|

IN BRIEF

|

Traveling is about living unforgettable experiences, whatever your age. However, for seniors, it is essential to ensure adequate coverage is in place. Travel insurance without age limit is a perfect solution for experienced travelers who want to explore the world in peace. In this article, we will explore the different options available, the essential guarantees to consider and practical advice for choosing the best travel insurance adapted to your needs. Come on board with us to discover how to protect yourself during your adventures, without age-related barriers.

When considering travel, it is essential to consider a travel insurance which is suitable for all ages, especially for seniors. Insurance companies are beginning to recognize that travel without age limit are becoming more and more common, allowing older people to enjoy their adventures without worrying about age-related restrictions. This article will explore the benefits And disadvantages of this type of insurance, to help you make the best choice for your next getaway.

Benefits

Access to comprehensive coverage

One of the main advantages oftravel insurance without age limit is that it provides access to comprehensive coverage, regardless of your age. This includes guarantees in the event of trip cancellation, loss of luggage, or medical assistance. For example, some policies offer protection of up to 500,000€.

Flexibility in travel duration

Another strong point is the flexibility in terms of travel duration. Although some companies limit coverage to three-month periods, other companies allow you to travel for longer without any age restrictions, which is ideal for adventurers.

24/7 service

Most insurers also offer a 24/7 support service. This means that no matter where you are in the world, you can get the help you need if something goes wrong. , which provides an undeniable feeling of security.

Understanding 1st euro insurance: a complete guide for policyholders

IN BRIEF Definition : What isfirst-euro health insurance ? Target : Intended for French expatriates. Advantages : Coverage from the first euro. Pricing : Advantageous and flexible rates. Coverage : Exemption from paying the costs in advance. Comparison: Differences between…

Disadvantages

Potentially higher costs

One of the major disadvantages associated withtravel insurance for seniors is that premiums may be higher. Insurance companies often take into account the increased risk of health problems, which results in higher prices for seniors.

Restrictions on pre-existing medical conditions

Another aspect to consider are the restrictions on pre-existing medical conditions. If you have a medical history, some companies may impose exclusions or additional charges, which may reduce the effectiveness of your coverage.

Limited choice of insurers

Finally, although more and more insurers offer options without age limits, the choice can remain limited. Some companies, which do not cater for seniors, may offer better guarantees or more competitive rates, which could frustrate some travelers.

Travel insurance is essential for all travelers, regardless of their age range. This guide explores travel insurance options with no age limit, allowing seniors to set off on an adventure with peace of mind. Learn about warranties, pricing, and other important things to consider for your next getaway.

Travel insurance without age limit: what you need to know

IN BRIEF Many insurers impose a age limit for travel insurance. Some insurers, such as Groupama, offer contracts with no age limit. THE essential guarantees include coverage for emergency medical expenses. Pay attention to age restrictions, which may vary depending…

Why choose travel insurance with no age limit?

Choose one travel insurance without age limit is a wise decision, especially for seniors. Travel can involve risks, and having the right coverage is vital to avoid significant medical expenses or other unforeseen events. By subscribing to insurance that imposes no age limit, you guarantee peace of mind, regardless of your age.

Everything you need to know about medical insurance in France

IN BRIEF Health Insurance : structure and operation in France Universal health protection : rights for all, even without activity Refund : rate varying from 15% to 100% depending on the treatment Supplementary health : essential to cover the remaining…

The guarantees offered by senior travel insurance

Travel insurance policies for seniors generally include various guarantees. Among the most common options, we find:

- Medical assistance : coverage of medical expenses in the event of illness or accident abroad.

- Trip cancellation : reimbursement of costs incurred in the event of cancellation for justified reasons.

- Repatriation : support for early return for medical reasons.

It is crucial to carefully read the conditions of each insurance, because the reimbursement limits may vary from one insurer to another.

Mutual hospitalization only: what axa offers

IN BRIEF Blanket hospitalization costs including the hospital package at €20/day. Reimbursement of 80% to 100% costs related to surgical procedures and drug treatments. Support of the fee overruns during interventions. Options private room in hospital, with reimbursement of up…

Travel insurance costs for seniors

The price of travel insurance for seniors can vary significantly depending on various factors, such as age, destination and length of stay. Generally, insurance policies start from €23 per day. It is essential to compare offers to find the best option in terms of cost and coverage.

