|

IN BRIEF

|

In a world where travel abroad is increasing, choosing the mutual insurance for foreigners adapted to your needs becomes a priority. Whether you are an expatriate or simply passing through, reliable health coverage is essential to protect you against the unexpected. This comprehensive guide offers you practical advice and criteria to consider when selecting the best international health insurance. From comparing guarantees to the particularities of care in your destination country, we will support you step by step in your approach.

When considering living or staying abroad, choosing a mutual insurance for foreigners becomes essential. It is essential to fully understand the different options available to you in order to guarantee health coverage adapted to your needs. This article offers you a detailed comparison of benefits and disadvantages linked to mutual insurance for expatriates, to help you make the best choice.

Benefits

Opting for mutual insurance for foreigners presents many benefits. First of all, the possibility of benefiting from coverage adapted to your geographical location is crucial. Indeed, health care can vary considerably from one country to another, and a good mutual insurance company will be able to adjust to these differences.

Then, mutual insurance companies for expatriates often offer high-end options, including access to specialized care networks. This includes services such as single rooms during hospitalizations or consultations with expert doctors recognized in your host country.

In addition, these mutual insurance companies generally offer emergency assistance, which can be invaluable when you’re away from home. This assistance includes, among other things, covering your medical expenses, medical evacuation if necessary and even repatriation to your country of origin.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages when choosing mutual insurance for foreigners. One of the main points to consider is the cost international health insurance. Depending on the guarantees chosen, premiums can quickly become high, especially if you opt for more comprehensive coverage.

Another disadvantage lies in the complexity of insurance contracts themselves. The clauses can be difficult to understand, and it is essential to read the terms and conditions carefully to avoid unpleasant surprises when reporting a claim.

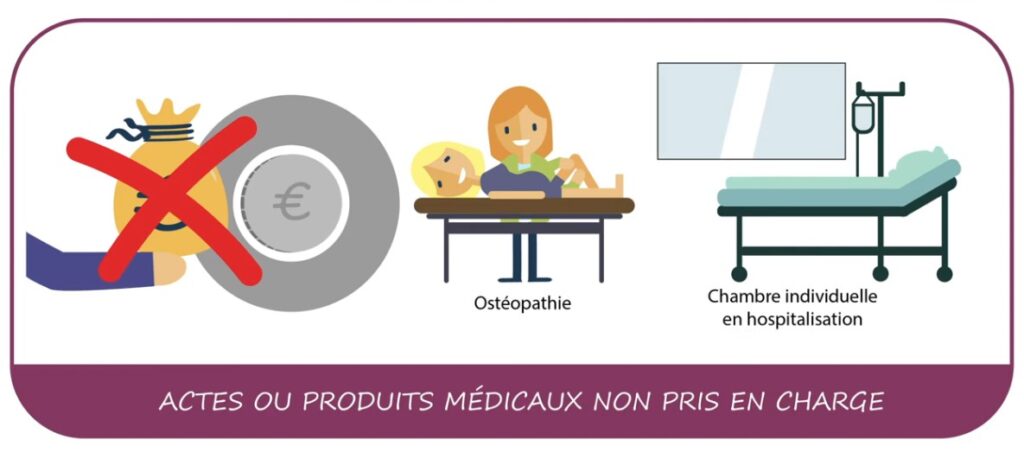

Finally, some mutual insurance companies may have geographic restrictions or strict admission requirements. It is therefore crucial to check whether your future country of residence is covered by the envisaged mutual insurance company, as well as the types of care that could be excluded from coverage.

For more information on mutual insurance companies suitable for expatriates, do not hesitate to consult resources such as this guide, or to use online comparators that will allow you to find the best option according to your needs.

When considering living abroad, it is essential to choose a mutual insurance adapted to your health needs. This comprehensive guide helps you make an informed decision regarding health coverage for expatriates, taking into account the specificities of care abroad. Whether it is comfort, prices or guarantees, we cover all the crucial aspects to help you choose your mutual insurance.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understanding health coverage needs abroad

Before choosing your mutual insurance for foreigners, it is important to clearly identify your needs. Assess whether you plan to use medical care frequently, if you have specific needs or if you travel to countries where care can be expensive. Anticipating these needs will allow you to select coverage that really corresponds to your situation.

