|

IN BRIEF

|

When it comes to choosing a mutual health insurance, the AXA plan stands out for its flexibility and customizable options. Whether you are looking for coverage tailored to your specific needs or simply want to protect your family with comprehensive guarantees, AXA offers a range of solutions. In this article, we will explore everything you need to know about AXA plans, including benefit tables, reimbursement examples, and key benefits that make this mutual insurance a wise choice for your health.

The Axa mutual insurance plan stands out for its flexibility and customizable options that allow each insured to find coverage adapted to their specific health needs. In this article, we will explore the advantages and disadvantages of this complementary health offer, in order to help you make an informed choice.

Advantages

Personalization of coverage

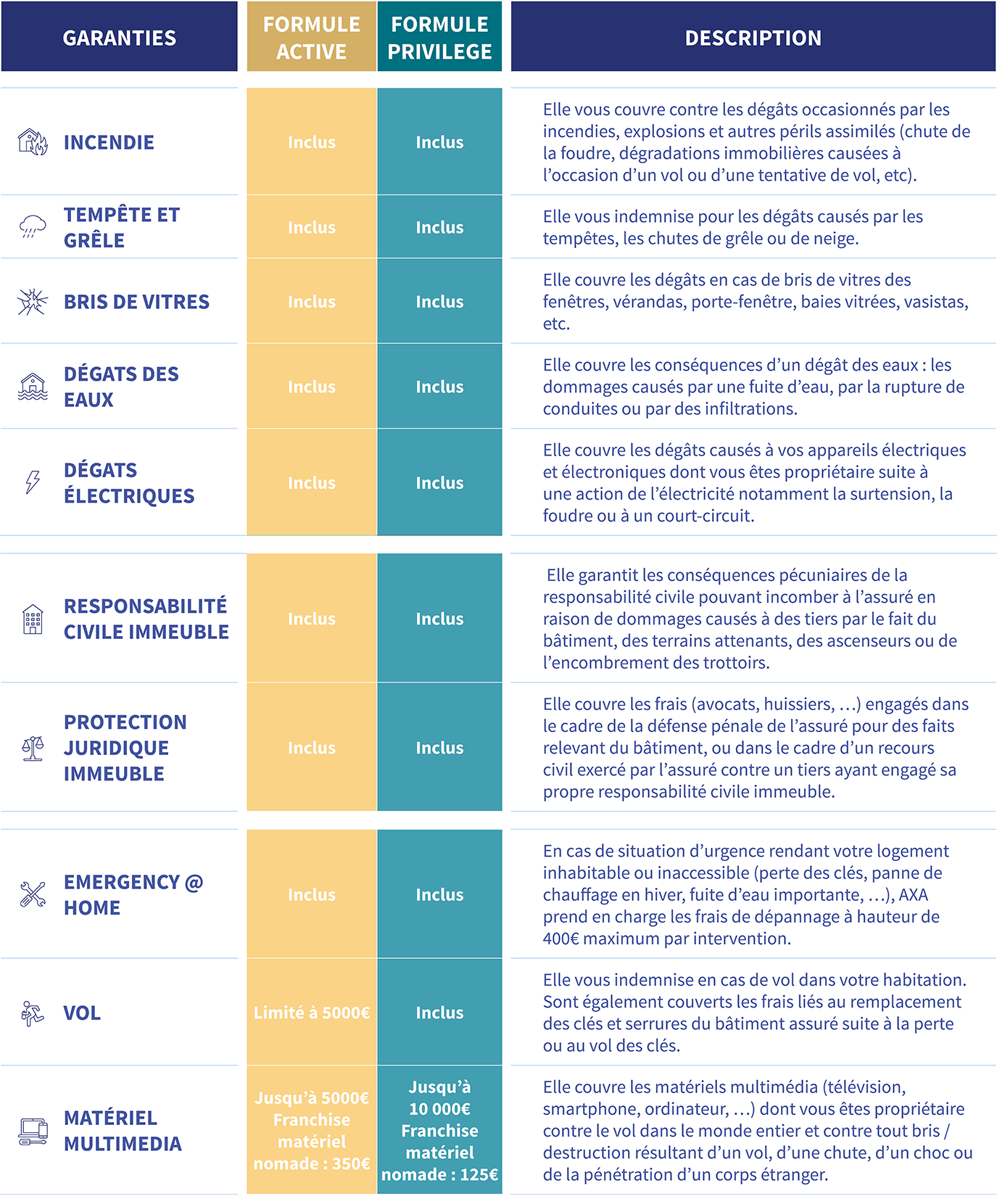

With 9 plans available, AXA allows insured persons to customize their contract according to their expectations. This modularity is a major asset, because it allows the coverage to be adapted according to the specificities of each family or individual. By choosing from the different options offered, you can create tailor-made protection.

