|

IN BRIEF

|

In a constantly changing world, choosing best health insurance in Spain has become essential, especially for expats and new residents. Whether you’re from a neighboring country or a distant corner of the globe, understanding the different health insurance options available and how they work can seem complex. This comprehensive guide will enlighten you on the key elements to consider, from the guarantees offered to healthcare networks, in order to help you make an informed decision that perfectly suits your needs. Prepare to navigate the Spanish healthcare system with confidence and peace of mind.

Choose one health insurance adapted in Spain is essential to guarantee your well-being and medical safety. This comprehensive guide allows you to compare the different options available on the market, so you can make an informed decision for your specific needs. Discover the characteristics of the best health insurance in Spain, as well as their advantages and disadvantages.

Benefits

Possibility of extended coverage

The best health insurance in Spain offer extensive coverage, including not only medical consultations, but also hospitalization, dental care, and even specialized services. This allows you to benefit from quality monitoring without financial worry in the event of illness or accident.

Rapid access to private care

With private health insurance, you benefit from rapid access to care, without a waiting list. You can consult doctors and specialists when you need them, which is particularly important for expats wanting to avoid delays linked to Spanish social security.

Service in French

Many companies offer support and services in French, which makes procedures easier for French expatriates. This allows you to ask all your questions and get clear information about your coverage without a language barrier.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage for foreigners in France essential Request from form S1 for registration to the social security Foreign students : compulsory registration for health insurance European Health Insurance Card (CEAM) for holidays in France Different rights depending on…

Disadvantages

Often high costs

The main disadvantage of health insurance private in Spain is the cost, which can be high. Monthly premiums vary depending on the coverage chosen and the age of the insured. It is therefore crucial to compare the different offers to get the best value for money.

Waiting clauses

Some insurance companies impose waiting clauses for specific treatments. This means that you cannot benefit from certain coverage immediately after subscribing. It is therefore important to carefully read the general conditions of the insurance you are considering.

Network of professionals

Policyholders must also take into account the network of health professionals approved by the insurance. Some insurers may not have large networks, which may limit your choices of doctors and hospitals.

To learn more about health insurance options, be sure to check out online resources, such as this complete guide on the best health insurance for expats or this comparative article to explore the different companies available in more detail.

Choose the best health insurance in Spain is crucial for anyone wishing to live or stay there, especially expats. This comprehensive guide provides you with all the information you need to navigate the Spanish healthcare system, learn about the different insurance options, and help you make an informed decision tailored to your specific needs.

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

Understanding the healthcare system in Spain

The health system in Spain is mainly composed of two parts: the National Health System (SNS) and private health insurance. The SNS provides basic healthcare to Spanish citizens and legal residents, but it may have limitations in terms of waiting times and coverage. On the other hand, private insurance can offer you faster and more varied options, including coverage for specialized care.

