|

IN BRIEF

|

There AXA mutual insurance raises many questions about its effectiveness and the quality of the services it offers. Known for its wide range of coverage and guarantees, this mutual insurance company presents itself as a solution that is both flexible and comprehensive for policyholders. However, behind this image lie diverse experiences and varied opinions from its users. Let’s analyze together the strong points and possible weak points of this mutual in order to determine if it truly meets consumers’ expectations in terms of health.

AXA mutual health insurance has sparked numerous debates around its effectiveness and the quality of the services it offers. In this article we will take a detailed look at the benefits and the disadvantages of this mutual, based on customer testimonials and reimbursement analyses. Whether you are already insured with AXA or if you are considering taking out a contract, this article will help you make an informed choice.

Benefits

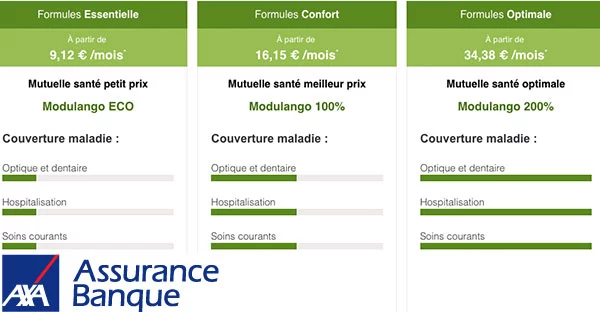

One of the main benefits of AXA mutual health insurance is its extensive coverage, which covers a wide range of medical services. Contracts, even the cheapest, often benefit from a competitive level of reimbursement, which is particularly appreciable for policyholders. In addition, AXA offers packages that adapt to the specific needs of each individual, whether for families, seniors or self-employed workers.

Users also reported easier access to a network of healthcare professionals and convenient digital tools, making it easy to manage reimbursements and make online requests. AXA’s reputation in the market and its solid history provide a feeling of confidence to policyholders, who often feel supported when needed.

Is AXA a good insurance for you?

IN BRIEF AXA : Evaluation of the services offered to policyholders Options blanket adapted to individual needs Analysis of price and guarantees Assistance and international services Comparison with others insurance companies Feedback fromusers and customer satisfaction Things to consider before…

Disadvantages

Despite its many advantages, AXA mutual insurance is not exempt from criticism. One of the main disadvantages mentioned by policyholders concerns customer service, which was sometimes considered disappointing. Some Internet users report billing problems and a lack of listening from advisors, which can generate significant dissatisfaction. This raises the question of the support offered to customers during administrative procedures.

In addition, although reimbursements are satisfactory for many medical procedures, certain guarantees present ceilings which may seem insufficient for expensive care. It is therefore crucial to carefully read the conditions of each contract to avoid unpleasant surprises, particularly in terms of hospital costs or specific treatments.

Finally, it is important to remain vigilant in the face of comparison criteria sometimes unclear, such as percentages or packages. To choose the right complementary health insurance, it is wise to ask yourself the right questions: what is the reimbursement percentage real? How often are reimbursements made? These aspects must be clearly understood in order to make an informed decision.

When it comes to choosing a health insurance, the question of effectiveness is paramount for many policyholders. In this article, we will take an in-depth look at the AXA mutual insurance, its advantages, its disadvantages, as well as user reviews to help you make an informed decision.

Non-resident health insurance: everything you need to know

IN BRIEF Health insurance for non-residents: a necessity to cover medical costs abroad. Social protection depends on residence and procedures administrative tasks to be carried out. Different coverage levels available according to the needs of expatriates. Importance ofaffiliation to benefit…

Comprehensive health coverage

The AXA mutual insurance stands out for its comprehensive coverage, including for its least expensive contracts. Depending on the formula chosen, it offers a wide range of services designed to meet the needs of its policyholders. This includes reimbursements for routine care, hospitalization and other medical expenses.