Premium options and comfort

Premium options offer extended coverage, including services such as private hospital rooms or access to specific healthcare networks for expatriates. These services can guarantee not only optimal quality of care, but also comfort during your stay abroad. Comparison of mutual insurance offers

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

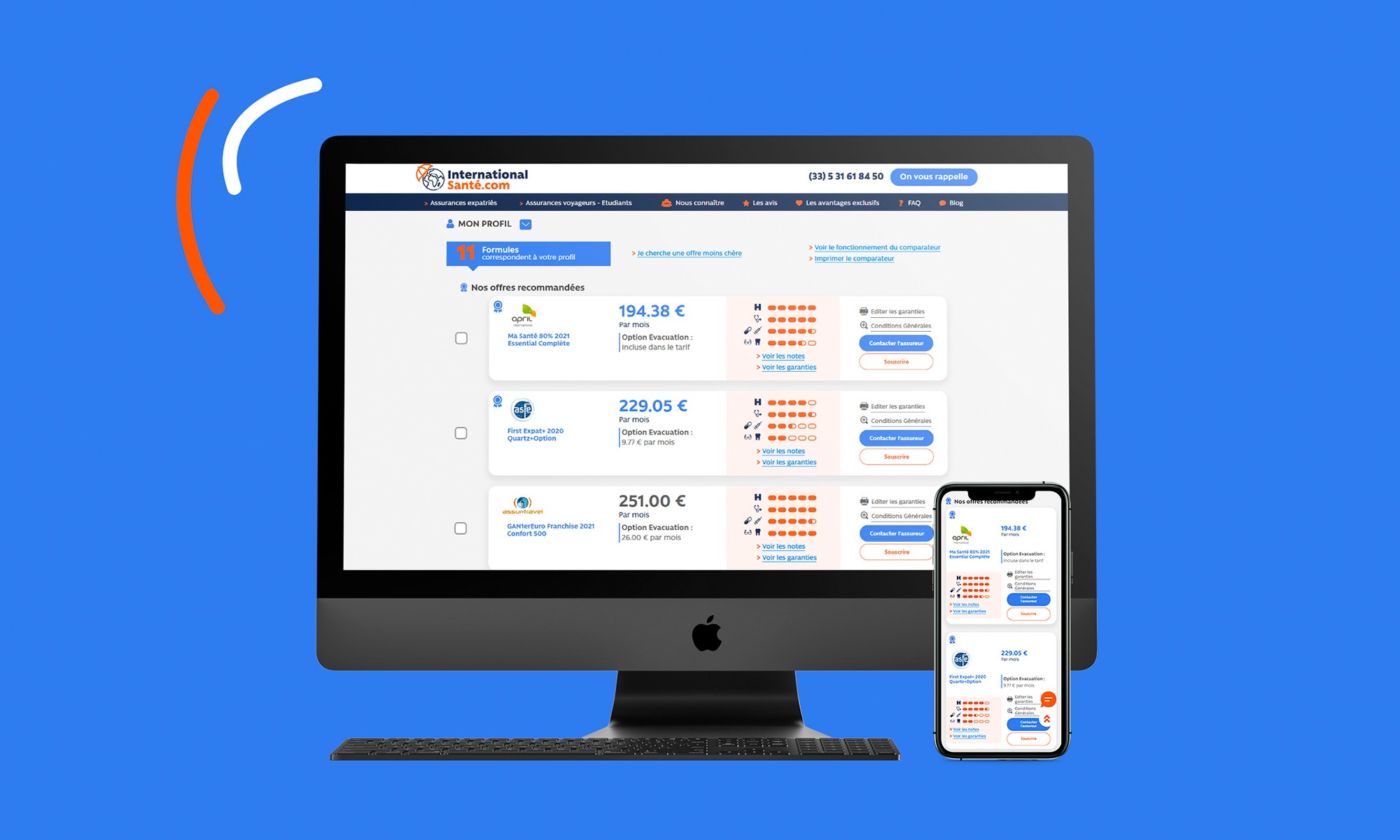

It is crucial to make a

comparison of the offers available. Specialized agencies often offer online tools to make these comparisons. Take the time to check the reimbursements on the care that concerns you, in order to be aware of the limits and conditions of compensation. Choosing the right coverage

To choose your

international medical coverage, start by requesting several quotes. Compare not only the prices, but also the guaranteeswhich are proposed. Some mutual insurance companies cover more extensive care than others. Be sure to read the fine print regarding exclusions and waiting periods. Anticipate health risks Before your departure, it is important to anticipate the

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

health risks

linked to the country of destination. This includes knowledge of necessary vaccines, local diseases and health infrastructure. These factors directly influence the type of mutual insurance you should choose. Where to find reliable information To help you in your choice, several sites such as

Reassure me

Or Alptis offer detailed guides on mutual insurance for expatriates. These resources will provide you with clear information about warranties, prices and the possible consequences of your choice. What about mutual insurance for foreigners in France? If you are a foreigner living in France, it is essential to inform yourself about the