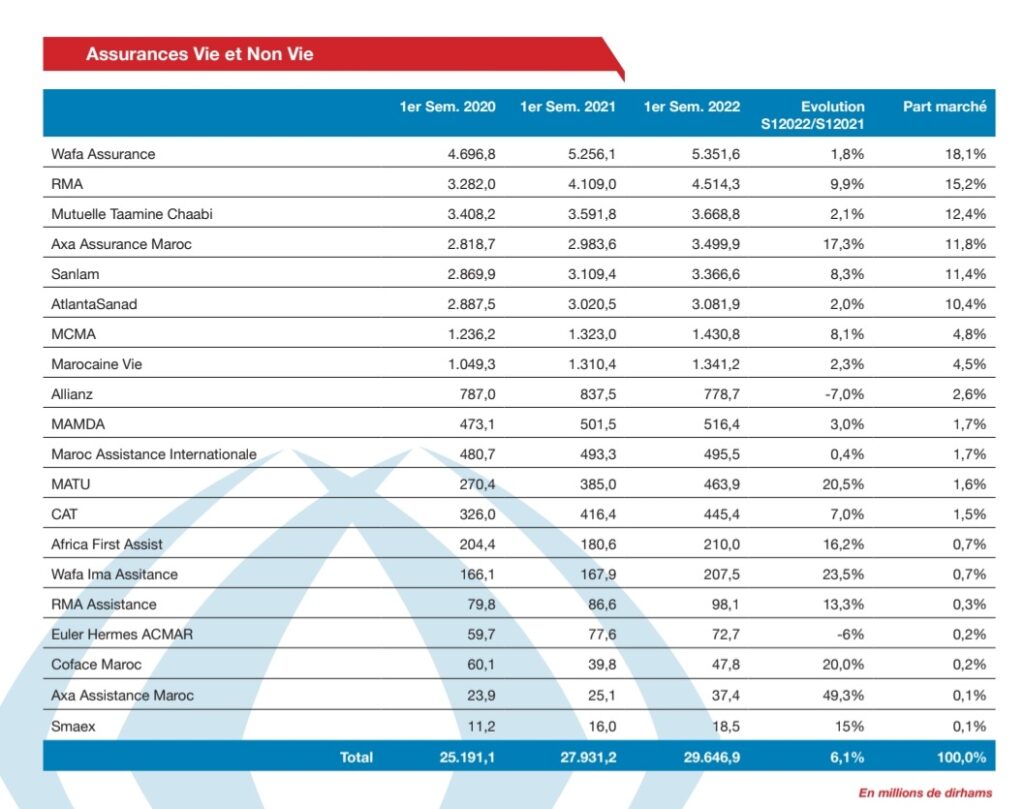

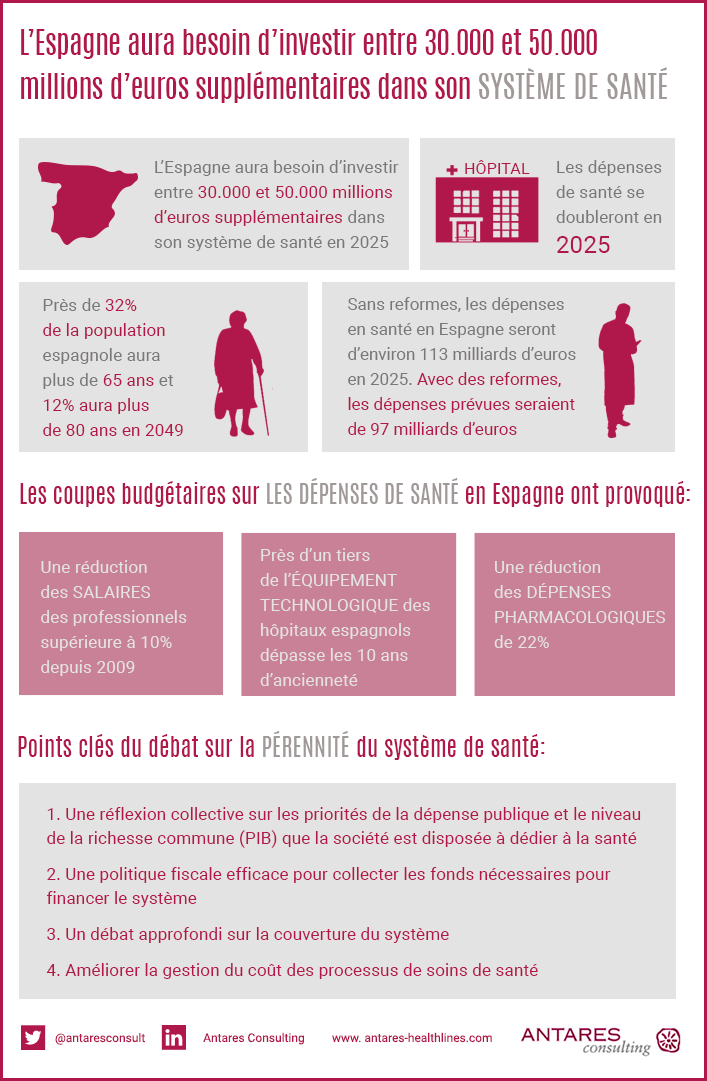

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

Health insurance for expatriates

As an expat, you will need to evaluate what type of health insurance will be best for you. Choices include SNS, there CFE (Caisse des Français Abroad) and the international insurance. Each option has advantages and disadvantages. For example, SNS is affordable, but the CFE and international insurance may offer more extensive coverage.