The best international mutual insurance: complete guide to choosing wisely

IN BRIEF Define your project : Identify your travel or expatriation objectives. Evaluate your needs : Consider your specific health requirements. Compare options : Use a insurance comparator for international mutual societies. Check guarantees : Ensure that the contract covers…

User reviews: the mirror of experience

To understand the effectiveness of a mutual insurance, nothing beats feedback. In total, 168 reviews have been posted on the AXA health insurance, offering an interesting overview of Internet users’ opinions. It is possible to sort them by rating to identify the most positive or negative feedback. These testimonials reveal key aspects, such as customer service and the responsiveness of the insurer.

Mutual document for abroad: what you need to know

IN BRIEF Cerfa form n°12267 to be completed for reimbursement of care abroad. Ask for the European health insurance card before departure. Online services available at Ameli to manage coverage abroad. There mutual can reimburse medical expenses incurred outside the…

Pitfalls to avoid when choosing a mutual insurance company

Choosing a complementary health insurance is not an easy task, and it is crucial to avoid certain pitfalls. For example, pay attention to the reimbursement percentages : what is the actual amount? In addition, check the packages and their frequency: are they sufficiently adapted to your needs? Finally, remain vigilant regarding the reimbursement ceilings, which can limit your guarantees in the event of large medical expenses.

Chapka mutual insurance: everything you need to know

IN BRIEF Chapka Insurance : expert in travel insurance since 2002. Medical coverage unlimited in the event of an accident or illness. Full support for stays abroad up to 90 days. Guarantees adapted for tourists, expatriates And PVT Medical teleconsultation…

The flexibility of AXA offers

One of the strong points of the AXA mutual insurance company is its flexibility. The different contracts allow policyholders to personalize their coverage according to their expectations and their budget. It is essential to compare the offers carefully to find the one that best meets your health needs.

Axa mutual business guarantee: everything you need to know

IN BRIEF Pension guarantees for the protection of employees against financial risks. Offer of complementary health adapted to the needs of businesses. Tables of guarantees and reimbursement of health costs. Information on the portability complementary health insurance in the event…

A double-edged reputation

Overall, opinions on the AXA mutual insurance are rather positive, although nuanced. While some customers praise the quality of warranties and refunds, others report issues such as a disappointing customer service or delays in processing requests. These elements must be taken into account to gauge the real effectiveness of the insurance.

Axa mutual company: how to contact customer service?

IN BRIEF Contact AXA company easily by phone at 01 55 92 21 94. For emergency problems, call the troubleshooting number at 01 55 92 26 92. Email address for customer information service: service.informationclient@axa.fr. Communicate by mail to AXA France…

Conclusion on AXA mutual insurance

Ultimately, choosing a mutual health insurance is a personal matter which must take into consideration your situation, your specific needs and the feedback from policyholders. To find out more about prices and guarantees, you can consult this link here or discover other opinions on Insurance Opinion. Other tools, such as the mutual insurance comparator, can also be useful to obtain a clear overview of the options available.

AXA mutual health insurance is a major player in the insurance sector. Its offer varies according to the needs of policyholders, but many users question its real effectiveness. This article discusses user reviews, the different aspects of the contracts offered, as well as advice for choosing your health coverage.

Axa car assistance abroad: everything you need to know to travel with peace of mind

IN BRIEF Car insurance to travel peacefully abroad Check its guarantees before departure Importance of green card for the cover Steps to follow in the event of breakdown Assistance 24/7 in case of immobilization Protection personalized for the vehicle Tips…

Complete support

AXA offers a mutual health insurance to full coverage, even for more affordable contracts. Depending on the formula chosen, the services offered go beyond basic reimbursements, also including additional services such as access to dental, optical or even alternative medicine. This makes it an attractive option for self-employed and retirees alike.

User opinions on AXA mutual insurance

The feedback from policyholders on AXA is varied. By examining the 168 reviews collected, it is possible to sort the returns by note. Some users highlight the quality of the guarantees and the responsiveness of the support, while others report problems with customer service, mentioning invoicing difficulties and a lack of empathy during exchanges. These testimonials are valuable for getting an idea of the real effectiveness of mutual insurance.

