|

IN BRIEF

|

There Mutual CGAM is positioned as a key player in the field of professional health, offering a wide range of services adapted to the needs of companies and their employees. Specialized in contract management complementary health and of foresight, the CGAM undertakes to ensure optimal reimbursement of health costs not covered by theHealth insurance. Thanks to competitive offers and personalized support, it effectively protects the well-being of professionals, while providing them with valuable peace of mind. In this article, we offer you an overview of the main advantages and essential elements to know about the mutual CGAM.

There CGAM mutual health professional is an essential option for healthcare professionals looking to reduce costs related to medical expenses. By offering solid and diversified coverage, it makes it possible to reimburse part or all of the costs not covered by Health Insurance. This article presents the benefits and the disadvantages of this mutual, in order to help you make the best choice for your health and your budget.

Benefits

The CGAM presents numerous benefits which make it an attractive option for healthcare professionals.

Fast and competitive reimbursements

With the CGAM, members benefit from quick refunds and competitive. This means less waiting to get your medical bills back, a crucial factor for those who want to manage their healthcare budget effectively.

Personalized support

CGAM is not just a simple mutual fund; it also offers a personalized support for its policyholders. Whether you have questions about your contract or need assistance with procedures, the CGAM team is here to help you.

Extended coverage

This mutual guarantees extended coverage, which includes guarantees for various areas such as medical consultations, dental care, optics and even hospitalization expenses. Enough to give you peace of mind in the face of life’s ups and downs.

Mutual insurance for foreigners in France: what you need to know

IN BRIEF Health coverage for foreigners in France essential Request from form S1 for registration to the social security Foreign students : compulsory registration for health insurance European Health Insurance Card (CEAM) for holidays in France Different rights depending on…

Disadvantages

Despite its many advantages, the CGAM mutual health professional also has some disadvantages which should be considered.

Potentially high prices

THE prices of the CGAM can vary considerably depending on the guarantees chosen. For some professionals, these costs may be considered too high, especially if you have a limited budget to respect.

Complexity of contracts

Understanding the contracts of the CGAM can sometimes be difficult, due to their specificities and multiple options. This can make the comparison and choice of suitable coverage more complicated for future members.

Limitations in certain situations

Finally, there may be limitations in certain situations, particularly in the case of specific or alternative care. It is therefore imperative to find out about the guarantees before committing.

There Mutual Cgam is an essential reference for all healthcare professionals seeking to maximize their reimbursement of medical expenses. With varied services, significant benefits and a personalized approach, CGAM positions itself as a key player in the field of complementary health insurance. This article guides you through the essential elements to know about this mutual and what it can offer you.

Explore the world: these seven careers that take you to the four corners of the Earth

https://www.youtube.com/watch?v=zAEl7tdE_b8 Are you looking for a career that will allow you to explore exotic landscapes, live unique experiences and set foot on all seven continents? This article reveals seven exciting careers that open the way to global adventure. Whether you’re…

Services offered by CGAM

Cgam mutual stands out with a variety of services adapted to the specific needs of healthcare professionals. Thanks to effective management of health and welfare contracts, it ensures rigorous monitoring of reimbursements made by Health Insurance. This allows policyholders to benefit from a smooth and rapid process, essential in the health sector.