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Obtain the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to the local social protection system. Mutual insurance companies do not cover…

Criteria for choosing health insurance

To select the best health insurance, it is essential to take into account several criteria: cost, coverage, waiting times, access to care and quality of services. Analyzing the different plans available based on these criteria will allow you to find the one that best aligns with your expectations.

The cost of private health insurance: what you need to know

IN BRIEF The cost of a private health insurance varies depending on age and length of coverage. Average price of mutual insurance: approximately 90 €/month for women and 105 €/month for men. THE monthly contributions generally oscillate between 30 and…

The best insurance companies in Spain

There are several reputable companies in Spain, such as Adelas, Axa, Cigna, DKV And Sanitas. Each of these companies offers varied plans that can adapt to your needs as an expat. It is crucial to compare these different options to benefit from the most suitable coverage.

Health insurance in Belgium: understanding prices and coverage

IN BRIEF Social security system in Belgium: a protective framework THE mutual reimburse between 60% and 75% of medical costs Conventional price for a general consultation: €22.22 with 75% refunded 20 to 25% of health costs remain the responsibility of…

Benefits of private health insurance

Opt for one private health insurance has many advantages, notably the absence of advance costs during hospitalizations and faster access to quality care. Private insurance policies may also include options such as alternative medicine, dental care and other services not covered by the SNS.

Occupational medicine in Clichy: a complete guide for employers and employees

IN BRIEF Presentation of the occupational medicine has Clichy Role of occupational health services in prevention Legal obligations of employers And employees Hours and contact details Center for occupational medicine Importance of medical visit and health monitoring Assistance in the…

Getting treatment in Spain

When you have chosen your insurance, it is important to know the process for accessing care in Spain. Most insurance companies will provide you with an insurance card, which will allow you to benefit from medical services and receive treatment in establishments approved by your insurance company. For more information on care available to French speakers in Spain, see the resources provided by theFrench Embassy.

Easy mutual: everything you need to know about health insurance

IN BRIEF Supplementary health : definition and objectives Importance of mutual health insurance for refunds Criteria for choosing best mutual adapted Coverage of health costs: dental, optical, etc. Comparison of offers and prices Conditions of termination and options available Mutual…

Compare health insurance prices

To help you make an informed choice, do not hesitate to use insurance comparison platforms, offering an overview of prices and coverage. There are also affordable insurance options, such ascheapest private health insurance in Spain, which may suit those on a limited budget.

Obtain suitable coverage

To ensure your peace of mind, it is essential to obtain coverage that meets your needs. For this, it is recommended to call on experts who can guide you in your choice, such as the site Health Insurance.org, which helps you find the right coverage quickly and easily.

Choose the best health insurance in Spain can be a real challenge, especially for expats. With a multitude of options available, it is essential to understand the different plans to ensure adequate coverage. This article will guide you through the criteria to consider, the types of insurance available and help you make an informed choice.

Understanding the Spanish healthcare system

THE Spanish health system is one of the best in the world, but it can be complex. It offers its citizens and residents basic coverage via Social Security, but this is not always sufficient for expatriates. Depending on your specific needs, you may need additional insurance to absorb costs not covered by Social Security.

Types of health insurance

There are several types of health insurance in Spain, including:

- Social insurance: Managed by the government, it is accessible to residents and covers basic care.

- Private mutuals: They provide additional coverage and rapid access to quality care.

- International insurance: Perfect for expatriates, it allows access to care anywhere in the world.

The key criteria for choosing your health insurance

When you choose a health insurance, several criteria must be taken into account:

- Blanket : Check the included care such as consultations, hospitalizations and dental care.