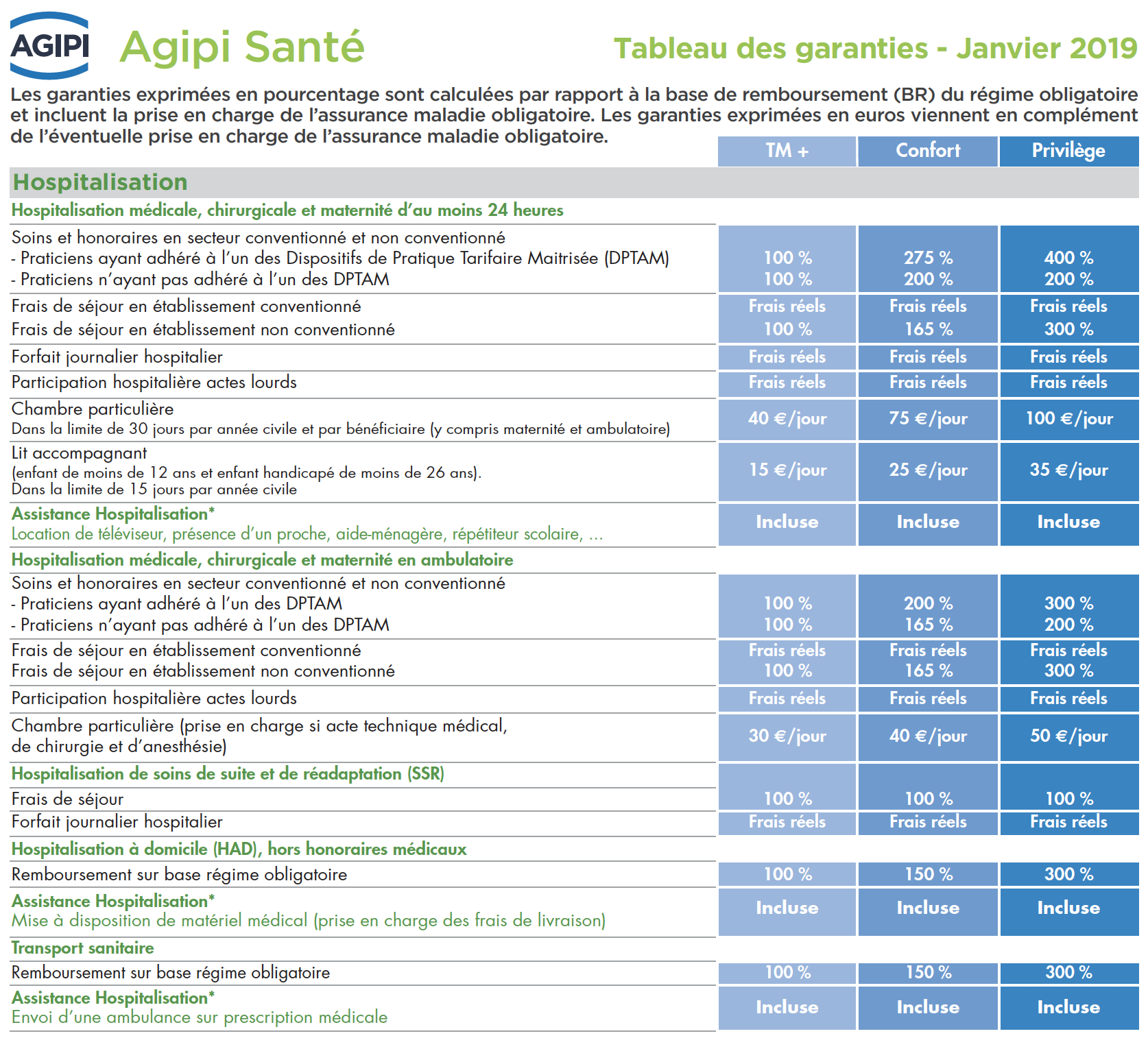

Attractive reimbursements

The AXA mutual insurance company offers reimbursement tables very competitive. For example, for routine care and medical consultations, support can go up to 400% doctors’ fees. This ensures a significant reimbursement, significantly reducing the remainder payable.