Price examples for travel insurance

To give you an idea, some companies offer travel insurance starting from €5 per day for travelers under 65 years old. However, prices may increase for people over 65, depending on the guarantees chosen and the associated risk.

First euro insurance: a complete guide to understand

IN BRIEF International health coverage from the first euro spent. Reimbursement of medical expenses at actual height. Exemption from advancing hospitalization costs. Prices advantageous and adapted for expatriates. Understanding of health insurance At 1st euro for the informed choice of…

Choosing the right insurer

With many insurance companies in the market, it is essential to do thorough research before purchasing. Take customer reviews into account and find out about the level of customer service offered. Don’t hesitate to compare the options available on dedicated platforms to find the one that best suits your needs.

To explore different options and find the right insurance for you, check out resources like this site which offers a range of tailor-made travel insurance.

By choosing travel insurance with no age limit, you ensure the coverage you need to travel with complete peace of mind. Take the time to explore the options available and choose the one that suits you best. For more information, do not hesitate to consult the recommendations ofAVA or other travel insurance specialists.

When considering a trip abroad, even at an advanced age, it is essential to take out a travel insurance adapted. Many companies offer policies with no age limit, allowing seniors to leave with complete peace of mind. This article walks you through the main options and tips for choosing coverage that meets your needs.

Everything you need to know about the AXA health contract: guarantees and options available

IN BRIEF Various formulas: 7 coverage options tailored to your needs. Basic warranty: Support for routine care, hospitalizations, dental And visuals. Reinforced options: 3 optional modules to improve your coverage. Refunds: Variety of examples of refunds thanks to the reform…

The advantages of travel insurance with no age limit

Opt for one travel insurance without age limit has a considerable advantage: you are not constrained by harmful age restrictions. Whether you are 60, 70 or even over 80, you can find suitable coverage. This ensures that even senior travelers can explore the world without worrying about unnecessary red tape.

Health insurance abroad: complete guide for expatriates

IN BRIEF Expatriates: Understand the challenges of health insurance abroad. Refund : Methods of compensation by the local insurance organization. Rights: Find out about your rights depending on the country of residence. Blanket : Choose the best international health insurance.…

Guarantees to consider

It is crucial to check the guarantees offered by each insurance policy. Make sure the insurance covers essential areas such as:

- Medical expenses abroad, including medical emergencies and hospitalizations.

- Repatriation in case of urgent medical need.

- Cancellation insurance, which protects you financially if you have to cancel your trip for unforeseen reasons.

- Loss of baggage or flight delays, which can also disrupt your travel experience.

Axa health: understanding your health coverage options

IN BRIEF Choice of complementary health insurance : tips for choosing wisely. Essential guarantees : protection for your daily needs. My Health AXA : access to medical equipment with support. Guarantee tables : clear understanding of AXA reimbursements. Avoid the…

Choose the right formula

To select a travel insurance appropriate, it is advisable to compare several offers. Take the time to explore the different options offered by well-known insurers. For example, companies like Groupama Or ACS-Friend offer coverage suitable for seniors with no age limit.

The cost of insurance

The cost of a travel insurance can vary considerably. Prices start with an accessible budget, sometimes from 23€ per day, even for the elderly. However, it is important not to focus only on the price, but rather on the quality of the guarantees offered. Coverage at a slightly higher price can save you a lot of money if something goes wrong.

Beware of exclusions

Each insurance contract includes exclusions. It is essential to read the general conditions carefully in order to know the situations which are not covered. Some policies may have limits for pre-existing health conditions or other conditions that could affect your trip.

Take your health into account

As a senior traveler, assess your state of health is crucial before leaving. Find out about any medical risks that may arise during travel. If you suffer from chronic illnesses, it may be wise to speak with your doctor before traveling and make sure you are well covered should the need arise.

When to take out your travel insurance?

Ideally, it is recommended to subscribe your travel insurance as soon as you book your trip. This allows you to benefit from all the guarantees, in particular that of cancellation, which can protect you financially against unforeseen events. For more information on the importance of purchasing travel insurance, you can check out this article.

Finally, do not hesitate to explore innovative solutions offered by insurers, such as those presented on Ava to benefit from modern coverage adapted to your specific needs.

