|

IN BRIEF

|

L’private health insurance is a solution increasingly chosen by those who wish to complete reimbursements of the Social security or who do not have access to it. While it can offer considerable advantages such as better coverage and rapid reimbursement, it is equally essential to be aware of its possible disadvantages. Whether you are looking for a complementary health adapted to your specific needs or whether you simply wish to understand the issues of these contracts, this exploration will enlighten you on the key points to consider to make an informed choice.

L’private health insurance has become a serious alternative for those who want more comprehensive medical coverage than that offered by Social Security. It presents a set of advantages which can reduce the remaining burden, but also disadvantages which it is essential to consider before making a choice. This article guides you through the different aspects of private health insurance to help you make an informed decision.

Benefits

Extended coverage

One of the main advantages of theprivate health insurance is its ability to offer broader coverage than that of Social Security. Policyholders can benefit from reimbursements for numerous treatments, including dental, optical and even alternative medicine treatments. This significantly reduces the out-of-pocket cost for these expenses, making care more accessible.

Flexibility and customization

Each individual has specific needs, a personalized health insurance can meet unique criteria. Depending on your family situation or your particular medical needs, it is possible to select tailor-made options which guarantee suitable coverage. This is especially valuable for families or individuals with a medical history.

Rapid access to care

With private health insurance, the waiting time to obtain a medical appointment is often reduced. This is particularly beneficial for consultations with specialists, as these health professionals may be overbooked in the public system. So, having private insurance can allow you to seek medical care more quickly.

Reimbursement on the first euro

In some cases, theprivate health insurance offers reimbursement on the first euro, reducing the financial stress associated with unexpected expenses. This provides peace of mind, especially when you need emergency care, both in France and abroad.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage for foreigners in France essential Request from form S1 for registration to the social security Foreign students : compulsory registration for health insurance European Health Insurance Card (CEAM) for holidays in France Different rights depending on…

Disadvantages

High cost

One of the main disadvantages ofprivate health insurance is its cost. Premiums can vary considerably depending on the levels of cover and options chosen, requiring careful consideration of your budget. Some plans can become prohibitive in the long term, especially if they include many additional options.

Complexity of contracts

Health insurance contracts are often complex. The general conditions, the different coverage options and the exclusions of guarantees can be difficult to understand for a layperson. This complexity can lead to misunderstandings about the actual coverage, which is harmful when urgent medical care is required.

Exclusions and deductibles

Private health insurance generally includes exclusions or deductibles that can limit the reimbursement of certain expenses. Therefore, it is crucial to read the terms of your contract carefully in order to understand what is actually covered and what is not. This can sometimes disappoint policyholders who expect a full reimbursement.

Without Social Security affiliation

For those who are not affiliated to Social Security, it is vital to choose insurance that covers all expenses. However, some private health insurance may not be entirely suitable or offer restricted conditions. Finding suitable coverage is therefore essential, especially for foreigners living in France. More information on this topic can be found here.

Private health insurance is an attractive option for those who do not have access to social security and want to guarantee optimal medical coverage. In this article, we will introduce you to its strengths and limitations. In particular, we will explore the types of contracts available, the possible reimbursements, as well as the criteria to take into account to make the best choice. The advantages of private health insurance

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

The main advantage of

private health insurance is the flexibility it offers. By choosing a contract adapted to your specific needs, you can benefit from tailor-made coverage. This often includes higher reimbursements on certain healthcare positions without having to pay more for general coverage. Another great advantage is the

speed of reimbursements . Unlike Social Security, reimbursement times with private insurance are generally shorter, which allows health expenses to be covered quickly. Some insurance companies even offer reimbursement on the first euro, offering apeace of mind , especially for expatriates who travel abroad.The disadvantages of private health insurance

