|

IN BRIEF

|

At AXA, the company mutual insurance positions itself as a true ally to protect your employees against the hazards of daily life. THE guarantees offered go well beyond simple reimbursement of health costs; they also provide coverage against financial risks linked to accidents or illnesses. Exploring the specifics of these guarantees will allow you to make an informed choice for the well-being of your staff. Discover in detail the options available and the advantages that make AXA mutual insurance a preferred choice for businesses.

In a world where the health and well-being of employees are essential, the AXA Mutual Business Guarantee represents an effective solution to meet the specific needs of businesses. This article explores the benefits and the disadvantages of this mutual, in order to allow you to make an informed choice for your staff.

Benefits

The main strength of the AXA Mutual Business Guarantee lies in its wide range of covers adapted to the needs of employees. Indeed, the guarantees effectively cover common health costs such as medical consultations, hospitalization, and even specialized care.

In addition, AXA offers a flexibility in the choice of formulas. Companies can choose the level of guarantees that best suits their budget while respecting a minimum base of essential coverage. This ensures great satisfaction and optimal protection of employees.

Another notable advantage is the portability of complementary health insurance. When an employee leaves the company, they can continue to benefit from mutual insurance guarantees, which offers a feeling of security and continuity. For more information on this topic, see this article: operation of a company mutual.

Is AXA a good insurance for you?

IN BRIEF AXA : Evaluation of the services offered to policyholders Options blanket adapted to individual needs Analysis of price and guarantees Assistance and international services Comparison with others insurance companies Feedback fromusers and customer satisfaction Things to consider before…

Disadvantages

Despite its many advantages, the AXA Mutual Business Guarantee also presents disadvantages. One of the main points to consider is the cost of contributions. Although this may vary depending on the options chosen, some companies may find these rates a little high compared to other insurers.

Furthermore, the complexity of formulas can sometimes confuse business leaders. It can be difficult to choose the right contract that meets employee expectations without an in-depth study of the guarantees available. To find out more about the different options, you are advised to refer to the AXA guarantee tables.

Finally, another potential constraint lies in the process of refund. Although the costs are generally well covered, there may be delays before the employee receives their reimbursement, which can be frustrating.

In a constantly changing professional environment, it is essential for companies to protect their employees. THE AXA guarantees for company mutual insurance companies offer a wide range of options to meet the specific needs of each employee, while ensuring financial security in the event of health problems. This article will guide you through the key aspects of AXA guarantees to enable you to make an informed choice.

Non-resident health insurance: everything you need to know

IN BRIEF Health insurance for non-residents: a necessity to cover medical costs abroad. Social protection depends on residence and procedures administrative tasks to be carried out. Different coverage levels available according to the needs of expatriates. Importance ofaffiliation to benefit…

The fundamentals of AXA guarantees

THE pension guarantees offered by AXA are specially designed for businesses. They protect employees against financial risks resulting from life accidents, thus guaranteeing peace of mind for both the employer and the employee. To find out more about how these guarantees work, you can consult the AXA frequently asked questions.

The best international mutual insurance: complete guide to choosing wisely

IN BRIEF Define your project : Identify your travel or expatriation objectives. Evaluate your needs : Consider your specific health requirements. Compare options : Use a insurance comparator for international mutual societies. Check guarantees : Ensure that the contract covers…

Guarantee and reimbursement tables

AXA provides tables of guarantees according to the formulas subscribed, which allows you to obtain an overview of the refunds possible for various treatments. For example, certain guarantees include reimbursement of costs for medical consultations, hospitalizations, and dental care. These tables are easily accessible and will help you understand what is covered by your mutual insurance.

Care management

It is important to consider the support of AXA mutual insurance which may vary. For example, for equipment such as glasses, AXA limits coverage to one frame and two lenses every two years, which is a good practice to take into account when selecting your contract.

Mutual document for abroad: what you need to know

IN BRIEF Cerfa form n°12267 to be completed for reimbursement of care abroad. Ask for the European health insurance card before departure. Online services available at Ameli to manage coverage abroad. There mutual can reimburse medical expenses incurred outside the…

Coverage options tailored to your business

When it comes to choosing a company mutual insurance, AXA allows you to opt for a contract that meets the budget and specific needs of your business. This not only allows you to comply with legal obligations, but also to guarantee suitable cover for your staff.