- Care network: Make sure quality doctors and hospitals are in the insurance network.

- Cost : Compare the monthly premiums and deductibles associated with each option.

The best health insurance companies in Spain

Here are some of the most reputable companies for health insurance in Spain:

- Axa: Known for its comprehensive offerings and efficient customer service.

- Cigna: Popular for its international coverage and flexible options.

- DKV: Offers solutions adapted to expatriates, with numerous healthcare networks.

The advantages of international health insurance

Opt for one international health insurance presents considerable advantages for expatriates. Among the main advantages are:

- No advance fees: In the event of hospitalization, you do not have to pay out of pocket.

- Wide network: This allows you to consult French-speaking doctors throughout Spain.

- Flexibility: You can choose to be treated in your home country if necessary.

Conclusion and practical steps

To make the right choice of health insurance, start by defining your specific needs, comparing different options and making sure the coverage fits your lifestyle. Do not hesitate to consult online comparison tools to obtain a clear view of the offers available. To deepen your knowledge, you can consult additional resources on quality of care in Spain or explore theorganization of the Spanish health system.

Comparison of the Best Health Insurance in Spain

| Insurance | Features |

| Adelas | Offers competitive rates and good coverage for consultations. |

| Axa | Quality service with a network of French-speaking doctors. |

| Cigna | International coverage, ideal for expatriates. |

| DKV | Excellent reputation and varied health services. |

| Sanitas | Extensive hospital network and home care available. |

| International Insurance | Comprehensive protection, adapted to the specific needs of expatriates. |

| Expatriate Health Insurance | Personalized coverage based on your situation and medical needs. |

| Cheaper Private Health Insurance | Cost-effective options for basic healthcare. |

| SNS | Public coverage, valid for all residents, but limits may apply. |

Testimonials on the best health insurance in Spain

When we moved to Spain, we were very concerned about the choice of our health insurance. It was by consulting several opinions and experiences that we understood the importance of a complete guide. Thanks to this, we were able to choose a international health insurance which perfectly suited our needs.

Another expatriate, Sophie, testifies: “I hesitated for a long time between SNS and one private health insurance. Finally, I opted for mutual health insurance. This allowed me to benefit from more extensive coverage, with the advantage of not paying up front with certain doctors. »

Jean, for his part, shares his experience by mentioning: “The quality of care in Spain is undeniable, but it is crucial to choose the right insurer. Thanks to online comparisons, I found insurance that combines affordable prices and quality services. I recommend everyone to follow this guide before making a choice. »

Another comment from Elodie highlights the importance of good coverage: “After having health problems, I realized that my mutual health insurance did not cover certain treatments. This taught me to research carefully before subscribing and to favor insurance that offers greater flexibility. »

Finally, a review from student Lucas states: “Being young and broke, I thought there were no affordable options. However, I found a private health insurance reasonably priced, with all the necessary benefits for a student. »

Choose the best health insurance in Spain can seem like a daunting task, especially with the multitude of options available. Whether you are an expatriate, a resident or simply looking for additional coverage, it is crucial to understand the various types of insurance, how they work and the criteria that will help you make the choice suited to your needs. In this guide, we tell you everything you need to know to navigate the Spanish healthcare system effectively.

Understanding the Spanish healthcare system

The healthcare system in Spain is based on both a public and private model. The Servicio Nacional de Salud (SNS) provides free basic coverage to all citizens and residents, however, this coverage may not be sufficient depending on your personal health needs. It is therefore essential to consider the option ofprivate health insurance.

Types of health insurance in Spain

There are mainly three types of health insurance in Spain:

1. Public Health Insurance

This cover is provided by the SNS and is completely free for residents. It covers basic medical costs, consultations and essential treatments. However, long waits for care and a lack of choice for practitioners can encourage people to opt for a private health insurance.

2. Private Health Insurance

More and more people are choosing this option to benefit from better quality of care, faster access to care and greater availability of doctors. Premiums vary depending on the guarantees chosen, and it is wise to compare several policies.