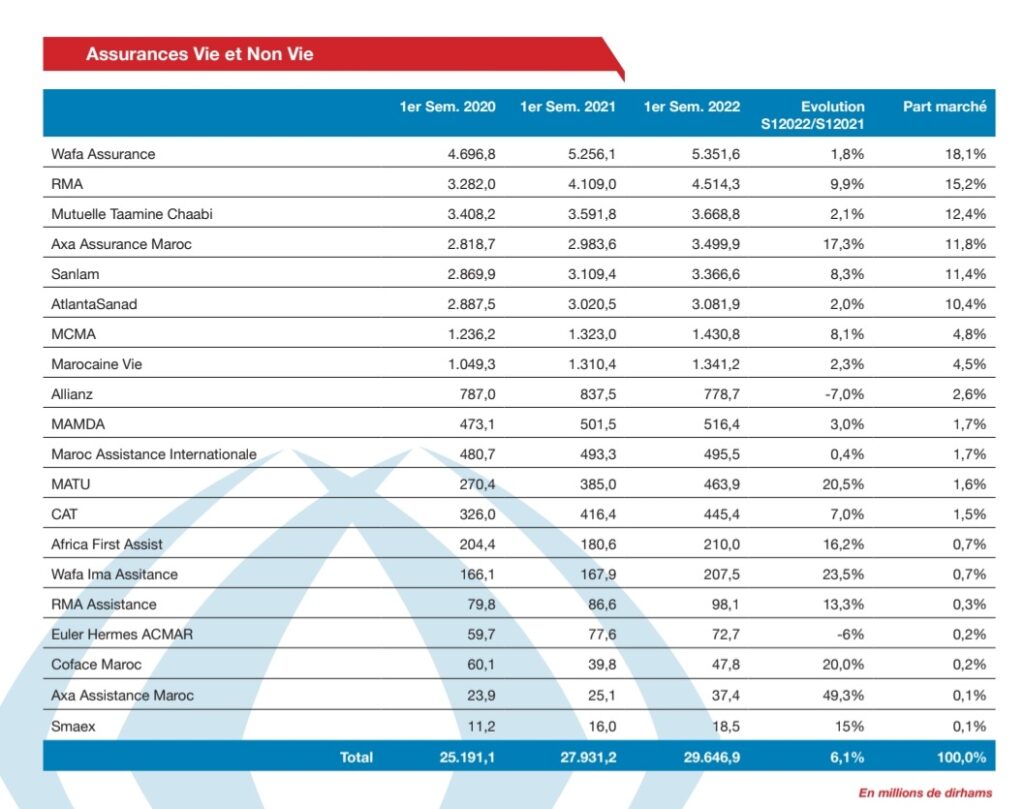

Everything you need to know about private health insurance in Morocco

IN BRIEF Social security in Morocco: coverage for public and private sector employees. AMO : partial coverage of care, from 70% to 90% depending on the sector. International health insurance recommended for expatriates, due to the high costs in the…

The advantages of the CGAM

Choose CGAM is to opt for fast and competitive reimbursements. Not only do you benefit from personalized support, but CGAM also guarantees you comprehensive coverage that meets your specific health needs. In addition, assistance in the daily management of medical procedures allows you to concentrate fully on your professional activity.

Coverage tailored to your needs

The CGAM mutual offers a wide range of adapted guarantees, whether for medical consultations, dental care or optics. Whatever your field of activity in healthcare, CGAM is committed to providing you with the best coverage solutions for your healthcare costs. This level of customization ensures that each professional benefits from optimal protection.

French mutual insurance abroad: everything you need to know

IN BRIEF Health insurance abroad: no coverage of care by Social Security. Obtain the European Health Insurance Card (EHIC) for travel in Europe. Expatriate workers are often subject to the local social protection system. Mutual insurance companies do not cover…

The CGAM membership process

Register for the Mutual CGAM is a quick and easy process. Simply contact the CGAM team via their website to obtain a personalized quote. Once your contract is established, you can easily access a personal online space to manage your reimbursements and information. This makes CGAM a convenient option for busy professionals.

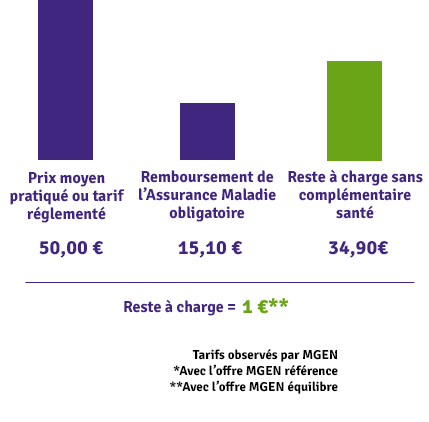

The cost of private health insurance: what you need to know

IN BRIEF The cost of a private health insurance varies depending on age and length of coverage. Average price of mutual insurance: approximately 90 €/month for women and 105 €/month for men. THE monthly contributions generally oscillate between 30 and…

Practical information and contact

For any additional questions or to follow up on your file, CGAM provides you with responsive customer service. You can contact them directly by phone, or visit their site for detailed information, including prices, user reviews, and guarantees offered. Transparency is at the heart of their approach, guaranteeing you a service that meets your expectations.

Whether you are an independent healthcare professional or an employer wishing to take out mutual insurance for your employees, the Mutual Cgam presents itself as an essential option on the market. To explore all the ranges of services offered, do not hesitate to consult the resources available on e-mutuel.

There Mutual CGAM is a key player in the field of health and professional welfare. It offers solutions adapted to the needs of companies and self-employed people, guaranteeing optimal reimbursement of health costs. In this guide, we will explore the services, benefits, and features that make CGAM a preferred choice for professionals.

Health insurance in Belgium: understanding prices and coverage

IN BRIEF Social security system in Belgium: a protective framework THE mutual reimburse between 60% and 75% of medical costs Conventional price for a general consultation: €22.22 with 75% refunded 20 to 25% of health costs remain the responsibility of…

Services offered by CGAM

There CGAM Mutual specializes in the management of health and welfare contracts. It ensures regular monitoring of reimbursements in connection with theHealth insurance, thus allowing policyholders to benefit from rapid and efficient reimbursement. One of its main assets is third-party payment, which limits advance payments during medical consultations and treatment.