Travel insurance without age limit: essential points

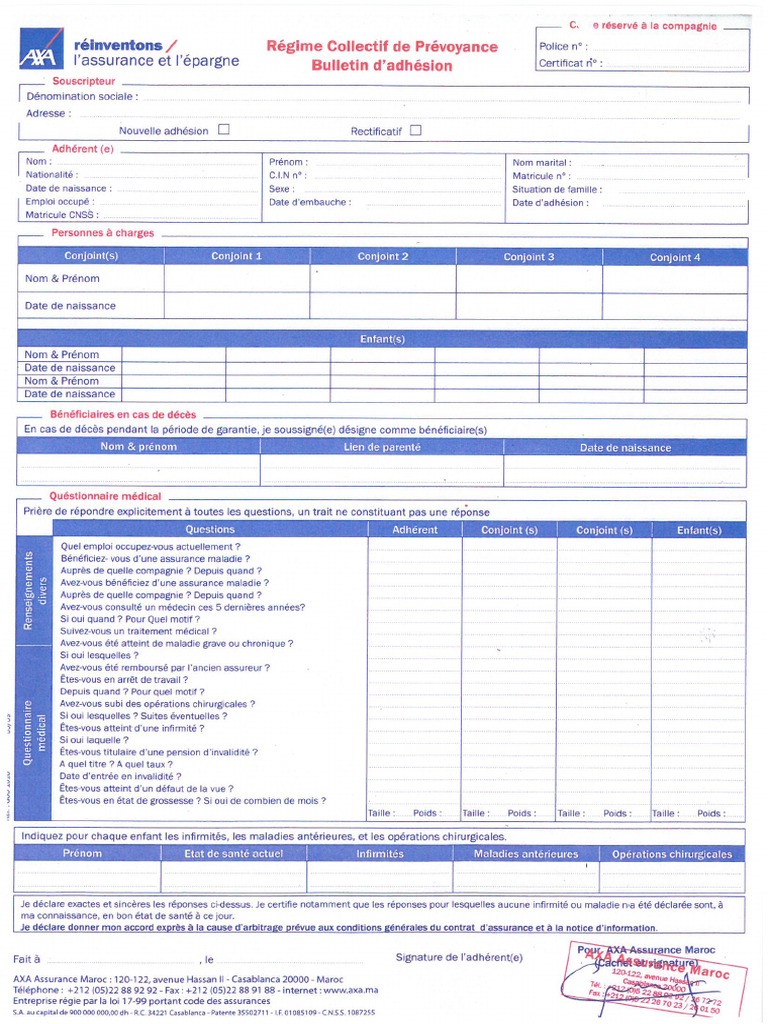

| Criteria | Details |

| Maximum age | No age limits imposed |

| Starting price | From 23€ per day |

| Reimbursement ceiling | Up to €500,000 |

| Maximum travel duration | May vary, often up to 3 months |

| Options available | Cancellation insurance, medical assistance |

| Health coverage | Supplement to Social Security |

| Health Requirements | May require health declaration |

| Supporting documents | Possible medical documents required |

| Assistance included | Repatriation, medical advice |

| Ease of subscription | Simple, quick online process |

When I prepared to go on a cruise at age 75, I was worried about finding travel insurance adapted. I had heard of policies without age limit and I finally found a plan offering coverage of up to €500,000. This allowed me to travel with peace of mind, knowing that I had adequate protection, from the first euro spent.

Maria, 68 years old, tells us: “For my last trip to Izmir, I took out insurance which did not set any age limit. I was a little skeptical at first, but ultimately I was pleasantly surprised by the value for money. From €23 per day, I was able to benefit from a cancellation insurance, a major asset in an uncertain context. »

Jean-Pierre, an 80-year-old globetrotter, emphasizes the importance of being well informed: “I compared several travel insurance. Some companies impose age restrictions which may seem unfair. Fortunately, I discovered an offer allowing me to travel with complete peace of mind, even at my age. I highly recommend taking the time to read the terms carefully. »

For my part, I learned that even for long-term trips, there are suitable options. Hélène, 72, shares her experience: “I was worried about a planned trip lasting 3 months. I finally found insurance with no age limits or duration restrictions, which was exactly what I needed for this type of adventure. »

There is no doubt that the travel insurance aimed at seniors are becoming more and more diversified, offering everyone the opportunity to explore the world without fearing the imponderables of life. From what I have seen, these policies are rated among the best for allowing all travelers, regardless of age, to enjoy their vacation with a peace of mind invaluable.