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

mutual insurance available

. Some French mutual insurance companies offer interesting options, adaptable to the needs of expatriates. Platforms like International Health Mutualcan help you navigate the different options available. Conclusion on choosing your mutual insurance company Remember, choosing your

international mutual health insurance

is a crucial step to guarantee your health security during your stay abroad. Take the time to carefully assess your needs, compare offers, and don’t hesitate to ask questions to ensure that you are making the best possible choice for your situation. discover our complete guide to mutual insurance for foreigners in France. Find out about the best health coverage options, the steps to follow, and how to benefit from medical assistance adapted to your situation. When you expatriate, choose a

adapted to your needs is essential to benefit from optimal health coverage. This guide offers practical advice and tips for making the best choice from the many options available. Coverage options available When you choose your

mutual

, it is crucial to understand the different coverage options. You can opt for high-end options, offering access to comfort care such as a single room, or opt for more basic options, depending on your budget and your needs. Compare offersIt is recommended to take the time to compare the different

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

international health insurance

. An online comparator can help you evaluate the guarantees, reimbursements and costs associated with each mutual insurance company. Be sure to read reviews and feedback from other expats to make an informed decision. Evaluate your specific needsBefore subscribing to a

mutual

, take stock of your personal medical needs. Consider your care habits, any necessary treatments and health risks in the host country. This will allow you to target the guarantees that will suit you best. Exclusions to knowEach

mutual contract

has specific exclusions. Be sure to read the terms and conditions carefully to understand the limits of your coverage, particularly with regard to pre-existing care and specific accidents. Don’t leave any gray areas that could cost you dearly later. Coverage of care abroad Make sure that the

mutual

that you choose covers care abroad. Some guarantees are only valid in France, while others cover treatments carried out in different countries. This is an essential aspect to check before your departure. Take into account repayment deadlines Reimbursement times can vary from one

mutual

to another. Find out about these times to know when you can expect to be reimbursed. This will save you inconvenience and financial pressure if you have to pay significant medical expenses in advance. Choose insurance that is adapted to your situation If you are a French expatriate, offers such as the

CFE

can be particularly interesting. Other plans specifically target foreigners living in France or French people living abroad. Do not hesitate to explore these options according to your personal situation. To go further in your research, you can consult the resources on international health insurance

or discover the details on Easy mutuelle . Also consider visiting ACSfor recommendations on expatriate insurance and advice on choosing the right coverage. Finally, for any questions about the AXA mutual

or how to contact them easily, go to this link . Mutual insurance for foreigners: selection criteria CriteriaDescription

Type of coverage

| Basic insurance or premium options for increased comfort. | Reimbursement |

| Compare the reimbursement rate for each type of care. | Access to healthcare networks |

| Check the partner providers in your destination country. | Assistance abroad |

| Medical assistance service available 24/7 in your language. | Warranty exclusions |

| Identify the care or situations not covered by the mutual insurance. | Pricing |

| Analyze the monthly cost in relation to your specific needs. | Subscription conditions |

| Find out about the requirements, such as age or state of health. | Waiting periods |

| Find out about the waiting time before coverage applies. | discover our complete guide on mutual insurance for foreigners. get practical advice to choose the best health coverage adapted to your needs during your stay abroad. |

| View this post on Instagram | Testimonials on Mutual Insurance for Foreigners: Complete Guide to Choosing Well |

was one of the priorities on my list. I quickly understood that the right choice would determine my peace of mind on site. By comparing various options, I was able to select coverage tailored to my specific needs, particularly regarding

medical care abroad . Every detail counts, and the possibility of benefiting from a single room in a healthcare establishment played a crucial role in my decision. Another expatriate mentioned the importance of turning to a international health insurance comparator. This allowed him to clearly visualize the different offers and to concentrate on those which offered

appropriate guarantees to its status. Thanks to this tool, she was able to assess healthcare reimbursements based on the countries visited, thus guaranteeing appropriate protection during her travels.A young couple shares their experience, saying that it is essential to anticipate the health risks of each destination. They advise carefully analyzing what the policy actually covers. mutual health insurance selected, because some high-end options offer exclusive access to expat care networks, making their stay abroad much more stress-free.

Finally, a professional mentions that relying solely on price evaluation is not enough. He recommends looking at the services included , such as remote consultations and rapid reimbursements. These elements can significantly influence the quality of care you will receive as an expat and make all the difference when it comes to dealing with an unexpected illness or accident.

Choose one mutual insurance for foreignersis a crucial step in ensuring your peace of mind during extended stays abroad. This article presents the essential elements to consider in order to select the coverage that best meets your needs. Whether you are considering a move, a study trip or a business trip, the criteria for choosing a suitable mutual insurance should be explored carefully.