Chapka mutual insurance: everything you need to know

IN BRIEF Chapka Insurance : expert in travel insurance since 2002. Medical coverage unlimited in the event of an accident or illness. Full support for stays abroad up to 90 days. Guarantees adapted for tourists, expatriates And PVT Medical teleconsultation…

The portability of complementary health insurance

One of the important aspects to consider is the portability of complementary health insurance. If an employee leaves, the company must inform them of their rights regarding the continuity of their health coverage. This option is crucial to help employees maintain their protection, even outside of the company.

Update on AXA mutual insurance: is it really effective?

IN BRIEF Full support contracts with AXA, even for the cheapest options. Analysis of 168 reviews of Internet users on AXA mutual health insurance. Watch out for some traps when selecting a supplement: percentages, packages, ceilings. Customer reviews shared on…

Access key information on pricing and quotes

To obtain pricing information, reviews, and make personalized quotes, you can refer to the different websites and resources. It is essential to compare the plans in order to choose the one that will best suit your organization. For more information, you can check out resources such as this guide to AXA prices.

Axa mutual company: how to contact customer service?

IN BRIEF Contact AXA company easily by phone at 01 55 92 21 94. For emergency problems, call the troubleshooting number at 01 55 92 26 92. Email address for customer information service: service.informationclient@axa.fr. Communicate by mail to AXA France…

Additional considerations for associations and other structures

For the sports associations or other types of organizations, AXA also offers specific offers that cover healthcare needs. These solutions allow all structures to ensure that their members are well protected. For more information, visit this link.

In the current context, offering guarantees of foresight to your employees is an essential action that can make the difference in retaining your staff. AXA offers a company mutual insurance with guarantees adapted to the needs of employees, allowing them to better manage the ups and downs of life. This article walks you through the different facets of these warranties, so you can make an informed decision for your business.

Axa car assistance abroad: everything you need to know to travel with peace of mind

IN BRIEF Car insurance to travel peacefully abroad Check its guarantees before departure Importance of green card for the cover Steps to follow in the event of breakdown Assistance 24/7 in case of immobilization Protection personalized for the vehicle Tips…

The advantages of an AXA company mutual insurance company

Opt for one company mutual insurance AXA has many advantages. First of all, it allows complete coverage of health costs, ranging from medical consultations to dental care. In addition, the refunds offered by AXA are in addition to those of the Social security, thus guaranteeing optimal care for your employees.

The different types of guarantees offered

AXA provides several types of guarantees which can be modulated according to the expectations of your company. You can choose options such as reimbursement for routine care, hospitalization and even specific care such as optical or dental. For more information on these different formulas, it is possible to consult the guarantee tables.

The portability of complementary health insurance

A crucial point to consider is the portability of complementary health insurance for your employees. This means that, even after leaving the company, they can continue to benefit from their mutual insurance. AXA undertakes to inform employees of their rights upon their departure, which provides additional security for them. For more details, you can refer to this resource.