Occupational medicine in Clichy: a complete guide for employers and employees

IN BRIEF Presentation of the occupational medicine has Clichy Role of occupational health services in prevention Legal obligations of employers And employees Hours and contact details Center for occupational medicine Importance of medical visit and health monitoring Assistance in the…

The advantages of the CGAM

Choosing CGAM means benefiting from numerous benefits. First of all, its effectiveness in reimbursements is a crucial point. Members thus benefit from quick refunds and competitive on various health expenses (hospitalization, consultations, dental care, optics, etc.). In addition, CGAM provides a personalized support for each policyholder, guaranteeing a response adapted to their specific needs.

Easy mutual: everything you need to know about health insurance

IN BRIEF Supplementary health : definition and objectives Importance of mutual health insurance for refunds Criteria for choosing best mutual adapted Coverage of health costs: dental, optical, etc. Comparison of offers and prices Conditions of termination and options available Mutual…

The guarantees offered

CGAM offers a wide range of guarantees which adapt to different professional profiles. The mutual insurance covers various essential aspects such as medical consultations, dental care, optics and even hospitalization. The prices are also designed to be accessible, with an average cost between €7 and €150 per month per employee, allowing companies to make a commitment without increasing their budget.

Opinions on the CGAM

The feedback on the Mutual CGAM are generally positive. Policyholders appreciate the speed of reimbursement processing as well as the quality of customer service. Many people emphasize the importance of such health support, particularly for professionals who need protection that meets their demands.

How to integrate CGAM into your business?

For employers, setting up CGAM as company mutual insurance is an essential and often indispensable step. Indeed, the law requires companies to offer additional health coverage to their employees. For this, it is recommended to request a estimate personalized in order to evaluate the options best suited to your structure. Discover the difference between mutual and complementary health insurance.

Contact and additional information

To obtain more information about the Mutual CGAM, it is possible to visit their websites or contact their customer service. Numerous online tools and insured spaces are also available to facilitate access to information and administrative procedures. For coverage tailored to your needs, consider get a quote today.

| Criteria | Details |

| Refund | Fast and competitive reimbursements for healthcare costs |

| Type of contract | Health insurance and welfare adapted to professionals |

| Accompaniement | Personalized and responsive customer service |

| Prices | Variable costs from €7 to €150 per month depending on the options chosen |

| Areas covered | Medical consultations, dental care, optics, hospitalization |

| Bonds | Compliance with coverage standards for businesses |

| Online access | User interface to track reimbursements and contacts |

| Permanence | Available since 1972, proven experience in health management |

Testimonials on CGAM Mutuelle Professionnelle de Santé: What you need to know

The mutual CGAM stands out for its commitment to its members. Many healthcare professionals appreciate the quality of refunds offered. Indeed, several testimonies highlight the speed with which health costs are covered. “I was surprised by the speed of my reimbursements, it’s a real relief in my daily practice,” confides a general practitioner.

In addition to speed, CGAM is also noted for the diversity of its guarantees. Healthcare professionals find solutions tailored to their specific needs, whether dental, optical or hospitalization care. “The choice of guarantees is impressive. I was able to select those which best correspond to my situation”, testifies a nurse.

Another aspect particularly appreciated by members is thepersonalized support that the CGAM offers. A pharmacist shares his experience: “I was able to discuss my specific needs with an advisor. This really made the difference and allowed me to choose a perfectly suited contract.”

There foresight is also a strong point of this mutual. Professionals note the importance of feeling protected in the event of the unexpected. “Knowing that I’m covered for difficult situations gives me peace of mind,” says one physiotherapist.

Finally, the prices offered by the CGAM are considered competitive. In return, users consider themselves satisfied with the quality-price ratio. “For the services offered, I find that the prices are justified. It is a relevant investment for my health,” concludes a dentist.

Introduction to CGAM Mutuelle

There CGAM Mutual stands out as a major player in the field of complementary health and insurance, providing solutions adapted to the needs of healthcare professionals. With its varied services, attractive reimbursements and personalized support, this mutual insurance is an option to consider to effectively protect yourself against health-related financial hazards. This article offers you an overview of the benefits, services And prices offered by CGAM Mutuelle.

Services offered by CGAM

CGAM Mutuelle offers a wide range of services intended to ensure optimal coverage of your health expenses. It specializes in the management of health and welfare contracts, which guarantees rigorous monitoring of refunds carried out by Health Insurance.