When planning to go on a trip, travel insurance becomes an essential aspect that should not be neglected, especially for the elderly. There are many options available to you, including no-age insurance that fits your needs, whatever your age. In this article, we will give you all the information you need to choose ultra-flexible travel insurance, which will offer you optimal protection throughout your adventure.

What does travel insurance without age limit mean?

A travel insurance without age limit allows you to take out an insurance policy regardless of your age. Unlike other companies which impose a threshold, often set around 60 or 70 years, these offers are designed for all travelers. This means that even if you are over 80, you will be able to choose insurance that fully covers you while you travel.

Guarantees to look for

When selecting travel insurance, it is crucial to pay attention to the guarantees offered. Make sure they include coverage for medical expenses, repatriation in the event of illness, as well as coverage for trip cancellations. Also opt for companies that offer high reimbursement limits, for example up to €500,000, to guarantee you adequate protection.

Cancellation insurance options

A nice option is cancellation insurance, which will protect you in the event of an unforeseen change of plans. Whether for personal or medical reasons, having this coverage can save you from significant financial losses.

Cost of travel insurance

The price of travel insurance varies depending on several factors, including your age, length of trip and the level of coverage selected. For seniors, the cost may be slightly higher, but there are attractive options from €23 per day. Pay attention to offers that include coverage at first euro, which means that you will be reimbursed from the first euro of costs incurred.

Duration of trips and subscription conditions

Generally, travel insurance policies adapted to seniors provide for a maximum travel duration. If you leave for less than three months, you will not have any problems, but it is always advisable to read the fine print in order to be informed of any possible restrictions that may apply. Some companies claim to offer renewable protection, which is an undeniable advantage for seasoned globetrotters.

Practical advice for choosing your insurance

To make the right choice, start by comparing different offers on the market. Use insurance comparators to identify the best options and check customer reviews. This will give you a clear idea of the reputation of each insurer. In addition, it may be interesting to contact your usual insurer, as they may have advantageous offers for their policyholders.

Choose one travel insurance without age limit will open the doors to adventure for you, no matter your age. Armed with these tips and information, you’ll be able to travel with peace of mind, knowing you’re well protected. Remember to plan early and explore all your options to find the coverage that best suits your needs.

When we approach the theme oftravel insurance For seniors, one of the first questions often concerns the presence or absence of an age limit. It is important to emphasize that several insurance companies now offer adapted solutions, without any age restrictions. This allows everyone, regardless of age, to travel with peace of mind.

Most of these insurances offer comprehensive guarantees, with reimbursement ceilings of up to €500,000. Furthermore, certain formulas are accessible from €23, which demonstrates that it is possible to protect yourself against the hazards of travel, without blowing your budget. In addition, many insurers include options such ascancellation insurance, which is essential to cover yourself in the event of an unforeseen event.

However, it is essential to carefully compare the different offers on the market. Seniors, or anyone over 60, should pay particular attention to subscription conditions and coverage levels. Some insurance policies may have exclusions related to pre-existing health conditions. Therefore, a good assessment of your needs and a careful reading of the general conditions are essential.

Finally, keep in mind that traveling at an advanced age is entirely possible, provided you have proper insurance. A travel insurance without age limit not only provides peace of mind during the stay, but also allows you to fully enjoy every experience. By taking the time to choose the insurance that best suits your needs, you will be able to explore the world freely and peacefully.

FAQ: Travel insurance without age limit

What is the main feature of travel insurance for seniors? Travel insurance for seniors is often offered without age limit, allowing many elderly people to travel with peace of mind.

Is it possible to take out travel insurance if you are over 75? Yes, several insurance companies offer options suitable for people over 75, allowing short-term trips without age restrictions.

What is the average cost of travel insurance for seniors? Prices start from €23, depending on the guarantees chosen and the age of the insured.

What guarantees are generally included in travel insurance for seniors? Insurance policies often include repatriation guarantees, medical assistance, and sometimes a cancellation insurance option.

Do insurance companies impose time limits on travel? Yes, in general, the duration of the trip should not exceed 3 months, but this may vary depending on the insurers.

Do you have to take out travel insurance if you already have Social Security? Although Social Security offers coverage, it is strongly recommended to take out additional travel insurance to benefit from additional protection.

Do health conditions influence the price of travel insurance? Yes, with age and possible health concerns, the cost of travel insurance for seniors can be higher.

What types of travel insurance are available for seniors? Several types of insurance exist, ranging from basic insurance to all-inclusive contracts, thus offering diversified choices according to the traveler’s needs.