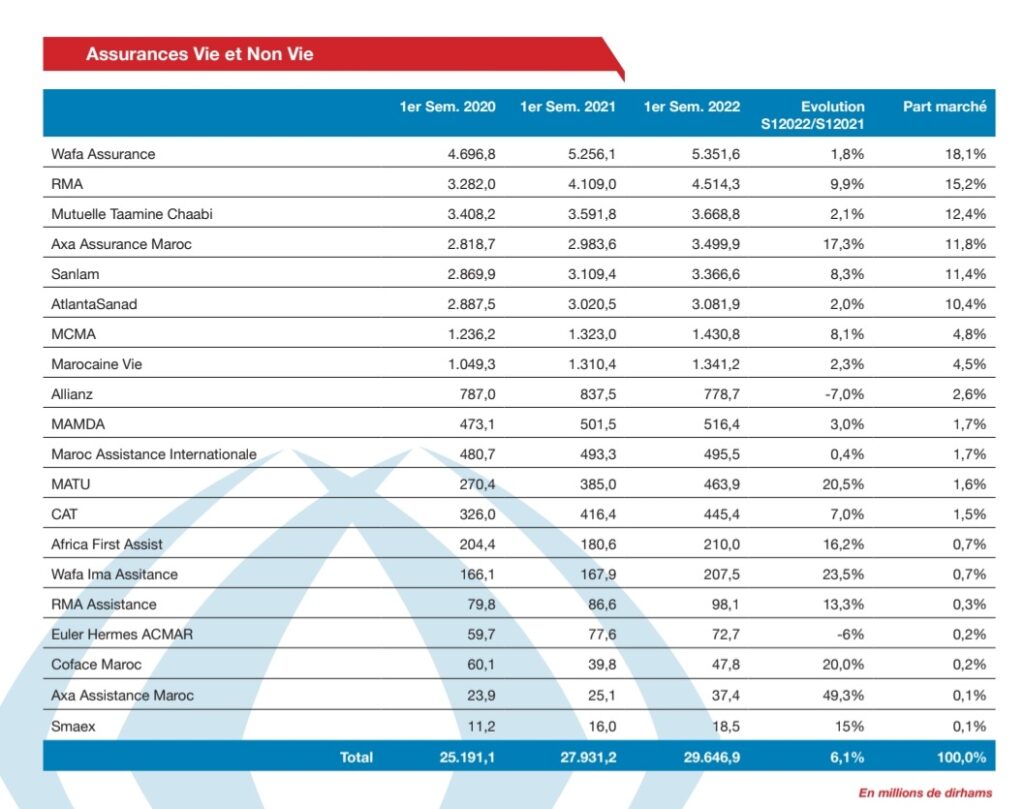

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

However, the

private health insurance has disadvantages that must be considered. First of all, the cost premiums can be high, which represents a significant financial investment. In certain cases, the guarantees provided for in the contract do not cover all of the costs incurred, which can leave a significant balance. Additionally, it is crucial to understand the

contract clauses before committing. Some insurance policies may have exclusions or deductibles that may reduce their effectiveness if necessary. It is therefore recommended to read the general conditions carefully and compare several offers to avoid unpleasant surprises. How to choose your private health insurance

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Obtain the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to the local social protection system. Mutual insurance companies do not cover…

The choice of your

private health insurance must be done carefully. First, assess your health needs and those of your family. Do you want increased coverage for specific care, such as vision or dental care? It is also important to learn about the guarantees offered by each insurance, including reimbursement levels and included services. Finally, it is advisable to consider the

customer reviews and the reputation of the insurer, as well as consulting online comparators. This will allow you to identify the insurance that best meets your expectations while taking your budget into account. Ultimately, navigating the world of

private health insurance may seem complex, but by taking the time to evaluate the different options available and fully understanding the advantages and disadvantages, you will be able to make an informed choice. For more information, you can check out resources like this site dedicated to health insurance in France. discover the advantages and disadvantages of private health insurance. Find out about the guarantees, costs and selection criteria to make an informed decision on your health coverage.

private health insurance . Whether you are self-employed, student or expatriate, this coverage can offer solutions tailored to your needs. By exploring its pros and cons, this article will help you make an informed decision when choosing yourhealth insurance .The advantages of private health insurance