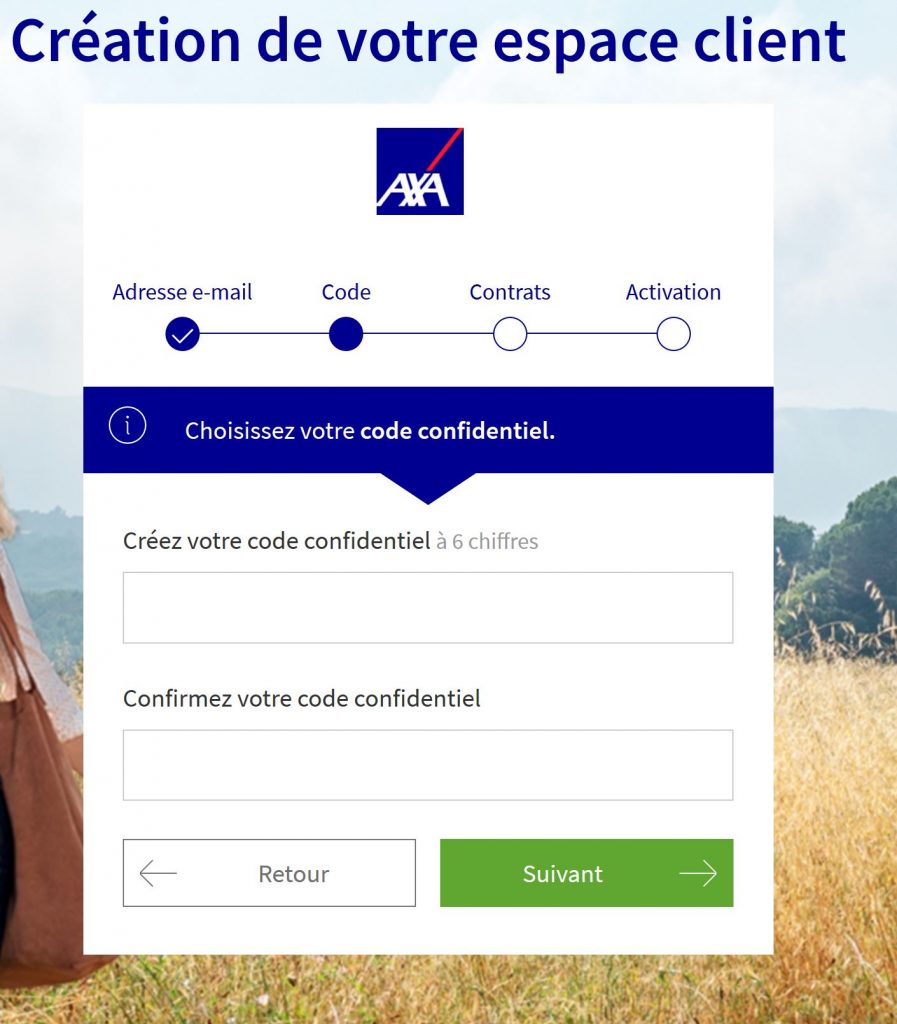

How to get reimbursed by AXA?

The reimbursement terms are practical and adapted to the needs of your employees. AXA offers several ways to reimburse healthcare costs: by sending invoices, by accessing the customer area, or automatic reimbursements in certain cases. To find out all the options available, do not hesitate to consult the guide refund.

Choosing the right health coverage for your business

Finally, an informed choice of guarantees focused on your company’s budget is essential. AXA allows you to personalize contracts according to the specific needs of your staff. You have the power to select a level of coverage that fits your budgetary constraints while providing a solid employee support.

To find out more about the prices and quotes available, consult the dedicated page on the subject. You will then be able to establish a solid plan for the social protection of your teams, while respecting your financial imperatives.

Comparison of AXA company mutual guarantees

| Type of guarantee | Details |

| Hospitalization | Reimbursement of hospitalization costs, including private room and medical expenses. |

| Routine care | Reimbursement of medical consultations and routine care. |

| Odontology | Coverage for dental care, including prosthetics and orthodontics according to the plans chosen. |

| Optical | Reimbursement of one frame and three lenses every two years. |

| Drugs | Reimbursement of medicines reimbursable by Social Security. |

| Prevention | Coverage for annual screenings and health check-ups. |

| Accidents of life | Financial protection against risks linked to major accidents. |

| Portability | Right to portability of mutual insurance in the event of a change of employer. |

| Assistance | Assistance services in case of hospitalization or urgent need. |

Testimonials on the AXA Mutual Business Guarantee: Everything you need to know

Many business leaders testify to the significant advantages offered by the AXA mutual company guarantee. For them, this solution is much more than simple health coverage: it represents real protection for their employees, offering them invaluable peace of mind.

A human resources director of a mid-sized company shares his experience: “Since we opted for AXA mutual insurance, we have noticed a notable improvement in the satisfaction of our employees. The guarantees cover a wide range of care, which allows our staff to feel secure in the face of life’s unexpected events.” This diversification of guarantees perfectly meets the varied needs of employees.

Another testimony comes from a business leader who had to face difficult situations. “I remember one of our employees who had an accident. Thanks to the company insurance from AXA, he was able to quickly benefit from complete medical monitoring and financial compensation during his convalescence. It’s a reassuring feeling to know that my colleagues are supported in the event of the unexpected.” This support is essential not only for the employees but also for maintaining the productivity of the company.

Furthermore, the portability of guarantees is often highlighted as a major asset by business leaders. A manager of a small company emphasizes: “When one of my employees left us, we were able to explain to him his right to the portability of complementary health insurance. This shows our commitment to supporting our team, even after their departure. ” This policy strengthens the bond of trust between the employer and employees.

Finally, the competitive rates and the personalized quotes offered by AXA are also frequently mentioned. A startup manager says: “We got a tailor-made quote which fit perfectly into our budget. This allows us to offer comprehensive coverage without compromising our financial health.” This proves that it is possible to find a balance between what is good for the business and what is beneficial for employees.

In the business world, employee health and well-being are essential to the success of any business. There AXA mutual business guarantee presents itself as an effective solution to protect employees against the financial risks linked to health problems. This article offers you an overview of the main characteristics of this mutual, as well as practical advice to get the most out of it.

