contract reviews can help you make an informed decision.

If you want to deepen your knowledge on the subject, you can consult this article on travel insurance for expatriates or this other on how repatriation insurance works.

Comparison of the benefits of repatriation insurance for expatriates

| Appearances | Importance |

| Medical coverage | Covers costs related to illness or accident abroad. |

| Repatriation in case of emergency | Allows a rapid return to France if your state of health requires it. |

| Support for loved ones | Facilitates the repatriation of family members if necessary. |

| 24/7 support | Access to a problem support hotline at any time. |

| Medical transport | Covers special transportation costs needed in the event of serious illness. |

| Prevention of heavy costs | Minimizes the risk of incurring substantial unplanned expenses. |

| Protection against the unexpected | Reduces anxiety related to unforeseen incidents while living abroad. |

Testimonials on the importance of repatriation insurance for expatriates

Marie, an expatriate in Asia, testifies: “During my first trip abroad, I had not subscribed to repatriation insurance, thinking it was unnecessary. Unfortunately, I contracted a serious illness which forced me to urgently return to France. The shipping costs were exorbitant and left me in a difficult financial situation. Since then, I haven’t left without my blanket.”

David, whose adventure abroad took an unexpected turn, shares: “Therepatriation assistance was a real lifesaver when I had an accident while traveling. I was safely transported to a hospital in France, allowing me to be surrounded by family during my recovery. Without this insurance, care would have been a financial nightmare.”

Alice, whose husband fell ill during their expatriation, explains: “We were able to benefit from a repatriation guarantee who took care of not only my husband’s return, but also that of our children. It is essential for an expatriate to be trained on the different aspects ofinternational health insurance, because it can really make the difference in critical moments.”

Jean, a retiree living in Spain, emphasizes the importance of foresight: “With therepatriation insurance, I am finally serene. If I have a health problem, I know I can return home safely without worrying about costs. It’s a peace of mind that all expats should have.”

Clara, an expatriate student, says: “I was so preoccupied with my studies that I downplayed the importance ofrepatriation insurance. When I had to have emergency surgery, I realized that it was a crucial choice. Being repatriated to my home country in comfortable conditions was truly a relief.”

These testimonies underline the extent to which therepatriation insurance is essential to protect not only your health, but also your peace of mind during an expatriation. Every experience shows that not having adequate coverage can lead to serious financial and emotional consequences.

Insurance repatriation is essential for all expats living abroad. Indeed, it offers valuable protection in the event of a medical emergency, illness or even death. This article explores the reasons why to subscribe to a repatriation insurance is essential to guarantee your safety and well-being abroad.

What is repatriation insurance?

Insurance repatriation is a guarantee that allows expatriates to be transferred to their country of origin, generally France, when their health requires it. Whether due to a sudden illness or an accident, this insurance covers transport costs and ensures a safe return.

Protection against the unexpected

When you live in another country, it’s crucial to prepare yourself for the unexpected. A medical emergency can happen at any time, and it is essential to be prepared. Medical costs abroad can be exorbitant, and without adequate insurance, repatriation can become a financial burden. This is why a repatriation insurance is essential to counter these unforeseen events.

Coverage adapted to expatriates

The different guarantees offered by various insurance contracts include medical repatriation, early return due to an accident, coverage of medical expenses and even repatriation of the body in the event of death. Choosing insurance with guarantees adapted to life abroad is essential for peace of mind. This allows expats to focus on their adventure without fear of medical consequences.

Assistance for loved ones

In addition to your own safety, it is also important to think about your loved ones. A repatriation insurance can take care of the repatriation of family members if necessary, thus ensuring support in difficult times. This is particularly crucial in delicate health situations where the presence of a loved one can make all the difference.

Comparison with other insurances

It is essential to understand the difference between a health insurance classic and a repatriation insurance. Many expatriates believe that their health coverage will sufficiently protect them abroad. However, many health insurance contracts do not provide for repatriation in the event of a serious accident or illness. It is therefore recommended to check the clauses of your contract and, if necessary, to also take out specific repatriation insurance.

Costs of repatriation and financial implications

Costs related to repatriation can vary considerably. Depending on the geographic location and the severity of the state of health, the costs can quickly reach very high amounts. Without one repatriation insurance, you could find yourself facing expenses you never anticipated. This is why investing in good insurance coverage is both wise and responsible.

Any expatriate must seriously consider subscribing to a repatriation insurance. It represents essential protection against the hazards of life abroad and guarantees a peaceful return if necessary. Being well insured also means being able to experience your expatriation fully, without apprehension.

Living abroad is a fascinating adventure, but it comes with many overlooked risks. One of the essential elements to consider during this experiment is therepatriation insurance. This coverage is designed to protect expatriates in the face of unforeseen events that could harm their health or well-being. Indeed, no one is safe from an accident or sudden illness, and being far from one’s country of origin can increase worries in the event of a delicate situation.

L’repatriation insurance allows you to benefit from an organized and secure return to your country of origin, at the expense of the insurer, if your state of health requires it. This guarantee is absolutely essential to avoid unforeseen costs which can quickly become exorbitant. Medical care in some parts of the world can be very expensive, and access to adequate medical facilities is not always assured. In the event of an emergency, these systems go well beyond simple medical advice, also providing suitable medical transport.

It is also crucial to note that therepatriation insurance covers not only the repatriation of the sick person, but also that of family members, if this proves necessary. In the event of death, it also takes care of the transfer of the body to the country of origin, thus relieving loved ones of the financial and logistical burden that each tragic situation entails.

In short, subscribe to a repatriation insurance is more than a simple financial choice: it is a security measure, a support in times of crisis which accompanies each expatriate on their journey. It is an investment for peace of mind, as it allows you to concentrate on discovering and integrating into a new country, while being protected in case of need.

- Why take out repatriation insurance?

- It is essential to subscribe to a repatriation insurance to guarantee your safe return to France in the event of illness or accident. This saves you significant costs and ensures optimal care of your situation.

- What guarantees does repatriation insurance cover?

- A repatriation insurance usually includes benefits such as medical repatriation, THE transport of the body in the event of death, as well as the repatriation of family members if necessary.

- Does international health insurance always include repatriation?

- All health insurance international standards do not provide for repatriation. It is crucial to check the details of your contract to ensure adequate coverage.

- What are the risks of not having repatriation insurance?

- Without repatriation insurance, in the event of an emergency, you could be faced with very high expenses for your transport in France, which could jeopardize your financial situation.

- How to choose the best repatriation insurance?

- To choose the best repatriation insurance, compare the offers by taking into account the amount of guarantees, the support conditions and the opinions of other customers.

- Is it possible to be repatriated without insurance?

- It is possible to make repatriate without insurance, but this will result in very high costs for you, making the situation financially difficult.