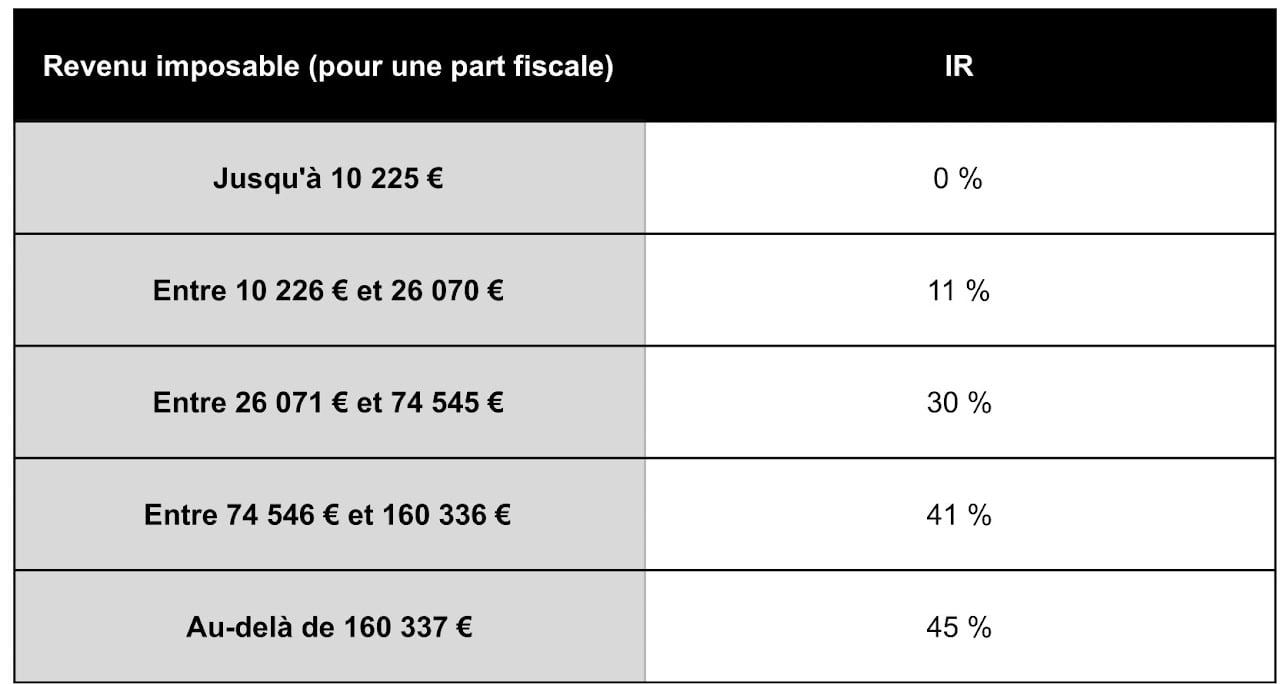

The cost of private health insurance: what you need to know

IN BRIEF The cost of a private health insurance varies depending on age and length of coverage. Average price of mutual insurance: approximately 90 €/month for women and 105 €/month for men. THE monthly contributions generally oscillate between 30 and…

One of the first assets of the

private health insurancelies in the personalization of your cover. Unlike traditional health insurance, you have the option of choosing a contract that precisely meets your specific needs. For example, for families, this may include options like reimbursement for dental care or specialist consultations. Another significant benefit is reimbursement for a wide range of healthcare costs. Private insurance is often more generous in its reimbursement terms compared to

social security . You can thus considerably reduce yourremains responsible for certain treatments. This allows you to access quality treatments without being held back by prohibitive costs. International coverage

Health insurance in Belgium: understanding prices and coverage

IN BRIEF Social security system in Belgium: a protective framework THE mutual reimburse between 60% and 75% of medical costs Conventional price for a general consultation: €22.22 with 75% refunded 20 to 25% of health costs remain the responsibility of…

For people traveling abroad or living abroad, the

private health insuranceoften provides comprehensive coverage. This even includes reimbursement on the first euro in certain cases, thus guaranteeing you protection in the event of a health problem, even internationally. To learn more about specific options for expats, check out this article: Expat health insurance .The disadvantages of private health insurance

Occupational medicine in Clichy: a complete guide for employers and employees

IN BRIEF Presentation of the occupational medicine has Clichy Role of occupational health services in prevention Legal obligations of employers And employees Hours and contact details Center for occupational medicine Importance of medical visit and health monitoring Assistance in the…

complementary health insurance can vary considerably. It is therefore advisable to compare several offers to find the one that suits you best.

In addition, there are also

reimbursement restrictions on certain services. For example, some policies may not cover pre-existing conditions or have waiting periods. This means that you need to read the terms of your contract carefully so that you are not caught off guard at critical moments. How to choose health insurance that suits your needs

Easy mutual: everything you need to know about health insurance

IN BRIEF Supplementary health : definition and objectives Importance of mutual health insurance for refunds Criteria for choosing best mutual adapted Coverage of health costs: dental, optical, etc. Comparison of offers and prices Conditions of termination and options available Mutual…

When you choose a

private health insurance , it is essential to take several factors into account. First, assess your health needs and those of your family. Then, review the reimbursement levels offered and the types of care covered, also checking the waiting periods. For tips on how to choose the right coverage, continue to explore resources likeMy Allowances Or Previssima .Finally, do not hesitate to request quotes from several insurers and ask questions about their offers. A good understanding of what is included in your coverage will allow you to make an informed choice, and thus protect your health with the contract best suited to your situation.