The advantages of AXA company mutual insurance

There AXA company mutual insurance offers several advantages that make it an attractive choice for employers. First of all, it allows you to benefit from suitable guarantees to the specific needs of employees. Whether it concerns routine care, hospitalizations or specialized consultations, AXA sets up a table of guarantees clear and transparent.

Extended coverage

With coverage that includes basic health care like doctor visits, dental care, and hospitalization, employees can access essential services without worrying about excessive costs. There basic guarantee is complemented by specific reimbursements for various healthcare professions, providing peace of mind to both employees and employers.

Optimized reimbursements

AXA is committed to providing optimized reimbursements for medical expenses. After coverage by Social Security, policyholders can benefit from additional coverage, making care less expensive. Employees can thus count on rapid and efficient support, facilitating their access to care.

The different formulas and their customization

AXA offers several company mutualformulas, ranging from basic options to more comprehensive coverage. Business leaders thus have the possibility of choosing a contract adapted to their budget while meeting the expectations of their staff. Each formula includes various levels of guarantees allowing the choice to be refined according to specific needs.

Customization of guarantees

One of the great assets of the AXA mutual is its ability to adapt. Employers can customize the guarantees according to the specificities of their company and the profiles of the employees. This can include options for routine care, but also for more specialized services, thus helping to create a healthy work environment.

The steps to follow for a successful membership

Joining the AXA mutual is a relatively simple process. Companies must first assess the needs of their employees and then choose the formula proposed by AXA according to these needs. A personalized quote can be requested to better understand the terms and rates.

Portability of health insurance

A key element to highlight is the portability of health insurance. When an employee leaves the company, he or she has the possibility of continuing to benefit from the mutual insurance under certain conditions. Informing employees of this right is essential to ensure their protection even in the event of a professional change.

Choose the AXA mutual insurance company guarantee is a wise investment for any company seeking to protect its employees and promote their well-being. Thanks to adapted coverage, optimized reimbursement and customizable options, this mutual represents significant added value for employers and employees. Take the time to study the different options and don’t hesitate to request a quote to find the most beneficial offer for your business.

There AXA company mutual insurance offers a complete range of guarantees making it possible to effectively protect employees from the unforeseen events of everyday life. Aware that health expenses can quickly become poorly supported, AXA has developed solutions adapted to the needs of companies, guaranteeing optimized reimbursements for various medical care, including dental care and specialist consultations.

This mutual is distinguished by its possibility of personalize the contract according to the specific needs of each company. By opting for AXA, managers can choose the level of coverage that best suits their needs. budget while respecting the base of recommended minimum guarantees. This allows each employer to ensure that their staff benefit from appropriate protection.

Another important aspect of AXA company mutual insurance is the portability of rights in the event of the departure of an employee. Employees can keep their health coverage, which represents an undeniable advantage and a guarantee of peace of mind for them and their families. This provision demonstrates AXA’s commitment to the professional and personal well-being of its policyholders.

Finally, the table of guarantees and refunds offered by AXA is clear and accessible, making it easier to understand the care reimbursed and the amounts covered. Whether for routine care or hospitalizations, it is crucial that each employee can have visibility on the guarantees offered to them.

FAQ on AXA company mutual guarantees

What is AXA company mutual insurance? AXA company mutual insurance is complementary health insurance intended for employees, offering financial protection against various health costs not reimbursed by Social Security.

What guarantees are included in AXA mutual insurance? AXA mutual insurance includes guarantees such as reimbursement for medical consultations, dental care, hospitalization, and care for medical assistants such as physiotherapists.

How do reimbursements work with AXA mutual insurance? Reimbursements are calculated in addition to those made by Social Security. Insureds must submit their invoices to obtain reimbursement according to the table of benefits.

What are the prices of AXA mutual insurance contracts for businesses? Prices vary depending on the levels of guarantees chosen and can be adapted to the budget of each company. A personalized quote is recommended to know the exact costs.

What is the portability of complementary health insurance? Portability allows employees to continue to benefit from their company mutual insurance after their departure, under certain conditions defined by law.

Can we adapt the guarantees according to the needs of the company? Yes, AXA offers flexible contracts allowing you to choose the level of coverage according to the specific needs of the company and its employees.

How to get a quote for AXA company mutual insurance? To obtain a tailor-made quote, simply contact AXA directly, who will provide an estimate tailored to your business requirements.

Do employees have to pay part of the contributions? Yes, the cost of company mutual insurance is often shared between the employer and employees, in accordance with the regulations in force and the established contract.

What are the reimbursement deadlines for healthcare costs? Reimbursement times depend on the nature of the care and the documents provided. In general, it takes between a few days to a few weeks for requests to be processed.