With CGAM, members benefit from easier access to their reimbursements, often processed within very short deadlines. In addition, the mutual offers a personalized support, allowing each insured person to find solutions based on their particular situation.

The advantages of choosing CGAM

Opting for CGAM Mutuelle has several essential advantages. First of all, the competitive rates offered by this mutual insurance company adapt to different budgets while offering numerous guarantees. This allows healthcare professionals to choose coverage that meets their specific needs.

Then, the CGAM ensures that it offers extended warranties, covering various items, including medical consultations, dental care, optical reimbursements, and hospitalization costs. This diversity allows each member to cover unforeseen costs related to their health.

Fast and quality reimbursements

With CGAM, you can expect quick refunds and quality. Indeed, the mutual is committed to monitoring Health Insurance reimbursements efficiently, thus reducing the waiting time for its policyholders. This represents a real plus for healthcare professionals, often involved in situations where time is of the essence.

The clarity and transparency of reimbursement conditions are also a major asset. You will have access to a table of guarantees, detailing precisely what is covered and in what amount, thus avoiding preconceived ideas or surprises when billing.

CGAM and its offers for businesses

The CGAM also offers specific offers for companies, allowing employers to take out compulsory mutual health insurance for their employees. Indeed, organizations are required, by law, to offer health coverage to their employees, and the CGAM stands out as a wise choice thanks to affordable rates and attractive guarantees.

By choosing CGAM for your business, you offer your employees not only quality health coverage, but also real support in the event of illness or accident, thus promoting their well-being and productivity.

Contact and quote

To find out more about the different options, simply contact CGAM Mutuelle or request a estimate. The dedicated team is available to answer all your questions and help you choose the best option for your situation. Whether you are a healthcare professional or an employer, CGAM has a solution adapted to your needs.

What you need to know about the CGAM Mutuelle Professionnelle de Santé

CGAM Mutuelle is a key player in the field of professional health, offering a range of services andbenefits exceptional for professionals in the sector. Getting involved with this mutual means choosing health coverage adapted to your specific needs.

One of the great assets of the CGAM is undoubtedly its ability to repay quickly health expenditure. In fact, it ensures precise monitoring of reimbursements linked toHealth Insurance, thus guaranteeing smooth and efficient management of healthcare costs. Members can thus benefit from partial or total reimbursement of their expenses, which allows them to concentrate on their professional activity while having peace of mind.

THE guarantees offered by CGAM stand out for their diversity, making their offers accessible and customizable according to everyone’s needs. Whether for dental care, optics or medical consultations, each member can find a solution that suits them. In addition, the CGAM offers a personalized support, allowing you to better navigate your mutual insurance contract.

Finally, it is essential to note that the CGAM also takes into account aspects of foresight, guaranteeing suitable coverage when needed. This holistic approach makes CGAM a preferred choice among professional mutual insurance companies.

By opting for the CGAM, healthcare professionals ensure not only coverage that complies with regulatory requirements, but also reliable support for their daily health and well-being. This mutual insurance company thus positions itself as a partner of choice for occupational health.

FAQ about the Cgam Mutuelle Professionnelle de Santé

What is the mutual Cgam? Cgam mutual is a mutual company specializing in the management of health and welfare contracts, offering solutions adapted to professionals.

What are the main advantages of mutual Cgam? Among the many benefits, we find refunds fast And competitive, as well as a personalized support for each insured person.

Who can benefit from the mutual Cgam? The mutual Cgam is mainly aimed at healthcare professionals, but it is also open to various sectors of activity wishing to ensure optimal health coverage.

What types of reimbursements does Cgam Mutuel offer? The mutual offers reimbursements for a wide range of care, including medical consultations, THE dental care, L’optical, and thehospitalization.

How does the coverage work? The Cgam mutual coverage completes the Health Insurance reimbursements, thus making it possible to significantly reduce uncovered health costs.

Does Cgam offer assistance if needed? Yes, Cgam Mutuel offers a personalized support, allowing policyholders to obtain advice and answers to their questions.

How to subscribe to the Cgam mutual? To become a member of the Cgam Mutuel, simply fill out an application form and provide the necessary documents to activate your coverage.

What are the points to check before choosing Cgam mutual? It is important to examine the guarantees offered, the cost of contributions, as well as reimbursement terms to ensure they meet your specific needs.

What are the opinions of policyholders on the mutual Cgam? Policyholders often appreciate the reactivity and the support offered by the mutual, as well as the competitive rates in comparison with other offers on the market.

How to contact Cgam mutual customer service? You can contact Cgam customer service by phone or via their assured space online, where you will find all the necessary information.