Financial accessibility

AXA contracts are accessible with attractive prices, starting from €7.39 per month. This competitive rate, combined with solid coverage, is ideal for budget-conscious families without sacrificing good quality care.

How to contact AXA customer service for your health insurance

IN BRIEF Phone number for customer service: 09 70 80 81 82 Accessible from Monday to Friday, of 9 a.m. to 6 p.m. For specific requests, use the email address: service.relationsclienteleweb@axa.fr Support available 24 hours a day And 7 days…

Disadvantages

Fluctuating pricing

Despite very attractive options, it is essential to understand that mutual insurance rates will change over time, which can lead to significant increases. This can impact your budget in the long term and requires regular monitoring of changes in prices.

Complexity of options

The wealth of choices can also be destabilizing. With so many plans and options, some policyholders may have difficulty navigating all the information available. This can complicate the underwriting decision for those who want health insurance that is simple and quick to understand.

Reimbursement Limitations

Although the reimbursement rates are attractive, it is important to pay attention to the specific limitations of each formula. Some healthcare expenses may not be fully covered, which can create unpleasant surprises when reimbursed, particularly for expensive care.

To further explore the details and benefit tables, you can consult the resources available on the AXA website or ask a health insurance advisor questions.

There AXA mutual insurance stands out for its formulas adapted to everyone’s needs, offering complete health coverage thanks to its “Ma Santé” range. Find out in this article everything you need to know about the characteristics of the plans, the guarantees offered, as well as the importance of a good understanding of your health coverage.

Understanding 1st euro insurance: a complete guide for policyholders

IN BRIEF Definition : What isfirst-euro health insurance ? Target : Intended for French expatriates. Advantages : Coverage from the first euro. Pricing : Advantageous and flexible rates. Coverage : Exemption from paying the costs in advance. Comparison: Differences between…

The characteristics of AXA formulas

AXA offers nine formulas customizable mutual health insurance. Each plan is designed to adapt to your specific needs, whether you are an individual or a business. The options included allow you to build your contract à la carte, thus guaranteeing a better fit with your situation and your expectations.

Reimbursement Examples

To better understand the characteristics of your contract, AXA provides you with guarantee tables and reimbursement examples. These documents give you complete visibility of covered costs, ranging from routine care to consultations with doctors. Do not hesitate to download these tables directly from the AXA website to consult them.

Travel insurance without age limit: what you need to know

IN BRIEF Travel insurance for the elderly people without age limit. Options from 23€ with extended guarantees. Reimbursement ceiling of up to 500,000€. Check if coverage starts from first euro. Insurance cancelation often available. Duration of stay generally limited to…

Understanding your health coverage

It is essential to master the terms related to your health coverage to avoid unpleasant surprises. For example, the copayment corresponds to the share of health costs which remains your responsibility after reimbursement by the Social Security. Knowing this amount will allow you to better plan your healthcare expenses.

Health reimbursements in detail

There Basis of reimbursement of Social Security for a consultation with a general practitioner is, for example, €25. With 70% of this base covered, you will quickly understand what expenses will be reimbursed by your AXA mutual insurance company and what amounts you will have to cover.

Travel insurance without age limit: what you need to know

IN BRIEF Many insurers impose a age limit for travel insurance. Some insurers, such as Groupama, offer contracts with no age limit. THE essential guarantees include coverage for emergency medical expenses. Pay attention to age restrictions, which may vary depending…

Adapt your mutual insurance to your needs

One of the great advantages of AXA mutual insurance is its flexibility. Between the different formulas and the options available, you have the possibility of adjusting your coverage according to changes in your personal or family situation. You can easily switch from one plan to another or add additional guarantees according to your needs.