Understand your health coverage needs Before you start looking for a expatriate health insurance

, it is important to assess your specific care needs. Take into account your general health, any necessary treatments and the frequency of your medical visits. If you have special needs, such as dental or optical care, make sure that the mutual covers these aspects satisfactorily.

Compare available offers An in-depth study of the different offers is essential to choose thebest international health insurance

. In order to make a judicious comparison, list the insurance companies and their offers. It is advisable to consult

online comparators to have an overview of the prices, the guarantees offered and the options available. Don’t forget to check what is included in each plan and what deductible you might be subject to.The essential guarantees When making your choice, pay particular attention to the essential guarantees that a mutual insurance abroad

must cover. Among these, we find hospitalization costs, consultations with general and specialist medicine, as well as prescribed medications. Also check if the cover includes access to an expat care network or the possibility of home care, which may be particularly important depending on where you live.

The importance of health networks One of the criteria not to be neglected is access to a care network

quality. Some mutual insurance companies offer exclusive networks where health costs are negotiated in advance. This can be financially beneficial, but make sure these networks are available in the country and regions where you are staying. This ensures that you can receive quality care at a reduced cost.

Anticipate local particularities When you choose your international mutual

, it is crucial to inform yourself about the particularities of the health system of the country in which you find yourself. In some countries, for example, the cost of care can be exorbitant, making comprehensive coverage essential. Also find out about any support conditions. This will allow you to prepare for any unforeseen health situations.

Check reviews and recommendations Finally, take the time to read the opinions of other expatriates on the different mutual insurance companies. User testimonials can shed light on the quality of services provided, the speed of reimbursements and the claims management process. This can give you a clearer vision on choosing yourmutual insurance for expatriates

, helping you avoid unpleasant surprises.

discover our complete guide to mutual insurance for foreigners in France. Find out about insurance options, administrative procedures and practical advice to choose the best health coverage suited to your needs. When we areexpatriate

adapted mutual is essential to benefit from ahealth coverage optimal. It is essential to evaluate its specific needs , particularly depending on medical care common in the country of residence. Good preparation will allow you to navigate the world ofinternational health insurance . Before making your choice, do not hesitate to compare the different mutual insurance offers. Each company offers

guarantees various, ranging fromsingle room to access to specialized care networks for expatriates. Take the time to study the premium options And comfort that can really improve your medical experience abroad. On the other hand, it is also crucial to anticipate health risks . These vary from country to country and should be taken into consideration when making your selection. Furthermore, it is recommended to check how your

mutual works abroad, particularly with regard torepayment period and the care procedures . Finally, to make the most informed choice, it may be wise to use a health insurance comparator. This can provide you with

personalized quotes and help you weigh theadvantages and disadvantages of each formula. By taking these precautions, you will be able to find the best mutual for expatriates, adapted to your situation and where you live. FAQ about Mutual Insurance for Foreigners What is the importance of having mutual insurance for foreigners? Have a

mutual insurance for foreigners

is essential to benefit from appropriate medical coverage during your stay abroad. This protects you from high medical costs and gives you peace of mind. How to choose the best mutual insurance for expatriates? To choose the best mutual insurance company, it is recommended to compare the guarantees

, THE price and therepayment period of the different companies. Also assess your specific care needs. What guarantees should you look for in an international mutual insurance company? You should look for warranties that include specialized medicine

, hospitalization, and medical repatriation . Depending on your situation, thedental care reimbursement and optical can also be important.Does my French mutual insurance work abroad? It all depends on your insurance contract. It is important to check if your French mutual insurance covers care abroad, because not all of them do.

How do I assess my needs in terms of international health insurance? Assess your needs based on your destination, the length of your stay and your state of health. Also prepare a list of the care you may need during your time abroad. Are the rates of mutual insurance for foreigners high?Rates vary depending on the insurance and the

guarantees offered. It is advisable to compare several offers to find the one that best suits your budget.

What documents are required to take out mutual insurance for expatriates? Generally, you will need an identity document, proof of address, and often information about your state of health. Check with the insurance company to find out the specific documents required. Can you take out mutual insurance for foreigners online? Yes, many companies offer the option to purchase

expatriate health insurance online, which makes the process easier and allows you to easily compare available options.

What are the common exclusions in expatriate health insurance policies? Exclusions may include cosmetic treatments, undisclosed pre-existing conditions, and certain non-urgent treatments. It is crucial to read the terms and conditions carefully. How do I cancel my expatriate health insurance if necessary? To cancel your health insurance, check the terms and conditions of your policy. Generally, notice is required, and the request must be made in writing to your insurer.