3. International Insurance

Particularly interesting for expatriates, this coverage provides access to a network of doctors and hospitals on a global scale. This type of insurance often offers care in several languages, which can facilitate access to care for French speakers.

Health insurance selection criteria

To choose the best health insurance, it is crucial to consider several factors:

1. Care coverage

Check the services included such as consultations, hospitalizations, dental care and alternative medicine. Comprehensive coverage is often more desirable, especially for families.

2. Costs and premiums

Analyze the different insurance premiums and possible co-payments. Sometimes opting for a higher plan can be more economical in the long run if you need frequent care.

3. Access to care

Make sure that the medical network offered by the insurer suits you. The proximity of hospitals, the availability of specialists or even opening hours are elements that should not be neglected.

The best health insurance companies in Spain

Among the many insurers present on the Spanish market, certain companies stand out for the quality of their services:

- AdeS – Known for its flexibility and excellent customer service.

- Axa – Offers a wide range of covers adapted to customer needs.

- Cigna – Specializing in health insurance for expatriates, offering good value for money.

- Sanitas – Offers varied options, including plans for families.

Choose the best health insurance in Spain requires a careful and thoughtful approach. By taking the time to assess your individual needs and comparing different options, you will be able to find the insurance that suits you best, ensuring peace of mind for you and your family.

Choose the best health insurance in Spain is a crucial step for anyone planning to live or work in this country. The options available can seem confusing, whether you are an expat, resident or Spanish citizen. THE health system Spanish offers various possibilities, and understanding these solutions will allow you to make an informed decision adapted to your needs.

It is essential to evaluate the different health insurance that meet your specific situation. There Social Security Spanish offers basic coverage, but it may not be enough for everyone, especially if you’re looking for fast care or additional medical services. Private insurance, such as Adelas, Axa, Cigna, DKV, And Sanitas, offer a range of options with extensive coverage, reduced waiting times and access to care in private clinics.

It is also advisable to compare the price, THE terms and the healthcare networks available to choose the insurance that best suits your lifestyle. Additionally, don’t forget to check the quality of care provided by different insurance companies. Good coverage isn’t just about cost; it must also include access to quality health care.

Ultimately, taking the time to research and compare health insurance options in Spain can make a big difference in your experience of living and receiving medical care in this country. Proper preparation is the key to successfully navigating the Spanish healthcare system and ensuring peace of mind in the face of medical unforeseen circumstances.

FAQs on the best health insurance in Spain

Q: What is health insurance in Spain? Health insurance in Spain is a system that provides medical coverage to residents, including consultations, medications and hospitalizations.

Q: What is the difference between SNS and private health insurance? THE SNS (National Health Service) is a public system that provides free health care, while a private health insurance offers additional services such as reduced waiting times and greater freedom of choice of doctors.

Q: What types of health insurance are available for expats in Spain? Expatriates have the choice between SNS, there CFE (Caisse des Français Abroad) and international insurance adapted to their needs.

Q: What are the advantages of private health insurance? Benefits includeno advance payment in the event of hospitalization, rapid access to specialists and extensive coverage.

Q: How to choose the best health insurance? To choose well, it is important to compare the offers, to check the coverage medical, THE price and reviews from other users.

Q: Do health insurance in Spain cover dental care? It depends on the insurance policies. Some private health insurance include dental care in their coverage while others do not.

Q: What is the average cost of health insurance in Spain? The cost varies depending on the type of coverage, age and health status, but in general, a private health insurance can vary from 50 to 200 euros per month.

Q: Is it necessary to have health insurance in Spain? Although not legally required, it is recommended to have a health insurance to guarantee rapid and complete access to care.

Q: How does medical care coverage work with health insurance? Insured people must often pay the initial costs and then be reimbursed, or use a card provided by the insurance to benefit from care without advance costs.

Q: Where can I find the best health insurance deals in Spain? It is advisable to go through insurance comparators or contact specialized brokers to obtain information on the best offers on the market.