Prices and quotes

To guarantee optimal value for money, AXA offers free online quotes. This allows you to compare the different options and choose the one that best meets your expectations while respecting your budget. Prices start from €7.39 per month, making access to good health coverage feasible for every household.

Everything you need to know about medical insurance in France

IN BRIEF Health Insurance : structure and operation in France Universal health protection : rights for all, even without activity Refund : rate varying from 15% to 100% depending on the treatment Supplementary health : essential to cover the remaining…

Additional Resources

For more information and practical guides on your health coverage, you can consult online resources such as AXA, which offers clear explanations on reimbursements, or other sites dedicated to health insurance and mutual insurance companies. This will help you make the best choice for your health and that of your family.

In a world where health is essential, choosing the right health insurance is essential. There Axa mutual formula stands out for its flexibility and multiple options, allowing you to adapt your health coverage to your specific needs. Whether you are looking for optimal reimbursements or simple protection for routine care, let’s find out together everything there is to know about this formula.

Mutual hospitalization only: what axa offers

IN BRIEF Blanket hospitalization costs including the hospital package at €20/day. Reimbursement of 80% to 100% costs related to surgical procedures and drug treatments. Support of the fee overruns during interventions. Options private room in hospital, with reimbursement of up…

Personalized guarantees

With Axa, you can personalize your contract by choosing from different “My Health” packages. These options allow you to benefit from a adapted reimbursement to your care habits. The benefit tables, available online, help you clearly visualize what is included in each plan. Do not hesitate to consult them and compare to make the best choice for you and your family.

First euro insurance: a complete guide to understand

IN BRIEF International health coverage from the first euro spent. Reimbursement of medical expenses at actual height. Exemption from advancing hospitalization costs. Prices advantageous and adapted for expatriates. Understanding of health insurance At 1st euro for the informed choice of…

Understanding Refunds

It is fundamental to understand how the refunds during a medical consultation or treatment. For example, for a consultation with a general practitioner, the copayment generally amounts to €6.60 plus a fixed contribution of €1. Depending on your Axa plan, the amount reimbursed may vary, making it essential to consult the guarantee tables to estimate your actual costs.

Everything you need to know about the AXA health contract: guarantees and options available

IN BRIEF Various formulas: 7 coverage options tailored to your needs. Basic warranty: Support for routine care, hospitalizations, dental And visuals. Reinforced options: 3 optional modules to improve your coverage. Refunds: Variety of examples of refunds thanks to the reform…

Access to routine care and hospitalization

THE current health expenses, such as consultations, medications and routine care, are covered by Axa. In addition, in the event of hospitalization, Axa guarantees coverage of stay costs, regardless of the option chosen. Consider checking specific details to maximize your coverage based on your personal situation.

An à la carte contract

Axa offers a health insurance contract entirely customizable. You have the possibility to subscribe to optional modules according to your specific needs, whether for optical, dental or alternative medicine costs. This allows you to create a contract that is perfectly suited to the particularities of your life.

Online quotes and support

To help you in your process, Axa provides you with a free online quote. This will allow you to easily compare the different plans and choose the one that best meets your expectations, while guaranteeing good value for money. Do not hesitate to visit their site to explore all the options available. Find out more about the plans.

Axa reviews

Axa’s reputation as an insurer is well established. However, it is always good to be informed about the customer reviews regarding their services and reimbursements. This can give you a clear idea of customer service responsiveness and overall policyholder satisfaction. To do this, you can consult insurance comparators or investment forums. To learn more about Axa reviews, click here.

Comparison of Axa Mutuelle Formulas

| Criteria | Details |

| Types of Formulas | 9 customizable options including additional modules. |

| Reimbursement of Routine Care | Reimbursement of 100% of actual costs depending on the formula chosen. |

| Medical Consultations | Coverage of costs of up to 400% of conventional fees. |

| Hospitalization | Stay expenses covered in an approved establishment, without conditions. |

| Private Room | Reimbursement of €90/day in private room. |

| Pricing | From €7.39/month, adjustable according to needs. |

| Optional Services | Possibility of adding specific options according to user needs. |

| 100% Health Reimbursements | Examples of reimbursement available for Ma Santé plans. |

| Assistance | Access to a telephone helpline for questions and emergencies. |

Testimonials on the Axa Mutual Formula: everything you need to know

There Axa mutual formula is often mentioned by its many policyholders who testify to their positive experience. Many emphasize the clarity of guarantee tables provided by AXA. They particularly appreciate the ability to easily download documents that allow them to understand precisely the reimbursement levels they can expect. This process greatly simplifies decision-making regarding their health coverage.