Pitfalls to avoid when choosing mutual insurance

While it is crucial to review the offers from mutuals like AXA, it is just as important to remain vigilant of potential pitfalls. For example, be careful of reimbursement percentages : check what it is exactly. Is it a percentage of the Social Security reimbursement base, or does it apply to a larger amount? Also, the packages must be analyzed carefully: do they define amounts per act or per duration, and what are the conditions for frequency of use? Find out about the reimbursement limits is also essential to avoid unpleasant surprises.

The flexibility of AXA contracts

Another undeniable advantage of AXA mutual health insurance lies in its flexibility. AXA allows policyholders to personalize their contract by choosing the level of coverage suited to their situation. This tailor-made approach is particularly appreciated by those who want optimal protection without paying for unnecessary guarantees. The multitude of coverage options available to meet the unique needs of each individual.

AXA and travel abroad

For those who travel often, it is essential to ask the question of international coverage. AXA offers mutual insurance that can adapt to expatriates and also offers options for foreign travel. Check the details of your contract to ensure you have adequate coverage in the event of an international medical need. Comparisons between mutual insurance companies for French expatriates and local insurance companies can also be beneficial to avoid certain pitfalls.

To learn more about benefits, reviews, and other additional information, please feel free to visit the following links: AXA mutual health insurance on Selectra, Top 10 mutual health insurance for seniors, And Importance of mutual insurance for traveling.

| Axis of Comparison | Description |

|---|---|

| Support | Complete, even for cheap contracts. |

| Feedback | Mixed reviews, some customers mention difficulties with the customer service. |

| Flexibility of offers | Allows you to choose according to personal needs and budget. |

| Company history | AXA benefits from a longevity and a solid reputation in the sector. |

| Refunds | Variable levels depending on chosen formula. |

| International coverage | Options available for coverage abroad. |

| Satisfaction rate | Varies depending on needs, important to compare. |

When we talk about the AXA health insurance company, the opinions of policyholders are often divided. Many users praise the completeness of the coverage, even for the most economical plans. The reimbursements, going beyond the usual reimbursement bases, allow many customers to benefit from care in good conditions.

However, some testimonials highlight negative aspects relating to customer service. Policyholders regret a lack of empathy during their discussions with advisors. Billing problems are highlighted, leading some customers to consider terminating their contract. These testimonials suggest that it is crucial to find out more and understand the offers before committing.

In another register, other insured persons testify to the flexibility of the contracts offered by AXA. They appreciate the possibility of adapting their coverage according to their specific needs, in particular for routine care or unforeseen expenses. This flexibility allows everyone to choose a formula that will fit their personal situation as closely as possible.

AUXA has built a solid reputation thanks to its longevity and constant development. However, opinions differ on the quality of the guarantees and reimbursements. Some customers say they are delighted with the guarantees offered, while others regret the reimbursement ceilings that seem insufficient to cover certain medical expenses.

Ultimately, the AXA mutual undeniably has advantages, but it is essential to analyze each formula in depth in order to choose the one that will truly meet everyone’s needs. The testimonials collected show that it is crucial to be well informed to avoid the pitfalls encountered by some policyholders.

In the vast world of health insurance, AXA stands out for the diversity of its offers. But the question that often arises is whether this mutual insurance company is really effective for its members. Renowned for its complete coverage, even for the cheapest contracts, let’s examine how it works through Internet user reviews, the pitfalls to avoid when choosing a supplementary insurance and the guarantees offered.

Internet user reviews on AXA mutual insurance

Customer testimonials are often revealing of the quality of a service. With 168 reviews posted on AXA mutual health insurance, it is essential to sort through them to get an overview. Many policyholders emphasize the comprehensiveness of services and the importance of the flexibility of options. However, some opinions report negative experiences with customer service, mentioning billing problems or a lack of empathy on the part of advisors. Thus, it becomes essential to weigh the pros and cons before choosing.The strong points of AXA mutual insurance

When we talk about advantages, AXA offers a range of

guarantees that vary depending on the formulas chosen. Whether it is routine care, hospitalization or alternative medicine, each option can be adapted to the specific needs of the policyholder. Thanks to scalable offers, each member of the family can find coverage that suits them, making AXA mutual insurance attractive to families. Avoiding pitfalls when choosing your mutual insurance

Choosing supplementary health insurance is not always easy. Here are some

pitfalls to avoid : Reimbursement percentages: Make sure you understand what percentage this is and what service it relates to.