Advantages and disadvantages of private health insurance

Criteria

| Details | Refunds |

| Improves reimbursements compared to Social Security | Flexibility |

| Customization options according to specific needs | Rapid access to care |

| Less waiting for consultations and care | International coverage |

| Protection of medical expenses when traveling abroad | Cost |

| May result in high monthly costs | Complexity of contracts |

| Conditions and levels of coverage sometimes difficult to understand | Remains payable |

| Possibility of non-reimbursed costs even with insurance | discover the advantages and disadvantages of private health insurance. Learn about the protections it offers, the associated costs and how it compares to public health systems to make an informed choice. |

Marie, 35, recently opted for a

private health insurance and shares his enriching experience. “I decided to take out this coverage because I was not satisfied with the social security reimbursements. Thanks to my mutual insurance, I benefit from better reimbursement on my dental and optical care, items that are often poorly covered. It’s a real relief to see my remaining expenses decrease.” Jean, a father, also testifies to the

benefits of this cover. “For my family, it was essential to subscribe to a complementary health which meets our specific needs. With the personalized health insurance we have chosen, we have access to specialized care without fear of exorbitant costs. It’s a real comfort to know that every member of the family is well covered.” However, not all testimonials are positive. Pierre, an independent professional, expresses his reservations. “I subscribed to a

mutual health insurance which seemed very advantageous at the start. However, I quickly realized that repayment times can be long, which is problematic when bills pile up.” Sophie, an expatriate, talks about the

disadvantages private health insurance abroad. “While this provides international coverage, costs can quickly add up. I have had to adjust my budget to accommodate the high monthly premiums. It is essential to fully understand the terms of the contract before committing.” Finally, Luc, a retiree, highlights another difficulty. “As a senior, I found that the

insurance premiums increase with age. In addition, certain exclusions can make the choice of complementary health insurance more complex. It’s a challenge to navigate the maze of options available to us.” Private health insurance has become an increasingly popular option to supplement Social Security reimbursements. This article aims to detail its

benefits And disadvantages , to help readers make informed decisions about their health coverage. Whether you are self-employed, an expatriate or simply looking for better protection, understanding how this insurance works can make all the difference to your health and your budget.The advantages of private health insurance

Covered more widely and quickly

One of the main

benefits of private health insurance is its ability to offer more comprehensive coverage. Unlike Social Security which only reimburses part of your health costs, health insurance contracts allow you to benefit from refunds improved on various medical expenses. For example, consultations with specialists, dental or optical treatments are often better covered. Flexibility and customization

With private health insurance, you have the ability to customize your coverage to your specific needs. Whether you have regular care needs or are looking for a

health insurance adapted to your family , it is possible to opt for a formula that suits you perfectly. You can choose to include or exclude certain expense items, which allows for finer management of your health budget.Reimbursement from the first euro

Many private health insurance contracts offer a

reimbursement from the first euro , which means you don’t need to pay out of pocket before being reimbursed. This option is particularly beneficial for people who want to avoid unexpected medical expenses. In addition, some insurance companies offer international coverage, guaranteeing access to healthcare regardless of where you live.The disadvantages of private health insurance

Potentially high costs

While offering many advantages, private health insurance can also present

disadvantages . Chief among them is cost. The monthly premiums can be significant, and depending on the guarantees chosen, the price can quickly increase. For many, this can be a difficult investment to make, especially in the event ofextended sick leave or other financial contingencies. Limited coverage for certain conditions

Another concern is potential coverage limitations. Some private health insurance may exclude

pre-existing pathologies , leaving policyholders without protection for illnesses they already have. It is therefore crucial to read the contract clauses carefully in order to fully understand what is included and what is not.Complexity of guarantees

The diversity of offers can also make the selection of private health insurance complex. Many contracts contain multiple options and levels of coverage, which can be confusing. It is essential to carefully compare the different

offers and learn about the guarantees that best meet your needs before making a final decision. In a constantly changing world, private health insurance is a valuable tool. By carefully weighing its pros and cons, you can make an informed choice that meets your health and wellness requirements.

discover the advantages and disadvantages of private health insurance. This analysis will help you weigh the pros and cons in order to choose the coverage that best suits your health needs.

private health insurance can be a major issue for many people. This type of coverage provides access to higher reimbursements than those offered by Social security . In fact, thecomplementary health are designed to reduce the out-of-pocket costs for patients by guaranteeing more comprehensive coverage of medical costs. This is all the more fundamental for individuals with specific health needs or for those who do not benefit from social security coverage. Among the main

benefits of private health insurance, we can mention the flexibility of contracts. Each individual or family can choose a plan adapted to their needs and budget. In addition, some contracts offer international services, which is particularly relevant for expatriates or people who travel frequently. THE reimbursement to the first euro is also an often appreciated aspect, allowing you to benefit from medical coverage from the first euro incurred in health costs. However, it is crucial to also consider the

disadvantages . Costs can quickly add up, impacting families’ budgets, especially if they make inappropriate coverage choices. Another difficulty lies in understanding the various reimbursement levels, which can seem complex for the consumer to decipher. Somemutual may also have specific exclusions, making careful reading of the terms and conditions necessary. In short, private health insurance offers varied and adapted options, but it is imperative to compare the delegations, calculate the costs and fully understand the many aspects of each contract in order to make the most relevant choice possible.

FAQs about Private Health Insurance