Users also mention that AXA offers 9 customizable formulas under the label “My Health”. These options allow mutual insurance to be adapted according to the specific needs of each individual or family. According to several testimonies, this degree of personalization ensures a better match with the health expenses real, such as routine care and consultations.

Another point often highlighted is access to examples of refunds specific, particularly with the 200% Neo formula. Many policyholders say that these examples allowed them to plan ahead and understand the financial impacts adapted to their personal situation. Transparency in communication of guarantees is therefore a major asset for AXA.

Regarding the copayment, policyholders note that the costs of a consultation with a general practitioner, for example, are clearly indicated, with a fixed amount. This level of detail helps customers better manage their expenses on a daily basis and to anticipate medical costs with greater peace of mind.

Finally, many members of the AXA mutual are attracted by the quality-price ratio, especially with contracts starting from €7.39 per month. This competitive rate, combined with an appropriate level of coverage, helps to create a feeling of security for policyholders. Feedback on the responsiveness of customer service and the simplicity of obtaining a free online quote also reinforce this positive image.

Introduction to the Axa Mutuelle Formula

Choosing a mutual health insurance is an essential step to guarantee optimal coverage of your medical costs. There Axa formula offers a wide range of guarantees adapted to your needs and those of your family. This article will provide you with all the information you need to understand the Axa mutual insurance offer, its advantages and its terms and conditions.

The Axa Mutual Formulas

Axa offers several formulas under the name “My Health”, allowing policyholders to personalize their coverage. Depending on your situation, you can choose from nine main formulas, enriched with optional modules to strengthen your health protection.

The formulas are designed to meet various needs, whether for routine care, hospitalization or alternative medicine. You have the flexibility to choose coverage that suits you best, ranging from basic to premium benefits.

Reimbursement Examples

Understanding the system refund is crucial to optimize your healthcare spending. Axa offers guarantee tables and reimbursement examples to clarify what you can expect from your mutual insurance company. For example, for a consultation with a general practitioner, the amount of the copayment is €6.60, plus €1 flat rate contribution.

With Axa plans, you can also view reimbursements of up to 400% for certain medical fees. This means that even after deducting the portion reimbursed by Social Security, Axa undertakes to reimburse you up to three times the base rate, thus maximizing your access to care.

Hospital Coverage

Hospitalization can result in considerable costs. Axa fully covers the costs of staying in an approved establishment, regardless of the formula you choose. You also benefit from support for private rooms, with a reimbursement of €90/day per night. This allows you to choose the comfort you need during your medical stay.

Pricing and Quotes

The cost of your Axa mutual insurance will depend on the plan chosen and the additional options you select. Axa offers contracts to suit every budget, with prices starting from €7.39 per month. To help you make an informed decision, Axa also offers the possibility of obtaining a free online quote.

The Advantages of Axa Mutual

Opting for Axa Mutual means choosing coverage adapted to each daily life situation. With its varied guarantees, you are assured of benefiting from protection in the event of routine care, hospitalization, and even alternative medicine. The formulas are designed to offer maximum flexibility while meeting individual health requirements.

With Axa, you are not just choosing an insurance product, but a real health partner who is committed to supporting you on a daily basis. You have peace of mind knowing that your health needs are taken care of completely and efficiently.

There Mutual Axa formula presents itself as an adaptable health coverage solution, designed to meet the specific needs of each individual or family. By offering several customizable plans, Axa allows its policyholders to create an à la carte contract, thus integrating various modules according to your health needs.

One of the most appreciated features of Axa mutual insurance is the possibility of choosing from nine formulas different, each offering various guarantees regarding reimbursements. Whether you need coverage for routine care or hospitalization in a private room, Axa offers you effective options for optimal protection. The transparency of the tables guarantees and refunds allows you to clearly visualize what you can expect in terms of support.

What makes Axa mutual insurance particularly attractive is its commitment to accessible coverage. With contracts starting from €7.39/month, it provides value for money that suits many budgets. Thus, even people with modest incomes can consider benefiting from a complementary health who will support them in the event of unexpected medical expenses.