- Packages: find out about their frequency and what is covered per procedure or per duration.

- Reimbursement ceilings: know the ceilings imposed for each type of care.

- This can make the difference between

healthy supplement and one that could become problematic when you need it most. Comparison with other mutual insurance companies

In a comparison with other mutual insurance companies, AXA ranks among the best according to various rankings. Indeed, its

longevity on the market and its reputation are assets. However, it is crucial to compare criteria such as prices , THErefunds and the guarantees offered. Additional insurance and coverage abroad

For expats or travelers, it is also interesting to note if AXA mutual insurance offers

coverage abroad . This can be a determining point in the selection of complementary health insurance, especially for those who frequently go abroad. Don’t forget to check the details and conditions of intervention in these cases.Finally, AXA mutual insurance offers attractive advantages but also comes with challenges that each potential insured person must evaluate. By studying customer testimonials, analyzing

guarantees and by avoiding common pitfalls, you will be better equipped to make an informed choice regarding your health coverage. discover the effectiveness of axa mutual insurance, its guarantees, its services and the opinions of policyholders. benefit from comprehensive coverage to protect your health and that of your family with mutual insurance adapted to your needs.

AXA is often cited as a major player in the health supplement market, providing full support even for the cheapest contracts. What attracts many policyholders are the many services and the advantages it offers. However, it is essential to provide feedback by taking into account the opinions of Internet users, who reveal varied opinions on the quality of its services. A major challenge facing consumers is to fully understand the

terminologies associated with contracts, including reimbursement percentages and ceilings. Many policyholders report that these elements can be confusing and make comparison between offers difficult. It is therefore crucial for future customers to take the time to analyze these details before making a final choice. Expert advice, like that of AXA, can greatly help navigate these sometimes murky waters. In terms of customer reviews, the

diversity of feedback is striking. While some users praise the flexibility and quality of services offered by AXA , others express dissatisfaction with customer service and billing issues. De facto, it would be wise to consult various testimonials before committing. Furthermore, AXA’s reputation and its longevity on the market are undeniable assets which contribute to its notoriety.In terms of prices,

AXA offers a variety of options, but the breadth of guarantees and the nature of the reimbursements strongly depends on the formula chosen. Future policyholders must therefore pay attention to details to ensure that they choose the coverage that best suits them in terms of needs and budget. FAQ about AXA mutual insurance

What is covered by AXA mutual insurance?

AXA mutual insurance offers full support , even for its most affordable contracts, with numerous services adapted to your needs.What opinions do Internet users leave about AXA mutual insurance?

Internet users express varied opinions. You can consult the 168 reviews available to sort the best from the worst. What pitfalls should you avoid when choosing complementary health insurance?

It is essential to avoid relying solely on percentages , to understand thepackages and check the ceilings reimbursement. How is AXA’s customer service perceived?

Some policyholders expressed their disappointment regarding customer service, citing billing issues and a lack of empathy in some interactions. What are the testimonials of policyholders regarding the quality of AXA?

Many customers share that the quality of the mutual is measured by its positive impact about their daily lives, but the testimonies are mixed. Does AXA have a good reputation in terms of mutual health insurance?

Overall, AXA’s reputation is positive , however it varies according to guarantees, prices and the level of customer satisfaction.Where can I find additional information on AXA mutual insurance prices?

THE AXA mutual insurance prices vary depending on the formulas chosen and the guarantees desired. Does AXA mutual insurance cover healthcare abroad?

Yes, AXA mutual insurance can cover you abroad, but it is important to check the specific conditions of your contract.