Finally, it is essential to emphasize that Axa is committed to informing its customers about the understanding their health coverage. Explanatory articles and reimbursement tables are made available to inform policyholders of their rights and responsibilities, thus promoting better management of their health.

Frequently Asked Questions about the AXA Mutual Plan

What is the AXA Mutual Formula? It’s a complementary health offered by AXA which covers your medical expenses not covered by Social Security.

What guarantees are offered by the AXA Formula? AXA plans offer varied guarantees ranging from routine care to hospitalizations, including preventive medicine costs.

How to choose the best formula among those offered by AXA? AXA offers several customizable formulas, it is therefore advisable to assess your health needs and compare the available options.

What types of expenses are reimbursed by AXA? AXA reimburses consultations with doctors, routine care, hospitalization costs and many other expenses related to your health.

Are there any additional options available with the AXA Plan? Yes, AXA offers optional modules which you can add to your contract to personalize your coverage according to your specific needs.

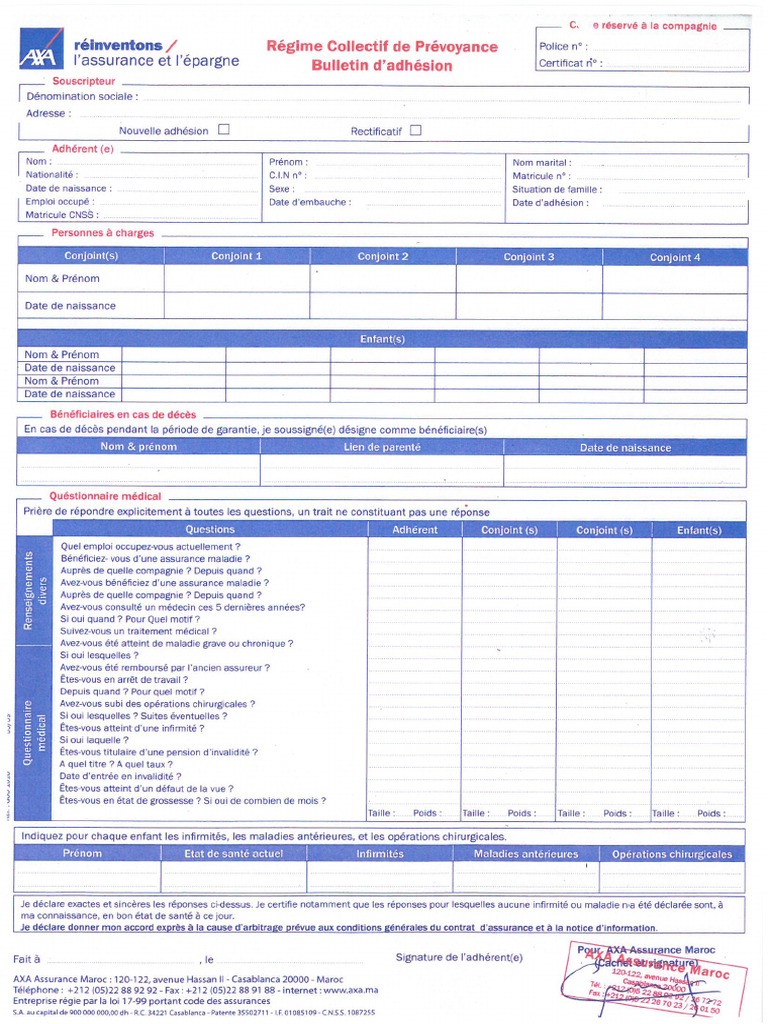

How to request a refund? Reimbursement requests can be made online or by sending a paper document to your AXA branch, depending on your preference.

What are the prices for AXA mutual plans? Prices vary depending on the plan chosen and the options added, but it is possible to benefit from coverage from €7.39 per month.

Does AXA offer a support service for its customers? Yes, AXA offers an accessible support service to answer all your questions regarding your contract and your reimbursements.

Do we have an online customer area with AXA? Yes, policyholders can access a online customer area to manage their contract, view their reimbursements and obtain information on their coverage.

Are children covered by the AXA mutual plan? Yes, coverage extends to children and can be adapted according to their specific health needs.